Contents

Explosive Options is an alert service and chat room started by Bob Lang over ten years ago.

Bob Lang is a directional options trader.

The services consist of four subscription plans:

- Directional Trading Plan

- Spread Trading Plan

- Trading Chat Room Plan

- Total Access Plan

A comparison of the plans can be found at ExplosiveOptions.net.

Directional Options Trading Plan

This plan is an alert service where the buys and sells come via email. But you can optionally opt into a members-only Twitter feed.

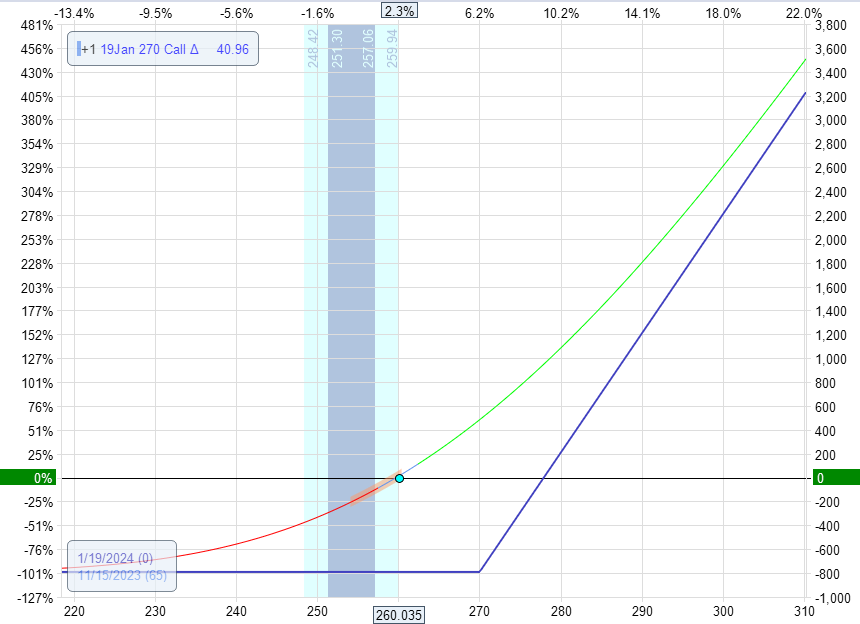

As an example, here is a typical trade from his Directional Options Portfolio:

If a stock was trading at $260, he might buy the $270 call with anywhere from 45 days to 3 months till expiration.

The longer days till expiration will mitigate the effect of the option’s time decay.

The payoff diagram for one contract would look like this with an asymmetric reward-to-risk profile.

Of course, it is up to you to decide how many contracts to trade based on your portfolio size and your comfort level.

In theory, this trade has an unlimited reward.

However, the risk is limited.

The maximum loss in the trade will be the amount you paid for the option.

As a good risk manager, Bob would not let an option go to max loss.

He would exit the trade as soon as the chart shows that the price is no longer going in the expected direction.

How Do We Know That Bob Is A Good Risk Manager?

We know because right after logging into my Explosive Options Dashboard and clicking on my “Directional Trading Welcome Kit,” I see the following:

Options Trading Rule #1: Practice Good Risk Management

Also, you can tell by watching his Daily Bites video on YouTube, published on Mondays and Thursdays. He keeps reminding traders to be risk managers and to always keep risk in mind, especially when the VIX is very low and the market is vulnerable to pullbacks.

He often likes to buy put protection when the price of puts is still reasonable.

This makes trading long calls more comfortable.

Daily Bites is where Bob provides commentary on the markets and on tickers to watch for.

Spread Trading Plan

This is a separate alert service for traders more comfortable trading spreads rather than long options.

While Bob prefers long options, as well as many Chat room members, there is nothing wrong with trading directionally using spreads, especially for newer traders.

They can provide better risk protection but also have a cap on the reward.

The type of spread trades that Explosive Options like to trade are at-the-money credit spreads.

This means they are more directional trades rather than theta collection trades (as would be in a bull put spread).

