Contents

- Introduction

- Maximum Loss

- Maximum Gain

- Breakeven Price

- Payoff Diagram

- The Greeks

- How Volatility Impacts the Trade

- How Theta Impacts the Trade

- Risks

- Summary

Introduction

Let’s explore the basics of a long put, understand the mechanics of the strategy, and learn how to use it like an option veteran.

A long put is an option strategy that gives you the right to sell the underlying stock at a predetermined strike price.

The buyer of the put option expects the stock price to fall below the strike price before option expiration.

The buyer pays a premium to buy downside protection.

A long put is like shorting a stock except that the long put benefits from a decline in the underlying stock below the strike price but does not suffer from an increase in the underlying stock above the strike price.

Consider the example of Nikola whose stock tanked after short seller Hindenburg Research accused it of securities fraud.

Let’s assume the investor has a short thesis that Nikola will face further scrutiny after Trevor Milton, executive chairman stepped down.

He wants to short the stock when it is trading at $23.11 but fears the stock will rally if Hindenburg’s claims are not true.

Shorting the stock outright will expose the investor to unlimited losses if the stock rallies so he decided to buy put options.

As we advised in our long call ultimate guide, option buyers should consider the trade offs between long term options and short-term options.

Generally speaking, longer dated options are more expensive but their theta erodes slowly, and that gives you ample time to test your thesis.

Because the investor in our example is hesitant about his short thesis, he considers buying longer dated December puts with strike price of $22.50.

Let’s look at the payoffs in more detail below.

Maximum Loss

The most one can lose on a long put is the premium paid to enter the call if the stock price closes above the strike price on expiration.

In the above example, the investor stands to lose $7.55 per share on the December put if the stock price closes above $22.50.

If investor’s thesis is incorrect and the stock rallies, he still has enough time to close out of his long put position and recover most of the premium because theta erodes slowly for longer term options.

More of this below.

Maximum Gain

Stocks can only go as low as zero, so your maximum gain is capped to strike price minus the premium paid on the put.

In the example above, if Nikola’s stock goes to zero, the investor would make $14.95 per share (strike price of $22.50 – premium paid of $7.55).

Realistically, stocks do not hit rock bottom so don’t expect to make $14.95 on this.

Breakeven Price

Breakeven is when you have recovered the premium paid to enter the long put.

It is the strike price minus the premium paid to buy the put.

In the example above, Nikola will have to decrease by 32.67% (premium paid ($7.55) / current stock price ($23.11) just to break even.

Does the investor have enough confidence in his thesis that he is willing to bet for a 33% decrease by December’s expiration just so he could break even?

Perhaps not.

He could fall for the cheaper shorter term puts to lower his breakeven price but that comes at a cost of higher theta.

A better trade would be selling another put below the strike price of the initial put.

Selling the put will provide a credit to offset some of the price of the long put.

