The Rhino options trade is an income-style trade that makes money from theta decay.

As such, it needs the underlying price to stay still, or at least not move so much.

It is traditionally done on the RUT (Russell 2000 index).

Contents

Trade Initiation

Let’s take the case where the Rhino started on May 22, 2023, just before RUT makes a big move up. And see how it did.

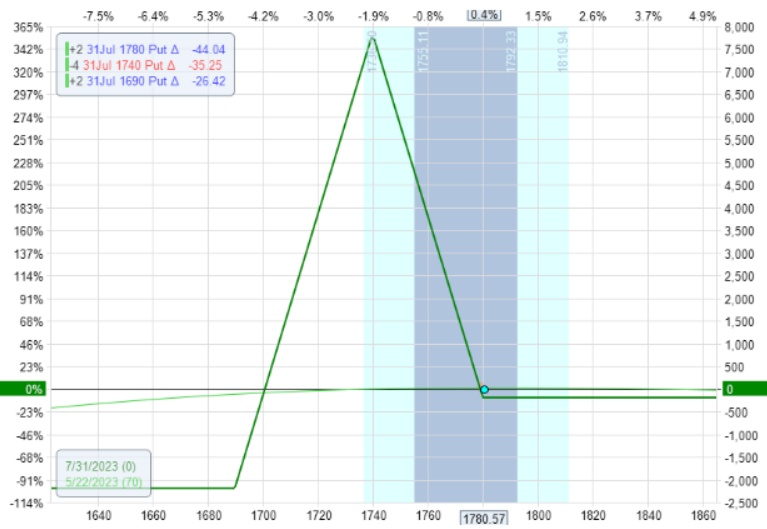

Date: May 22, 2023

Price: RUT @ 1780

Buy two July 31 RUT 1780 put @ $57.69

Sell four July 31 RUT 1740 put @ $44.39

Buy two July 31 RUT 1690 put @ $32.55

Net debit: -$292

Delta: 0.18

Theta: 4.9

Vega: -35.06

The debit of $1.95 does not mean that is the risk we are taking in the trade.

This is a broken wing butterfly.

The max risk is what you see in the expiration graph, not the debit paid.

The max risk is about $2400 right now. But this risk increases as the trade progresses.

Scale Up

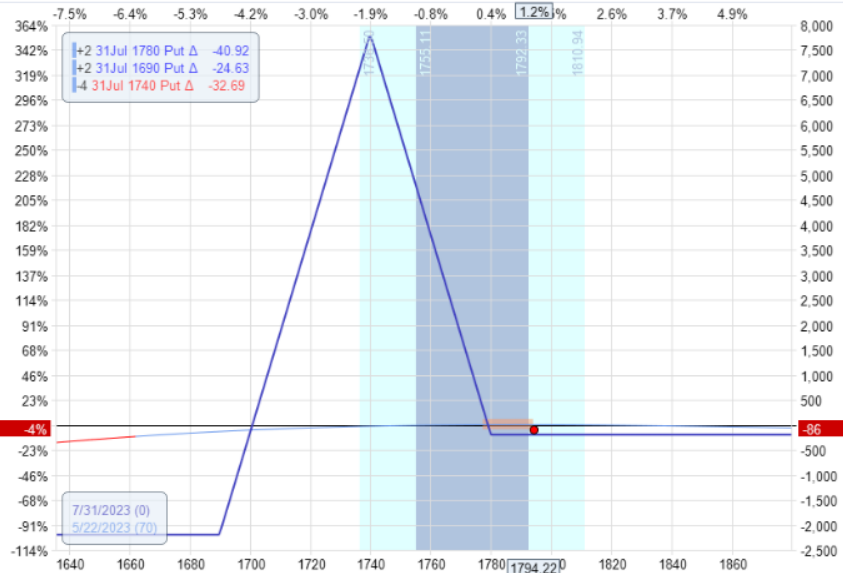

On May 23, 2023, RUT moved up and outside the tent at 1794.

