Have you ever wondered about trading iron condors in a low volatility environment?

Experienced iron condor traders know they have a better edge if they trade them during higher implied volatility (IV).

The higher premiums allow for wider iron condors when the shorts are placed at a certain delta in the option chain.

Iron condors have negative vega and would benefit from a drop in implied volatility.

Therefore, they start an iron condor at high implied volatility expecting IV to drop back towards the mean since volatility exhibits mean-reverting characteristics.

Many of these advantages disappear when we are in a low IV environment.

With IV so low already, how much more can it go?

If IV increases (which it eventually will someday), the iron condor will suffer due to its negative vega.

These are valid concerns.

Admittedly, there are better conditions for iron condors, as we shall see.

However, they can still be traded, which we will discuss in this article.

Contents

Iron Condor During Low IV

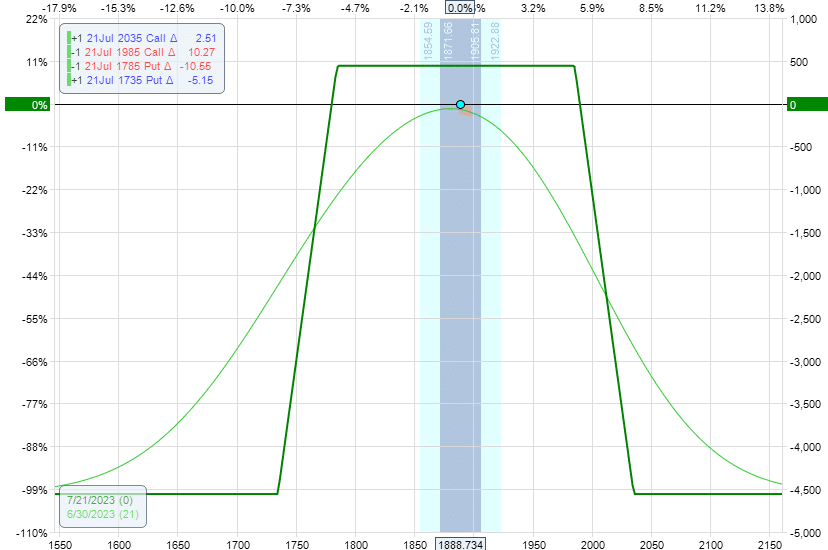

Consider this 21-day iron condor on the RUT with the short put at 10-delta and the short call at 10-delta.

The wing widths are 50 points wide.

On June 30, 2023, the RVX (a measure of RUT volatility) was at a three-year low of 19.

Date: June 30, 2023

Price: RUT @ 1890

Buy one July 21 RUT 1735 put @ $1.95

Sell one July 21 RUT 1785 put @ $4.05

Sell one July 21 RUT 1985 call @ $3.50

Buy one July 21 RUT 2035 call @ $1.28

We get a credit of $443 with a max risk of $4558, a risk-to-reward ratio of 10.

The breakeven points are around 1775 and 1990, 115 points and 100 points away from the current price.

