Uncover the ‘Tom King 112 Income Options Strategy’—a reliable approach for generating income in options trading.

In this post, we’ll delve into the intricacies of this strategy, exploring its principles, implementation, and potential benefits for investors looking to bolster their income portfolios

Contents

In mid-2023, options trader Tom King (with 30 years of trading experience) published this video explaining his favorite strategy, known as the 1-1-2.

It is called the 1-1-2 because it consists of one out-of-the-money long put option, one short put option below that, and two short put options below that.

Yes, that’s correct.

You have two naked short-put options.

Or preferably, it should be cash-secured put options.

The trade is meant to run to expiration unless it reaches its exit loss trigger first.

Potentially, you would be obligated to purchase stock at the strike price should the short put expire in the money.

Although, this would be an unlikely scenario.

Based on how the trade is set up, it has a theoretical win rate of 95% (because the two short puts are typically out at the 5-delta location).

Nevertheless, you should do this trade on liquid assets where you don’t mind purchasing the stock at a discount.

This is akin to the first step of the Wheel strategy.

If you get assigned, take the stock and sell covered calls, exit, or whatever you like.

While most of the time, when the stock is not assigned, you collect regular credits.

This is a trade initiated for a credit to achieve no upside risk.

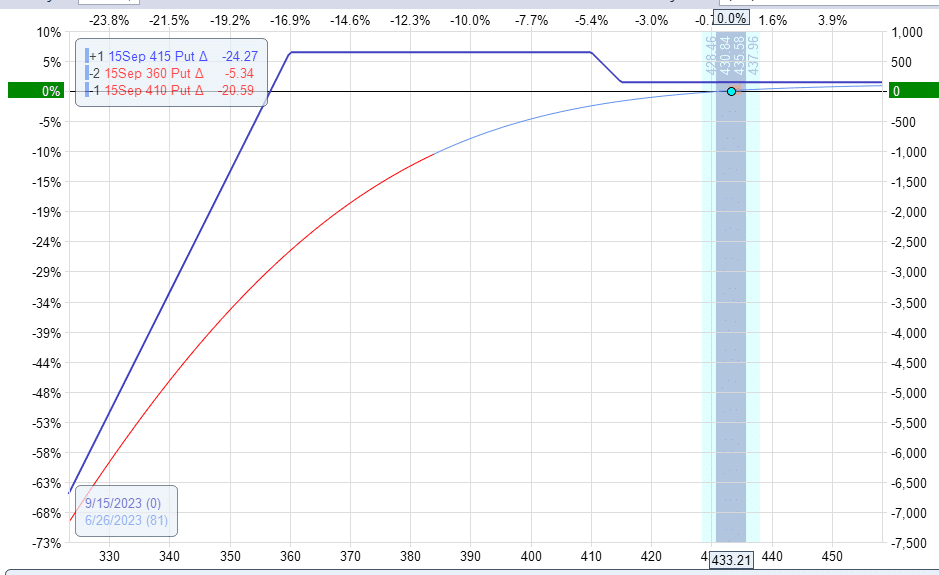

Let’s look at the analysis graph. While Tom King likes to trade this on futures, we are doing this example on SPY (the S&P 500 ETF).

The graph was constructed with an out-of-the-money put debit spread at around the 25 delta, And then the sale of the two short puts further out-of-the-money to get a net credit.

Trade Details

Date: June 23, 2023

Price: SPY @ $433

Buy one Sept 15 SPY $415 put @ $5.06

Sell one Sept 15 SPY $410 put @ $4.34

Sell two Sept 15 SPY $360 put @ $1.10

Net credit: $147

The proceeds of the short puts need to be greater than the cost of the put debit spread so that we get a net credit, which in our case is $147.

The net credit is what makes the trade have no upside risk.

You would keep this credit if all the put options expire out of the money.

If the price expires in the trap (the high hump on the expiration graph), the trade will make about $650, about four times the credit.

The buying power reduction depends on your account and broker, but a trade like this typically uses up $7273 of buying power.

$147 / $7273 is 2% in 81 days, up to 9% annualized. This example trade has been configured for a smaller profit potential than what Tom King would do. But it is more conservative for a bearish market.

Tom King tries to target at least 3% per month, or 36% annualized.

