Contents

We were in this DIS iron condor for quite a bit of time.

If you were watching this month-long trade in real-time, you would have had to wait a long time to see how the trade played out.

In the end, you would have forgotten what adjustments we had made or why we made them.

So let’s summarize this case study.

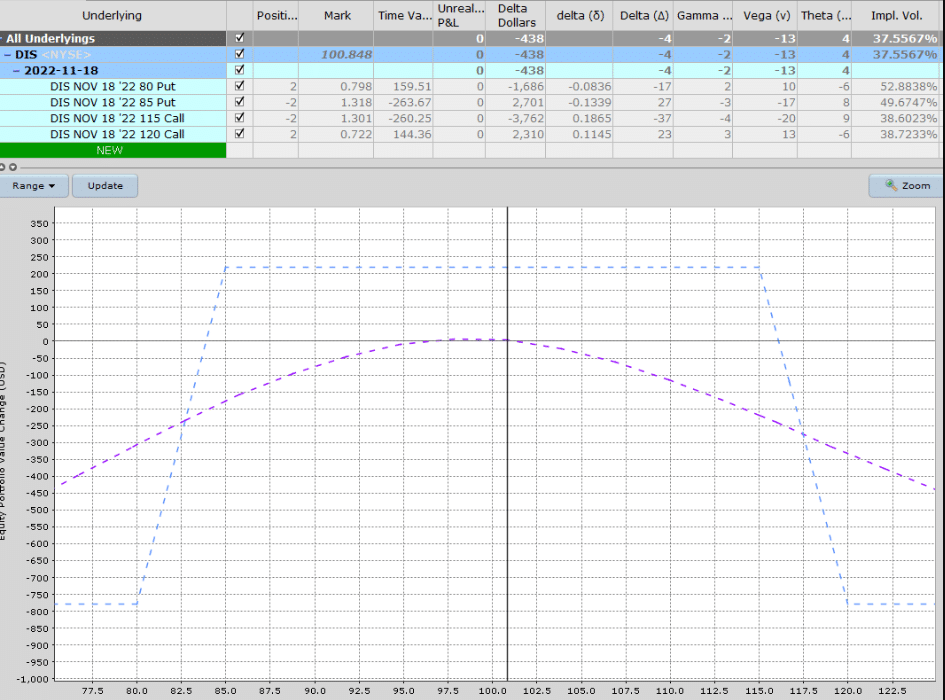

On October 6, 2022, we started with two contracts with about 45 days to expiration.

Date: October 6, 2022

Price: DIS @ $100.85

Buy two November 18 DIS $80 put @ $0.80

Sell two November 18 DIS $85 put @ $1.32

Sell two November 18 DIS $115 call @ $1.30

Buy two November 18 DIS $120 call @ $0.72

Credit received: $219.80

The short call is being sold at the 19-delta. The short put is being sold at the 13-delta.

We are keeping the wings 5 points wide.

With the max potential reward of around $200 and a max risk of $800, this is a 4-to-1 risk-to-reward ratio trade.

Play Defense

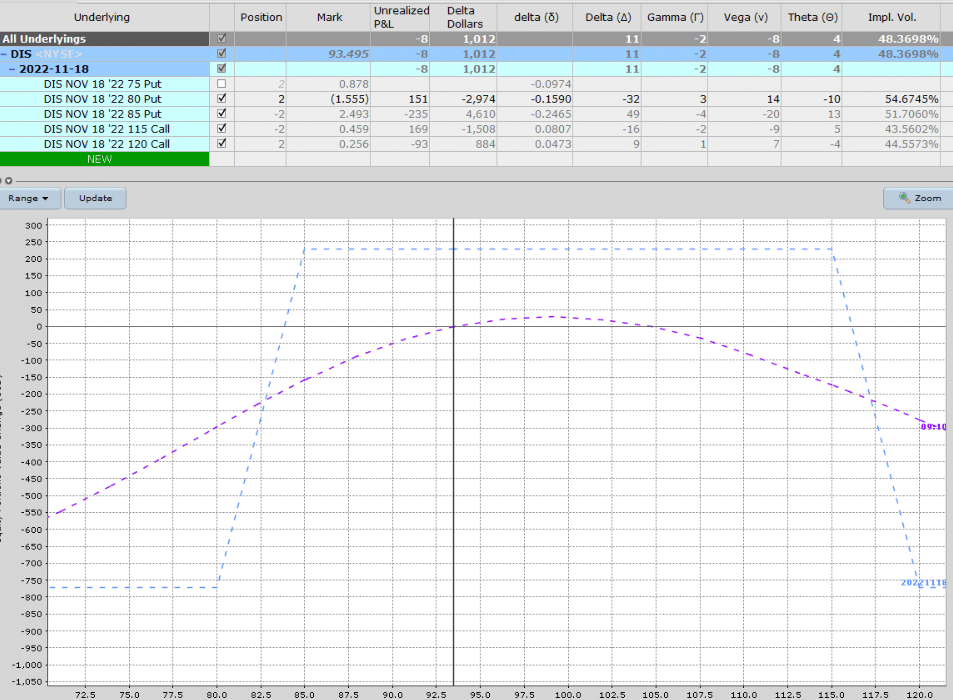

On October 12, Disney dropped to $93.50.

