Apple stock has dropped 10.22% since making its high on July 19th.

When it comes to options, most people normally look at short-term trades. Anywhere from one week to one month.

Today, we will look at a longer-term bull put spread.

Longer-term option trades tend to move a little slower than shorter-term trades. That allows more time to adjust or close, but also means a lower annualized return.

As a reminder, a bull put spread is a defined risk strategy, so you always know the worst-case scenario in advance.

This type of trade will profit if AAPL stock trades sideways or higher and even sometimes if it trades slightly lower.

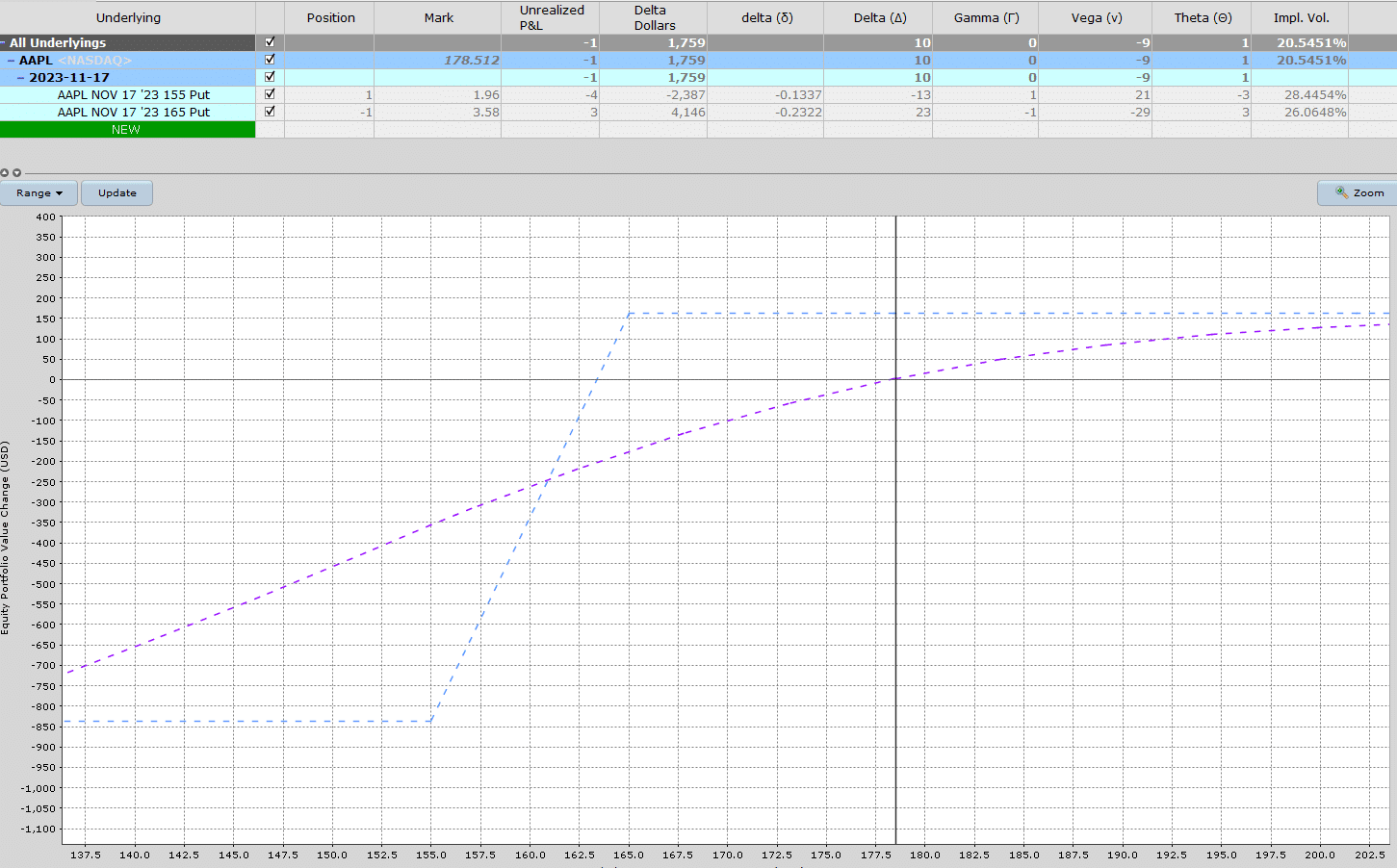

With AAPL stock trading around 178, if we use the November 17 expiration, we can sell a 165-strike put and buy a 155-strike put to set up the bull put spread. That spread was trading around $1.60 yesterday.

Selling this spread would generate roughly $160 in premium with a maximum risk of $840.

If the spread expires worthless that would be a 19% return in just over 3 months provided AAPL is above 165 at expiration.

The maximum loss would occur if AAPL stock closes below 155 on November 17 which would see the premium seller lose $840 on the trade.

The plan for the trade would be to hold until expiration and if AAPL is below 165, take assignment and start a Wheel trade.

Let me know if you have any questions.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.