Today, we’re looking at the long iron butterfly strategy.

How is it different from a put butterfly or call butterfly?

How do you set one up?

Does it make money?

Let’s find out.

Contents

- Introduction

- Max Gain

- Max Loss

- Long Iron Butterfly Breakeven Prices

- Volatility

- Time Decay

- Assignment Risk

- Long Iron Butterfly Example

- How Does The Trade Make Money?

- How Much Theta Does The Iron Butterfly Have?

- How Is The Iron Butterfly Different From The All-Put Fly?

- FAQ

- Conclusion

Introduction

What does the term “iron butterfly” mean?

The term “iron” (as in iron condor) means that you are using both puts and calls instead of an all-put butterfly or an all-call butterfly.

It can be thought of as an iron condor with a bear call spread, and a bull put spread.

With the iron butterfly, both spreads are at-the-money, so both short strikes are touching.

Hence the center of the butterfly consists of a short put and a short call.

We are buying one long call further out of the money.

And we are buying one long put further out of the money.

These long options make up the wings of the butterfly.

Max Gain

The max gain on an iron butterfly is the initial credit received.

This is calculated the same way as the iron condor.

The credit received for the bull put credit spread plus the credit received for the bear call credit spread is the max gain.

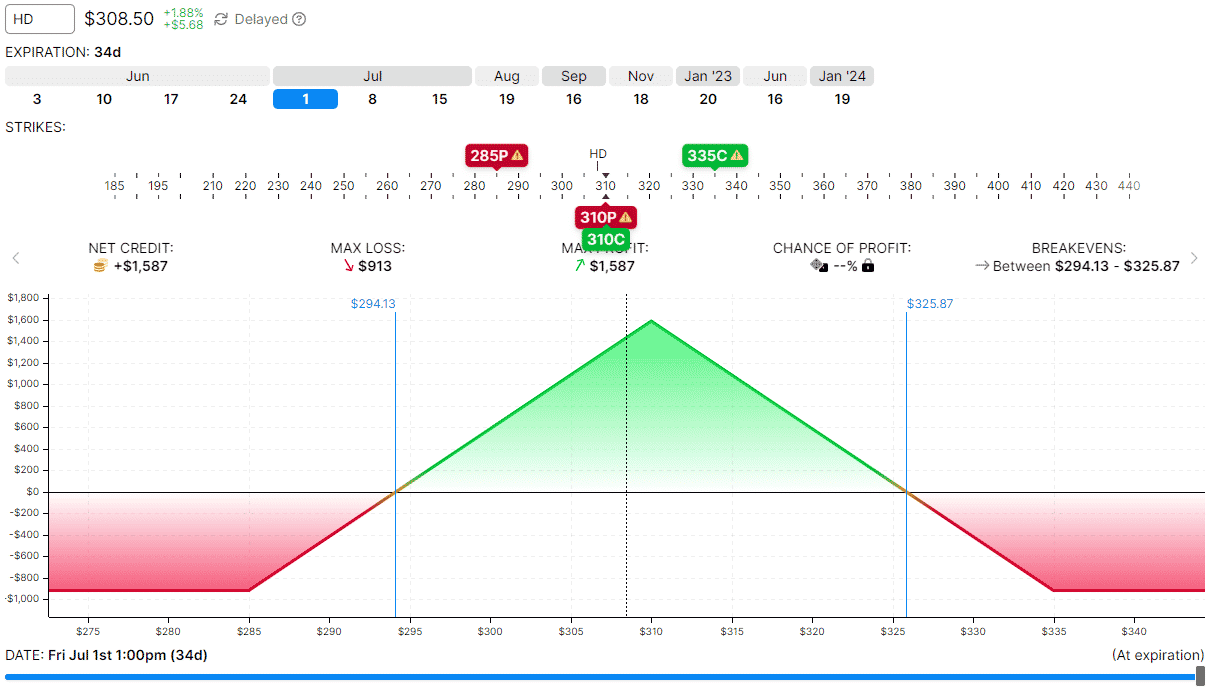

In our example, the max gain is $1587.

The underlying has to land exactly at the short strike at expiration for that maximum gain. Most traders would have exited the trade by then.

Max Loss

The max loss of the iron butterfly is calculated the same way as the iron condor.

The width of the larger wing minus the credit received is the max loss.

If both the wings are the same width, just use that width.

The width of the wings of the HD iron butterfly is $25, which represents a risk of $2500 if breached. Our initial credit offsets this risk:

$2500 – $1587 = $913

$913 is the max risk in the trade.

