Option writing is a strategy with a proven long term track record of success ever since options themselves have been created.

This article will provide a guide for options writing designed for beginner investors who have very little knowledge of options themselves.

Our goal is to understand the reasons why options writing makes money.

For more intermediate and advanced investors, this is a good simple review of some principles that will make option writing profitable in the long term.

Hopefully, this will serve as a guide to further your interest in options and alternative income streams for beginner investors.

Contents

Why Do People Buy And Sell Insurance?

Have you ever thought that you have overpaid or are overpaying for your insurance?

News flash, you are most likely right.

Providing insurance is a money-making business, and it is not a small one.

In 2020 over 1.28 trillion dollars of insurance premiums were paid by individuals.

These people are looking to insure everything from their homes to microwaves, to even their health and hands (think a plastic surgeon).

This insurance is rarely profitable. Most premiums are paid out and never seen back.

These premiums pocket large amounts of money for insurance companies fancy offices, bonuses and Herman Miller boardroom chairs.

Of course, this money is not completely free.

Occasionally an unforeseen event happens, a forest fire destroys a home, or your nephew sticks a fork in the microwave.

Then, the insurance company has to payout.

When this happens, the amount is far greater than the average premiums they receive.

It is easy to think of insurance as a rigged game.

Let’s be clear.

Nor the insurance company or the individual buying insurance is stupid.

A rational individual buys insurance for losses they are not prepared to live with, generally things such as their home, car and health or sometimes just for peace of mind.

An insurance company provides this assurance but needs some incentives to take on the added risk.

After all, receiving a few hundred dollars a month from thousands of policyholders sounds great until a hurricane strikes, and you are on the hook for millions.

Maybe you have seen these companies and thought to yourself.

I wish I could sell insurance for myself, but I do not have the qualifications, money or resources to set up an insurance company.

The good news is you can still be an insurance provider.

It turns out any person with a few thousand dollars, a computer, and an internet connection can be an insurance provider themselves, all through writing options.

Why Should You Consider Writing Options?

An options contract is just like an insurance contract.

One investor buys insurance through a call or a put option.

This gives them the right to buy or sell a security at a certain price before certain expiry date.

The other investor sells them that insurance in return for a premium.

Just like other forms of insurance, options contracts usually are overvalued.

After all, if insurance were free for portfolios, then everyone would buy it.

The overvaluing of options contracts through time is a phenomenon known as the variance risk premia.

While it is true that variance risk premia can be negative over shorter periods of time, over the long term, it is resoundingly positive and will likely continue to be so.

Of course, there are many caveats, and not all insurance is created or priced equal after all.

These caveats create a challenge.

We can write options on thousands of equities, interest rates and commodities, so how should I know which options to write?

For an astute investor, understanding company fundamentals, volatility, and more in-depth analysis can result in resounding gains from writing options at the correct time.

This is the same as an astute insurance provider can know when a policy has added risks below the surface.

Yet, odds are you didn’t go to school as an insurance broker, nor are you a professional trader.

Can you still make money writing insurance without knowing much about the market?

Yes, and here are a few simple, intuitive steps to do so.

1. Sell the Insurance People Want!

Imagine you are at an insurance fair trying to sell toilet insurance.

The odds are you are not getting a buyer.

Nobody wants insurance for their toilet.

Even worse is if you finally get someone to buy your insurance at a marked-down price, they are the ones probably getting a good deal.

Hence provide the insurance people want.

This will naturally lead to higher premiums and profit over time.

In the stock market, the options in the most demand are usually index put options which protect a portfolio against a market-wide drawdown.

As this risk is, to an extent, undiversifiable, investors are willing to pay up for the protection index puts provide.

It is a risk they do not want to take.

The data backs up this trade as index options have historically had a much higher premium than single stock options.

2. Focus on Liquid Underlyings

Perhaps at the local fair, you have had the chance to see a jar of pennies (or other small objects).

Guess the right amount of pennies, and you win the jar.

It is not easy to do!

Most likely, you will be significantly off.

Interestingly, while your individual guess is often not very accurate, you get a remarkably close guess to the number of pennies in the jar by taking all of the guesses and aggregating them.

This is known as collective wisdom.

The stock market is unique in that everyone can see each other’s guesses, and the average guess is the price of the option.

This usually results in a very fair price, especially on liquid options.

