Today, we’re doing an Option Omega review.

We will walk you through how to use the software as well as adding technical criteria, stop losses and profit targets.

I really like this new software and I think you will to.

Contents

-

- Introduction – Option Omega Review

- Setting Up Multiple Legs

- Incremental Improvements To Strategy

- VIX Entry Criteria

- Adding Technical Entry

- Setting Profit Target and Max Loss

- Timed Exit

- Iron Condor Backtest Results

- Problem of Overfitting

- Trade Logs

- Actively Managing Iron Condors

- Problems of Strike Selection

- Portfolio Allocation

- 0-DTE Iron Condors

- FAQ

- The Final Verdict

Introduction – Option Omega Review

Finding a good options backtesting software that is able to backtest sophisticated options strategies is difficult.

This is because there are so many variables involved in options strategies.

It is not as simple with options as just buying and selling shares.

There are multiple legs, different strikes, various expirations, etc.

Today, we will take a look at OptionOmega and put it through test runs, starting with a core options strategy — the iron condor.

Setting Up Multiple Legs

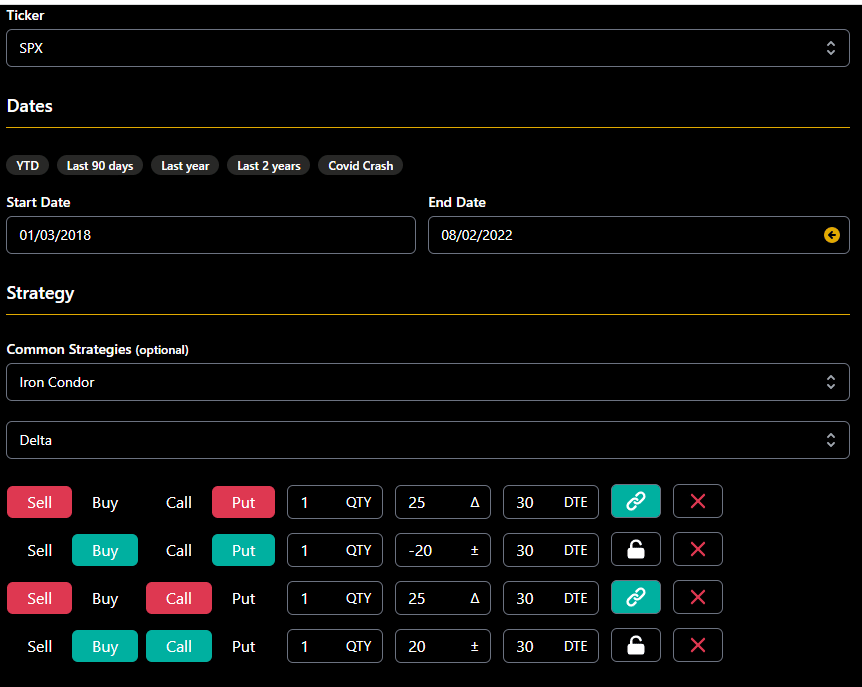

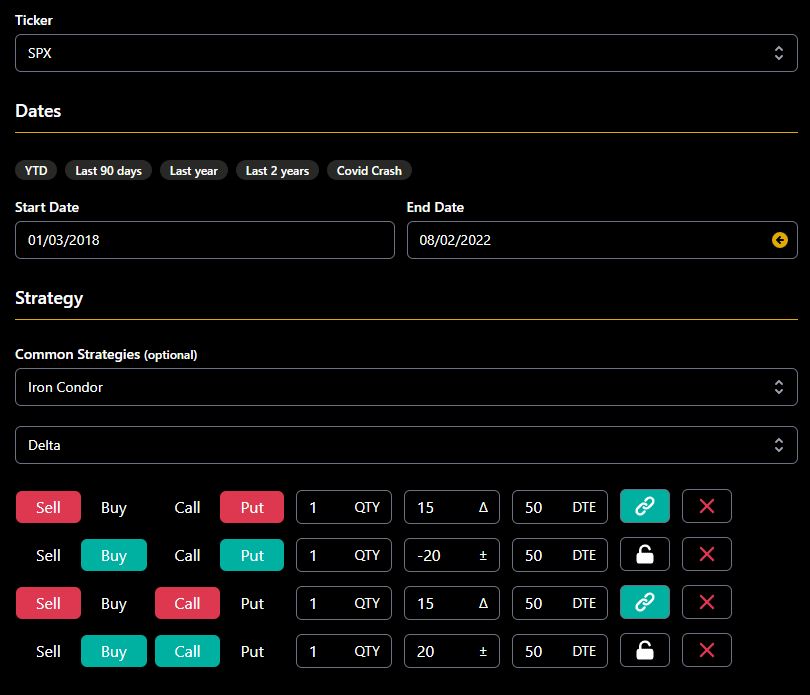

Option Omega lets you set up trades with multiple legs.

Below I have specified that I wanted to sell the short call and the short put at the 25 delta with the wings 20 points wide on SPX with 30 days to expiration.

source: OptionOmega.com

At the point of this writing, OptionOmega will only let you run backtests on SPX, SPY, IWM, and QQQ.

Unfortunately, no RUT or NDX.

This video explains why the owners have decided to not include NDX options.

OptionOmega has intraday data at one-minute intervals as far back as January 1, 2013.

I’m running this backtest from January 3, 2018, to August 02, 2022.

The test will try to initiate an iron condor 15 minutes after the market opens every day.