Delta: -0.24

Theta: 4.47

Vega: -30

We scale up the Rhino by buying another two-lot broken-wing-butterfly higher in strikes:

Date: May 23

Price: RUT at 1794

Buy two July 31 RUT 1800 put @ $54.32

Sell four July 31 RUT 1760 put @ $42.19

Buy two July 31 RUT 1710 put @ $30.96

Net debit: -$180

New Greeks:

Delta: -0.11

Theta: 9.21

Vega: -67

The adjustment decreased the delta slightly and increased the theta because we are adding butterflies.

The more important thing is that it got the price underneath the expiration graph again.

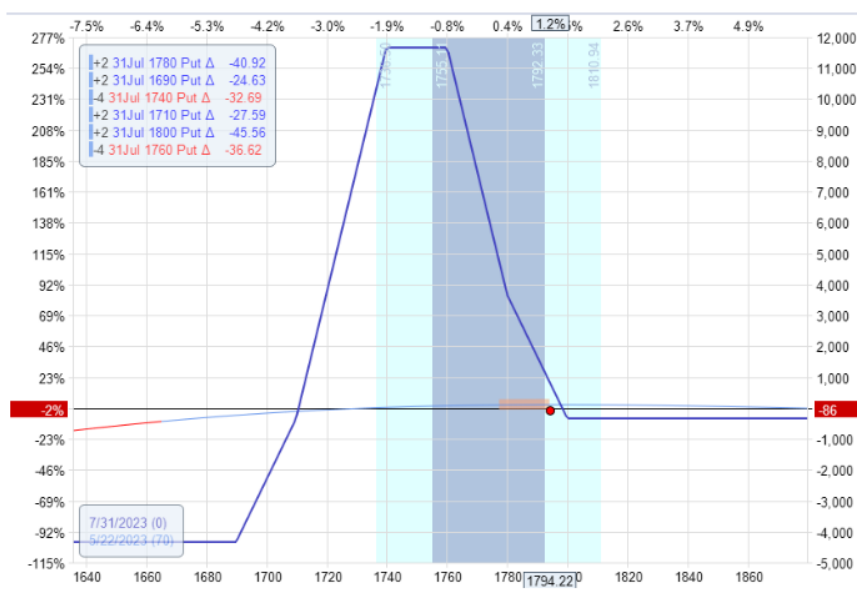

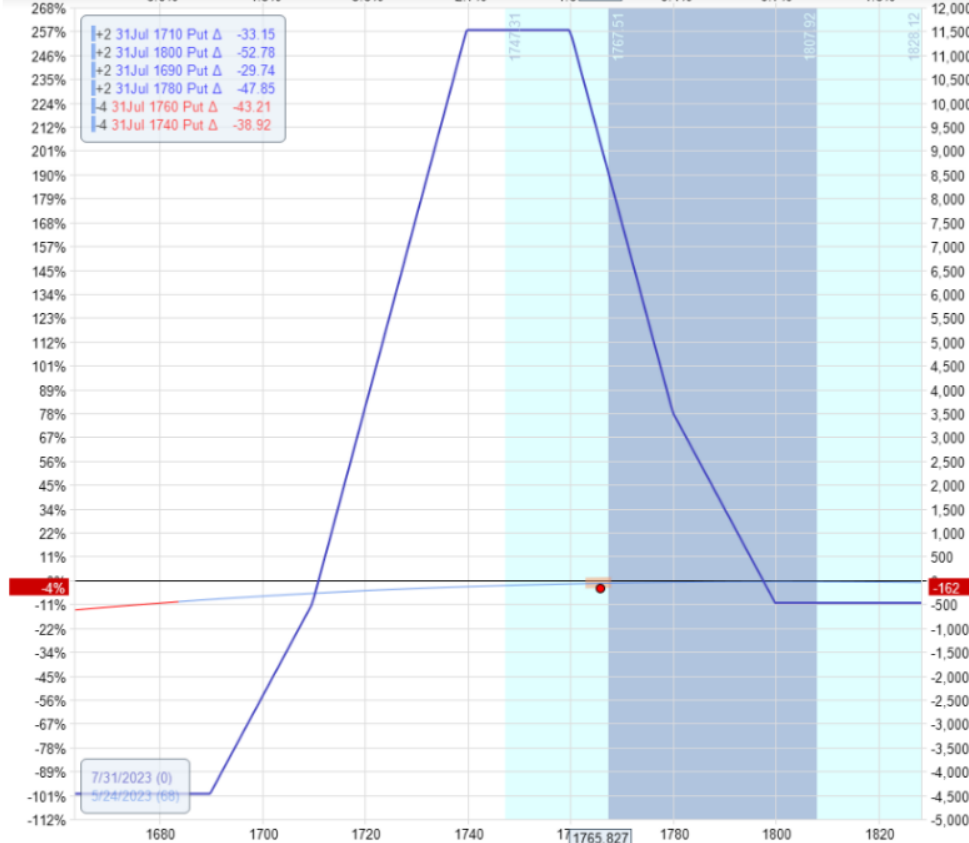

May 24, 2023

A drop in the RUT…

But not much damage to the P&L.

Down –$162, or -4%

This is one of the good things about the Rhino.

The market can make big moves without hurting the trade too much.

Delta: 1.86

Theta: 10

Vega: -78

However, the delta has become positive at 1.86. Not a big deal.