While there may be certain opportunities in illiquid options, there can equally be times where you are on the wrong side as a beginner.

Add increased commissions and transaction costs, and it is not pretty.

By writing options on more liquid underlyings we reduce execution costs and skill while also ensuring we get a fair premium (fair price + variance risk premia) for our contracts.

3. Do Not Sell Too Much of a Good Thing!

Remember, the first slice of pizza is always the best.

Even after the sixth slice, an avid pizza lover might want to throw up.

As an options writer, it can be tempting to sell more and more options when the experience goes well.

Despite this, overleveraging, even on a good thing, will eventually lead to disaster.

Whenever you write options, be aware of the absolute worst scenario that can happen.

If you cannot survive or live with it, trade a smaller size.

How to Structure Options Writing Trades?

There are numerous ways to structure short option trades.

For an investor who wants long exposure, simply selling S&P 500 puts will offer both long equity exposure and short volatility (insurance writing) exposure.

For investors who do not want to take a directional view, Strangles or Iron Condors are two good choices.

These are trades where the same delta put and calls are both sold.

Generally speaking, option writing is a stress-free process.

When transactions go against you, it’s crucial to know how to hedge your position.

Benefits Of Option Writing

The basis of option writing is that you are making money by selling things. In this case, you are selling options contracts.

You sell them when premiums are high.

You repurchase them when premiums have dropped. Options contracts premiums contain both intrinsic value and extrinsic value.

Extrinsic value always drops to zero at expiration.

This is known as “time decay”. Option value decreases with time (with other things being equal).

This fact is one of the benefits of option writing.

Risks of Option Writing

The only problem with this is the change in intrinsic value that has occurred during the trade.

While you do make money on the extrinsic portion of option writing.

This may or may not be enough to compensate for any loss you incur due to changes in the option’s intrinsic value.

Depending on the underlying price change, the intrinsic value may have gone up a lot, causing the value of the option to increase, which is a bad thing if you are selling options.

The biggest risk to option writing is a big price move in the wrong direction that causes the value of the option to go up, and hence you lose money on the trade.

The second biggest risk to option selling is an increase in implied volatility during the trade.

Rising volatility causes the value of the option you sold to go up, causing you to lose money on the trade.

The effect of implied volatility indeed goes to zero at expiration.

This means that you have to hold the option to expiration, at which point the option’s value is solely determined by where the strike price is in relation to the current price of the underlying.

Holding the short option that long till expiration risks exposure to a large price move against you.

The risk to reward in options writing is not ideal because you are risking a lot but have only a limited reward.

This is not to say that option writing is not profitable.

It can certainly be profitable because profitability also depends on the probability of profit.

Option writing (especially writing options further away from the money) is often a high-probability trade.

Naked Options Writing

When selling an option, you have unlimited risk.

This is known as naked options writing without any other extra protection layered on top of the options writing strategy.

If you sell a put option, you are obligated to buy the stock at the strike price at expiration if the stock price drops below the strike price.

If you don’t have enough money in your account reserved to buy this amount of stock, it is said that you are writing a naked put option.

If you do have money reserved in your account readily available at any time, then it is not considered naked options writing.

It would be considered selling a cash-secured put.

If you sell a call option without owning the shares of the stock, this is naked call selling.

And if the underlying stock price goes up to infinity, you can lose an infinity amount of money.

Because now you are obligated to sell stock that you do not have.

You need to buy the stock at market to fulfill your obligation.

But if the stock price has risen to an infinitely high amount, your loss is theoretically unlimited.

While, in reality, a stock price can not go to infinity, there is no cap on how high it can go. So we say that the loss is “unlimited.”

The characteristic of naked options writing is that you have “unlimited” theoretical loss.

Many options investors mitigate this risk by covering the short call by owning the underlying stock.

They cover the short put by securing the necessary cash to pay for the stock.

Very commonly, they will sell a call spread or a put spread instead.

These spreads limit the risk and are not considered naked option writing.

