Today, we will dive into the realm of unconventional wisdom with our latest blog post, where we unravel the secrets of uncommon option strategies that could reshape your approach to trading.

Options trading offers a whole host of possibilities for investors and traders looking to use strategies other than the normal long/short trades.

While many traders are familiar with common options strategies like buying calls and puts or entering covered calls, there is a large universe of lesser-known strategies that can be equally, if not more, profitable.

In this article, we’ll explore five uncommon options strategies that can enhance your trading and potentially lead to new trading strategies.

Contents

1. Straddle-Strangle Swap

Introduction to Straddle-Strangle Swap

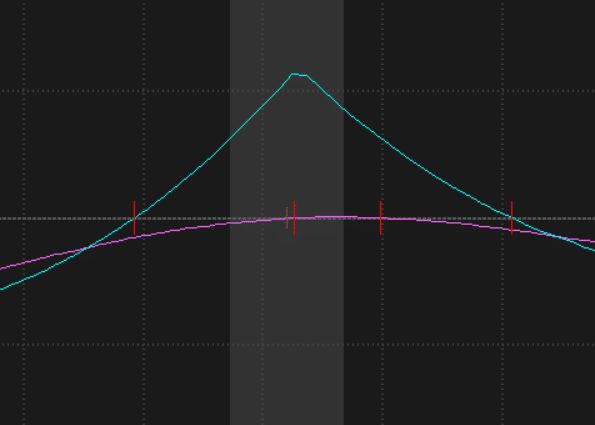

The Straddle-Strangle Swap (also known as the Double Diagonal) is a relatively delta-neutral advanced options spread strategy.

This spread capitalizes on the difference between near-term and longer-term volatility, usually around earnings or news releases.

How to trade it

To implement a Straddle-Strangle Swap:

1. Select the instrument: Choose an asset with elevated near-term implied volatility, such as a stock with an earnings release in the coming days/weeks.

2. Sell a straddle: Sell a short-dated straddle as close to the ATM as possible. You are looking for the dates with the elevated IV.

3. Simultaneously buy a strangle: Buy a further dated strangle to offset the risk of the short trade above.

4. Manage risk: Your max loss is calculated by subtracting the short and long strikes and then either adding or subtracting the credit or debit to initiate the trade. This strategy is all about selling the shorter-term volatility, so once the event is over, it’s often a wise move to close the trade if you’re in profit.

2. Iron Butterfly

Introduction to Iron Butterfly

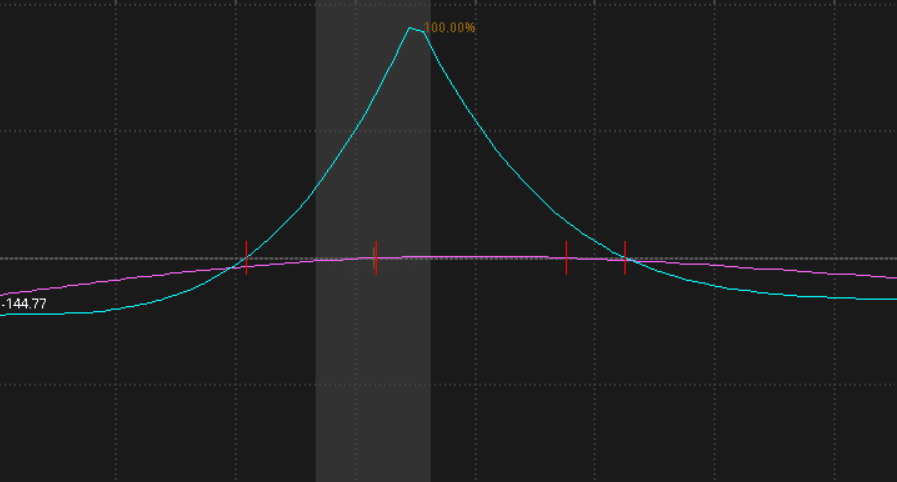

The Iron Butterfly is a versatile spread that traders use to profit from an asset’s neutral outlook and low expected volatility.

It involves selling a straddle and simultaneously buying a strangle, creating an “A” shaped risk profile.

