Iron condors are a popular options strategy that aims to profit from a stock price that stays within a certain range.

While the strategy is typically delta-neutral, meaning that it has no directional bias, traders can modify it to express a bullish or bearish view.

In this article, we’ll take a closer look at an AAPL Condor that started with a slight bullish bias.

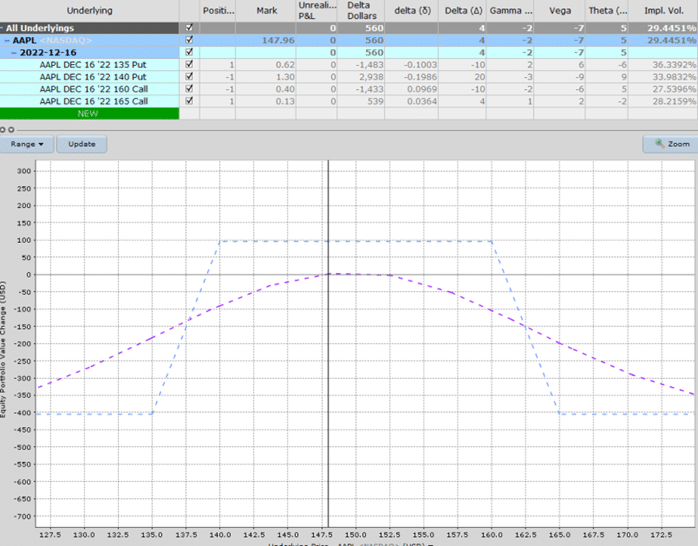

Trade details:

Date: Nov 30, 2022

Price: AAPL @ $147.96

Buy one Dec 16 AAPL $135 put @ $0.62

Sell one Dec 16 AAPL $140 put @ $1.30

Sell one Dec 16 AAPL $160 call @ $0.40

Buy one Dec 16 AAPL $165 call @ $0.13

The Greeks of this trade were as follows:

Delta: 4

Vega: -7

Theta: 5

Gamma: -2

The positive delta of 4 indicated a slight bullish bias. Let’s see if it works out.

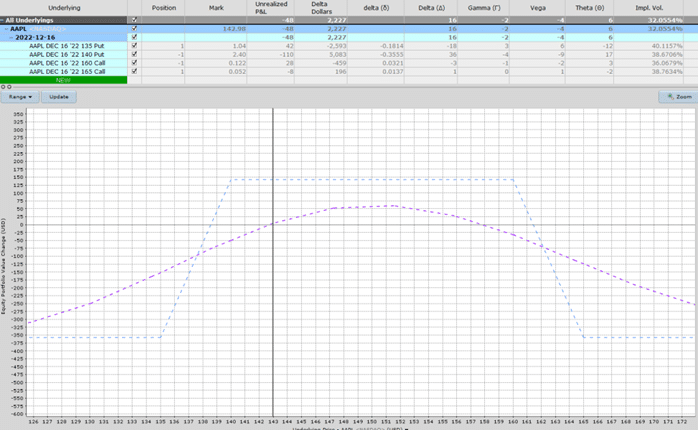

Dec 7th

On December 7, the price of AAPL moved against the position, causing the short put option to blow out to delta 35.

To contain the potential loss, the trader re-centered the condor and increased the position to two contracts.

Increasing the position size increases the profit potential, but also increases the risk.

