Today, we’re going to learn about how to screen for high implied volatility stocks.

Contents

What Is Implied Volatility

Before we start scanning for stocks with high implied volatility (IV), let’s make sure that we have a really solid understanding of exactly what IV is.

“In financial mathematics, the implied volatility of an option contract is that value of the volatility of the underlying instrument which, when input in an option pricing model, will return a theoretical value equal to the current market price of said option.”

Put more simply, IV is the volatility that market participants are expecting before the expiration of the option.

The volatility is “implied” because it’s a variable solved for in an equation and thus not the actual volatility which of course cannot be forecasted with certainty.

“Volatility” refers to the fluctuation of a stock or underlying asset’s price.

Therefore, the higher the implied volatility, the higher the expected price movement.

implied volatility is not, by itself, a directional indicator.

It means that the market expects the stock to be some percent away from its current price by the time the option expires.

The higher the IV, the higher the premium of the option.

This makes sense if you take this to its logical conclusion.

If markets were completely stable and predictable then there would be no market for options–there would be no demand for them because everyone would just purchase (or not purchase) the underlying asset.

How (And Why) To Scan

Now that we have a solid grasp on IV we might want to start scanning for stocks that have a higher than normal IV.

Why would we scan for these?

Well since we know that the price of options correlates positively to the implied volatility of the underlying, we can draw a few conclusions that will be helpful.

The first conclusion from high IV is really straight forward and helpful to even those who are not options traders–option market participants are expecting a large move in price and therefore if you are an owner or potential owner of the stock you can use this information to hedge, take risk off, add to your position, etc.

This might be related to an earnings call, product launch, management change or any other catalyst for price change in an individual stock

Another reason to scan for high IV is that you think that implied volatility is actually too high and therefore options are overpriced.

This presents you with the opportunity to sell contracts to open new short positions or sell to close long positions that you opened at lower levels of IV.

A final reason to keep your eye on IV is as a signal of the overall market and macro-environment.

Fortunately, we have easy-to-read gauges for this like the VIX, but if you’re extra curious you might scan for high IV in a basket of stocks that correlates well with particular macro events.

Through Your Broker

The best way to start scanning for high implied volatility will be through the broker that you trade with.

This will make the process much easier and depending on the brokerage, may even allow you to place orders from within your scanner.

Different brokers have varying levels of sophistication so choose wisely.

If you are approved for options trading in your IRA or 401k, don’t expect those accounts to come with access to very sophisticated scanning tools.

Vanguard for example, which is one of the most highly respected investment companies in the world, does not even have a view that allows you to place option orders while viewing the associated chain.

You’ll have to pull up option chains in another window and then go back to Vanguard to select your desired strike and expiration from an old-school drop-down menu.

TD-Ameritrade, on the other hand, offers very sophisticated scanning tools that will be more than sufficient for most individual traders.

They allow you to scan for all of the options data that you’d be interested in including implied volatility.

Creating Alerts and Indicators

Not only that, but someone with even a basic understanding of computer programming will be able to tweak specific parameters or even build completely custom alerts or indicators using plug-n-play variables.

Someone with a higher level of programming skill will be able to build completely customized pricing models, volatility metrics, etc.

There’s quite a variety of tools that may or may not be available through your broker so it’s a good idea to study up before you commit to one–it might save you a fee at a separate subscription service.

TD-Ameritrade is fantastic but honorable mentions are E*Trade, Interactive Brokers, and Charles Schwab whose Street Smart Edge platform is really quite robust.

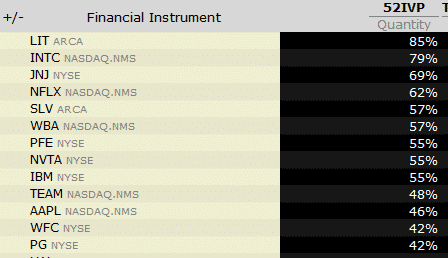

With Interactive Brokers, you can create a stock watchlist and the then add the 52 Week IV Percentile column.

We then sort descending in order to find the high iv stocks.

This video shows you how to do it and explains a bit about how I use this to find short vega and long vega trade ideas.

With A Subscription Service

If the tools that are offered by your broker aren’t getting the job done, some great subscription services will help you scan for implied volatility.

The bonus here is that scanning for IV with a subscription service will likely be the least of what you get with your subscription.

IV is a relatively basic concept so if you sign up for a premium service, you’re like to be getting much more than just a scanner for volatility.

One of the more notable services is ivolatility.

