Today, we will share with you our high beta stocks list.

We will discuss what beta is, how it works and why it’s important.

Contents

- Introduction

- What Is Beta?

- Stock Beta Formula

- How To Interpret A Stock’s Beta

- Current High Beta Stocks List

- How To Use Beta For Diversification

- Why Invest In High Beta Stocks

- Risk of High Beta Stocks

- FAQ

- Conclusion

Introduction

Understanding the beta of a stock can help investors determine the overall volume and volatility of a particular investment.

Betas are determined by a simple formula that usually results in a decimal-based number.

A higher result usually means the stock is extremely volatile compared to the overall market.

A lower result means that the stock has almost no volatility and is very stable.

In this guide, we will cover all the important details of high beta stocks and try to inform you on how to calculate and interpret a stock’s beta.

Many investors heavily rely on a stock’s beta to help make swing trading decisions, but that doesn’t mean that it is the only indicator you should use.

If you decide to invest in stocks with a high beta, there are pros and cons.

More volatility generally means more opportunities to gain or lose money, depending on whether the stock is climbing or dropping.

If you are still confused about a stock’s beta, you should probably check out the following section, where we take an in-depth look to describe exactly what a stock beta is and how it works.

What Is Beta?

Beta is simply a measurement that can be used to compare an individual stock’s volatility to the volatility of the overall market.

Investors that prefer day trading or swing trading might prefer stocks with a higher beta because there are more significant swings, which can provide opportunities to make money in the short term.

Longer-term investors will most likely prefer stability in their investments, which is why they might prefer a portfolio of stocks with relatively low beta.

If you plan on making swing trades based on volatility and a stock’s beta, then you should always look for high-volume stocks that have a higher beta because you will gain exposure to more swings in the stock’s price.

It can sometimes be a good idea to use a stock’s beta with other indicators that can signal a stock’s current trend and momentum.

For example, using moving averages or bollinger bands to calculate a stock’s beta can help establish a general idea of what the stock is most likely to do over the next period.

Generally, high-beta stocks with a positive trend are extremely appealing to investors because of the increased chance of the trend continuing with increased volatility.

While these investments are not a guaranteed profit, so many indicators are signaling to buy that it’s at least worth the risk.

It’s hard to make short-term gains on stocks with lower betas because they are incredibly stable, even in the most volatile market conditions.

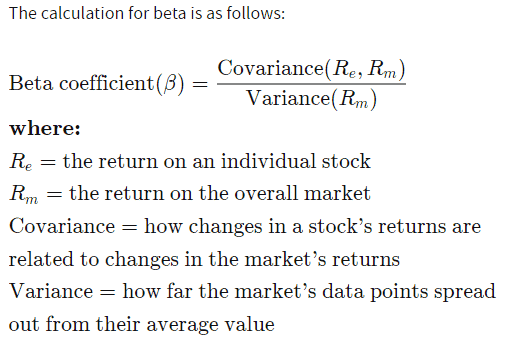

Stock Beta Formula

The stock beta formula is described below and is purposefully used to determine the general volatility of a particular stock.

The measurement or calculation generally compares the returns of the individual stock against the market average as a whole.

Source: Investopedia

Most experienced investors may even struggle to understand the stock beta formula.

The good news is that you don’t necessarily have to know this formula if you use a stock screener online that provides filters for high beta and low beta stocks.

Most investors are happy to use a stock screener to save time with advanced calculations like this.

How To Interpret A Stock’s Beta

The general rule is that a stock beta of 1.0 means the stock falls directly in line with the average market volatility.

A lower beta number implies that investors should interpret the stock as relatively stable without many swings, at least compared to the rest of the market.

On the other side of the spectrum, a higher stock beta number means the stock is way more volatile than the market average.

Swing traders and day traders often look for popular stocks with the highest beta numbers because of the opportunities to make gains on the volatile swings.

There are some rare cases where a stock’s beta might be negative.

When a stock’s beta is negative, it generally moves in the opposite direction of the S&P 500 market.

It’s pretty rare to find a stock with a negative beta, but some investors look for these types of stocks during bearish market conditions because that would technically be when a negative beta stock goes up in value.