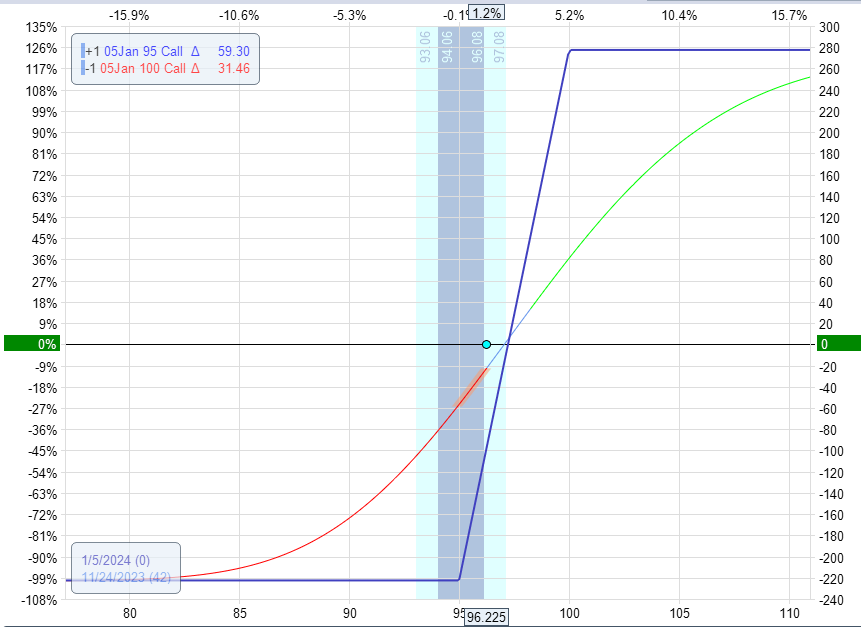

Here is an example of a typical directional credit spread taken from his spread trading portfolio.

If a stock were trading at $96, he would buy the $95 call and sell the $100 call with expiration about a month or 45 days out in time.

Because spreads do not decay in value as fast as with long options, we don’t need to have their expiration that far out in time.

An expiration graph would show that one contract would have a limited loss of $220 and a max gain of $280.

That’s roughly a one-to-one risk-to-reward ratio.

Trading Chat Room Plan

This particular plan gives you access to a Slack channel called the “Trading Chat Room.”

I poked my head inside to look and was pleasantly surprised at how friendly and cordial the group was. People were saying “welcome” to me and other similar comments.

As members log into the chat room during pre-market every day, they say “good morning” – every morning. It is like they are coming to work and greeting their co-workers.

Sometimes, when a member closed out a trade that Bob pointed out, they would post “Thanks, Bob.”

Wow.

How did Bob get these people so well-trained?

This starkly contrasts with random chaos in other groups on the internet.

Other members of the chat room are also posting their trades and ideas.

However, if you want to see only Bob’s chat room trade posts, those are filtered to another channel on Slack.

Members use a variety of technical analyses and indicators.

Besides the standard ones, I’ve seen members posting charts with Heikin Ashi, volume profile, and Ichimoku cloud.

Bob likes to use Chaikin Money Flow, Traders Dynamic Index, PSAR, MACD, and others.

Does Bob Post In The Chat Room?

Yes, he does.

But you must remember the Chat Room is not an alert service.

For the alert services, you must sign up for either the two plans mentioned above or the all-inclusive one.

The chat-room-only plan does not include the alerts.

The chat room is just a group of highly technical traders posting their ideas and what they are trading.

They may post their entries, but they might not post their exits.

As a trader, you have to decide if it is a trade you want to get into based on your favorite indicators.

You decide your targets and exits.

Here is one of Bob’s posts in the chat room.

