Contents

Sometimes, a butterfly trade just needs a helping hand.

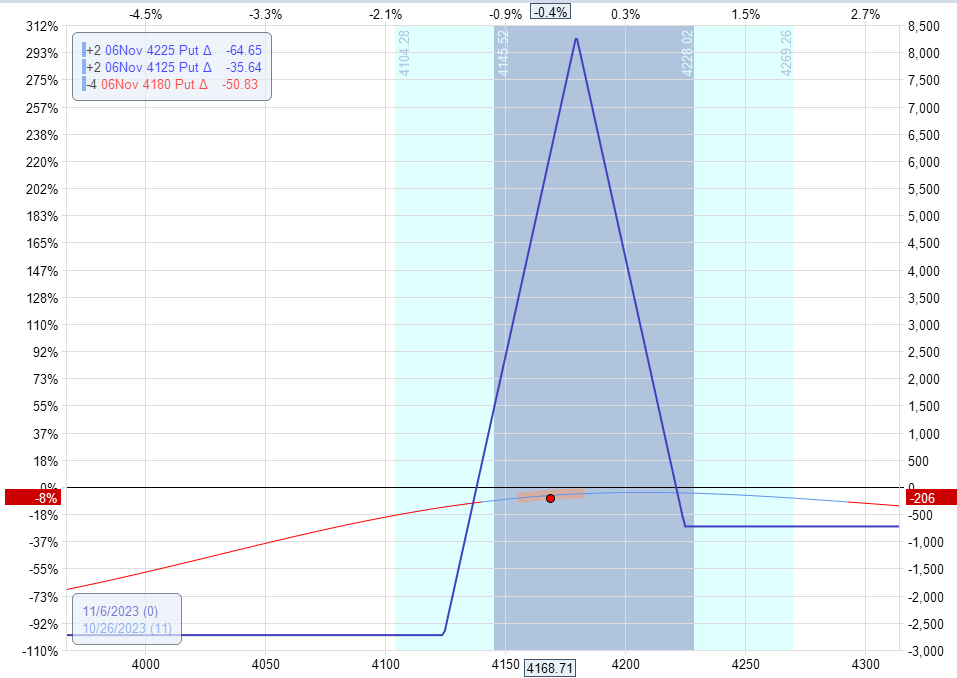

There was once a tiny butterfly that had only 11 days left till expiration:

It is tiny because its upper wing is 45 points, and its lower wing is 55 points in a large index like the SPX.

The trader employing this butterfly tried to capture theta in a non-directional strategy.

The butterfly got caught in a market downwind on October 26, 2023, where the S&P 500 had been going down steadily.

This got the butterfly in trouble with a P&L loss of -8%.

The price is already in the lower half of the expiration tent with a position delta of positive 2.9 with two butterfly contracts.

If the market continues its downward move another day, the butterfly would need to exit due to its exit loss trigger.