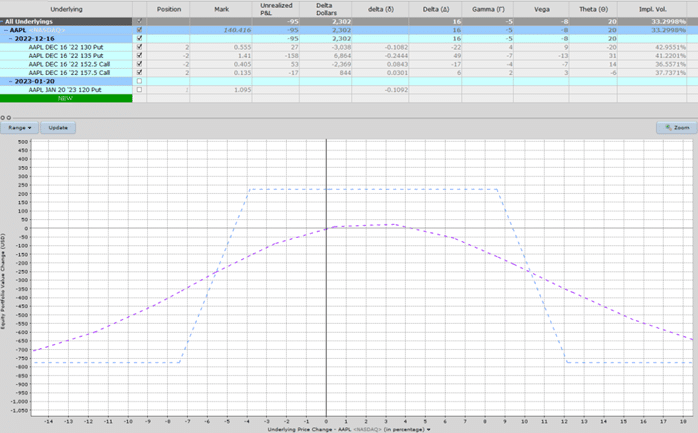

BEFORE

AFTER

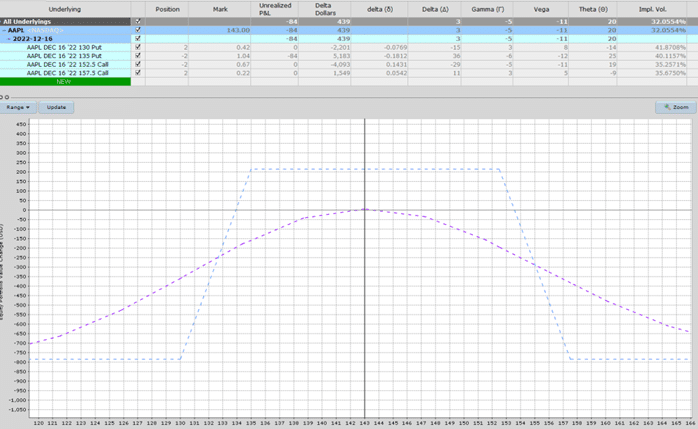

Dec 8th

These short-term condors move so fast, which is why I don’t like them.

The short put has gone from 18 to 24 delta. Also notice the big gap in delta from 24 to 11 for only a 5-point-wide spread.

Highly risky when we get into the last week.

That being said, we added a 10-delta put in the next month as a hedge.

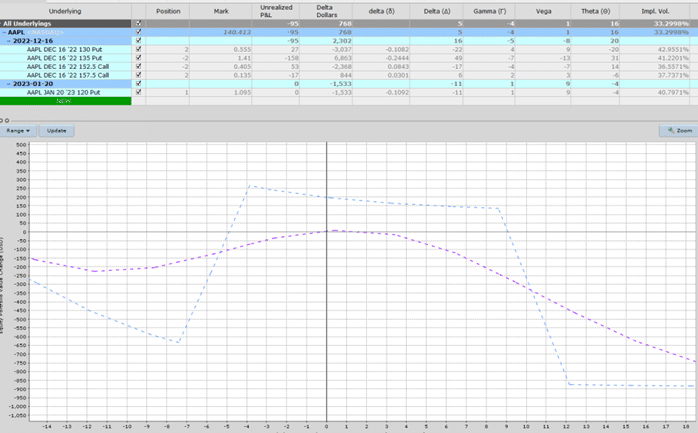

BEFORE

AFTER

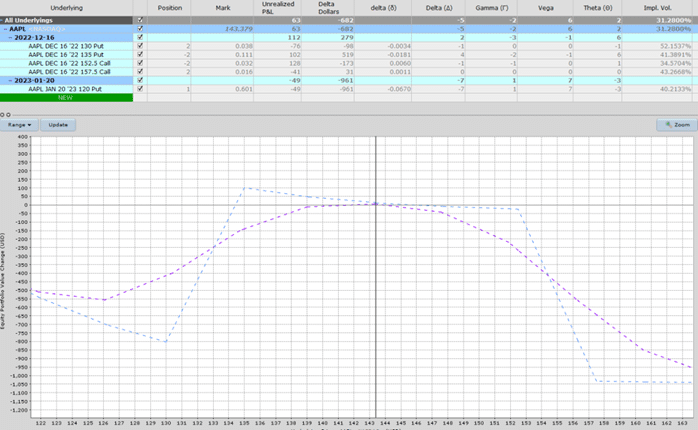

Dec 15

The hedge from last week lost $49 but allowed us to stay in the condor longer and achieve a near-full profit on the condor.

No real point in holding for the last two days.

Total profit $105 or around 10%.

Conclusion

Whew. What a trade. We saw a couple of different adjustments in this trade.

We started out thinking the price was going to go up.

But instead, it went down.

We quickly re-centered and also added an additional contract.

When the price still continued down, we hedged the condor by buying a straight put option.

This trade illustrates the importance of risk management and flexibility in options trading.

We hope you enjoyed this article about this AAPL condor.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.