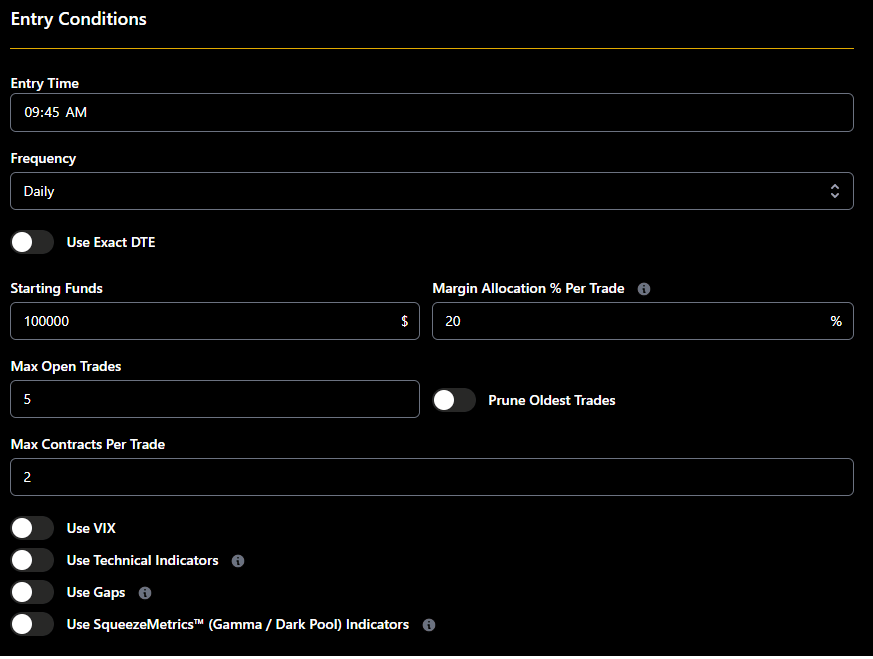

This can be specified in the Entry Conditions.

It will open up to a maximum of 5 trades with two contracts of SPX per trade.

For this first run, we are not going to be very sophisticated.

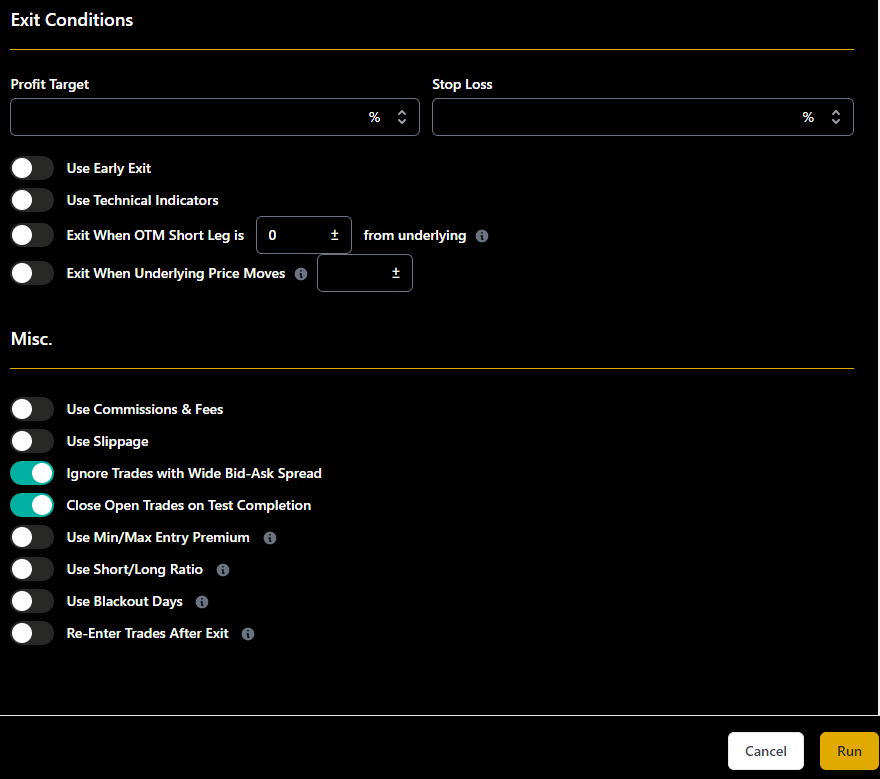

We are just holding to expiration and leaving the exit conditions empty as follows:

We specify “Close Open Trades on Test Completion” to take into account the P&L of the open trades in the results at the test end date.

Turneing on “Ignore Trades with Wide Bid-Ask Spread” will help avoid trades the could incur large slippage.

In a product such as the SPX, if you see unusually large bid/ask spreads, it usually means the market is moving very fast, in which case we don’t want to put on iron condors.

Or it can be one-off bad pricing data.

Incremental Improvements To Strategy

Before we show you the results of this run, we should say that this is not the correct way to trade iron condors.

We do not hold iron condors to expiration.

And we do not let losses run against us without exiting the trade or adjusting.

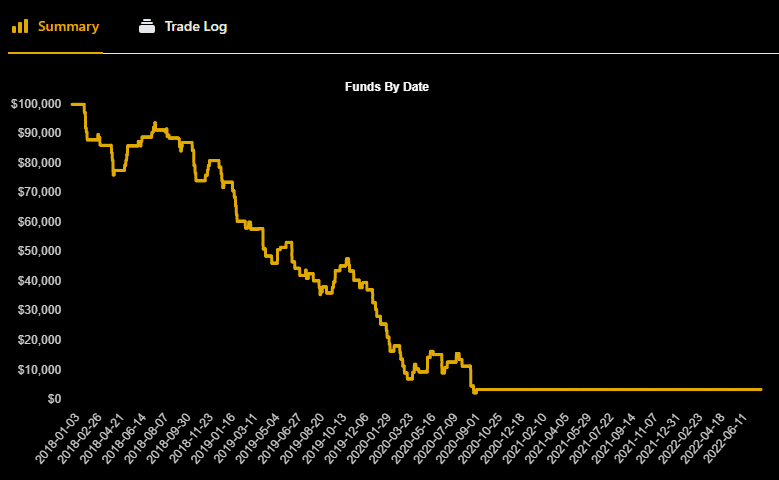

Otherwise, this is the result:

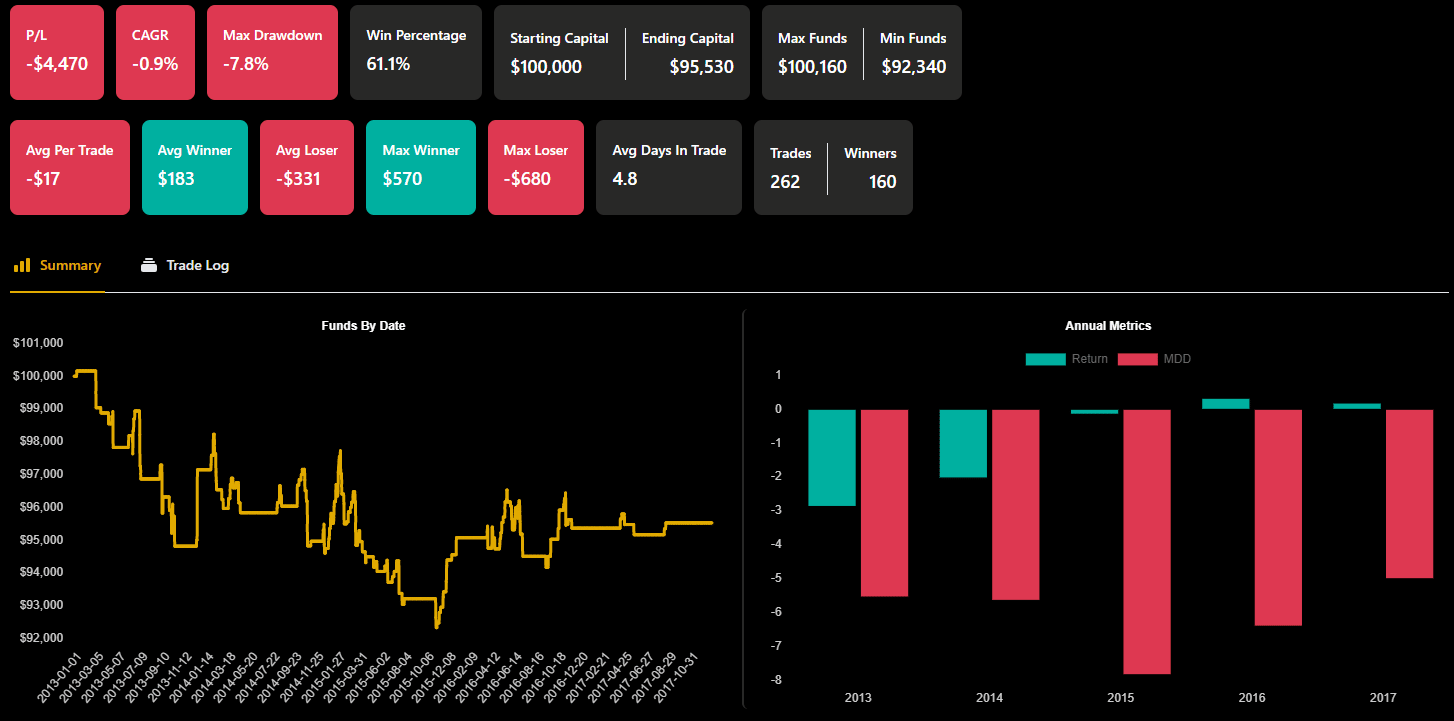

source: OptionOmega.com

The account was drawn down to zero after 2.75 years, even at the small allocation level that we had set.

Part of the benefit of backtesting software is seeing if we can get better results by adjusting certain strategy parameters.

And, of course, we can.

For the next run, we moved the short strikes further out to the 15-delta.

That improved things.

The account didn’t hit zero this time.

But we still saw negative P&L at the end of the test.

We make one change at a time to see the effects of each change.

Next, we increased the duration of the iron condor to 50 days to expiration instead of 30 days.

This brought the P&L to a positive $5606 at the end of the test.

The result showing a win rate of 70% is pretty good.

Except we don’t like to see the -29% max drawdown.

VIX Entry Criteria

Another nice feature of OptionOmega is the ability to enter option positions based on VIX levels.

Since iron condor prefers higher VIX levels, we tell it to put on iron condors only when VIX is above 15, but not above 25 (since that could mean large price moves).

The result gave a P&L of $4420 and a max drawdown of -28.4%.

Adding Technical Entry

OptionOmega allows you to set trade entries based on RSI and/or moving averages.

Setting the iron condor entry only when SPX price is above the 200 simple moving average improved the results with a P&L of $10538 and max drawdown of -26.8%.