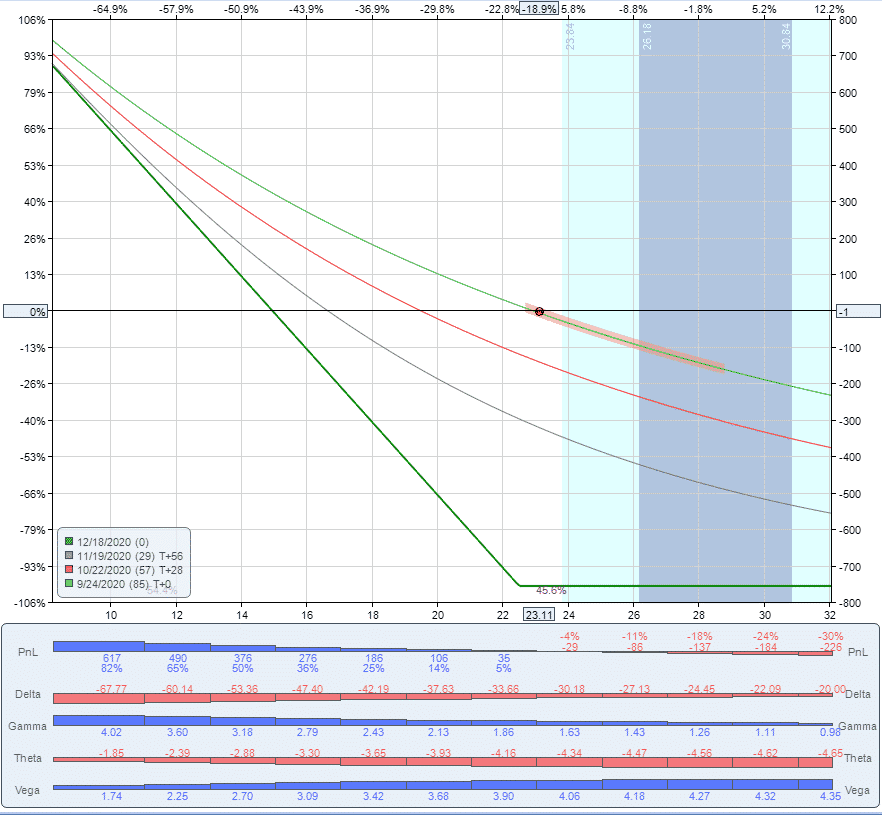

Payoff Diagram

The long put payoff has substantial profit potential but it’s capped at the strike price minus the premium paid.

On the other hand, its downside is limited to the premium paid.

The Greeks

Delta

Let’s quickly glace at delta now. Put options have delta between 0 and -1.

In the example above, Nikola’s December put is trading near money so its delta is -0.31.

Delta is directly proportional to moneyness.

Deep in-the-money put options have a delta of -1 and its payoff behave like the short stock payoff.

Deep out-of-the-money put options have a delta closer to 0 and its payoff isn’t impacted much by changes in the stock price.

In the example above, the price of the put option will increase by $0.31 for each dollar decrease in the stock price.

On the other hand, if you were simply short the stock, the value of your position would increase by a $1 for every $1 drop in the stock price.

Gamma

Gamma is always positive for long options. It measures the rate of change in delta with respect to the change in stock price.

Gamma is the second derivative of the value function with respect to the stock price – Delta being the first derivative.

It is highest for at-the-money options because that is the point where delta changes fastest with changes in the stock price.

As the stock price moves away from the strike price (in either direction), gamma approaches zero and delta becomes less sensitive to changes in the stock price.

In our Nikola example, for the December at-the-money put, the delta will change by a factor of 1.73 for a change in the underlying stock.

How Volatility Impacts the Trade

Long put options are long vega trades. So, you will benefit if volatility rises after the trade has been placed.

Looking at our Nikola long put example with strike price of $22.50 and expiration date of December, the position starts with a vega of 3.97.

In other words, the value of the option will increase by $3.97 if implied volatility increases by one point.

Of course, the opposite is also true and the value of long puts can drop significantly if volatility falls.

How Theta Impacts the Trade

Theta measures how sensitive the option price is to the passage of time – i.e. how much value does the long put option lose each day as the trade approaches expiration.

Remember, time is your enemy unless you use it wisely.

In the example above, the put price will only decrease by 0.57% with each passing day (theta of (-0.043) / put price ($7.55)).

If the investor’s thesis does not materialize, he can close out of his long put position in the next month or so and recover most of the premium paid.

Risks

The risk of buying put options is that you could lose the entire premium you paid for the option.

This is especially true for short term out-of-the-money puts. Such options generally expire worthless and you stand to lose your entire investment.

One way to hedge this risk is to sell another put option with a lower strike price and same expiration.

Let’s assume the investor in the Nikola stock example believes the stock will fall below $22.50 before December but does not think it will fall below $18 by then.

The $7.55 premium paid for the $22.50 strike put gives him all the upside below $22.50. But if his believes it is unlikely for the stock to fall below $18, he can sell another put with the same expiration to offset some of the $7.55 premium paid for the long call.

Summary

Buying long puts allows the trader to benefit from declines in the stock price, but time decay is your enemy.

The nice thing about them is that they can give you control over a large number of shares for a fraction of the price.

However, be careful as they are a levered bet and to make money you have to be right about the direction as well as timing.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.