Iron Condor During High IV

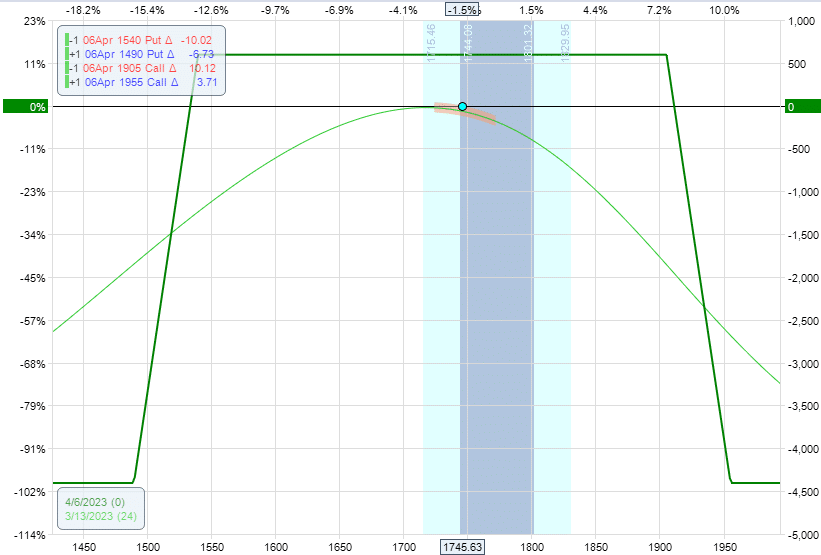

Suppose we had placed a similar iron condor on March 13, 2023, when RVX was higher at 33.

Same 50-point wings and short put and short call at the 10-delta.

Date: March 13, 2023

Price: RUT at 1745

We would get a larger credit of $595 with a max risk of 4405 and a lower risk-to-reward ratio of 7.4.

The breakeven points are at 1530 and 1910, 215 and 165 points away from the current price.

So we get a larger credit, a better risk-to-reward, and our spreads are further away when we are in a higher IV environment.

Iron Condor With Longer DTE

How can we improve our iron condor in a lower IV environment?

How about extending the DTE (days to expiration)?

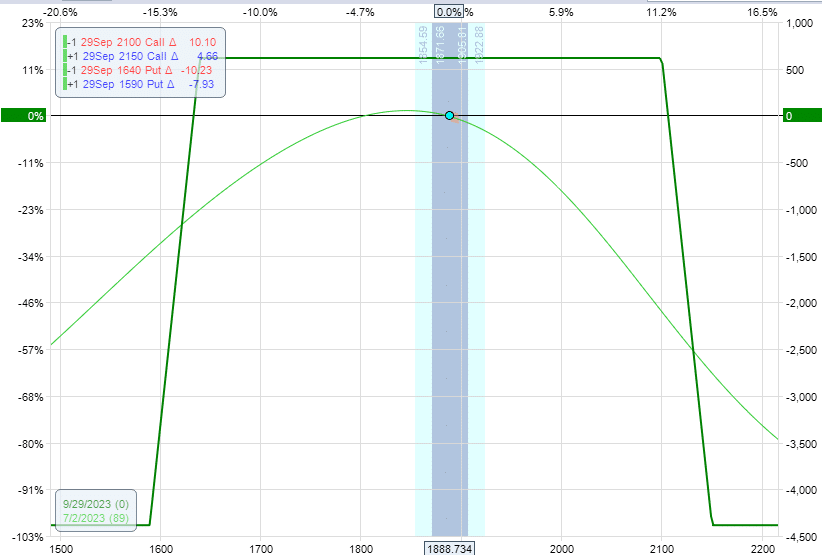

We are back to June 30, 2023 (a low IV period). Instead of a 21-day iron condor, we will do an 89-day iron condor.

Again putting the 50-point spreads at the 10-delta.

Date: June 30, 2023

Price: RUT @ 1890

Buy one September 29 RUT 1590 put @ $8.25

Sell one September 29 RUT 1640 put @ $10.95

Sell one September 29 RUT 2100 call @ $7.90

Buy one September 29 RUT 2150 call @ $4.45

We get a credit of $615 with a max risk of $4385 – a 7.1 risk to reward.

The breakeven points are at 1625 and 2100, 265 points, and 210 points away.

See that? By extending the days to expiration, we can get similar credit, risk-reward, and distance as the iron condor in the higher IV environment.

Conclusion

A longer DTE iron condor in low IV is similar to a shorter DTE iron condor in high IV.

The only difference is that profits will accrue at a slower rate in the longer DTE iron condor.

There are advantages to trading iron condors in a higher IV environment.

And some traders will refuse to trade them when IV is low.

However, for some traders who have no other strategy to do during low IV and are itching to trade their iron condors, it is still possible to trade them.

They need to extend the days till expiration and have more patience in collecting their profits.

We hope you enjoyed this article on trading iron condors in low volatility.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Good article thanks for sharing knowledge