Examples

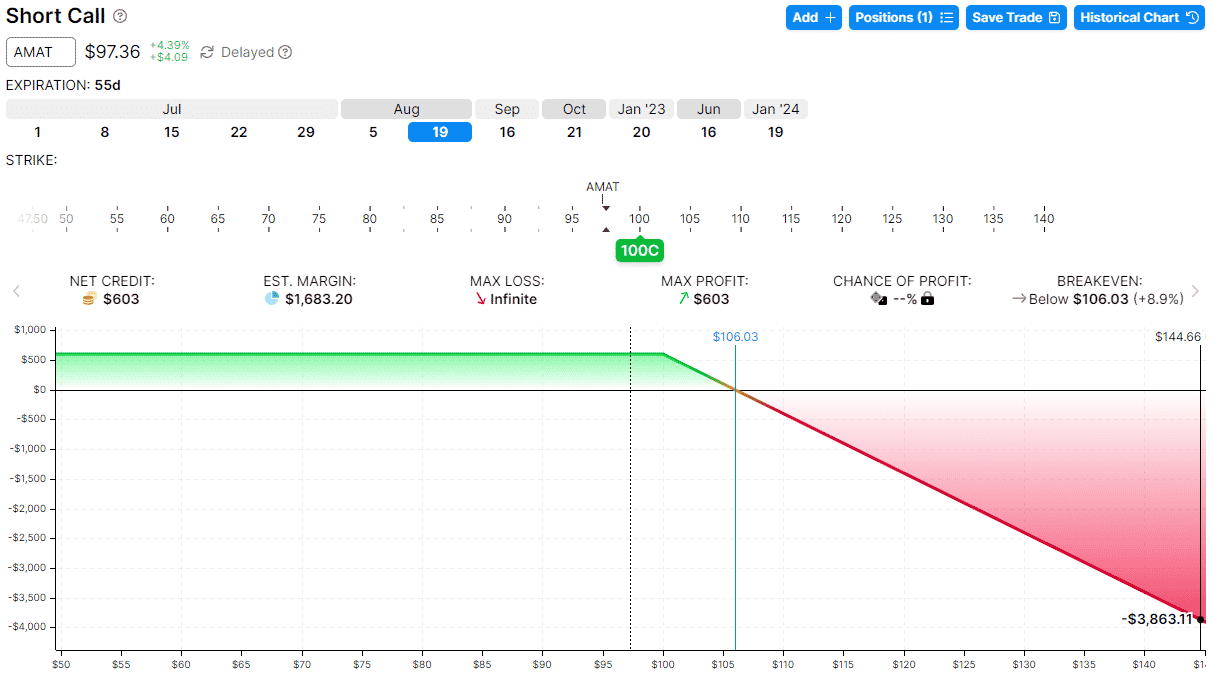

Short Call Example:

On June 24, 2022, the price of Applied Material (AMAT) was at $97.36 per share.

Suppose an investor sells a call option with a strike price of $100 on Applied Material (AMAT).

The investor collected $603, and the option expires on August 19.

This trade is a naked call option because the investor does not currently own 100 shares of AMAT stock.

The risk graph looks like the following, with the vertical axis showing the P&L (profit and loss) for the different prices that AMAT might be at expiration (horizontal axis).

source: OptionStrat.com

The red expiration line does not end at the right edge of the graph, as shown.

As the price of AMAT keeps going up, the P&L of the trade keeps going down.

