Individual traders may not always be aware of the value that Market Makers add to their own daily trading strategy, in addition to the value they add to the overall market.

As an individual trader, your strategy depends on being able to make a trade when your buy or sell parameter is reached. You want to do this at the time that point is reach, which may be at any time during the market hours. If you had to search for a buyer (or seller), on your own at the time you need that individual or entity to appear, it could be a costly trading day for you. This is true both in terms of time spent in the search, which is time not spent on other analysis or critical trading activity, and opportunity lost if your search effort is fruitless.

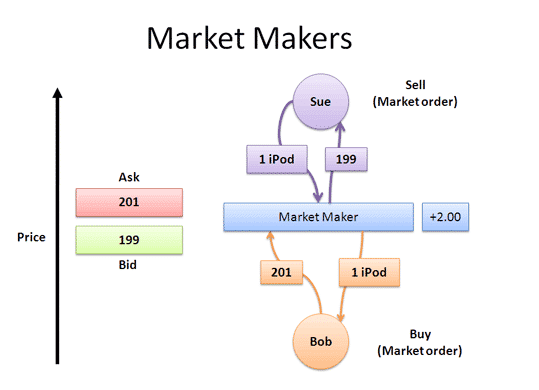

Enter the Market Maker. Market Makers are tasked with executing both the buy and sell side of the trade, and they will buy or sell stock and / or options regardless of whether or not they have the other side of the equation readily available. They take the risk of locating that other side of the equation to make their profit, and create the opportunity for you to make to make your trade in a timely (real-time) and efficient manner. Market Makers are assigned to hundreds of trading vehicles (stock/securities/options), which creates a wide variety of choices for real-time trading, and allows you to keep your portfolios moving and to use your time efficiently.

Image Credit – betterexplained.com

Image Credit – betterexplained.com

On a grander scale, Market Makers generally earn their money by taking small profit margins on large volumes of trade. For the market in general, this has several important outcomes: retention of liquidity, robust volume trading, and mitigation of market volatility.

With the small gap in the bid / ask spread (the trading vehicle may only have to move a few cents between both sides of the trade), the majority of cash stays both in the market and with that same trading vehicle. Markets with greater cash retention will attract or retain more traders and their cash, creating a robust market that has a greater tendency to be self-perpetuating.

The same outcome occurs with volumes. Market Makers trade in high volumes. A high volume of trades within very small price differentials can also be indicative of a stable, robust market. Mitigation of market volatility—lowering the peaks and valleys of price swings on hundreds of trading vehicles—has a huge impact on trading strategies. It will affect the calculation of a Market Volatility Index, which is used extensively to predict the future position or direction of a market. Predictions on the future direction of the market drives the strategy of every individual trader.

Just as important, mitigating market volatility also has the specific upside of creating trader confidence in the market, and in general, consumer confidence in the overall economy (i.e. savings and retirement funds values are not fluctuating wildly, so consumers will not cut back on discretionary spending, or pull all their assets out of the market to “cut their losses”). Success in market trading will still ultimately boil down to confidence in the economy, and the subsequent willingness of individuals to invest cash in the market.

Even though we might get annoyed when we can’t get our trades filled, Market Makers play a vitally important role in the investment / trading process.