Current High Beta Stocks List

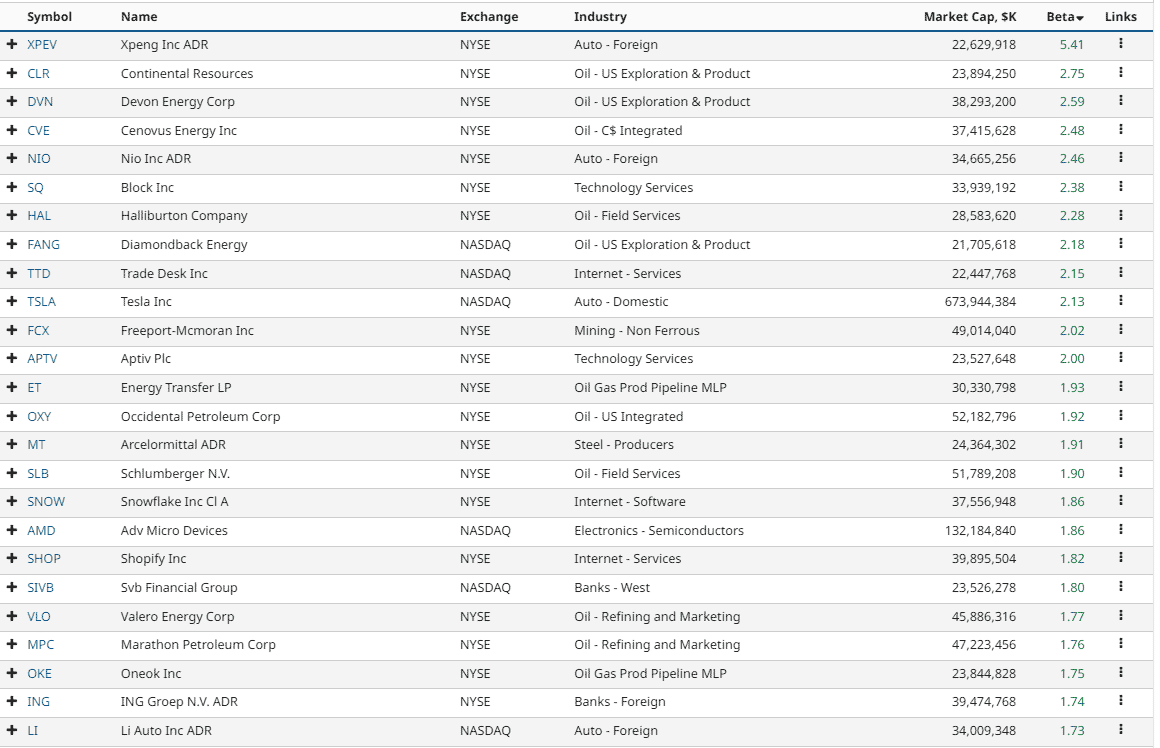

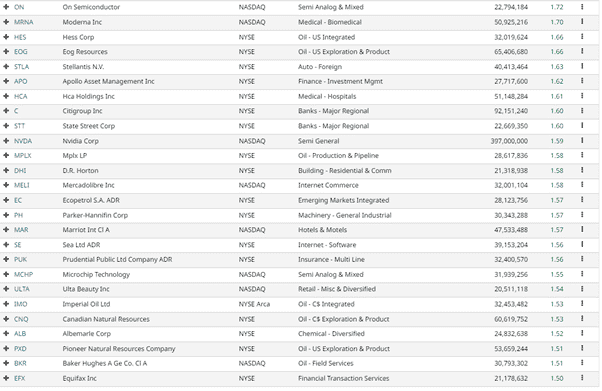

Here’s a short list of the highest beta stocks list during the second quarter of 2022.

Many of these stocks are also included in the S&P 500 High Beta Index, which includes up to 100 constituents.

Here is a list of some of the most common stocks with high beta:

- NVDA – Nvidia Corp

- ENPH – Enphase Energy Inc

- AMD – Advanced Micro Devices

- DKNG – Draftkings

- FTNT – Fortinet Inc

- MPWR – Monolithic Power Systems

- KLAC – KLA Corporation

- AMAT – Applied Materials Inc

- LRCX – LAM Research Group

Most of the stocks on this list are included within the S&P 500 High Beta Index.

They have proven to be the most sensitive to market changes over significant periods.

This means swing and day traders will most likely prefer these stocks when trading due to the increased percentage swings in both directions.

The following list from Barchart shows all stocks with a market capitalization greater than 20 billion and a beta of over 1.50.