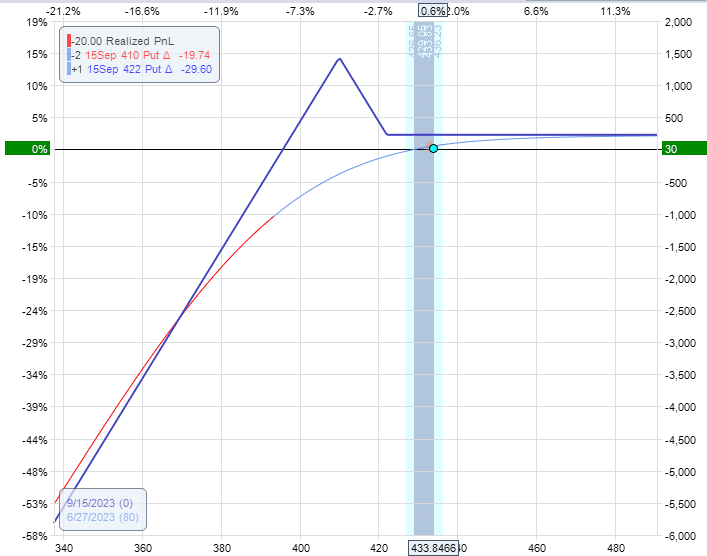

Flexible Structure

The structure is flexible enough so that you can adjust the strikes depending on how bullish or bearish you feel.

If more bullish, then set it up with greater upside credit.

This credit is seen in what is known as the “tail” of the expiration graph.

If more bearish, then set it up with a larger downside trap.

The hump in the expiration graph is known as the trap because if the price falls in there at expiration, your gains can be 3 to 4 times as large as what you get at the tail.

Alternatively, you can view the trade as selling premium from the short puts hedged by a put debit spread.

If the short puts have gained 95% of their potential profit, buy back the short puts to close them.

Now you just have a free hedge for your portfolio in case of a black swan crash.

Exit Loss Trigger

If the trade loses an amount equal to the max potential profit of the trade at the trap, exit the trade before losing any more – unless you are willing to take assignment on the underlying and keep it as a long-term holding or use it for the Wheel strategy.

You can also consider rolling the short put out in time to receive a credit and potentially delay or prevent the assignment.

Hold To Expiration

Otherwise, hold the trade to expiration (or at least very close to expiration) to capture the full profit potential of the trade.

This is not a hard rule.

If, for example, the price is in the trap and you see the price about to rally out of the trap, you might want to close the trade to lock the profit instead of taking the smaller profit of the tail.

Alternatively, you can lock in profits by narrowing the width of the put debit spread.

Days To Expiration

We have used 81 DTE (days to expiration) in this example. You can do the 1-1–2 anywhere from 45 days or higher DTEs.

There are advantages to using an even longer term, although I know some of you may not be used to these super-long DTE trades.

Tom King is using 120 DTEs.

Frequently Asked Questions:

How is the 1-1-2 different from selling a strangle?

Both are non-directional premium-selling strategies making money as time passes.

The short strangle is more efficient because it can generate greater income with less buying power.

It is more efficient because the strangle has no hedges (hence no “friction”).

However, it has risks on both sides should the market go up or down significantly.

The 1-1-2 is a more conservative trade with no risk on the upside.

It has a debit spread as a hedge. By being safer, it has less return potential.

How is the 1-1-2 different from a cash-secured put?

A cash-secured put and the 1-1-2 are undefined risk strategies with unlimited risk on the downside.

However, the 1-1-2 has a put debit spread hedge; the cash-secured put does not.

This makes the 1-1-2 downside risk further out; hence, some would say it is a more conservative trade.

How is the 1-1-2 different from the put-ratio spread?

It is very similar to a put-ratio spread in that both can be constructed with no upside risk.

And both have unlimited downside risks.

The difference can be seen on the expiration graph, where the ratio spread has a triangular peak.

The 1-1-2 has flattened out that peak so that its max potential profit is less but has a wider range in which it can profit.

Conclusion

This is a nice income-style strategy to add to your portfolio.

However, as Tom King mentioned in his video, he does not risk more than 2% of his portfolio in any single trade.

He uses only half of his account size for trading.

And he never allocates more than 30% of that to any trading strategy,

We hope you enjoyed this article on the Tom King 1 1 2 income strategy.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

There is an occasional mention of Discord chat, How can I sign up for that?

Hi Bruce. That’s part of my Accelerator Program. The next enrollment period will open in late Aug/early Sept. I will email you when it opens.