Coinbase Global, an American cryptocurrency exchange platform, is changing the way we think about work.

As a modern company, Coinbase has embraced remote work, with its geographically distributed team empowered to work from anywhere.

This “remote-first” policy is part of CEO Brian Armstrong’s vision for a more flexible and collaborative work culture.

Now, let’s turn our attention to options trading.

In this example, we will explore a strategy that involves selling a short put on COIN and delta hedging it with short stock.

This technique is designed to help traders manage risk and maximize profits, and can be a valuable tool in any investor’s toolkit.

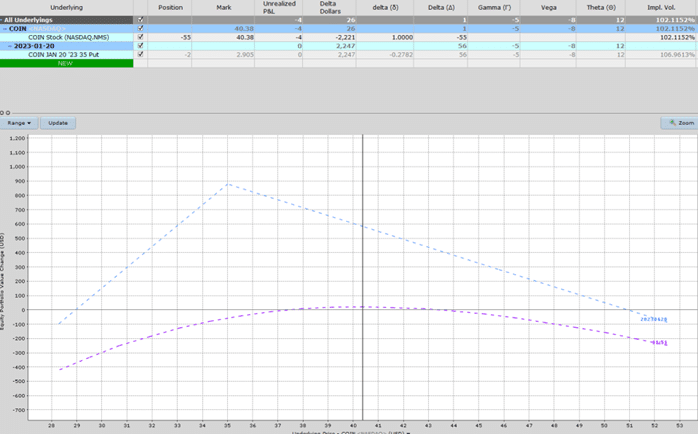

Trade Details

Date: December 15, 2022

Price: COIN @ $40.38

Sell two January 20, 2023 COIN $35 put @ $2.91

Sell 55 shares of COIN stock @ $40.38

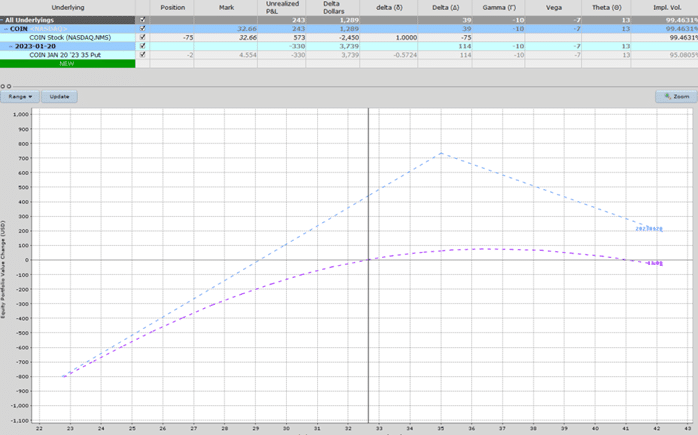

Below is the payoff diagram graph:

In this options strategy, we will be using a technique similar to a short strangle (see example trade of Nike short strangle), but instead of selling a call spread, we will be selling stock to balance out our short puts.

The bearish component of the trade is selling shares of stock, while the bullish component is selling out-of-the-money puts.

We sold each of the short puts when they were at the 28-delta on the option chain, resulting in a position of 56 deltas.

To balance out the delta risk, we sold 55 shares, giving us a net positional delta of 1.

It’s worth noting that the stock is a pure delta position and has no theta, vega, or gamma.

In this non-directional trade, we want to avoid price risk, or delta risk.

To manage this risk, we aim to profit from the decay of options and generate positive theta.

Our trade currently has a positive theta of 12, which is twelve times larger than our delta risk.

To monitor price movements, some traders may choose to set price alerts, which can help manage risk and make informed decisions.

By implementing this options strategy, traders can take advantage of market inefficiencies and potentially generate profits in a range-bound market.

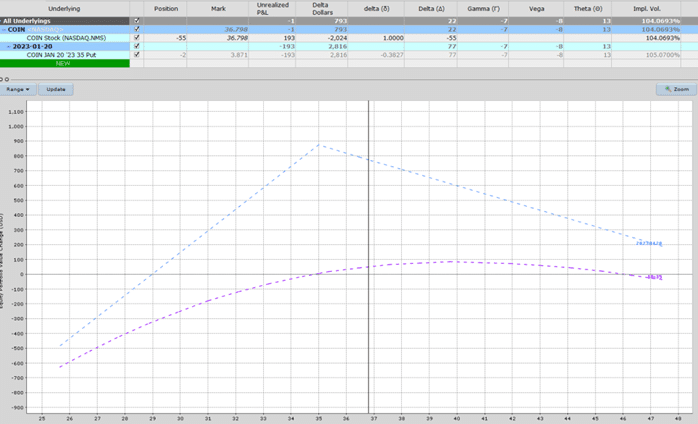

December 19:

On December 19, a price alert was triggered. But P&L is flat.

The current risk graph is as follows:

The delta is now positive 22.

It has gotten larger than our theta of 13.

We could sell some more shares to return to delta neutral, but it’s also ok to leave as is.

One day later the P&L is looking good at +$91 despite the stock dropping.