How To Use Beta For Diversification

Smart investors should have diversified portfolios with a reasonable amount of high beta and low beta stocks.

Naturally, by investing in the S&P 500 index, you’ll gain exposure to many stocks with high and low volatility characteristics.

The S&P 500 High Beta Index is a tremendous generalized investment for some investors because it provides so much exposure to sensitive stocks in the market.

If you’re looking to reduce some of your risk, you should probably never exclusively invest in high beta stocks.

Having a reasonable percentage of low-beta stocks will protect your investment and reduce your risks during significant swings in the market.

This theory holds for more than just high and low beta stocks.

It’s never a good idea for an investor to have too many eggs in a single basket.

In other words, investing in different economic sectors and types of investments is a good thing for an investor’s portfolio.

Why Invest In High Beta Stocks

Many short-term traders prefer to invest in high beta stocks because they provide investment opportunities that wouldn’t usually exist if trading with low beta stocks.

Short-term traders generally make their gains by trading in stocks that swing heavily in both directions during changes in the market’s conditions or the overall trend.

High beta stocks are more likely to swing more often because they react more sensitively to a change in the market.

Some investors prefer the higher risks and higher profit potential that exists with stocks with higher beta, but that doesn’t mean that things will always be favorable to the investor.

Risk of High Beta Stocks

Now that we have discussed a few reasons that an investor may be interested in placing an investment in a high beta stock let’s talk about some of the risks.

Stocks can experience volatility resulting in a massive plunge just as easily as they could rise.

This volatility is why investing money in high beta stocks can be risky during a downward swing.

Investors should understand the risks and conduct a lot of market research before placing a trade in a high beta stock.

It is possible to lose money much quicker while investing in high beta stocks because the plunge will be several times worse than in the traditional market.

After all, it is more volatile.

FAQ

Which are high beta stocks?

Nvidia, AMD, and DraftKings are a few high beta stocks that regularly experience more volatility than the average market stock.

These stocks may be suitable for short-term traders that want exposure to large swings.

What are the best high beta stocks?

Fortinet and Nvidia have an exceptional reputation for being reliable high beta stocks, but the list is constantly changing.

Many of the best high beta stocks are already included in the S&P 500 High Beta Index.

How do I find high beta stocks?

If you don’t want to invest in the S&P 500 High Beta Index directly, then you could opt to use a stock screener to filter your results.

Almost all stock screeners have a feature that will easily allow you to find high beta stocks.

Is a high stock beta good?

If investors make intelligent trading decisions with a high beta stock, the results can be highly profitable.

Bad decisions at the wrong time can just as easily lead in the other direction toward massive losses.

Depending on how you invest, high stock betas can be a good thing, but there are risks that you should be aware of too.

Is Apple a high beta stock?

Apple is considered a high beta stock, but other stock investments with higher betas could be even more volatile than the Apple stock.

What is the beta for Tesla?

Tesla has a beta of 1.47, meaning it is way more volatile than the market’s average stocks. Tesla’s stock is generally way more volatile than other sectors of the economy.

What is the beta of Apple stock?

The Apple stock has a beta of 1.2, meaning it has a slightly higher beta than the market average.

Apple’s stock can be a bit more volatile than other sectors of the economy.

What is the beta for Amazon stock?

The Amazon stock has a beta of 1.23, meaning it has a slightly higher beta than the market average.

Amazon may be a bit more volatile than the average stock in the market.

What is the beta for Coca-Cola?

The Coca-Cola stock has a beta of 0.59. Coca-Cola is a very stable stock with low volatility.

It does not react to market swings nearly as much as other stocks in the market.

What is Costco’s beta?

The Costco stock has a beta of 0.69. Costco is very stable with low volatility.

It does not react to market swings nearly as much as other stocks in the market.

What is the beta of Google stock?

The Google stock has a beta of 1.13, meaning it has a slightly higher beta than the market average.

Google may be a bit more volatile than the average of stocks in the market.

Conclusion

The stock beta formula and understanding how it impacts investors’ trading decisions can be helpful.

To summarize, low beta stocks are very stable and don’t fluctuate in price as much, while high beta stocks are volatile and experience significant swings.

If you want a simple way to find the highest beta stocks, a free online stock screener may be able to assist you.

Alternatively, you could look at the stocks listed within the S&P 500 High Beta Index.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.