Setting Profit Target and Max Loss

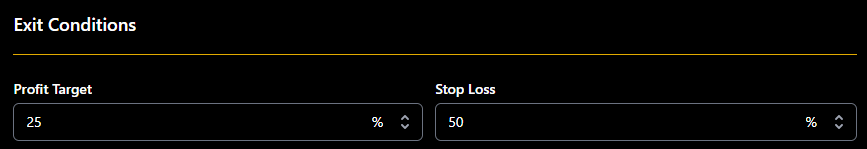

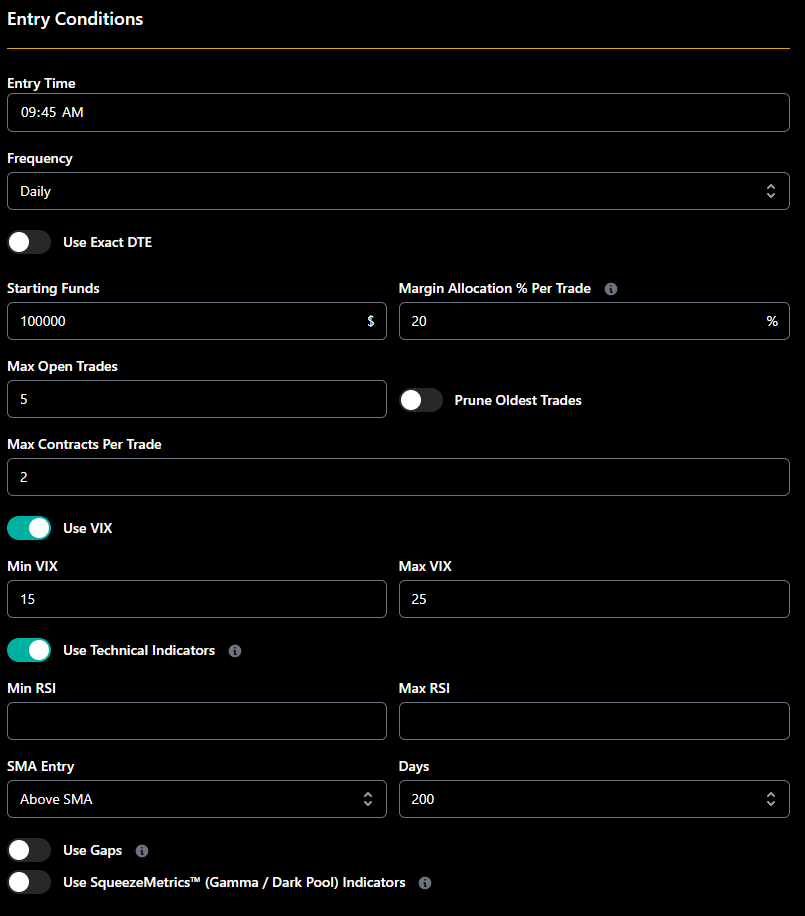

A must-have in any options backtesting software is the ability to set profit targets and stop loss.

For example:

This tells OptionOmega to exit the trade if we have profits of 25% of the premium received.

And we exit the trade at a loss of 50% of the premium.

Alternatively, you can specify a fixed dollar amount instead of percentages if you like.

We also turn on these two settings “Require two consecutive hits”…

Since we don’t want OptionOmega to take prices that are not realistically fillable in real trading,

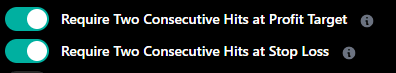

we tried different take profit and stop loss with the following results.

But there is no one right answer.

Investors with higher risk tolerance can use a larger stop loss to achieve larger gains.

More conservative investors can take a tighter stop loss and achieve a more stable P&L curve with a smaller max drawdown.

To continue with our experiment, we will use a take profit of 15% and a stop loss of 30% of the premium.

This take-profit rule reduces the days in the trade to around five days.

This provides a higher turnover of our capital so that we can reuse the capital immediately in a fresh new trade.

This video gives a quick overview on how to set profit target exit conditions in Option Omega.

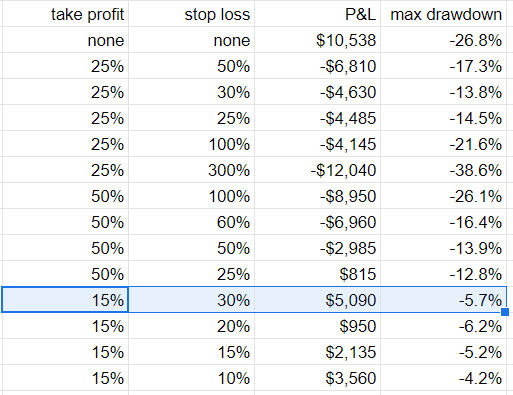

Timed Exit

OptionOmega has a feature to exit a trade after a certain number of days if the profit target and stop loss is not hit.

We will tell it to exit after 15 days in the trade.

Alternatively, you can specify to exit X number of days prior to expiration.

