Contents

- Price Action Edge

- How Big Is This Edge?

- Candlestick Patterns Edge

- Using Indicators

- Stacking Edges

- Edge In Options

- FAQs

- Conclusion

A trading edge is an observation of a pattern or condition in the markets that results in a greater than random chance of one thing happening over another thing.

This statement may leave you with only a vague notion in your head.

It is not something easy to explain.

The best way to explain a trading edge is to give you examples using stocks and options.

Traders who capitalize on trading edges will have an advantage over traders who do not.

The edge gives them a prediction with a greater than 50% chance of happening.

Price Action Edge

Well-known trader Larry Williams had observed a price action edge that he calls the “smash day.”

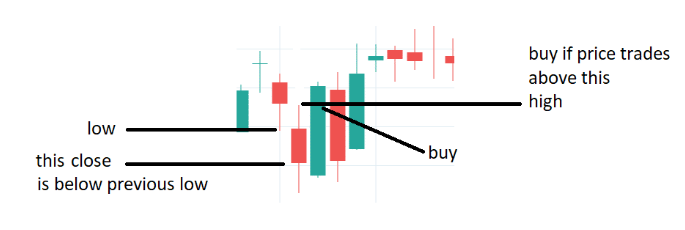

Let me just draw the pattern and then explain:

If a candle closes below the previous day’s low (and possibly below many days’ low), then buy if the next candle trades above the high of the candle.

He found that when he executed this pattern, it worked more often than not.

This is an edge.

How Big Is This Edge?

How likely is this edge? What does “more often than not” mean?

He didn’t have statistics on the win rate of this pattern.

It was probably based on his intuitive sense after many years of trading and seeing this pattern.

In the same book: Long Term Secrets to Short Term Trading, Larry writes of another edge in the market.

This time he gives some statistics:

He found that if you buy the stock after three red candles, you have a slightly better chance of winning the trade — about 5% better.

In general, any edges in the market are small.

With an edge of 55%, you may have ten more wins than losses if you make 100 such similar trades.

Due to random distribution, you may have to execute many instances of this trade in order to see the edge materialize.

The profit you may achieve will also depend on how much larger your win is than your loss.

The above statistics show that buying after two red candles has a 52% win rate, but the strategy is still not profitable.

Candlestick Patterns Edge

Take, for example, two of the more powerful candlestick patterns: the bullish reversal piercing candlestick pattern and the bullish engulfing candlestick pattern.

According to ThePatternSite.com, these have an accuracy of 63% to 64% of the time.

“The theoretical performance of the piercing pattern candlestick is as a bullish reversal and testing found that it acts that way 64% of the time. That is quite good. Better yet, the overall performance ranks 13th out of 103 candles.”

“The bullish engulfing candlestick acts as a bullish reversal 63% of the time, which is respectable, ranking 22 where one is best out of 103 candle patterns.”

These statistics were published in 2008 when the Encyclopedia of Candlestick Charts came out.

It is quite possible some of the edges might have faded a little by now.

Markets change, and edges come and go.

Larry Williams writes:

“What once worked no longer works.” [page 216]

Some of these trading edges are quite well-known by many traders and investors.

They are not anything secret, nor are they the holy grail.

For certain types of edges (especially arbitrage or pairs trading), the edge tends to fade and becomes less and less powerful with time, especially with the advent of high-frequency trading and algorithmic trading.

Using Indicators

Some traders may notice edges as that watch indicators.

Larry Connors (no relation to Larry Williams mentioned above) writes in his book Street Smarts of a strategy where he would buy the first pull-back in a strong uptrend.

His strong uptrend is defined as an ADX indicator above 30 with the +DI above -DI.

The pull-back is the retracement back to the 20-day moving average, where the trade will trigger when the price breaks above the previous day’s high.

Stacking Edges

Because each individual edge is small, traders may like to stack multiple edges in one trade.

For example, one might buy the piercing candlestick after three red candles when an up-trending price chart makes a pull-back down to the 20-day moving average, etc.

I’m just making an example up.

Edge In Options

Are there edges for options traders? Sure there are.

Option traders may be capitalizing on the same edges as the price-action trader.

They are just using options to express the directional movement of the underlying.

For the options sellers, there is an additional edge known as the “variance risk premium.”

The price of the option is proportional to the option’s implied volatility.

Over the long term, in a large enough sample size, the option’s implied volatility tends to be greater than the realized price volatility of the underlying asset.

This is just a fancy way of saying that options are theoretically overpriced.

Hence, we want to sell them.

This trading edge is similar to the business edge that insurance companies have.

Insurance companies sell policies for a premium that is just slightly higher than the cost they would have to pay out in claims.

Some options traders stack their edges by selling options and capitalizing on any edge seen in price patterns — for example, credit spreads.

Other options traders may feel that they don’t have a strong enough edge in picking a direction, or there may not be any directional edge for that particular stock at that particular time.

Therefore, they may only utilize the edge of selling risk premiums — for example, iron condors.

FAQs

Is there any edge in capitalizing on time decay?

Yes, there is. But fundamentally, it is the same edge as selling risk premiums.

After all, you only get time decay in your favor when you sell options.

The essence of time decay is that the longer you stay in the trade, the more you are paid.

It is also true that the longer you stay in the trade, the greater you risk an adverse move in price.

You are getting paid to take the risk.

The edge is that you are getting paid slightly more than the risk you are taking.

Going back to the insurance analogy.

They are taking a risk that you don’t crash your car.

But they are getting paid to take on that risk.

Their edge is that they are getting paid slightly better.

Can you give an example of an edge using a casino analogy?

Sure.

The casino game roulette has a house edge of 2.7% to 7.7% depending on whether we are talking about American or European roulette or triple-zero wheels.

source: Wikipedia article

This calculated statistical probability is based on the rules of the game.

Hence over a large sample size, the casino is likely to win more often than not.

The rules are just complicated enough that players on vacation looking for a few laughs are not going to realize these statistics.

Since the edge is not large, you do often see players win at roulette.

This draws in more players, which is what casinos want because they need many players for their edge to play out, according to the calculated statistics.

Why do edges fade when more people use them?

I’m not saying that all edges fade when more people use them.

Some edges tend to fade more than others.

Take pairs trading, for example; the price of Coke (KO) and Pepsi (PEP) should somewhat mirror each other because they are in similar industries.

When their price diverges, a pairs trader will sell the high-priced one betting it will come back down to the norm.

The act of selling the high-priced stock will bring the stock price down.

If enough people are doing this and if computers are doing this fast enough, then as soon as the price goes up, the traders and computers drive it back down.

At some point, as soon as the price of one goes up, the arbitrage drives the price back down so quickly that slower traders have a more difficult time capitalizing on the edge.

Conclusion

As traders, we seek to have an edge in the market.

What makes trading difficult is that the edges are small and sometimes ephemeral.

This is why traders stack their edges.

Options traders have an additional edge of selling premium to stack on top of any directional edge they might have.

We hope you enjoyed this article on trading edge.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.