Contents

The Rhino is a broken-wing-butterfly typically done on the RUT with a 40-point upper wing spread and a 50-point lower wing spread.

It has a fairly long time to expiration, such as 70 to 90 days is not unusual.

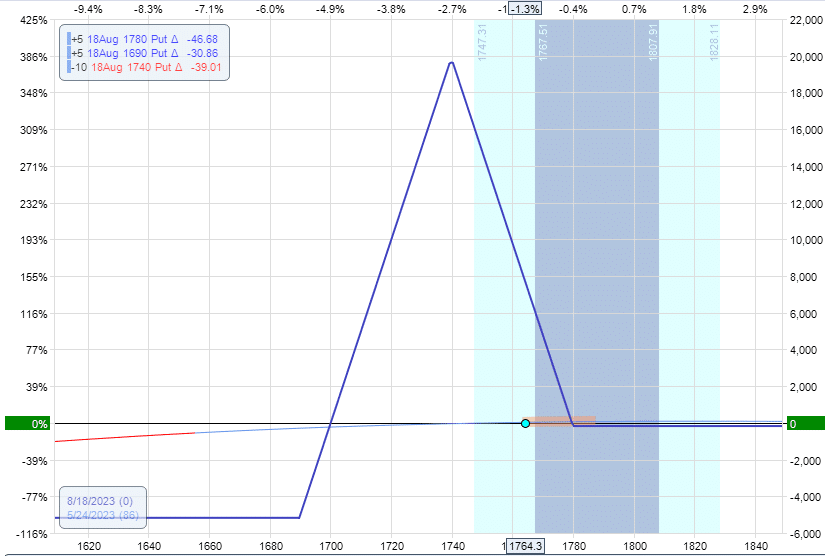

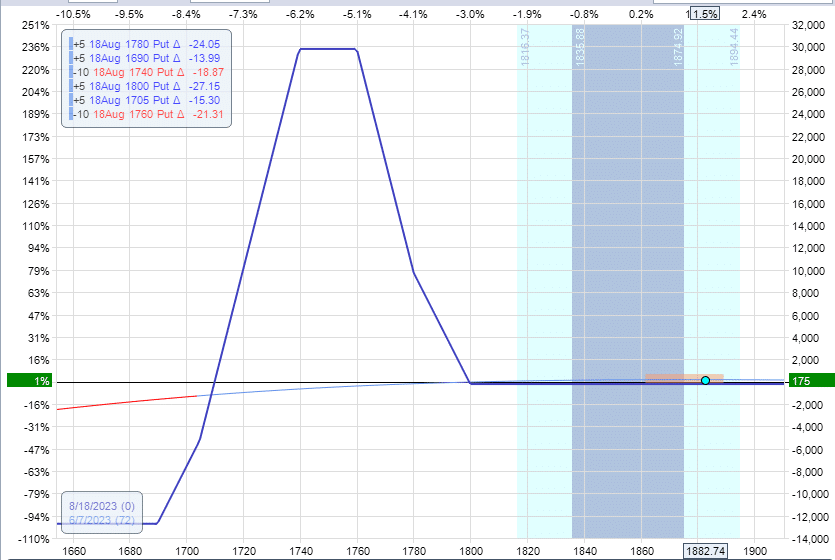

For example, here is a Rhino that is 86 days away:

Date: May 24, 2023

Price: RUT at 1764

Buy five Aug 18 RUT 1690 put @ $46.35

Sell ten Aug 18 RUT 1740 put @ $60.50

Buy five Aug 18 RUT 1780 put @ $75.00

Debit: 5 x 35 = -$175

In this example, we are doing a 5-lot with an initial risk of $5175.

However, this risk can double if we scale up the Rhino to a full Rhino.