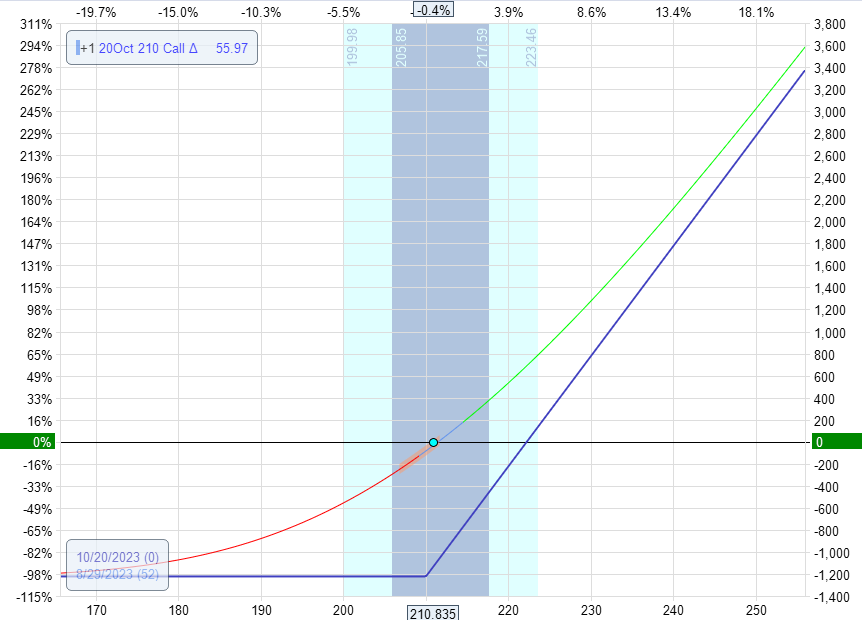

This happens to be an earnings play, which he does occasionally.

Bob bought some Salesforce (CRM) October $210 call options at $12, as he posted on August 29th, 2023, in his chat room.

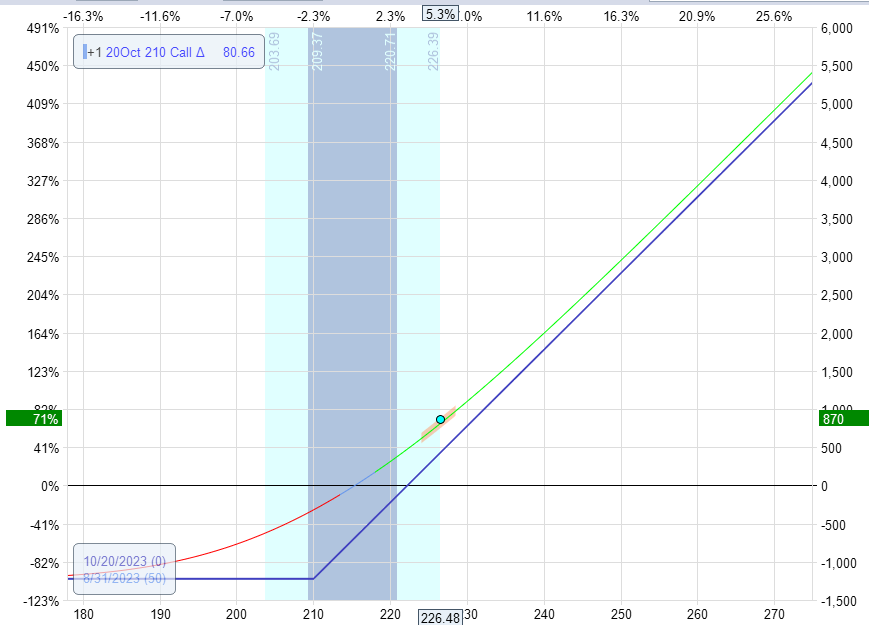

Then, I sold those same calls two days later for $21.

Well, those call options certainly exploded in value by 70%.

Now you know why they call it “Explosive Options.”

Looking at the daily charts, we see that the options were held over an earnings announcement that caused a huge price gap:

Some of you may be thinking about how a long option can be held across earnings.

Wouldn’t the “volatility crush” depress its values after the earnings?

The key is in the expiry.

These monthly October calls are more than 50 days till expiration and hence are less affected by volatility crush.

Even though it did experience some of that effect, the gain from the large price move more than offset that loss.

With a starting graph like this:

Two days later, it looked like this:

The chat room primarily trades these directional long gamma and long vega trades.

It is true that long options decay in value with time due to negative theta.

But this is a small effect if you are holding the trades for a short duration compared to the full expiry days.

Advantages of Chat Room

The advantage of being in the chat room is that multiple pairs of eyes from many technically trained traders are better than one pair of eyes.

As an example, one member spotted unusual options activity in ImmunoGen (IMGN), which caused chatter in the chat room even before any news was announced.

And when news came out on November 30th, 2023, that Abbie (ABBV) was going to buy IMGN, this happened to the IMGN stock.

Anybody in long calls would have seen some “explosive options.”

Another member in the Chat Room spotted a textbook morning star pattern on a monthly chart:

Do you know what happens if you have a morning star on the monthly?

You are more likely to end up with this on the daily chart the following month:

Conclusion

Finally, Bob has an all-inclusive Total Access Plan, a subscription plan that includes Directional Trading, Spread Trading, and Chat Room plans.

Do you know why animals form herds? Because more eyes are better than one – for protection and hunting.

Find your herd and trade safe.

We hope you enjoyed this Explosive Options Review.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.