They offer a whole variety of options for scanning volatility including a Volatility Ranker and a Spread Scanner that looks deeply into implied volatility data to identify spreads that take advantage of higher (or lower) than usual IV.

A competing service that’s worth looking into is Market Chameleon.

A relative highlight here is their scanner that looks for IV Movers.

Think of this as stocks that have very volatile implied volatility.

This is similar to the VVIX index which measures the volatility of the Volatility Index.

Looking at this information for an individual stock will provide another clue about whether or not you should be buying or selling contracts based on IV as well as how long you might expect to remain in a trade.

For example, if the volatility of the volatility is very high, you might expect that you can sell a contract and then buy it back cheaper relatively quickly when IV unwinds. Iron condors can also work well on stocks with a high IV rank.

Free Scanners

If you’re investing with a company like Vanguard that doesn’t have great tools for trading options but don’t want to splurge on a premium, don’t worry!

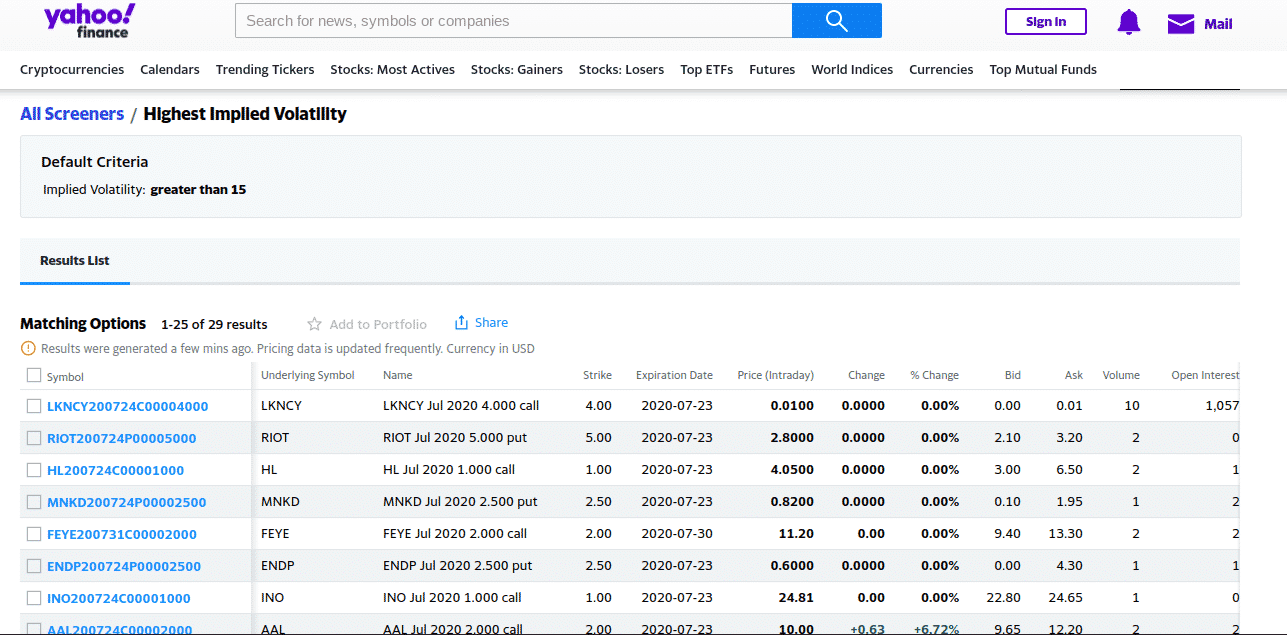

Yahoo! has tools and screeners that are sufficient for many scenarios.

The option chains provide a detailed view in near-real-time and they even have a screener that lists the stocks and contracts with the highest implied volatility.

Yahoo! is really a great resource for new traders or even experienced traders who might be looking for some quick information.

If you are sticking to basics with strategies like writing covered calls then the views and scanners offered by Yahoo! are likely sufficient.

If you are trading for income or with more complicated multi-leg strategies then you’ll want to be sure to choose a broker with advanced tools or sign up for a subscription service–or both!

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thoughrtful article, thank you. Even as an advanced trader, this was helpful to get additional insight into IV. If you are not yet using IV, read this article thoroughly as it will help you deploy your capital better!

Glad it helped you.

Hi Gavin,

Thank you for posting the article.

What if vol is low?

1) you avoid selling options until is high again? Or..

2) you still sell but the trade is setup with a less favorable risk/reward ratio?

Thanks!

Herman

Try to avoid selling options when vol is very low. Can still be profitable as long as vol stays low and it depends on the strategy too. Sometimes price will be more of a driver than volatility.