Long Iron Butterfly Breakeven Prices

There are two expiration breakeven prices in this trade.

They occur where the expiration graph crosses the horizontal $0 P&L line.

If the price is $310 at expiration, you keep all your initial credit, which is $1587 (or $15.87 on a per-share basis).

If the price is to the right of $310, you lose a part of your initial credit.

How far to the right do you lose all your credit?

It is at $310 + $15.87 = $325.87.

This is your upper expiration breakeven price.

For the lower expiration breakeven price, it is:

$310 – $15.87 = $294.13

Confirm that these number matches the numbers calculated by OptionStrat screenshot shown above.

Volatility

Like the iron condor, the iron butterfly is a short vega strategy.

Therefore, it profits when volatility drops.

When volatility drops, the value of options decreases across the board.

However, not all strikes decrease by the same amount.

The at-the-money center strikes have the most extrinsic value, so it tends to drop more than the out-of-the money long legs.

That is good news for us because we sold the center legs and want their value to drop.

We purchased the out-of-the-money legs and want them to maintain their value — or at least not drop as much.

Time Decay

The iron butterfly will generally have positive time decay.

This means that its theta is positive.

For every day that passes (with all other factors being the same), the butterfly will increase in value.

This means that time is on our side.

However, if the price moves too far away from the butterfly in either direction, the theta will become negative (which is not good for us).

Some traders will just exit the butterfly when this happens.

Assignment Risk

Iron butterflies should not be held all the way to expiration.

While it is true that a profitable butterfly makes a lot of its money as it approaches expiration, we need to make sure we don’t let it get too close to expiration.

The risk of assignment is greater the closer we are to expiration.

Because the iron butterfly has one short put and one short call at the same strike, one of those legs will always be in-the-money.

The short in-the-money option is the one risking assignment.

Some traders will exit before the last week of assignment.

Other traders may stay all the way till they have one or two days left till expiration.

It also depends how the margin constraints and how much free cash you have in your account.

If you have enough funds to take ownership of the stock, then being assigned is not a big problem.

If you get assigned the stock, you can always just sell it.

Long Iron Butterfly Example

Here is a typical long iron butterfly centered near the current price of Home Depot (HD) stock.

Date: May 27, 2022

Price: HD at $308.50

Buy one July 1st HD $335 call @ $1.48

Sell one July 1st HD $310 call @ $8.78

Sell one July 1st HD $310 put @ $12.55

Buy one July 1st HD $285 put @ $3.98

Credit: $1587

Like the iron condor, you collect a credit when you place the trade.

In our example, we collected a credit of $1587.

This is also the maximum profit possible for the trade.

The payoff graph looks like this, with expiration on July 1st (34 days away).

source: OptionStrat.com

We can see from the graph that the max loss on the trade is $913.

This gives us a reward-to-risk ratio of 1.7.

If you want to close the trade prior to expiration, you will need to pay a debit to close it.

You want to pay as low as possible.

The lower the debit you pay to close, the more of the initial credit you get to keep.

How Does The Trade Make Money?

The basis for how the trade makes money is that you are selling premium on the at-the-money call and put, which has a lot of extrinsic value.

It is like selling a short straddle.

Unlike the short straddle, the iron butterfly is a defined-risk trade. It buys a long call as protection against the short call.

It buys a long put as protection in case the short put is severely breached.

The iron condor makes money under the same premise, except it sells premium further away from the money with out-of-the money spreads instead of at-the-money spreads.

When you sell premium, you want premiums to drop and buy it back at a lower price.

This decay in premium is known as theta decay.

Selling premium further away from the money has less theta decay.

However, you are safer and less likely to have the spread be breached by the price going through it.

How Much Theta Does The Iron Butterfly Have?

It depends on the strikes, the expiration, the underlying, and the implied volatility.

Look to your trading platform to tell you the Greeks. In our Home Depot example, the Greeks are:

Delta: 1.75

Theta: 8.00

Vega: -20.80

This butterfly has a theta decay of about $8 per day at the start of the trade.

But this will change as time passes and the price of the underlying moves.

The butterfly has negative vega, which means that it profits if implied volatility drops, with all other factors being equal.

How Is The Iron Butterfly Different From The All-Put Fly?