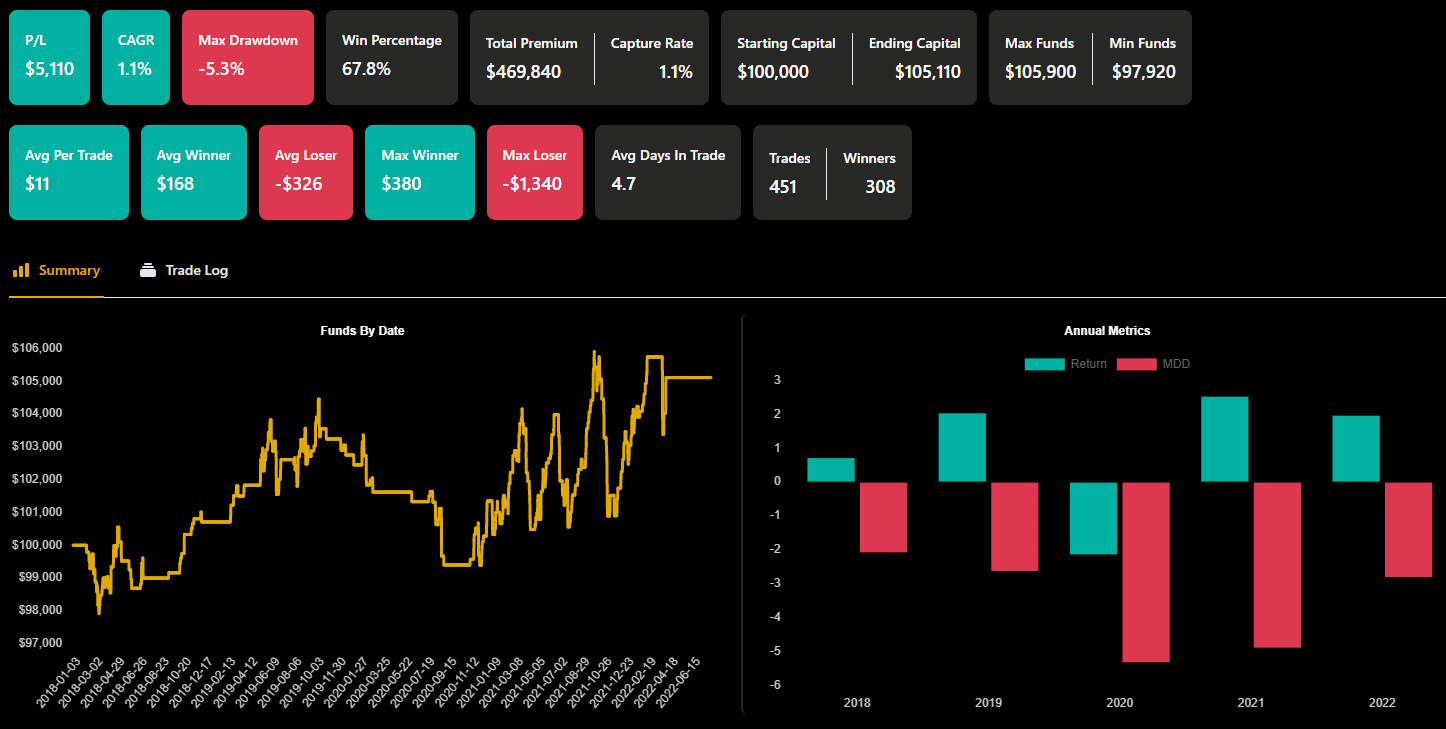

This further improves the results slightly, with P&L of $5110 and max drawdown decreasing to -5.3%.

Iron Condor Backtest Results

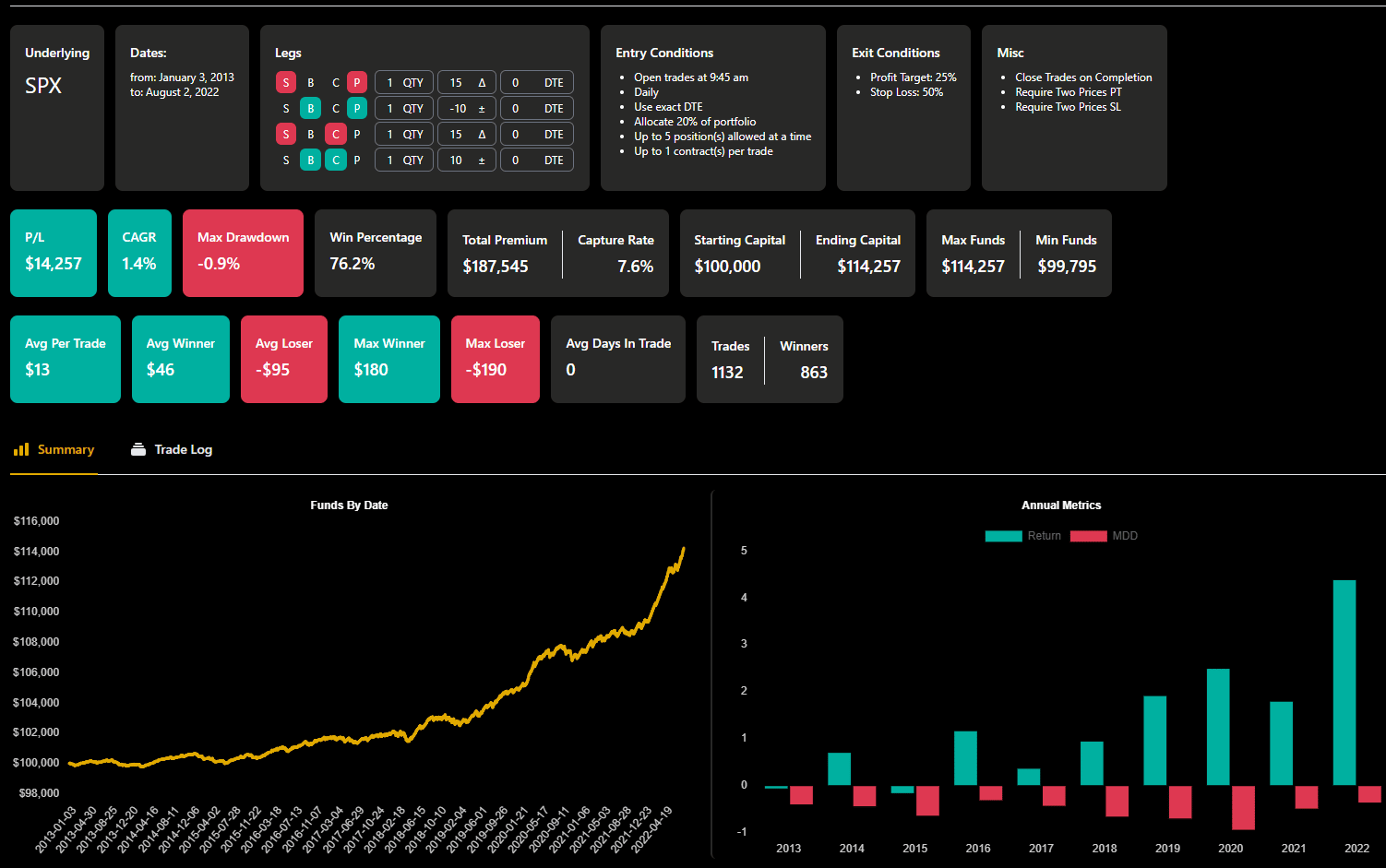

Here is the P&L graph of the results…

source: OptionOmega.com

The annual metrics show this iron condor to be profitable in 2018, 2019, 2021, and the first half of 2022.

There is a negative return for the year 2020.

The complete backtest settings are:

We are not saying that these are the optimal iron condor configurations.

But it is a good starting point.

Problem of Overfitting

One common danger of backtesting is overfitting the data.

We had made many adjustments to get these results.

