With stocks dropping fast, many quality companies can be bought at fire sale prices.

Apple is one such stock and is currently trading 12.22% below its 52-week high.

Here’s how you can potentially generate a stress-free 12% return from Apple stock in the next ten months.

What is a Covered Call

A covered call involves buying 100 shares of the underlying stock and simultaneously selling a call option against those shares.

Selling the calls limits the upside but increases the yield from the investment in the form of option premium.

The investor keeps the premium generated from selling calls no matter what happens with the stock.

When trading covered calls, most investors sell monthly calls against their stock to make the most of the effects of time decay.

That makes a lot of sense but also requires a lot of active management.

What if we sold a ten-month covered call against AAPL stock? Let’s take a look.

Apple Stock Ten-Month Covered Call

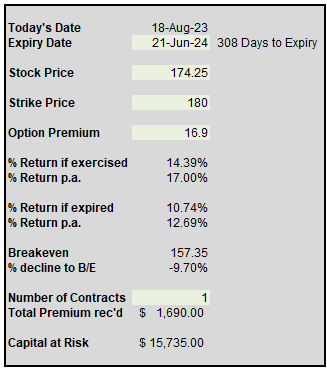

On AAPL stock, a June 2024, call option with a strike price of 180 can currently be sold for around $16.90, generating $1,690 in premium per contract.

Purchasing 100 shares of Apple stock will cost around $17,425, but the net cost can be reduced by the $1,690 option premium received.

Therefore, we have a potential return of (1,690 / 15,735) in 308 days which is 12.69% annualized.

That sure beats the dividend yield on most stocks in the current market and is certainly a whole lot better than the current AAPL yield of 0.54%.

Covered calls are a fantastic way to generate extra income from a stockholding while also providing some downside protection.

Investors would need to weigh the pros and cons of the stock before initiating a bullish trade like a covered call.

The main risk is a sharp drop in the stock price of AAPL which could be more than the premium received for selling the covered call.

We hope you enjoyed this trade idea.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Related Articles

Selling Covered Calls – A Detailed Guide

How To Write Covered Calls: 2024 Ultimate Guide

Weekly Versus Monthly Covered Calls

How To Make Money With Covered Calls

When to Roll Covered Calls

Selling Deep In The Money Covered Calls: Why Do It?

Covered Calls For Dummies

Covered Calls With LEAPs Options Strategy

Supercharge Your Covered Calls Using LEAPS

Selling Weekly Covered Calls

Covered Calls 101

\

\

IMO it is not correct tot deduct the premium from the investment price to calculate the return… no? I would say return = 1690 / 17425

Or am I missing something here?

The capital required (margin) is equal to the cost of the 100 shares less the premium received, so that is what is used to calculate the return. If you set up a covered call trade in your broker account you will see what I mean.