The difference between this and the Straggle-Strangle Swap is that the Iron Butterfly is all done with the same expiration.

How to Trade it

To create an Iron Butterfly:

1. Select the instrument: Choose a stock, ETF, or index that you believe will trade within a defined range until the options’ expiration date. Low-volatility ETFs work particularly well.

2. Sell the Straddle: Sell both a call and a put at the strike price where you think the underlying will stay close to.

3. Buy a Strangle: Next, you buy a call at a strike higher than the sold call and buy a put at a strike lower than the sold put. The purchased options should be the same distance away from the sold options.

4. Manage risk: This is a fixed risk, fixed reward trade because the purchased options protect against any large price moves outside the target price (The sold strike). This trade max profit occurs when the price ends directly on the sold strikes. Because of this, it is often wise to close these when they are profitable.

3. Calendar Spread

Introduction to Calendar Spreads

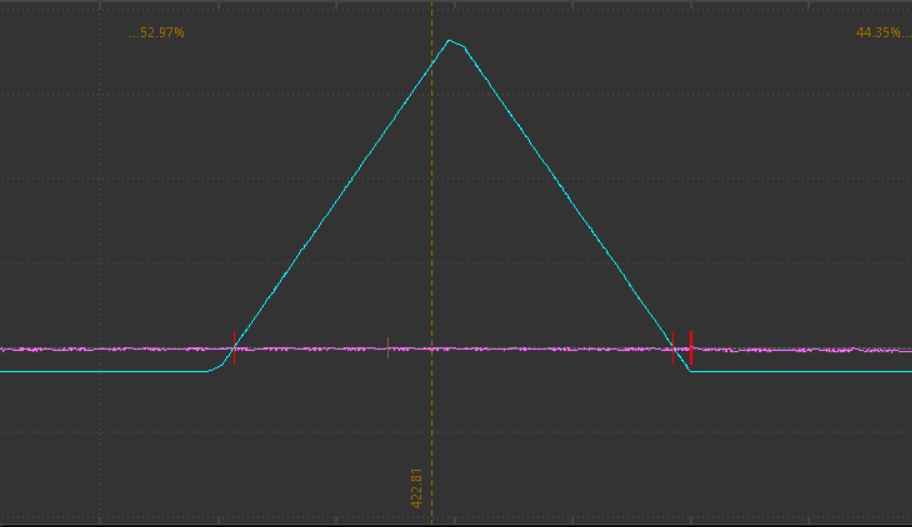

Calendar spreads, also known as Time spreads or Horizontal spreads, are options spreads that involve simultaneously buying and selling options with the same strike price but different expiration dates.

This strategy capitalizes on the concept of time decay (theta) and is ideal when you expect minimal price movement in the underlying asset.

This spread also has a similar risk profile to the previous two strategies.

How to trade it

To implement a Calendar spread:

1. Select an instrument: Identify an asset that you believe will experience limited price movement. Similar to the Iron Butterfly, ETFs work well here.

2. Choose your strike: Select a strike price that is near the asset’s current market price or slightly out of the money where you think the price will end up.

3. Execute two transactions: Simultaneously buy the longer-dated options and sell the shorter-dated option to create the spread.

4. Manage risk: Calendar spreads are limited-risk strategies, as your maximum loss is typically the initial cost of the spread. Your maximum profit occurs if the underlying asset closes at the strike price of the short-term option at expiration. If you believe the price will move in the direction of the longer-dated option, you can also let the short leg expire and now hold a directional long option.

