Contents

- Initial Position

- Before Adjustments

- Adjustment #1: Add Another Butterfly

- Adjustment #2: Use Stock To Hedge

- Adjustment #3: Convert To Broken Wing Butterfly

- Convert To Unbalanced Butterfly

- Other Ways To Adjust

Today, we will learn four techniques to adjust butterflies that are drifting outside our desired range.

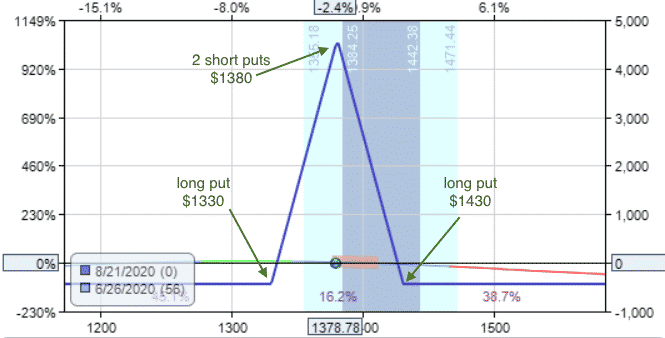

Initial Position

Suppose an investor starts a trade with a balanced all-put butterfly centered on the current price of the RUT:

Date: June 26, 2020

Price: $1378.78

Buy 1 Aug 21st RUT 1330 put @ $68.00

Sell 2 Aug 21st RUT 1380 put @ $87.00

Buy 1 Aug 21st RUT 1430 put @ $110.35

Debit: $4.35 per share

Capital At Risk: $435

Delta: -0.53

Delta Dollars: -0.53 x $1,378.78 = –$730.75

Profit Target: $435 x 20% = $87

Stop Loss: $87

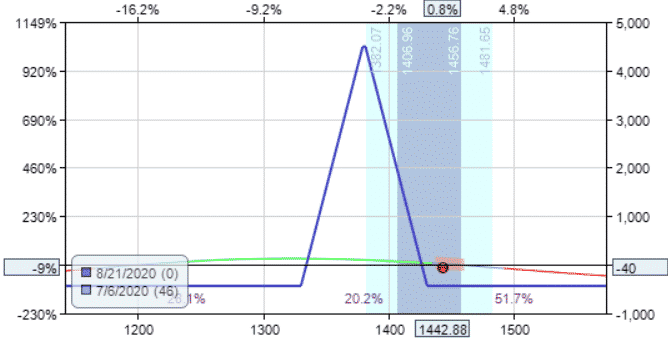

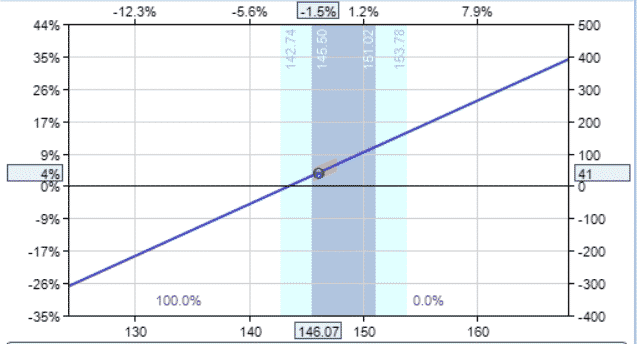

Before Adjustments

RUT has rallied from $1378.78 to close at $1442.88 on July 6.

The price dot in the below payoff diagram has gone outside the tent and looking like it is about to roll down the hill.

Delta: -1.63

Delta Dollars: -1.63 x $1,442.88 = –$2,351.89

Delta has increased.

Delta dollars has tripled.

The position is down about 9% with a paper loss of –$40.

Some investors will choose to adjust the position here.

Here are four adjustments to consider.

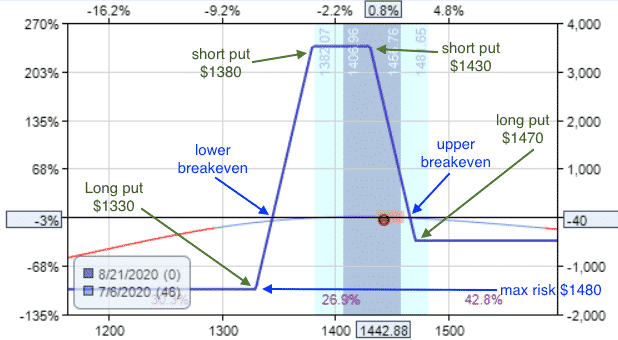

Adjustment #1: Add Another Butterfly

Since price is going up, a second butterfly centered higher up in price can be added.