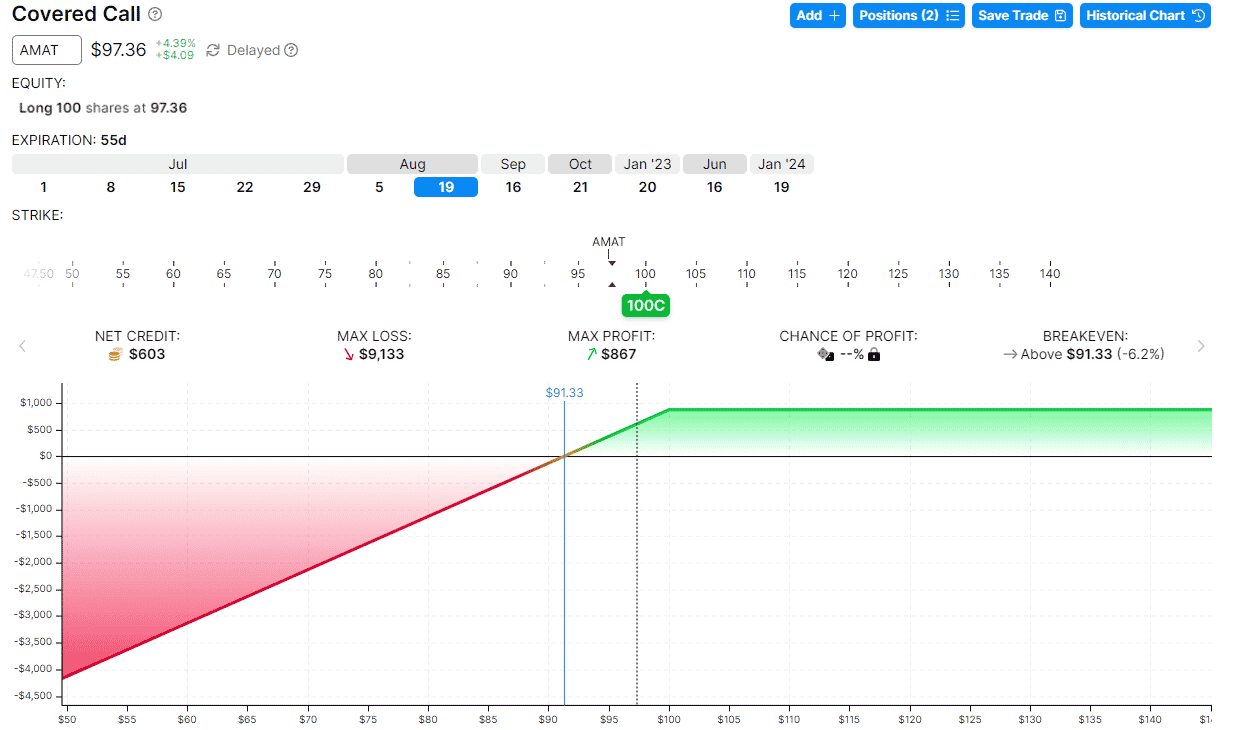

Covered Call Example:

If, however, the investor owns 100 shares of AMAT or buys 100 shares of AMAT at the same time the call option is sold, then it changes the risk graph to be as follows:

It completely switches from a bearish position to a bullish position.

It is no longer considered naked; it is a covered call.

Although in theory, it still has a somewhat “unlimited” loss that can occur if the stock price goes to zero.

But it is no longer “naked” as the price of AMAT increases.

In reality, it is not likely that a stock like AMAT will go to zero.

And even if it does, the max loss is the purchase price of the stock less the credit received from selling the option.

Even in this unlikely event, the investor did better by selling the call option than the buy and hold investor.

The investor had at least collected a small premium from selling the option.