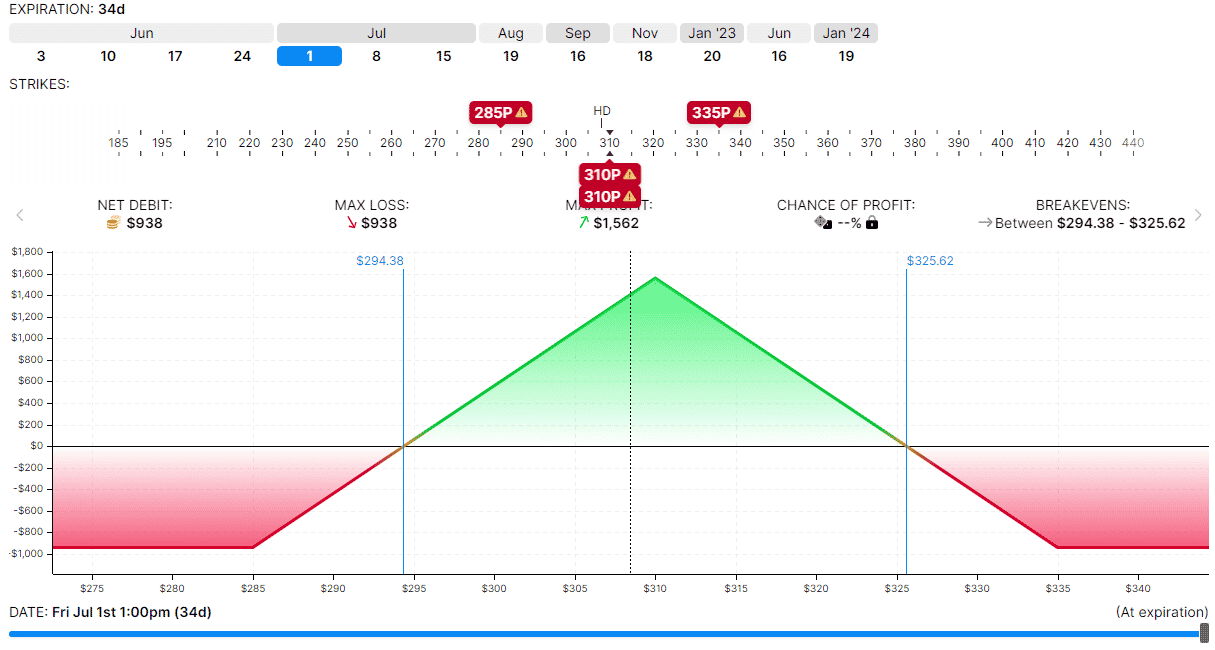

If the strikes are at the same location and the options are at the same expiration, then there is no difference.

Except you pay a debit to buy the all-put fly, whereas you receive a credit to place the iron butterfly.

Here is the equivalent all-put fly:

Buy one July 1st HD $335 put @ $30.50

Sell two July 1st HD $310 put @ $12.55

Buy one July 1st HD $285 put @ $3.98

Debit: –$938

For the all-put and all-call symmetrical butterfly, the debit paid is the maximum potential loss of the trade.

Other than that, the Greeks and the payoff graph are the same as the iron butterfly.

It is also the same for the all-call butterfly.

Try it on your trading platform and see.

FAQ

Which is better, an iron condor or an iron butterfly?

Which is better depends on which one you are more comfortable trading.

There is no particular edge of one over another.

The iron condor has short strikes far from price, so many traders feel comfortable with this aspect.

However, it has a smaller theta, which means it is slower to profit from time decay.

The iron butterfly with the same equivalent amount of risk has a higher theta due to its center strike being at-the-money.

How do you trade a long iron butterfly?

You can trade a long iron butterfly directionally or non-directionally.

If you have a directional bias about where the price will go, place the center strikes of the butterfly at that price.

When the price goes there, the trade will profit.

If you don’t have a directional opinion and think the price will stay in a range.

Put the center strike of the butterfly at the current price.

You will profit from the theta decay if the price does not move too far away from the center strike price.

Conclusion

For traders that are used to trading iron condors, the iron butterfly will feel very comfortable.

They simply think of the butterfly as being composed of two credit spreads: a bear call spread and a bull put spread.

The fact that you receive a credit to place the iron butterfly versus you paying a debit for the all-put or all-call butterfly is not particularly significant.

There is no advantage to receiving a credit.

The risk-to-reward, probability of profit, and payoff graphs are the same in all three cases.

Note that when people say “iron butterfly,” they are referring to the typical butterfly with the tent-shaped payoff graph (as we have seen in our examples).

Technically speaking, this is a “short iron butterfly” because we are selling the body of the butterfly.

In the next article, we will look at the reverse iron butterfly.

We hope you enjoyed this article on the long iron butterfly strategy.

If you have any questions, please send us an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.