Date: July 6

Price: $1442.88

Add second butterfly:

Buy 1 Aug 21st RUT 1380 put @ $48.25

Sell 2 Aug 21st RUT 1430 put @ $65.40

Buy 1 Aug 21st RUT 1470 put @ $83.00

Debit: –$0.45 per share

Cost: $45

By having the second butterfly overlap two of the strikes of the first butterfly, we will get a condor-like payoff diagram like the following:

Note that the investor had also decreased the upper wing width to 40 points wide (instead of 50 points) — buying the RUT $1470 strike instead of the RUT $1480.

This change gets the resulting delta closer to zero. (Using the 50 point wing did not decrease the delta enough.)

This is why the legs of the condor is uneven in the payoff diagram.

New delta: -0.61

New delta dollars: -0.61 x $1442.88 = –$880

New asymmetrical condor position:

Long 1 Aug 21st RUT 1330 put

Short 1 Aug 21st RUT 1380 put

Short 1 Aug 21st RUT 1430 put

Long 1 Aug 21st RUT 1470 put

As seen from the graphs, this adjustment increases the expiration breakeven point on the upper side, while the lower breakeven stays the same as before.

The trade-off is that the adjustment increased our max capital at risk to $1480.

Max risk calculated as … [(1380 – 1330) – (1470 – 1430)] x 100 = $1000 $1000 + $435 + $45 = $1480

Adjustment #2: Use Stock To Hedge

The price of RUT is going up and beyond the tent of the original butterfly.

The investor wants to buy stock to hedge the delta.

Because RUT is an index, investor can not buy shares of RUT (even though investor can buy options on RUT).

So, the investor needs to buy IWM, which is an ETF that tracks the RUT.

IWM is about one tenth the price of RUT and is currently trading at $143.50.

Delta dollars of the current position is –$2,351.89.

To get delta neutral, the investor needs to buy $2,351.89 worth of IWM, or about 16 shares.

Date: July 6

Buy 16 shares of IWM @ $143.50

Debit: $2296

New total capital at risk: $435 + $2,296 = $2,731

Initial profit target amount: $87

Initial stop loss amount: $87

The investor decides to stick with initial planned profit target of $87, because the capital at risk is mostly stock and it is difficult for any stock to go up 20% in a month.

The stock is here only to help the butterfly achieve its profit target.

On July 24, the RUT butterfly is showing a profit of $65 and the IWM stock position is showing a profit of $41.12.

The combined $106.12 exceeds the profit target and investor exits the trade.

Although the trade ended with RUT price dot outside the butterfly tent, the investor was able to capture profits as IWM went up 4%.

This amount more than makes up for any loss seen by the butterfly.

The benefit of using stock as a hedge is that it is very liquid and an investor can enter and exit multiple times without incurring large commissions or slippage.

Because the use of stop loss orders on stock works much better than using stop loss orders on options, the investor can implement a trailing stop if desired.

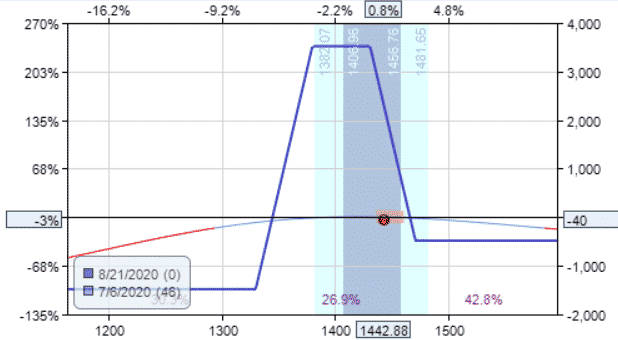

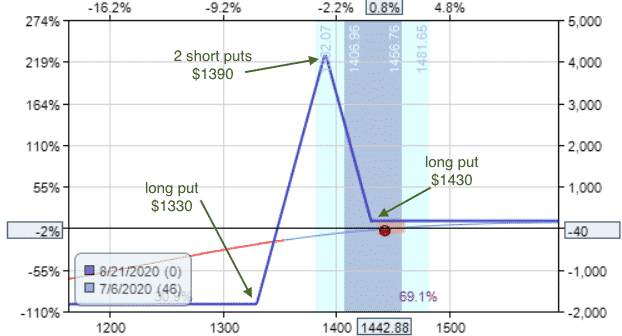

Adjustment #3: Convert To Broken Wing Butterfly

Since the upper wing of the butterfly is being tested with price going up, the investor reduces risk on the upside by moving the short put strikes up to narrow the width of the upper wing.