It is possible that these tweaks were optimized only for the data tested (Jan 2018 to Aug 2022) and may not work for future data or other untested data.

To determine if we have overfitted the data, let’s run this test on new data we have not tested.

This is known as testing with “out of sample data.”

With all the same settings, but using the testing period from January 2013 to the end of 2017, the results we get are:

See what I mean.

Sometimes a backtest can look great over a certain data sample set but look bad on a different data set.

The future set of price data will not be the same as the previously tested data.

If you are a bit disappointed by the iron condor backtest results, don’t be.

This is due to the limitations of backtesting software.

Experienced iron condor traders can do better than what the backtest results suggest.

They can do so because:

- They actively manage iron condors by use of adjustments. They monitor the Greeks throughout the trade, keeping the delta theta ratio in check and making discretionary decisions based on that in conjunction with the amount of time left till expiration.

- Experienced traders can fine-tune the strike selection to account for put call skew and start the trade-off with a more delta-neutral position.

Price action and other technical indicators can also be used to be more discerning in determining when it is safe to enter an iron condor.

They also want to relax some of the technical entry rules.

For example, it is possible to enter iron condors when the price is below the 200 moving average — but only when the price action and other information say it is safe to do so.

These are all things that automated software cannot do.

We will see shortly how actively managing iron condors can improve the results.

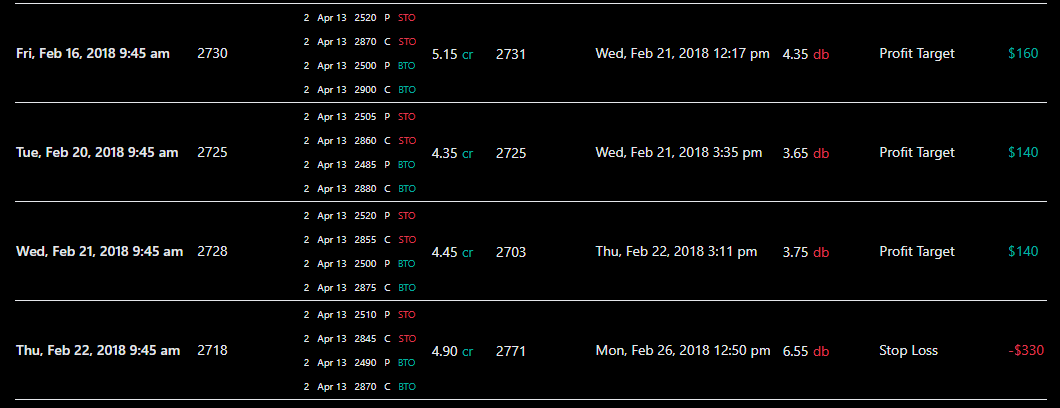

Trade Logs

Another must-have in backtesting software is the ability to see every single trade that was taken.

It is useful to see how many consecutive losses can occur and the exit reason for each trade.

But more importantly, it is to confirm that the backtesting software is doing what you think it is doing.

Here is a snippet from the trade logs:

And if I model the Feb 20, 2018 trade using OptionNet Explorer (or any other tool you like), I see that the payoff graph is looking as expected.

Actively Managing Iron Condors

We noticed that there is a large drawdown from the beginning of October 2019 to the end of September 2020.

After downloading the OptionOmega trade logs into a spreadsheet, let’s see if we can reduce this drawdown during this period.

First, we don’t want to initiate an iron condor if the VIX term structure is in backwardation.

Since OptionOmega is not able to detect this, I manually remove these trades from the log spreadsheet.

This brought the P&L up from $5110 to $5520.

Next, I will manually back-trade the losing trades from October 2019 to September 2020.

I actively managed the trade, initiating adjustments as needed.

I also noticed that many trades were not starting delta neutral.

As such, I adjusted the strikes in order to start the trade at a more delta-neutral.

Sometimes the short put had to be moved up to the 17 delta, and the short call had to be moved down to the 12 delta.

Other times it may be the 20 delta and 10 delta depending on the put-call skew of SPX at the time.

This is another thing that automated software cannot account for that a human trader can tweak to give them that extra edge.

By actively managing those trades, I increased the P&L even further to $9,134.

Now I understand what caused the drawdown in the iron condor strategy during that one-year period starting from October 2019.

The market was in an unusually bullish trend.

During the back trading, I had to continually add bull call spreads to keep the position delta under control.

Then it was followed by the Covid crash and subsequent V-shape recovery that started another bullish run.

Such large trending moves are unprofitable for iron condors.