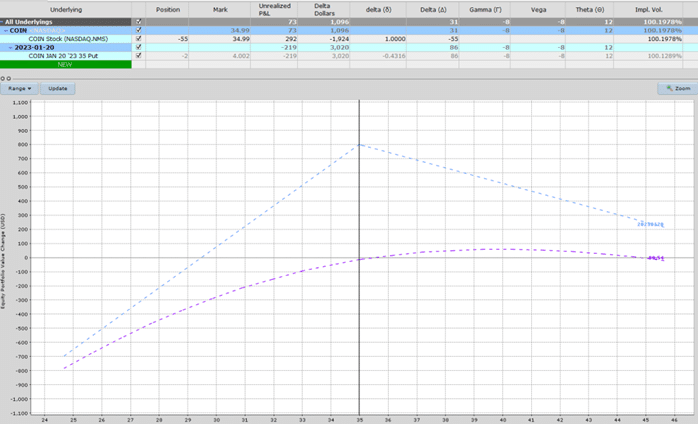

BEFORE

Implied volatility has dropped from 105% to 100%, which has helped since this is a negative vega trade.

Delta has increased more to positive at 31.

At this point, it’s worth adjusting the delta hedge to get it closer to neutral. Something like the following:

AFTER

We are now short 75 shares of COIN.

This lowers our net position to an acceptable level of positive 11, which is just less than our positive 12 theta.

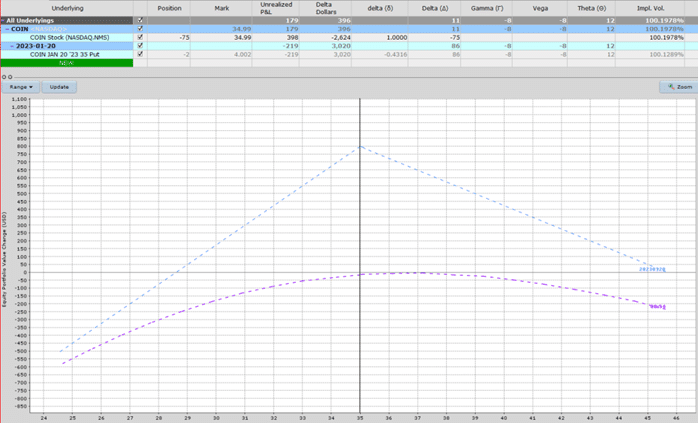

December 28:

On December 28, the stock was down another 8%.

Delta has increased to positive 39 and is due for another adjustment. See the graph below:

However, the P&L of our trade has gone from +80 to +144 due to time passing and theta decay.

There are about three weeks till expiration. It is a good spot to take profits here.

Conclusion

In this example, we showed that short puts with short stock act similarly to that of a short strangle.

While the short strangle may have a bit more theta due to the extra theta coming from the call spread, the short stock allows us to adjust the delta more precisely.

It is also easier to set up pending orders to buy and sell stock based on price triggers.

Both strategies have unlimited risk potential. So trade safely.

FAQ

What is a short put?

A short put is an options trading strategy where an investor sells a put option with the expectation that the price of the underlying asset will rise or remain stable, allowing them to profit from the premium received.

What is a delta hedge?

A delta hedge is an options trading strategy that involves adjusting the position in the underlying asset to maintain a neutral delta, which means that the value of the portfolio is not affected by small changes in the price of the underlying asset.

How does a short put with delta hedge work?

When an investor sells a short put option, they receive a premium in exchange for the obligation to buy the underlying asset at a predetermined price (strike price) if the option is exercised by the buyer.

To delta hedge a short put position, the investor sells a certain amount of the underlying stock to offset the positive delta of the short put.

What are the benefits of a short put with delta hedge?

A short put with delta hedge allows investors to profit from the premium received when selling the put option, while also limiting their downside risk by maintaining a neutral delta.

The other advantage is that it takes advantage of volatility skew by selling the expensive OTM options.

What are the risks of a short put with delta hedge?

The main risk of a short put with delta hedge is that if the price of the underlying asset falls sharply, the investor may be forced to buy the asset at a higher price than the current market value.

This can result in significant losses, particularly if the investor has not hedged their position effectively.

How do you manage a short put with delta hedge?

To manage a short put with delta hedge, investors should regularly monitor the position and adjust the delta hedge as needed to maintain a neutral delta.

They should also set stop-loss orders to limit their losses if the price of the underlying asset falls sharply.

Additionally, investors may choose to close the position early if the price of the underlying asset rises or if they are no longer comfortable with the risk profile of the position.

What are some best practices for trading a short put with delta hedge?

Some best practices for trading a short put with delta hedge include choosing a strike price that is below the current market price of the underlying asset, selecting an expiration date that allows for enough time to profit from the premium received, and carefully monitoring the position to ensure that the delta hedge is maintained effectively.

Additionally, investors should have a clear exit strategy in place and should be comfortable with the risks involved in the position before opening the trade.

We hope you enjoyed this article about our COIN short puts with delta hedge example trade.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.