Date: July 6

Price: $1442.88

Buy 2 Aug 21st RUT 1380 put @ $48.25

Sell 2 Aug 21st RUT 1390 put @ $51.30

Credit: $3.05 per share

Total credit received for the adjustment: $610

New payoff diagram:

It has turned into a broken-wing butterfly with this configuration:

Long 1 Aug 21st RUT $1330 put

Short 2 Aug 21st RUT $1390 put

Long 1 Aug 21st RUT $1430 put

Note that the profit at expiration on the upper side is above zero.

That means the price can go as high as it wants, the investor will still be profitable.

The trade off is that the risk on the downside has increased to $1825.

Calculated as follows: –$435 + $610 – $2000 = –$1825

where $2000 is what we have to pay out at expiration if all puts are in-the-money: [($1390 – $1330) – ($1430 – $1390)] x 100 = $2000

As is typically the case, when an adjustment reduces risk on one side, it increases the risk on the other side.

There’s no free lunch in the market.

The investor just needs to shift and balance the risk based on the market’s movements.

Another point to consider is that delta after the adjustment had gone from -1.63 to positive 2.24 with new delta dollars being $3232.

We can also see from the upward curving slope of the T+0 line that this is a bullish position where we profit if price goes up.

If price reverses down, the profit goes down.

A delta neutral investor who wants delta to be small as possible may not want to perform this adjustment.

However, an investor who feels that the technicals have changed such that there is high confidence that price will continue to go up would make this adjustment to a more directional play.

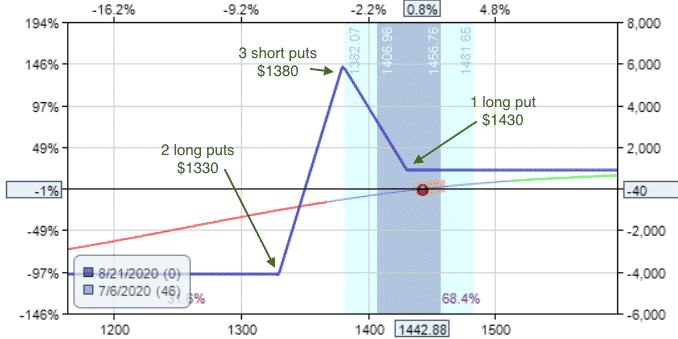

Convert to Unbalanced Butterfly

Since price is going up, the lower wing of the butterfly is profiting.

The investor can scale up the contracts on that wing by doing the following:

Date: July 6

Price: $1442.88

Buy 1 Aug 21st RUT 1330 put @ $35.05

Sell 1 Aug 21st RUT 1380 put @ $48.25

Credit: $13.20 per share

And the resulting position ends up as an unbalanced butterfly:

Long 2 Aug 21st RUT 1330 put

Short 3 Aug 21st RUT 1380 put

Long 1 Aug 21st RUT 1430 put

with a payoff diagram that looks similar to that of the broken-wing butterfly:

One difference is that since investor added additional contracts, the risk is larger with the max risk at $4115 calculated as follows…

–$435 + $1320 – $5000 = –$4115

where $5000 is from… [2 x (1380 – 1330) – (1430 – 1380)] x 100 = $5000

In this particular case, this adjustment had made the delta go up too much — from -1.63 to 6.88.

Delta: 6.88

Delta dollars: 6.88 x $1442.88 = $9927

The delta dollars may have increased too much for the investor’s account size.

Therefore, this aggressive adjustment may not be warranted at this time. That is why it is good to use software to model what the Greeks and payoff diagram will look like after a proposed adjustment before putting on the live trade.

We had used Option Net Explorer to model these examples.

Other Ways To Adjust

We have seen four possible adjustments.

That is not to say that these are the only ones.

For example, another situation may require an investor to take the whole butterfly off and reposition it at a different price (also known as rolling the whole butterfly).

However, this is equivalent to closing the existing position and opening a new position.

Another more controversial adjustment strategy involves “going inverted” with an iron butterfly.

This means the adjustment causes the short put strike to be above the short call strike of an iron butterfly — a highly unusual configuration. Perhaps, we can discuss the pros and cons of this in a future post.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

This is amazing information!

Thanks, I appreciate the kind words.

Thank you so much for the info. Adjustments always are not easy to be understood for me. Your sharing really help. Thanks again.

You’re welcome

Gavin can you please provide the backtest results of iron condor vs iron fly

In adjustment #2 I’m pretty sure the iron butterfly was in a loss even though you said both the fly and the stock were in profit.