But many butterfly traders like to keep a little bit of negative delta when the price is in the middle or left downward side of the tent.

We decided to scale back down to a half Rhino by removing the two-lot upper butterfly we added the day before.

Date: May 24

Price: RUT @ 1765

Sell two July 31 RUT 1800 put @ $76.71

Buy two July 31 RUT 1760 put @ $60.10

Sell two July 31 RUT 1710 put @ $44.27

Net credit: $156

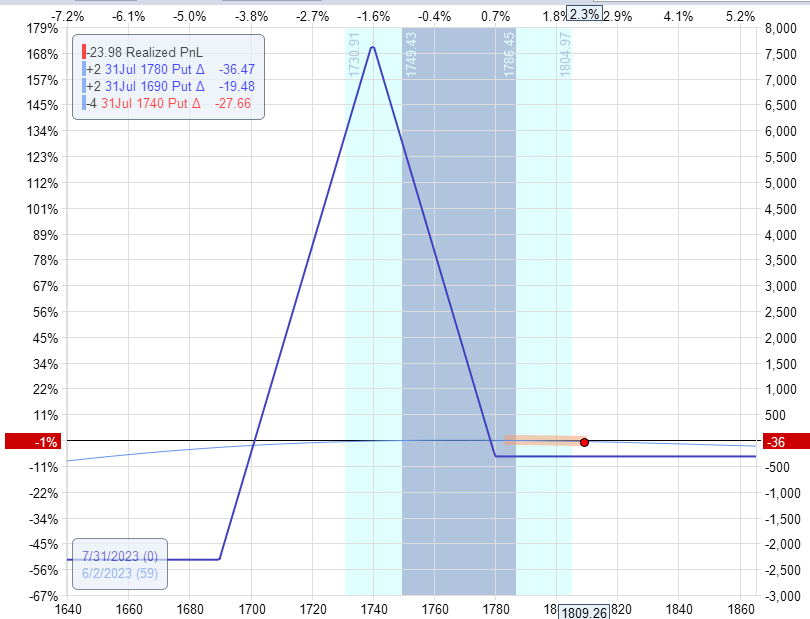

The resulting graph:

And the resulting Greeks:

Delta: 0.58

Theta: 5

Vega: -36

That decreases our positive delta.

Theta and vega naturally will be lower since we now have only two-lot butterflies.

Trading is like that.

The market makes a move, and then we respond and follow the move.

We do not try to predict the move, but we react to the move.

Tomorrow we’ll see what the market does, and then we will react to that move – if we have to.

The next day, we didn’t have to do anything.