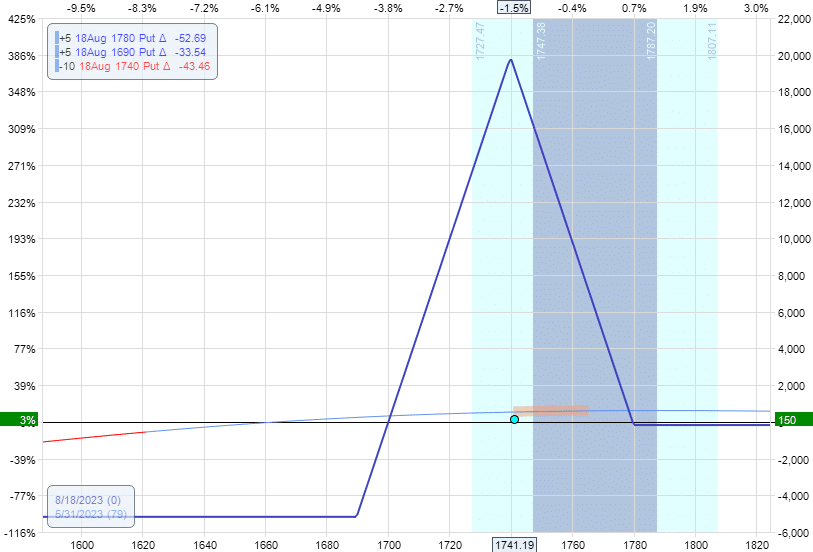

May 31, 2023

On May 31, the price of RUT was going down and was about to cross the center strike of the fly and could potentially run into the less favorable portion of the expiration risk graph (which would be the left side of the tent).

The P&L is $150, or 3% of the initial risk.

Some traders may decide to take early profits here.

However, we decided to wait one more day.

The next day, the market rallied.

So nothing to do.