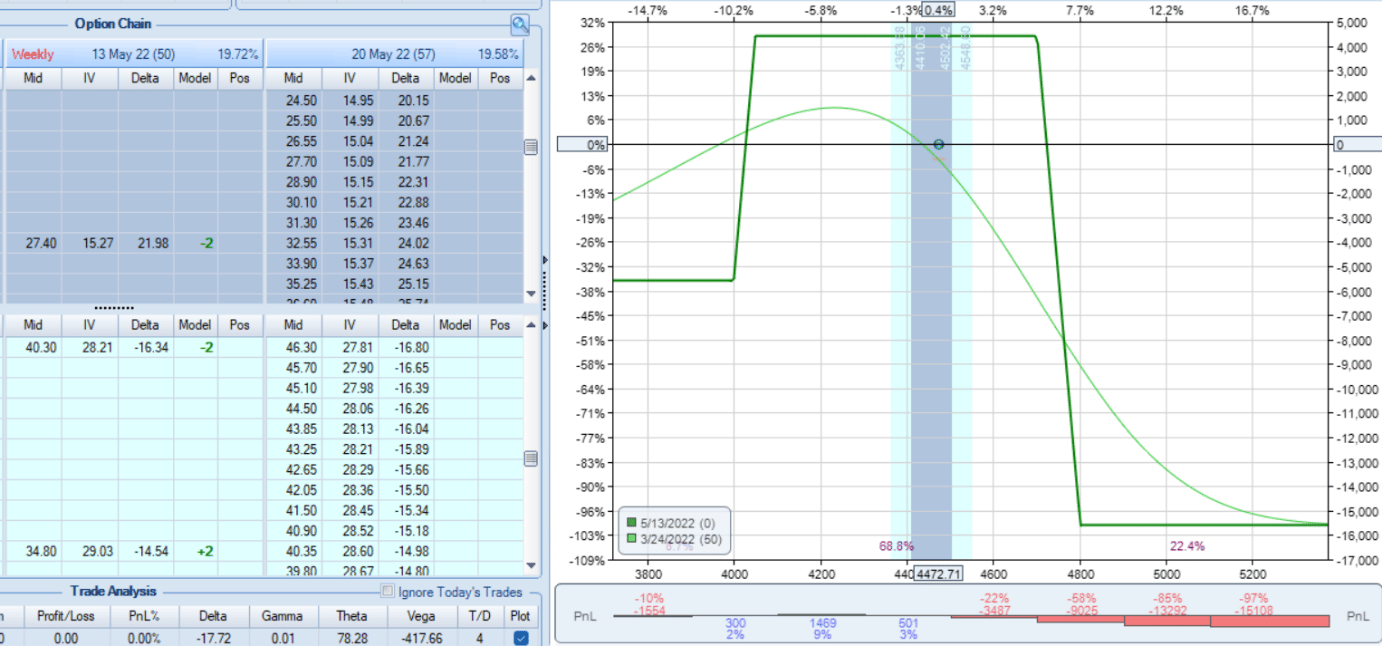

Problems of Strike Selection

Another purpose for looking through the logs is scanning for data anomalies.

I saw one trade made by OptionOmega on March 23, 2022, that had a loss of –$1340.

How can that be? Because we are using a stop loss that gets us out at around a loss of $300 to $400 even if the market gapped on open that day.

Upon simulating this trade in OptionNet Explorer, I now saw what happened.

The expiry on May 13, 2022, did not have enough strikes at the 15-delta.

So OptionOmega had to use 50-point wings on the put spread and 100-point wings on the call spread, producing a lop-sided condor with the initial Greeks way off that is nowhere near delta-neutral:

source: OptionNet Explorer

While it is possible to tell OptionOmega to use the exact days-to-expiration and strike differences, we did not set this option in the backtest because that would have drastically reduced the number of trades it took.

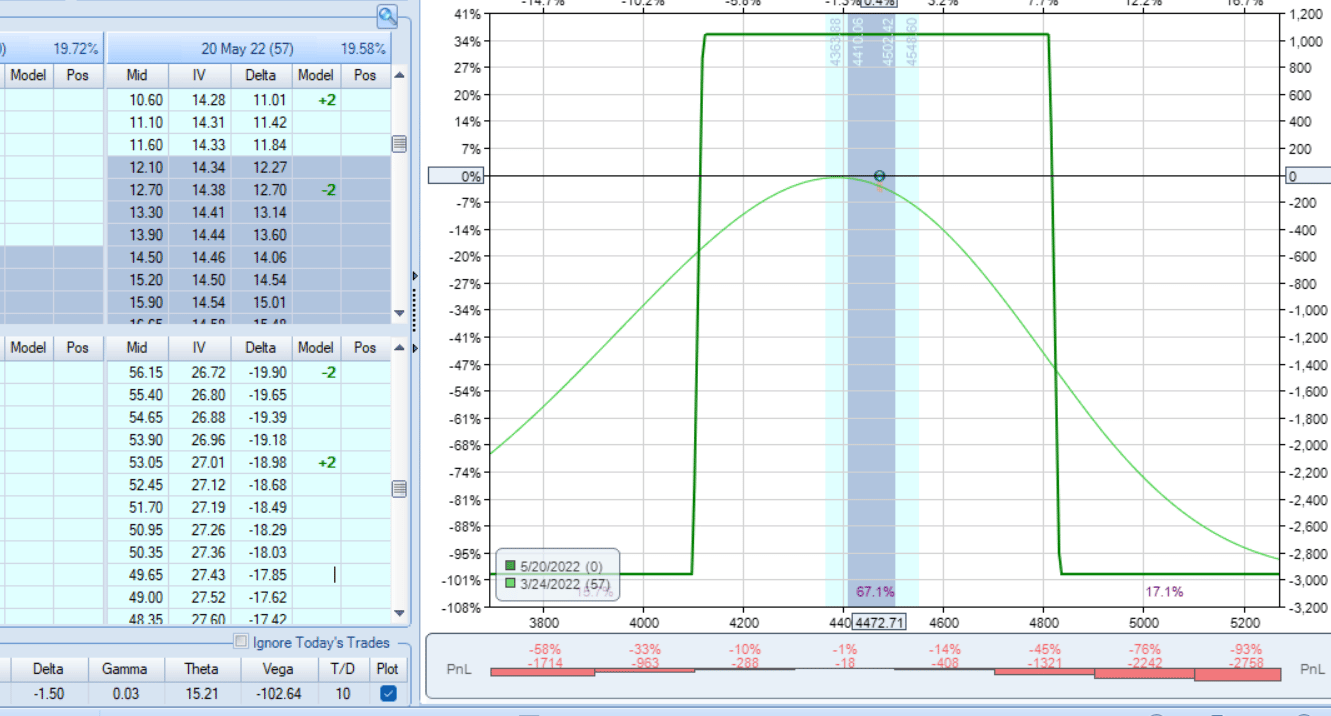

As a human trader, if I had seen this, I would have gone to the next week’s May 20 expiration which had many more strikes to choose from, producing a condor that looks like this:

Manually back-trading it, the trade would have made $125 instead of losing –$1340.

This would have brought the P&L to $10599 for the time period from January 3, 2018, to August 2, 2022, backtested.