June 2

We didn’t have to do anything until June 2, when RUT was up to 1809:

We add a calendar as an upside hedge:

Date: June 2

Price: RUT at 1809

Sell one July 31 RUT 1850 call $46.63

Buy one Aug 18 RUT 1850 call $56.73

Net debit: -$1010

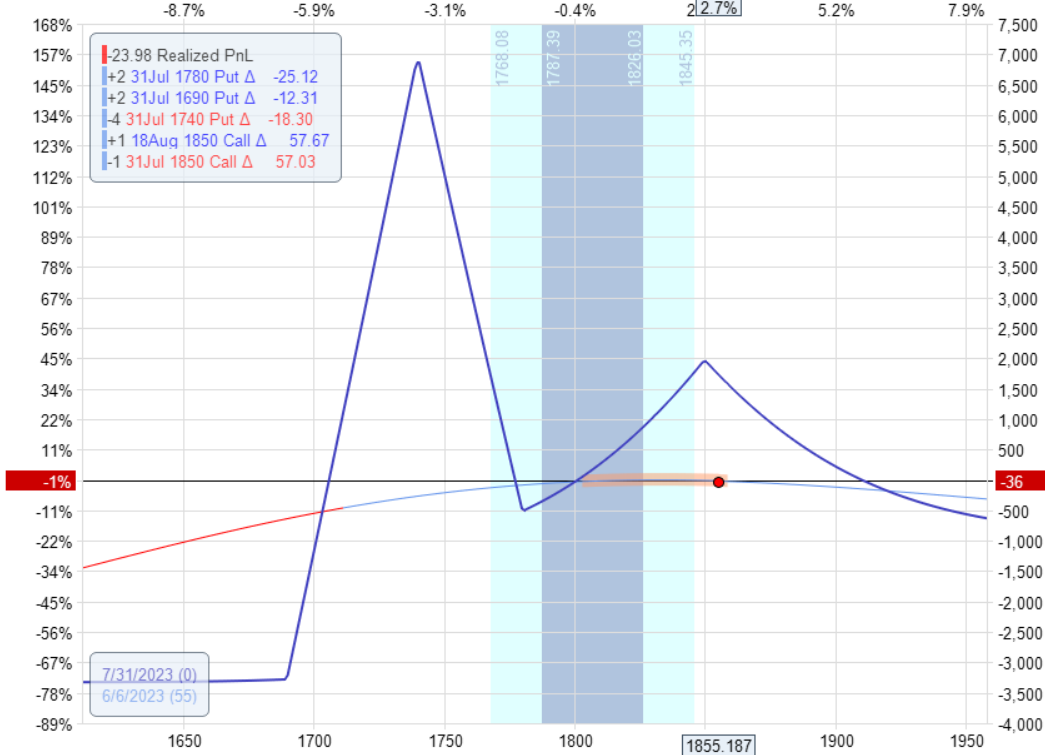

June 6

RUT moves up past the short strikes of the calendar…

The adjustment is to sell the calendar and open a new one higher up.

Date: June 2

Price: RUT at 1855

Sell the calendar

Buy to close one July 31 RUT 1850 call @ $63.59

Sell to close one Aug 18 RUT 1850 call @ $74.28

Net credit: $1069

Open a new one:

Sell to open one July 31 RUT 1880 call @ $47.35

Buy to open one Aug 18 RUT 1880 call @ $57.55

Net debit: -$1020

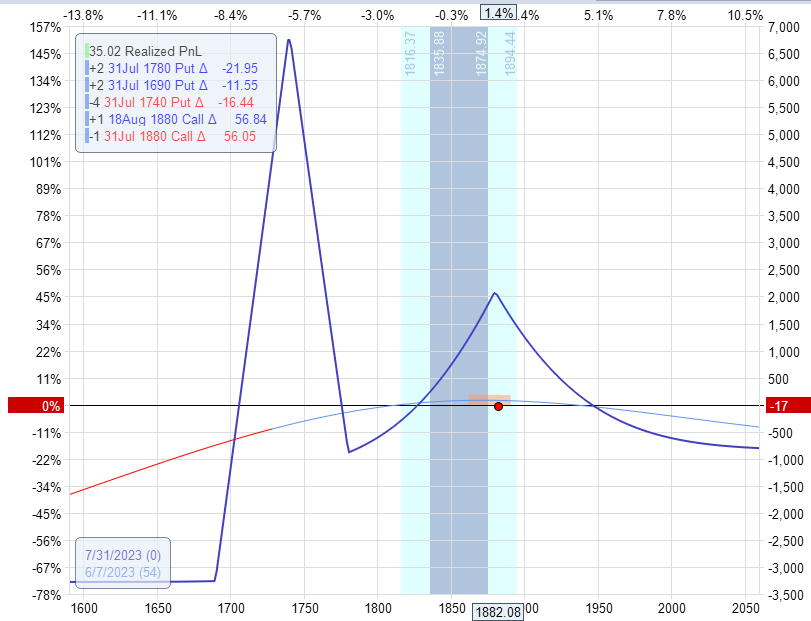

June 7

Price up to the short strike again.

We roll up the calendar again. We perform the transaction in a single order.

Buy one July 31 RUT 1880 call @ $62.65

Sell one Aug 18 RUT 1880 call @ $73.45

Buy one Aug 18 RUT 1910 call @ $56.55

Sell one July 31 RUT 1910 call @ $46.45

Net credit: $70

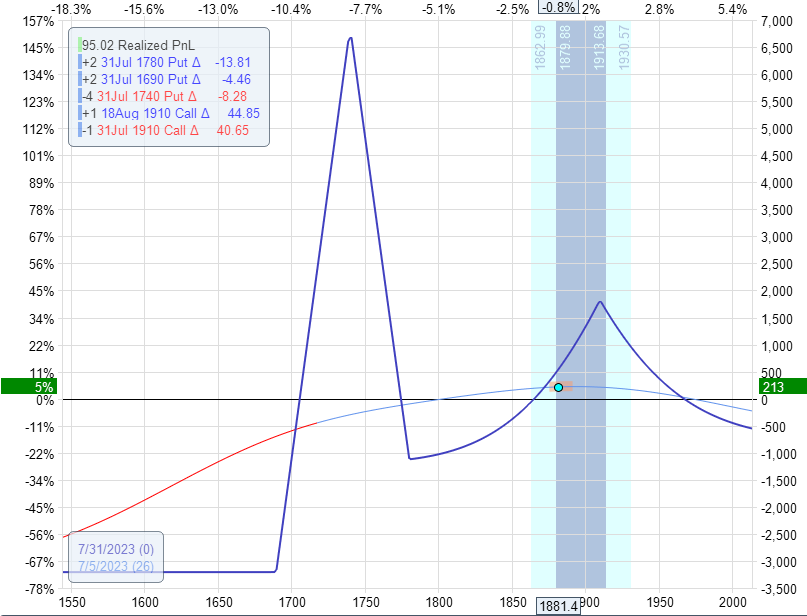

Exit

On Jul 5, with 24 days to expiration and with the price dot sitting on top of the ball of the T+0 line, we decided to take the profit of $213, or 5% of the current margin.

This is lower than the typical profit target but with the unrelenting up move and multiple adjustments.

Conclusion

Yes, the Rhino trade did survive despite a big up move in the RUT from May 22, 2023, to Jul 5:

The trade didn’t make as much money as we would like, but at least it made money.

Alternatively, instead of closing this trade entirely, we can close parts of it and turn the rest into a black swan hedge.

Let’s look at how in the next article.

We hope you enjoyed this Rhino options trade review.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thanks for writing such a informative blog. I am from India and I regularly reading your blog. Can I use rhino strategy in weekly expiry.

Please suggest the best strategy for weekly option

Go to this page and search “weekly” and you will find some ideas. https://optionstradingiq.com/option-education/

Thanks for sharing, I really like this rhino trade. Would you say it’s the best / most flexible 0 delta strategy? I see others only do this on RUT..any reason not on SPX?

One of the best, yes. I would stick to RUT as the strikes are a bit more friendly.

Loving this strategy I just have one question – can this be modified to use regular butterflies instead of broken wing? I understand the purpose is to protect the upside a little more, however, my brokers margin requirements for broken wings are really high to the point where I can’t even put a full set on let alone allow for buying power to put on call spreads. What adjustments would I have to make to make this work?

That’s strange. What broker are you with? I would suggest moving to an option friendly broker like IBKR or ToS.