4. Ratio Call Backspread

Introduction to Ratio Call Backspread

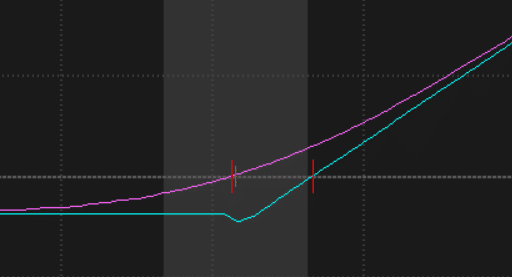

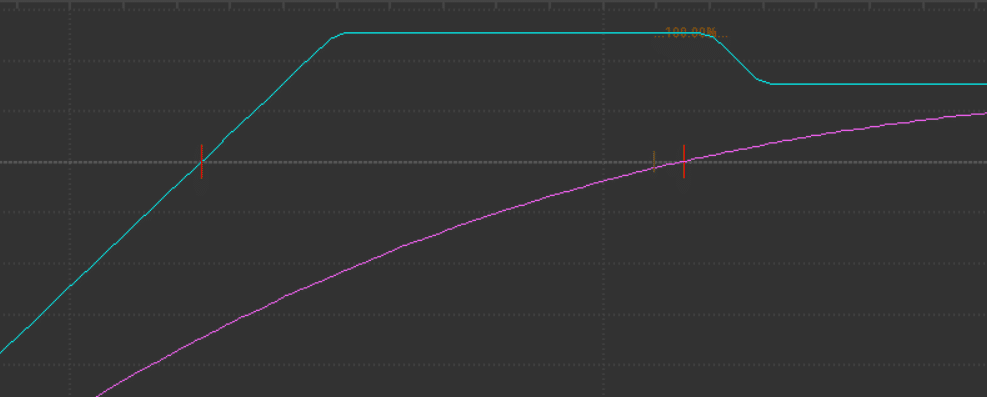

Ratio Call Backspread is a high-reward, low-risk strategy traders employ when anticipating a substantial upward price movement in the underlying asset.

It involves a combination of long and short call options, creating an asymmetrical risk-reward profile similar to the one you see here.

It allows the trader to capitalize on additional leverage while removing some of their downside risk.

How to trade it

To implement a Ratio Call Backspread, you:

1. Select an instrument: Choose a stock you believe will experience a significant upward price movement and identify two neighboring strikes you wish to trade.

2. Buy 2 Call options: Buy two higher strike calls to gain upward exposure.

3. Sell 1 Call option: This is where you create the actual ratio. You only sell one call at the lower strike to create a net-long position. For instance, if you are looking at the SPY 222/223 strike, you sell one call at the 222 strike and purchase two at the 223 strike.

4. Manage risk: To control risk. Ratio Call Backspreads can be customized by altering the strikes and ratio amounts. You can add or subtract contracts to adjust the ratio to fit your needs and the current market conditions. This is an extremely versatile spread.

5. Jade Lizard

Introduction to Jade Lizard

The Jade Lizard is a unique options strategy consisting of a credit spread for trades with a neutral to slightly bullish view of the market.

The trade consists of 3 contracts at three strikes: two are sold, and one is purchased to help offset some risk.

How to Trade it

To implement a Jade Lizard:

1. Select an underlying asset: Choose a stock that you have a neutral to slightly bullish outlook and would not mind owning at a lower price.

2. Execute three transactions: Ideally, these happen simultaneously

– Sell a put option with a strike below the current stock price. You could end up getting assigned at this price.

– Sell a call option with a strike price at or slightly above the current stock price.

– Buy an OTM call option with a higher strike price than the short call option.

For instance, let’s say you expect AAPL to remain fairly range-bound and is currently trading at 175 a share. You could open a jade lizard by Selling a 165 put, selling a 175 call, and buying a 177.5 call. This lets you collect the premium while you wait for the price to finish chopping around.

3. Manage risk: The risk here is that you could get the short put assigned to you if the stock price falls below the short strike. If you are content with owning the stock, then you can just let everything expire and collect the premium and the stock. If you are not comfortable owning the stock, then you could watch the price of the underlying and close the position if the underlying starts to trade around your short put strike.

Conclusion

While common options strategies like buying calls and puts are in every trader’s toolbox, exploring uncommon options strategies can provide a competitive edge and enhance your portfolio returns.

The Straddle-Strangle Swap, Iron Butterfly, Calendar Spread, Ratio Call Backspread, and Jade Lizard are just a few examples of the many strategies available to options traders.

It is also important to note that while many of these uncommon strategies are profitable, several less complicated strategies can get you close to the same returns and exposure.

We hope you enjoyed this article on uncommon option strategies.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.