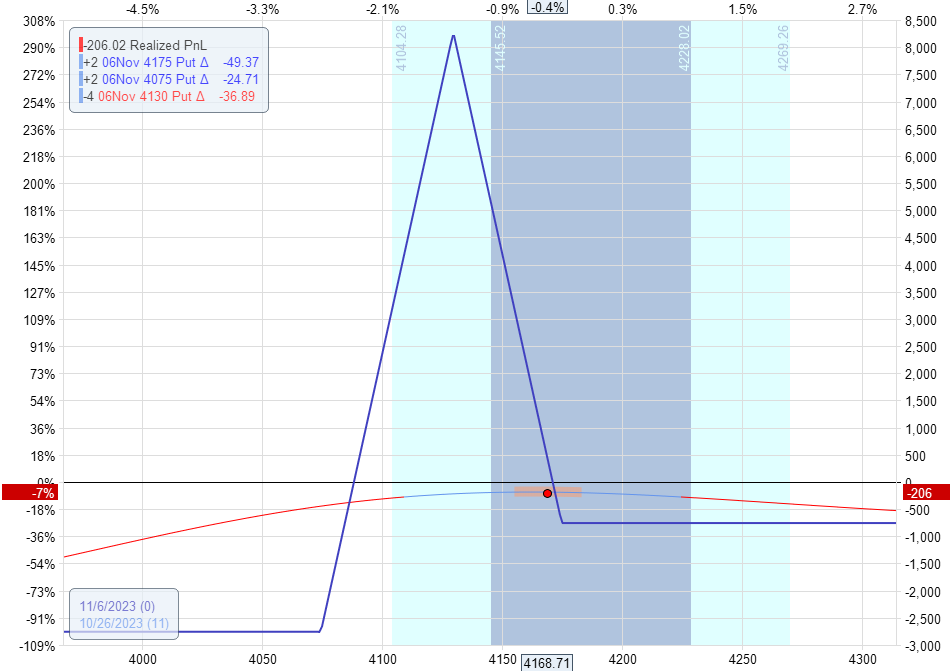

The standard adjustment is to roll the entire butterfly down to reduce the delta and reposition the price in a better location of the tent like this:

This would have reduced the position delta to a delta-neutral position of -0.4.

The drawback is that in a fast, down-moving market, the bid/ask spread widens, and executions are difficult to get filed.

There is a cost of slippage due to the rolling of three legs.

This is not a problem for a longer-term butterfly, and it can compensate for the cost.

With a trade that only has 11 days to expiration, there may not be enough time to collect enough positive theta to make up for this cost.

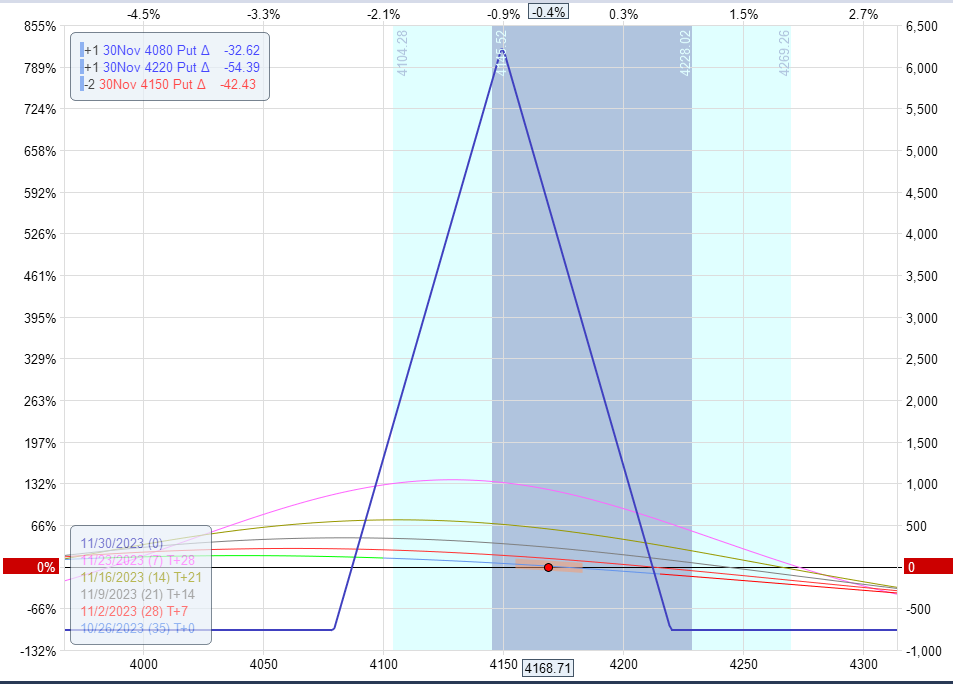

Fortunately, another longer-term, bigger, and wider butterfly came to help.

It was a symmetrical butterfly with 60-point wings on both sides.

It had 35 days till expiration.

