Contents

In options trading, a call option sweep is when a large number of call option contracts are bought or sold at the same time.

Often it is executed in a substantial order size, typically exceeding the average trading volume for that particular option contract.

Hence, it can be seen as a significant market activity that can potentially influence the price and liquidity of the underlying asset.

The increased demand for call options in a sweep can increase their prices and impact the overall market sentiment.

Trading software can see every single order that goes through the exchanges.

Various software can detect these significant (and sometimes unusual) market activities.

Sometimes these orders can be seen buying above the ask.

The ask price of an option is the higher of the two prices in the bid/ask spread.

Buying above the ask is like paying more than what sellers are asking for, which indicates greater urgency to get the order filled.

Such large orders may be broken up and filled in multiple exchanges.

I can understand that a retail trader might buy above the bid for a few contracts due to the sway of emotions such as FOMO (fear of missing out) and the need to get into a trade or reverse a mistake, exit a bad trade, etc.

But those would not be considered a call sweep.

A call sweep is often hundreds of thousands of dollars (and sometimes millions of dollars) in size.

Those are not the workings of a retail trader.

They are the activity of large institutions, hedge funds, and smart money.

Do they know something that we retailer traders don’t?

Is that why we call them smart money?

They must be convinced that the stock price will go up if they buy that many calls (sometimes above the ask).

That is why some retail traders watch for these call sweeps and piggyback on their trades – copying the trade (albeit at a much smaller size).

But remember that the purchase of the calls can be part of a spread or used as a hedge of another position.

The only potential problem is that we will not know when they will exit the trade.

Are they holding only for a few minutes, or are they holding for weeks?

How much profit target are they expecting?

I guess that would be up to you.

Frequently Asked Questions

What is a call option?

Call options give the holder the right, but not the obligation, to buy the underlying asset at a predetermined price (known as the strike price) within a specified time prior to the expiration of the option.

Are call sweeps bullish or bearish?

A call sweep is often bullish. Buying above the ask price is often bullish.

Traders may use call sweeps to take advantage of perceived market opportunities or express a bullish outlook on a particular stock or index.

Traders conducting call sweeps may be looking to initiate a large bullish position or capitalize on an expected price increase in the underlying asset.

However, a large purchase of calls can also be part of a spread or used as a hedge.

So it may not always necessarily be bullish.

Why do retail traders care about call sweeps?

Due to the substantial capital required to execute such trades, it’s important to note institutional investors, such as hedge funds or large financial institutions typically execute that call sweeps.

Retail traders may monitor call sweeps as part of their market analysis to gain insights into market sentiment and potential trading opportunities.

Conclusion

Okay, now you know that institutional investors are buying call sweeps because they are potentially bullish on an underlying.

The final question is, where can we retailer traders see such activities?

Just to give you an idea of what a call sweep might look like.

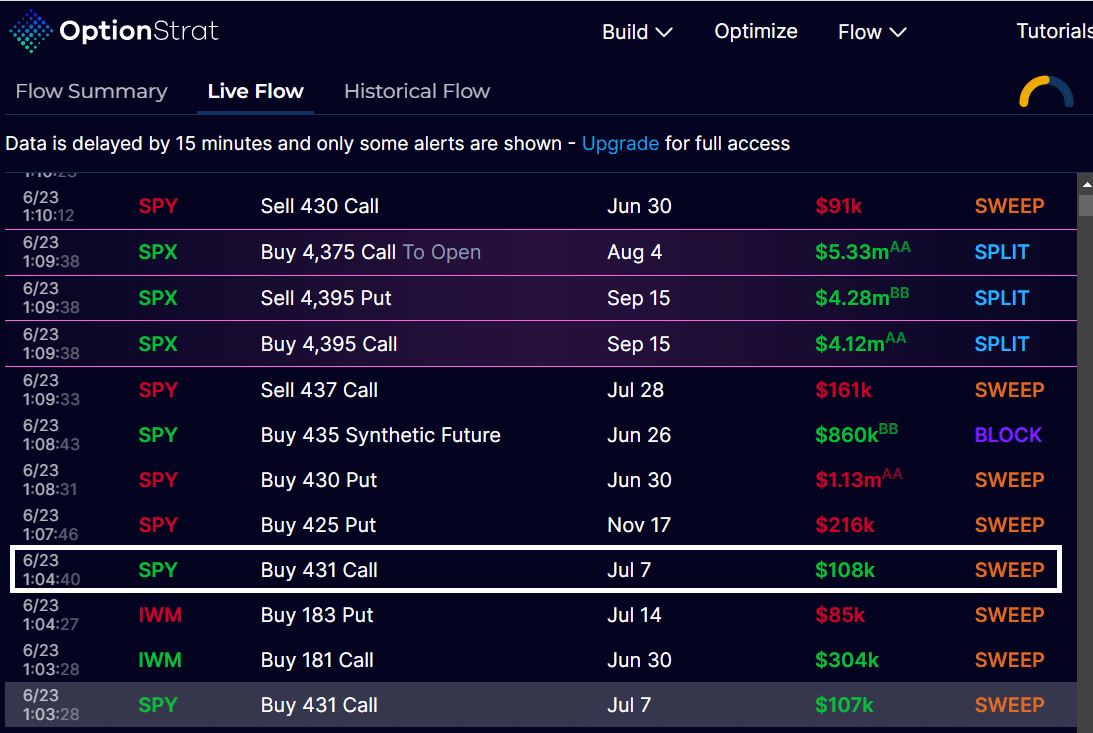

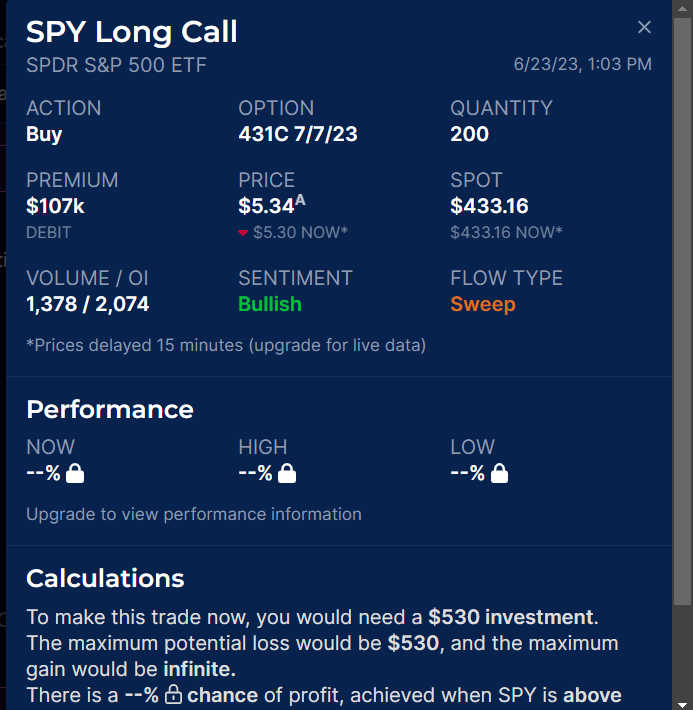

Here is a call sweep as detected by the free membership version of OptionStrat:

Clicking on the data row will give you more details of the order.

Much more advanced software can demonstrate this and perhaps in more detail.

But many of these programs will require a paid subscription.

We hope you enjoyed this article on call options sweep.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.