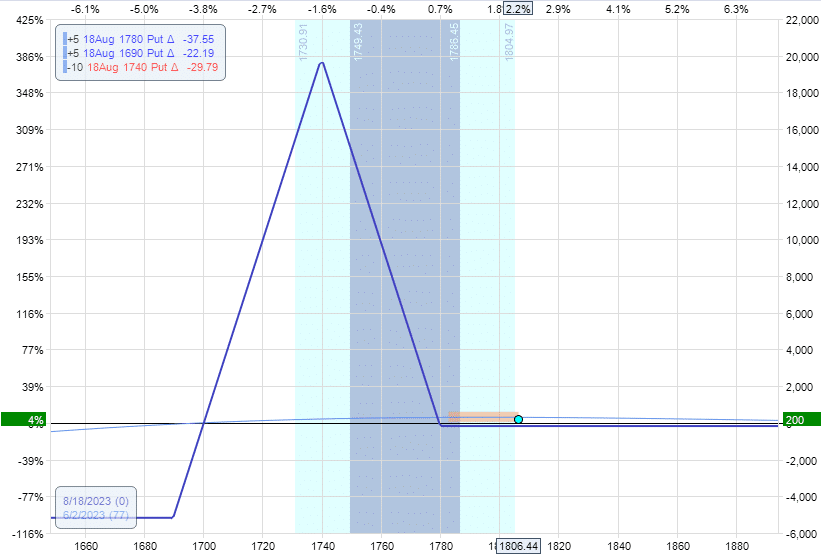

June 2, 2023

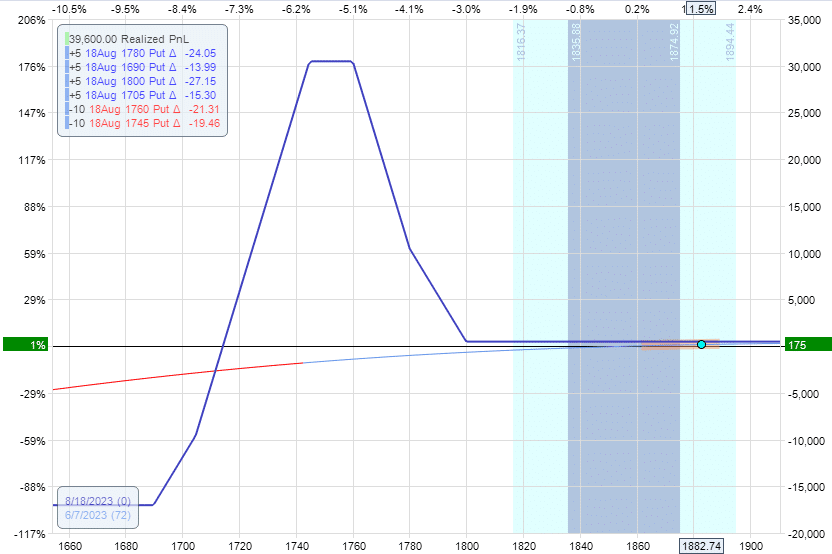

On June 2, the price of RUT exceeded the upper long leg.

Some traders will want to scale into a full Rhino at this point.

Date: June 2, 2023

Price: RUT @ $1806

Buy five Aug 18 RUT 1705 put @ $28.15

Sell ten Aug 18 RUT 1760 put @ $40.45

Buy five Aug 18 RUT 1800 put @ $52.85

Debit: 5 x 10 = -$50

This increases the trade to a risk of $12,725.

Traders who do not want to scale in do not have to.

There is no law against that.

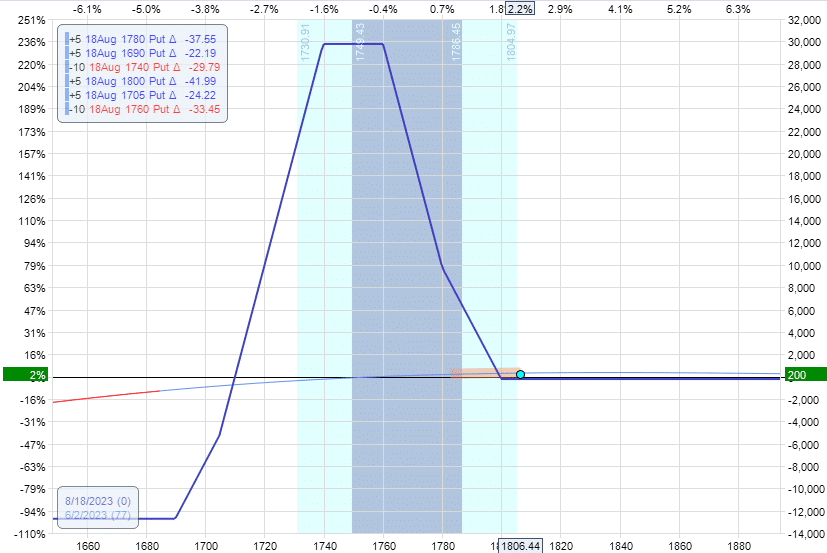

June 7, 2023

The market is running away from the butterfly:

Some traders could take early profits here since P&L is $175, or 1.4%.

They can then re-use the capital to reset the trade to the starting configuration.

Other traders will want to continue since there is very little upside risk.

They will want to make an adjustment to make the trade a bit more bullish since the market is running up so much.

To do this, they can roll the shorts of the lower butterfly up.

Date: June 7

Price: RUT at 1882

Buy to close ten Aug 18 RUT 1740 put @ $20.90

Sell to open ten Aug 18 RUT 1745 put @ $21.60

Credit: 5 x 70 = $350

This increased the risk in the trade further to $17,025.

But we now have no upside risk if the trade expires with the price on the tail of the graph:

June 28, 2023

The price essentially chops around in that area until June 28 (about one month into the trade) when we see that our P&L is $1300, or 7.6% of the risk.

It’s a good spot to take profits for a very low-stress trade.

Other traders might still continue since it still has 51 days to the expiration date.

There is no law against that either.

We hope you enjoyed this article on a low stress Rhino butterfly trade.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Well written thanks for sharing your knowledge

appreciate your efforts