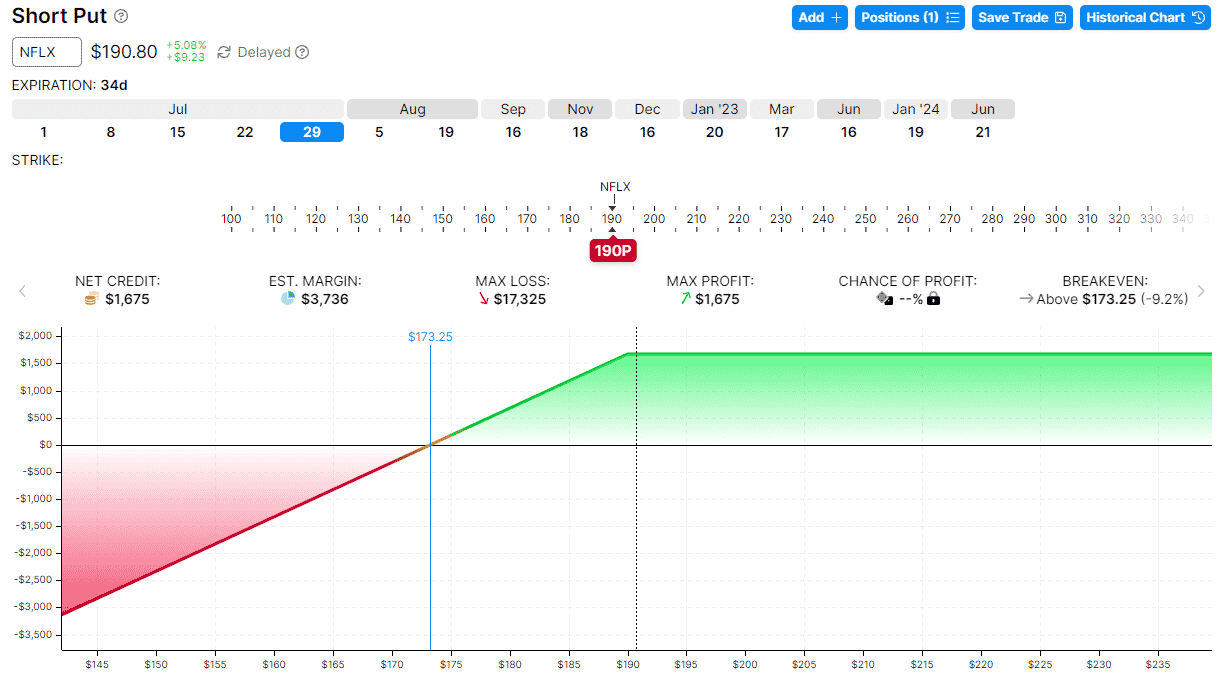

Short Put Example:

On June 24, 2022, Netflix (NFLX) is trading at $190.80 per share.

Suppose an investor sells the $190-strike put expiring on July 29 (with 34 days till expiration).

The investor collected a premium of $1675 for this sale.

The graph looks very similar to the covered call graph. If NFLX goes to zero at expiration, the investor loses an amount equivalent to 100 shares of NFLX at the strike price and then less the premium already collected.

The max loss is as shown by OptionStrat as $17,325 and is calculated as:

$190 x 100 – $1675 = $17,325

If the investor does not have this amount of cash in the account, the sale of this short put is considered naked.

Even if the investor does have this amount readily available, the margin used in this trade is high.

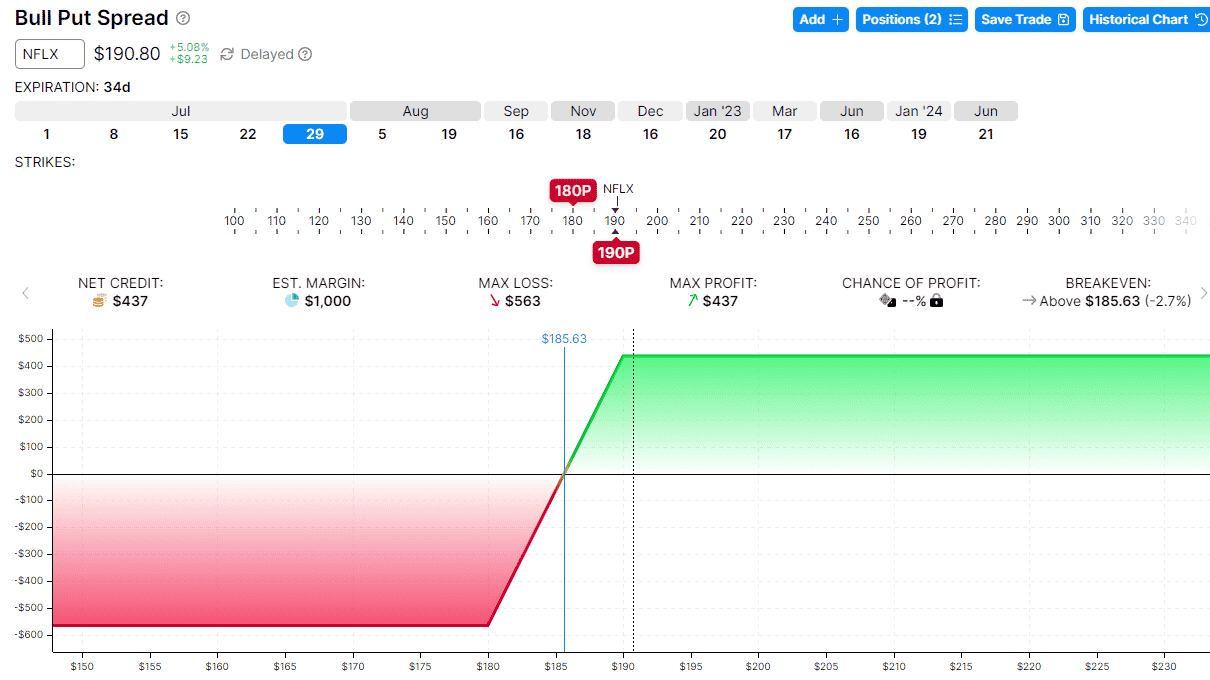

Put Spread Example:

For more efficient use of margin, some investors prefer to sell a put spread instead.

