Contents

Introduction to Quadruple Witching

What is quadruple witching?

It is the day when simultaneous expiration of stock index options, stock options, stock index futures, and single stock futures all expire on the same day.

Friday, June 16, 2023, is an example of a quadruple witching day.

However, the single stock futures haven’t been traded in the United States since 2020.

So it should be called “triple witching,” if you want to be precise about it.

It happens four times a year on the third Friday of March, June, September, and December.

Some traders feel this confluence of expirations results in heavier volume and may make the markets move more dramatically that day.

The word “witching” suggests the unpredictability of that day’s price moves.

In folklore, the “witching hour” is when supernatural events occur.

But many times, it turns out to be nothing special and is just another day in the office at trading.

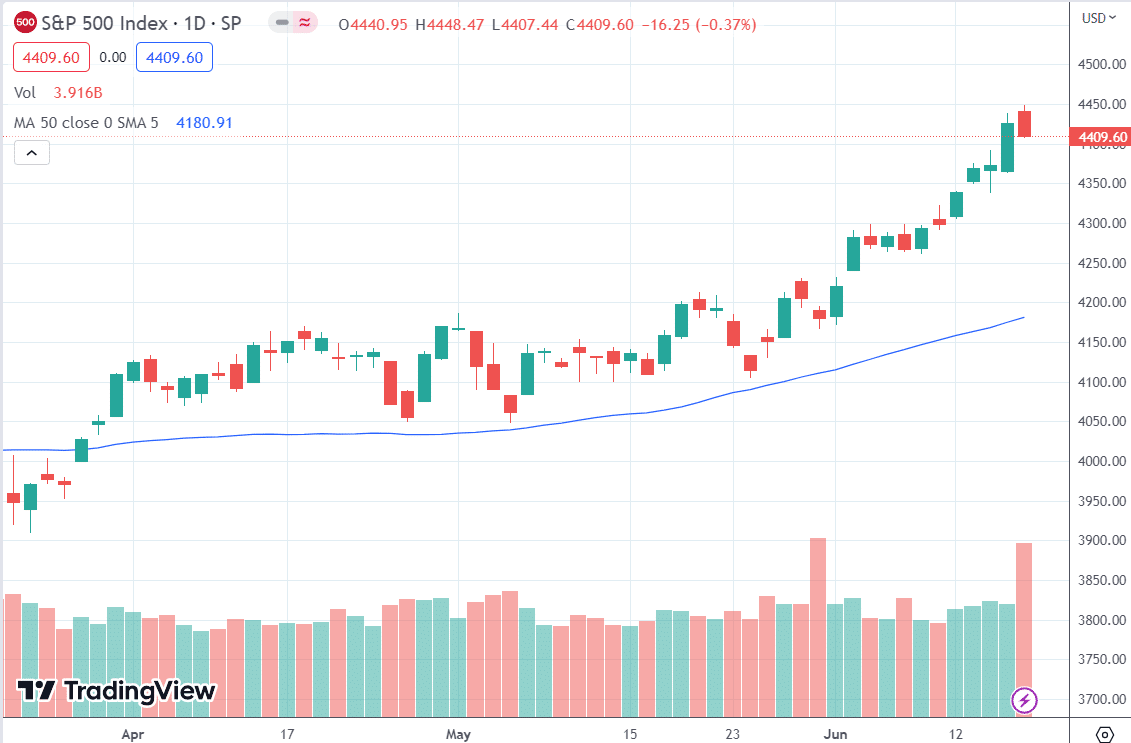

The last candle shown below is what the SPX (S&P 500 index) did on quadruple witching June 16, 2023:

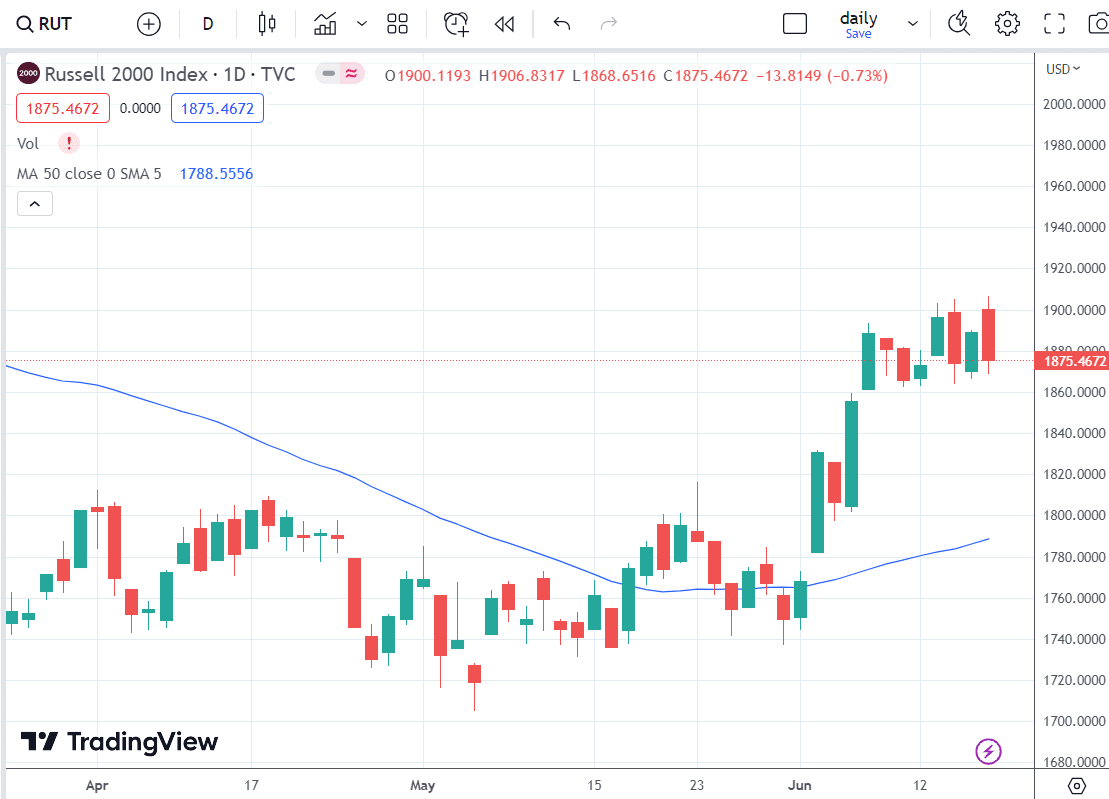

And here is what the RUT (Russell 2000 index) did:

For longer-term trades, the candles produced by this particular quadruple switching do not seem to be any more volatile than normal.

Understanding Quadruple Witching

During quadruple witching, market participants may experience increased trading volume and volatility as market makers and traders close out or roll over their positions in these derivative contracts.

The convergence of multiple expirations can lead to heightened market activity, especially during the final hour of trading.

One reason why quadruple witching attracts attention is the potential impact on stock prices.

As market participants adjust their positions, there may be increased buying or selling pressure, which can influence the overall market direction.

Traders and investors closely monitor these periods for potential trading opportunities or to manage their existing positions.

Additionally, quadruple witching can affect the liquidity and pricing of the underlying securities.

The expiration of options and futures contracts can result in changes to the composition of market participants’ portfolios, leading to fluctuations in demand and supply dynamics.

This, in turn, may impact the pricing and liquidity of the individual stocks and stock indices involved.

It’s important to note that quadruple witching is not a guaranteed predictor of market movements or volatility.

While it can create short-term fluctuations and increased trading activity, its overall impact may vary depending on other market factors, such as economic news, geopolitical events, or broader market sentiment.

FAQ on Quadruple Witching

What is quadruple witching?

Quadruple witching refers to the simultaneous expiration of four different types of financial contracts—stock index futures, stock index options, stock options, and single-stock futures—on the third Friday of March, June, September, and December.

Why is quadruple witching significant?

Quadruple witching is significant because it often leads to increased trading volume and volatility in the market.

It can impact stock prices, liquidity, and overall market activity.

How does quadruple witching affect stock prices?

Quadruple witching can influence stock prices as market participants adjust their positions, potentially leading to increased buying or selling pressure.

The impact on stock prices, however, can vary depending on other market factors and overall market sentiment.

Does quadruple witching guarantee market movements or volatility?

No, quadruple witching does not guarantee specific market movements or volatility.

While it can create short-term fluctuations and increased trading activity, its impact is influenced by various factors, including economic news, geopolitical events, and investor sentiment.

How can traders and investors take advantage of quadruple witching?

Traders and investors can develop strategies to manage risk or capitalize on potential opportunities during quadruple witching.

These strategies may involve adjusting options positions, implementing hedging strategies, or timing trades based on expectations of increased volatility.

What should traders consider during quadruple witching?

Traders should consider the potential for increased volatility, liquidity fluctuations, and the overall market sentiment during quadruple witching.

They should also approach market timing strategies with caution and base investment decisions on comprehensive analysis.

How does quadruple witching impact liquidity?

Quadruple witching can impact liquidity as contracts expire and new positions are established.

The liquidity of certain stocks or indices may change, and traders should monitor liquidity conditions to ensure efficient execution of trades.

Can quadruple witching be predicted?

Quadruple witching dates are known in advance, as they occur on the third Friday of specific months.

However, predicting the specific impact on market movements or volatility is challenging, as it is influenced by multiple factors.

Are there any risks associated with quadruple witching?

Quadruple witching can introduce increased volatility and potential risks in the market.

Traders and investors should be aware of the potential for sudden price swings, liquidity fluctuations, and the need for proper risk management.

Should long-term investment decisions be based on quadruple witching patterns?

Long-term investment decisions should not solely rely on quadruple witching patterns.

It’s important to consider broader market trends, fundamental factors, and conduct thorough analysis when making long-term investment decisions.

Quadruple witching should be viewed as one of many factors in the investment decision-making process.

Conclusion

In conclusion, quadruple witching is a notable event in the financial markets, occurring four times a year when four types of derivative contracts expire simultaneously.

It can lead to increased trading activity, volatility, and potential opportunities for traders and investors.

Understanding the dynamics of quadruple witching and its potential impact on stock prices and liquidity can help market participants make informed decisions and manage their portfolios effectively.

We hope you enjoyed this article on what is quadruple witching.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.