Its Greeks are:

Delta: -1.8

Theta: 11.24

Vega: -36.5

This butterfly has a negative delta of -1.8 (to offset partly the positive delta of the first butterfly).

It says to the first butterfly.

“Hey buddy, I see you are in a bit of trouble. Set your order to break even so that you can get out of this windstorm. In the meantime, you can lean on me.”

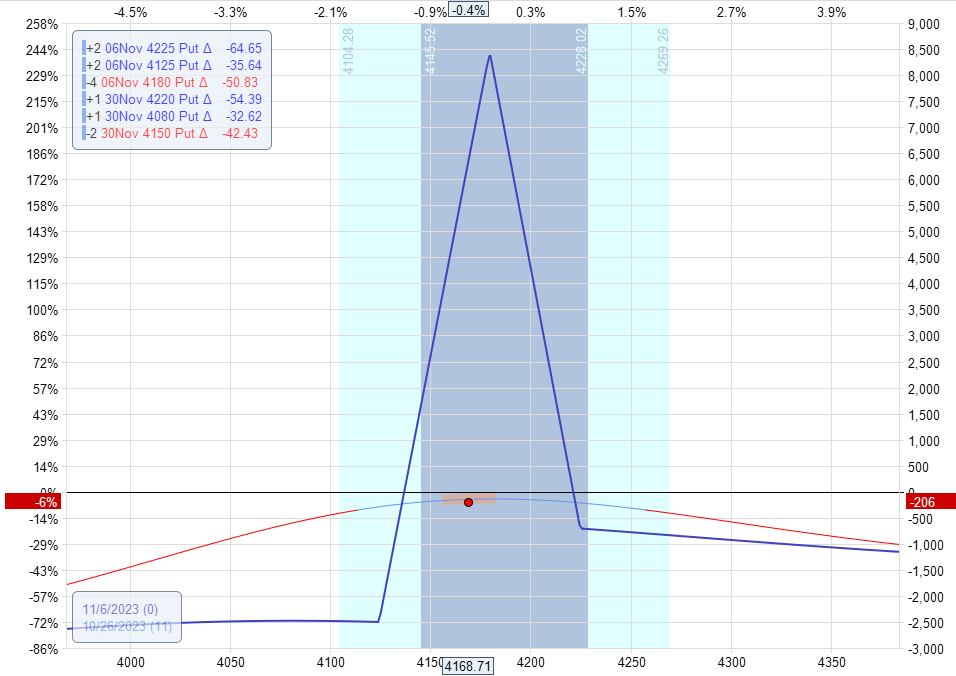

When we merge the expiration graphs of the two butterflies, it looks like this:

The combined delta is now down to 1.2.

Whereas before, the solo butterfly had a 2.9 delta.

Keep in mind that the blue expiration graph shows the P&L of the position 11 days from now (at the expiration of the first butterfly).

The second larger butterfly will still have more time after that.

The goal is to hedge the smaller butterflies’ positive delta so that it can have extra time for theta to come in and get out at breakeven.

Getting Out At Breakeven

In fact, on Monday, October 30, that’s what happened.

The first butterfly’s good-till-cancel order was triggered, getting it out at breakeven.

The passage of time over the weekend and the slight gap in the opening price of SPX Monday morning helped.

The second butterfly is not any worse off.

Later on that day, the second butterfly P&L also ended up positive.

It could have also exited or continued on its merry way as its own trade.

Conclusion

In this example, we have seen how we can add another trade to hedge a losing trade.

We can monitor the combined Greeks (just add them up) and draw its combined expiration graph.

The combined P&L is monitored to see if we can get both trades out at breakeven or a positive gain so we don’t have to take a loss on the initial trade.

This is what traders refer to as “layering” trades.

It can be done with iron condors or other options structures.

It works best when the loss on the initial trade is not so bad.

If it is too far gone, closing it rather than trying to save it is probably best.

Risk management is the key to successful trading.

We hope you enjoyed this article on how to use a butterfly hedge.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.