The short $85 put is now at the 25-delta. And the payoff graph looks like this:

It’s time to play defense, just in case.

We roll the 85/80 put spread down 5 points to 80/75.

Date: October 12, 2022

Price: DIS @ $93.50

Close put spread:

Sell to close two November 18 DIS $80 put @ $1.49

Buy to close two November 18 DIS $85 put @ $2.49

Open new put spread:

Sell to open two November 18 DIS $80 put @ $1.49

Buy to open two November 18 DIS $75 put @ $0.88

Net debit: –$77.80

You can think of rolling a put spread down as closing the existing 85/80 spread.

And opening a new 80/75 put spread.

If the market is moving down fast and the investor thinks it will continue to move down throughout the day, they may prefer to perform this as two transactions.

First, they close the existing spread to stop the loss.

Then they wait and let the market continue down, or wait till the price settles a bit, or wait till near the end of the market day.

And then, they would open the new put spread at the 10 or 15 delta.

Some may even wait till the next morning to open the new put spread in order to avoid any potential overnight gap.

However, in this case, the market was not moving particularly fast and did not appear to be a strong trending day.

We are just playing a little defense.

So we just perform the roll all in one transaction.

You can see that we are actually selling four of the $80 puts.

And then buying the $75 and the $85 puts on either side.

This is a butterfly.

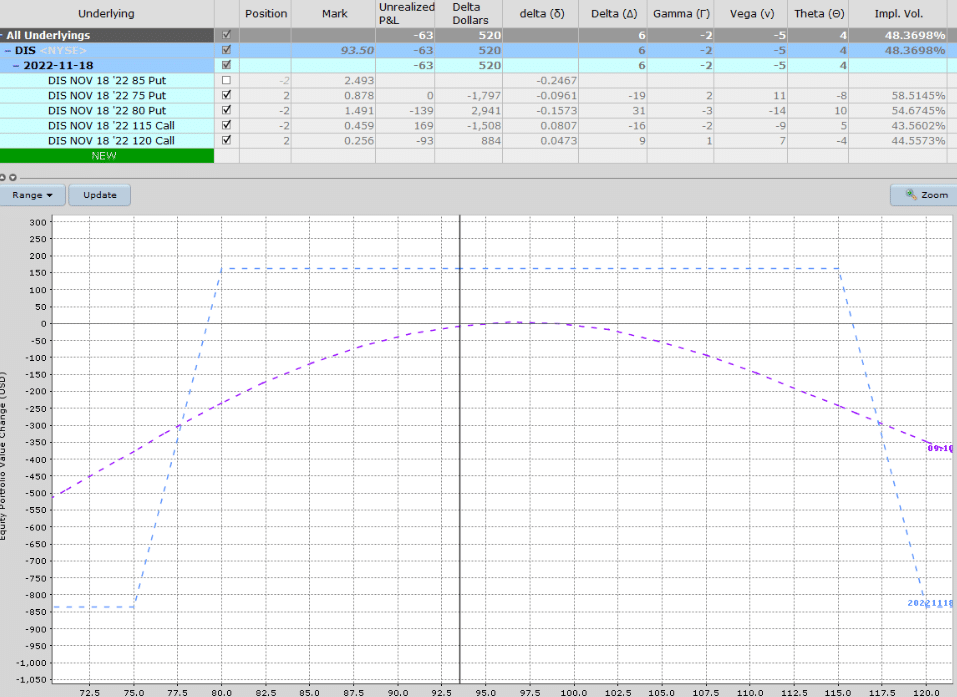

Butterfly Adjustment

Rolling the put spread as we did, in this case, is, in fact, buying a butterfly, as you can see here:

Buy two November 18 DIS $85 put @ $2.49

Sell four November 18 DIS $80 put @ $1.49

Buy two November 18 DIS $75 put @ $0.88

Net debit: –$77.80

Some investors will call this the “butterfly adjustment.”

However you want to call it or think of it, the net debit for the adjustment is the same at $77.80.