Portfolio Allocation

With two contracts per trade that we had specified, the maximum margin used is about $3000 per trade.

We told OptionOmega to use at most five trades running simultaneously.

So, the max margin used at any time would be about $15,000 (assuming no adjustment).

If adjustments were made, the margin requirements would be larger.

This is on a hypothetical portfolio of $100,000.

Hence the backtest is allocating 15% of the portfolio to this iron condor strategy and assuming the rest in cash.

You can change these settings in your backtest, but your P&L, percentage drawdown, and other metrics will be different.

Increasing the allocation will most likely increase your returns and your max drawdown.

To confirm this, change the setting from max contracts per trade from 2 to 12.

Keeping all other settings the same, the drawdown would increase from -5.3% to -26.7%.

The allocation size is a personal choice based on risk tolerance and investment style.

0-DTE Iron Condors

Because OptionOmega has one-minute interval data, it can backtest 0-DTE options strategies.

Let’s initiate an iron condor 15-minutes after the open on the same day expiration.

We will set a profit target of 25% of the premium received.

And stop loss of 50% of the premium received.

I got a really nice looking P&L curve with the settings shown here:

I’ve tried several variations, and this curve can only be achieved with a stop loss setting in place. But how will one implement a stop loss on a zero-DTE trade?

Do we monitor the trade continuously or set an automatic order?

How likely will it fill at the backtested price if we set an automatic order?

And how bad would the slippage be even on a liquid product such as SPX?

I cannot comment much on this since I don’t trade 0-DTE condors frequently.

Those that are interested in 0 DTE SPX Iron Condors may find this video interesting:

If you want to try out the software at a discounted rate, you can do so here:

https://optionomega.com/register/optionstradingiq

The software is normally $99.99 per month or $599.99 per year, but I have managed to secured a price of $74.99 per month and $449.99 per year for my readers.

Note that this is an affiliate link which means I receive a small commission for arranging the referral.

FAQ

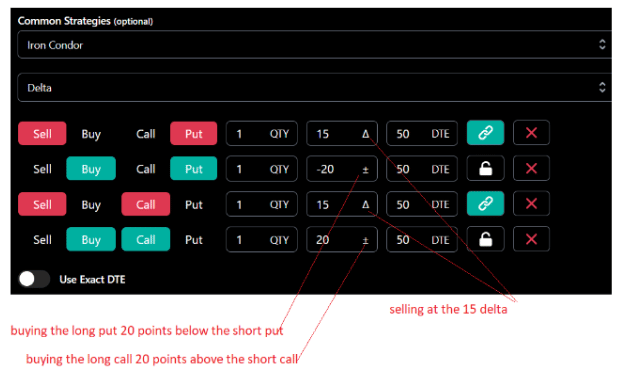

Why Does the setting look like it is selling the 20 delta and buying the 15 delta?

We are not selling at the 20 delta. We are selling at the 15 delta and buying the long put 20 points below the short put. That is why the “-20” has a +/- symbol next to it rather than a delta symbol.

The Final Verdict

Yes, I would definitely use OptionOmega backtesting software.

Despite a few limitations inherent with automated backtesting software in general, the tool still will be able to give me a good idea of how a strategy performs as various parameters of the strategies are changed.

Some things that can be discovered from backtesting iron condors are that it is better to have wings further out-of-the-money, have longer-dated expires, and exit earlier rather than holding to expiration.

But the one thing that automated backtesting software can not do is adjust the strategy during the trade.

By actively managing the option strategy, it gives the options trader an edge that is not achievable by the backtesting software.

This key skill in profitable options strategies comes only with practice and experience.

Practice manually by back-trading on historical data.

Practice paper trading on live data. Or practice live trading using a small position size.

We hope you enjoyed this Option Omega review.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Gavin;

I’ve read your email and looked at your coursework as well. In fairness, you are being quite generous in your pricing vs. substance.

I fear that beyond some of the basics, I would still not be in a position to comfortably try some of your other strategies.

I originally found you on the internet have used some of your early instruction tools and done quite well on various calls, puts, credit spreads, etc. Still, I am not more than 60% sure I understand them well enough to now launch into a more robust methodology. Personally, I am more concerned with my skill-to-confidence ratio and, as you said, the more lucrative strategies require a very high level of confidence.

Still, $3,600 – lifetime access – etc. is not financially intimidating as it is mentally paralyzing. I thank you for the candor and professionalism that you exhibit toward your clients and future clients.

So glad to have found you and thank you for your advice.

Thanks for your extensive review, Gavin. The backtesting features of Option Omega look attractive. But because of the limited tickers I think I’d still prefer OptionNET.

Experienced iron condor traders can do better than what the backtest results suggest.

You say experienced option traders can do better than backtest results because:

> They actively manage iron condors by use of adjustments. They

> monitor the Greeks throughout the trade, keeping the delta theta

> ratio in check and making discretionary decisions based on that in

> conjunction with the amount of time left till expiration.

While I’m tempted to say the same thing, how do we know? Monitoring theta-delta ratio and net position delta may help some backtrades that otherwise lose big while potentially hurting other backtrades that ended up profitable. In order to know if the active management guidelines work, you really need to backtest the guidelines, which is exactly what you’re saying this product cannot do. Is this a potentially fatal flaw?

You say experienced option traders can do better than backtest results because:

> They actively manage iron condors by use of adjustments. They

> monitor the Greeks throughout the trade, keeping the delta theta

> ratio in check and making discretionary decisions based on that in

> conjunction with the amount of time left till expiration.

While I’m tempted to say the same thing, how do we know? Monitoring theta-delta ratio and net position delta may help some backtrades that otherwise lose big while potentially hurting other backtrades that ended up profitable. In order to know if the active management guidelines work, you really need to backtest the guidelines, which is exactly what you’re saying this product cannot do. Is this a potentially fatal flaw?