Date: June 24, 2022

Sell one July 29 NFLX $190 put @ $16.75

Buy one July 29 NFLX $180 put @ $12.38

Net Credit: $437

This is known as a bull put spread with the graph as follows:

As seen from the graph, it greatly reduces the profit potential to a max profit of $437. The advantage is that it limits the max loss to $563. This is a defined risk trade.

If NFLX ends above $190 at expiration, the profit on the trade is $437, with the maximum capital at risk of $563. This produces a yield of 78% ($437/ $563) on the capital at risk – an efficient use of capital.

FAQ

Can anyone write an option?

No, you need to have an account with option selling privileges.

Depending on your broker, you can often apply to have an existing equities cash account be converted to an options margin account.

Then there are different levels of options privileges which also depend on your broker. A

low privilege level allows you to sell a covered call.

Whereas, a high privilege level will allow you to sell naked calls.

Many retirement IRA accounts may not allow naked options writing.

What is an option writing strategy?

An options writing strategy is where you sell options to collect a premium.

This can be in the form of selling naked calls and puts or selling covered calls and cash-secured puts.

It can also be in the form of vertical spreads, as discussed.

Or it can be in a complex option structure consisting of multiple legs but still as a net seller of options.

For example, selling iron condors, butterflies, straddles, and strangles.

What is call option writing?

Call option writing is the selling of call options.

The term “option writing” comes from the idea that the option seller is “writing” up a new option contract to sell to a buyer who wants insurance that the contract may provide.

How do option writers make money?

Option writers make money by selling options known to decay in value (if all other factors stay the same).

When you sell things at a certain price, and the value of that thing drops, and you repurchase it at a lower price, you make money.

How much do you need to write options?

You need to have a margin account with enough buying power to sell the specific options that you are selling.

Selling naked options will require larger amounts of buying power and capital.

Selling spreads will require less capital and can be done in small accounts.

It can be done with as little capital as the max risk in the trade.

In our example, you can sell a spread on high-priced stocks like Netflix with less than $600.

Is writing options profitable?

Yes, writing options can be profitable.

Some successful investors specialize in selling covered calls.

Others are successful in selling covered puts and calls in a strategy known as the wheel.

Then others successfully trade delta-neutral strategies such as iron condors and butterflies.

Can I make a living trading options?

Yes, it is possible to make living trading options.

But not in the beginning.

In the beginning, the trader first learns how to avoid large losses.

Then the trader learns to have their wins equal their losses so that the account equities remain stable without large drawdowns.

And then, the trader learns to slant the wins in larger amounts than the losses.

And then, the trader needs to be able to comfortably increase size to the level that it can generate enough income for living.

As with any strategy, the strategy can give you profits and losses.

You need to exploit certain edges that might occur in the options market to have more profits than losses.

Most of the time, option and stock prices are fairly priced, as suggested by the efficient market hypothesis.

When the value of assets are fairly priced, it isn’t easy to make money from buying or selling them.

Some computers might exploit an edge they see in the directional movement of a stock.

Other computers might exploit the edge that option prices are priced slightly higher than the eventually realized move of the underlying.

Other computers may take advantage of the fact that volatility tends to revert to its mean.

With all these computers seeking out tiny edges in the marketplace, whatever edge that is left is small and not obvious to the beginner trader.

After a few years of practice, the trader may be able to find a trading style and strategy that they can resonate with, and that does have an edge.

A competent trader at this level may make a 15% to 20% return per year.

To make living trading options, you need to have a large enough account to generate the amount needed for living expenses based on these yield percentages.

Concluding Remarks

Writing (or selling options) is profitable in the long run.

Even if you are a beginner, learning to write options and take advantage of these premiums is not highly complicated.

All you need to do to be profitable in the long run is sell the options that investors want and are liquid.

Despite this, it is essential to understand risk management as writing options, like insurance, has a significant tail risk.

The good news is by sizing your trades small; you can sell insurance by yourself and reap the long term gains in an investment portfolio!

We hope you enjoyed this article on option writing. If you have any questions, please send us an email or post a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thanks for the info. I can never get enough of your classes. Looking forward to your course in March.

Thanks

Sounds good. Thanks for the kind words.