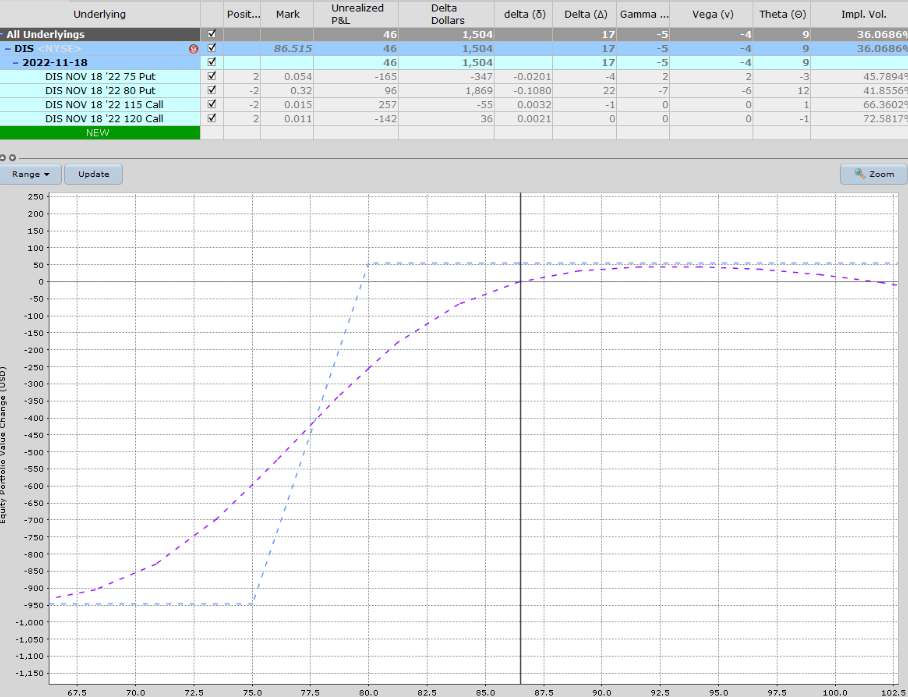

And the resulting payoff graph looks like this:

The keen observer will notice that our potential reward has decreased slightly (to $160), and our max risk has increased slightly (to $840).

The risk-to-reward ratio increased to 5-to-1.

Still fine. Not an issue at all. The Delta Dollars looks good.

Still Okay

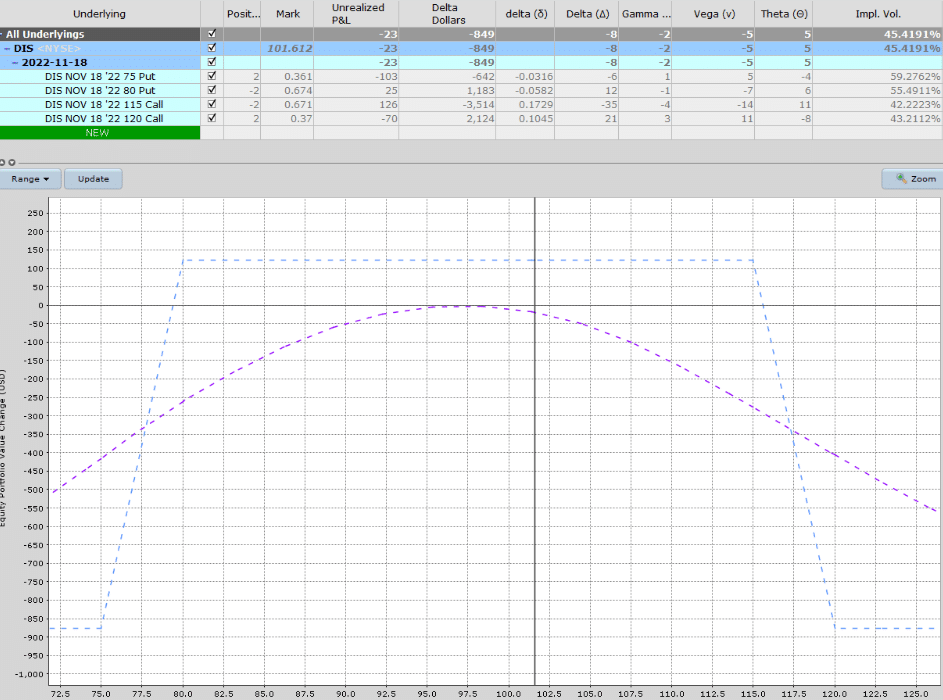

On October 18, the price of Disney is $101.61. We can see the price now moving closer to the short call:

With the short call delta at 17, we are still okay and have nothing to do.

But keep an eye on this delta and be prepared to adjust if it gets to delta-25.

Closing Trade

On November 9, Disney had a big drop of 12% due to the earnings announcement.

But with the volatility crush post-earnings, we have actually done okay with P&L at +$87.

With only $50 remaining and the condor expiring on November 18, there is no real point holding into the last week of expiration.

We close out the trade as follows:

Date: November 9, 2022

Price: DIS @ $86.52

Sell to close two DIS $75 put @ $0.05

Buy to close two DIS $80 put @ $0.32

Buy to close two DIS $115 call @ $0.02

Sell to close two DIS $120 call @ $0.01

Net Debit: –$54

Final P&L

Initial credit received: $219.80

Roll put spread down: –$77.80

Close trade: -$54.00

Total: $88.00

With initial credit received, then paying for the adjustment, and then paying to close the trade, plus some slippage and fees, this trade ended up with a profit of $87.

We hope you enjoyed this DIS iron condor example.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thanks. The biggest problem I have are adjustments, when and with what. This helps a lot. Can’t wait for the next episode!

Glad it helped you Dave.

Thank you Gavin for posting this. Looking at the daily price chart of DIS, I found after Oct 18 (the 2nd adjustment), DIS price had a week-long bull run up to price 106 as of Nov 1.

Did it not trigger the 25 delta adjustment signal before the earnings?

Hi Howard, I went back and looked at it in OptionNet Explorer and the highest it got was 24.03 on Nov 1.