A Call Calendar Spread provide an investor a unique ability to take a view on the volatility of a stock through different time periods.

Despite being relatively simple in structure, they are far more complex in the view they express.

This complexity results in some traders trading them entirely incorrectly.

This article will provide a brief overview of Calendar Call Spreads and a few tips on trading them.

Contents

- What Is A Calendar Call Spread?

- What View Am I Expressing?

- Breaking Down A Calendar Call Trade

- Calendar Calls As A Low-Risk Strategy

- Concluding Remarks

What is a Calendar Call Spread?

A Calendar Call spread is an options strategy where two calls are traded on the same underlying and the same strike, one long and one short.

The only thing that separates them is their expiry date.

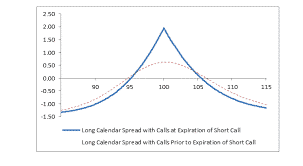

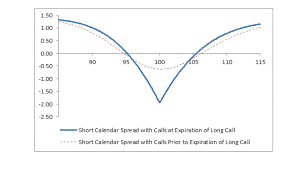

A long Calendar Call consists of selling a shorter-term call option and buying a longer-term call option, shown below.

In the example of a long Calendar Call, a debt is paid.

This debt equals the extra time value of the further dated call option.

It also coincides with the maximum loss on the position.

Source: Fidelity

In contrast, a short Call Calendar consists of buying a shorter-term call and selling a longer-term call. In this example, a credit is received.

The credit is the maximum gain, and the maximum loss is unlimited, though it will often be muted.

Source: Fidelity

If you are saying to yourself, these structures look similar to the long and short straddle, you are correct.

However, they are quite different, as we will find out below.

What View Am I Expressing?

Whenever you place a trade, it is essential to know what view you express by your trade.

A Calendar Call represents a view of forward volatility (or the volatility between two expiration dates).

Thus, by trading a calendar, you are making a direct view of the term structure of the options chain.

In the case of a long calendar, you express the belief that forward volatility is low compared to what you expect.

For the short calendar, it is the opposite, that volatility is too high between the two expiries.

In a long calendar, you are short more Gamma and long more Vega.

Here you will benefit from the passage of time (Theta) and an increase in implied volatility (Vega).

In a short calendar, you are long more Gamma and short more Vega.

In this case, the position will benefit from a significant, realized move (Gamma) or a decrease in the level of implied volatility (Vega).

Neither of these is inherently better.

It depends on your view on the term structure and what you think the stock will do.

Breaking Down A Calendar Call Trade

Now let’s look at a potential trade.

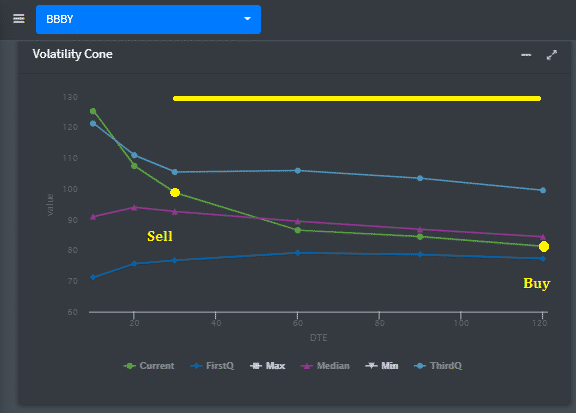

Below I have the term structure shown by the green line on Bed Bath and Beyond.

We can see that the near-term options have higher volatility than the longer-dated options.

The shorter-dated options have volatility near the first quartile, where the longer-dated options have significantly lower volatility near the third quantile – quite a significant difference.

Let’s say I believe that volatility will stay high and that the market underestimates the long-term meme potential of the stock.

Despite this, I think near-term volatility is overpriced.

Source: Predicting Alpha

So, what can I do?

Go long a Calendar Call.

I sell the 30-day options while buying the cheaper (in volatility terms) 120-day options.

I am therefore buying volatility between the 30 and 120-day expiries.

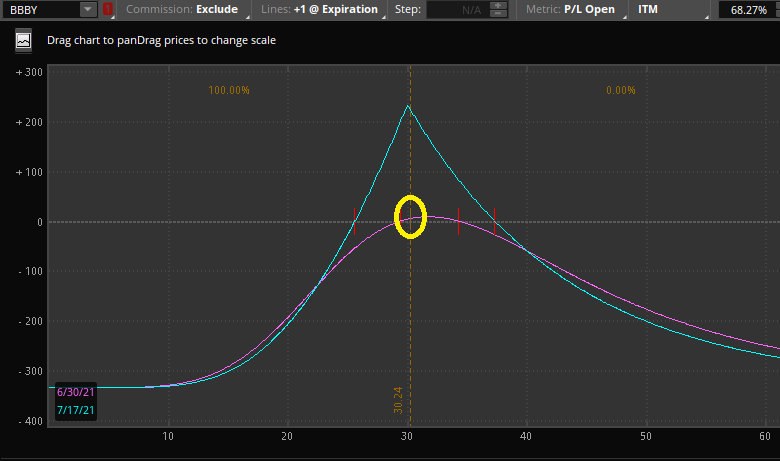

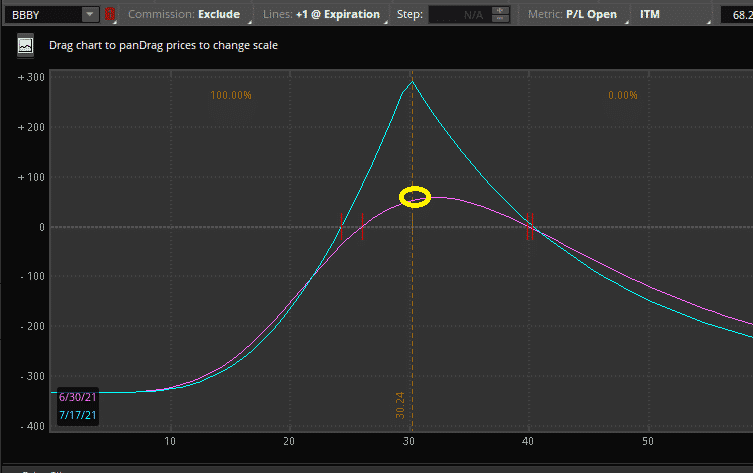

We can see our position above with inception P&L at the yellow circle.

It is tempting to look at this like a short straddle, but let’s see what happens when we increase volatility by 10% on both contracts.

$50 profit per lot traded!

So, while you may think it looks like a short straddle, it does not exactly act like one.

We can also see that if the stock moved down to $20 tomorrow, we would lose a lot of money even with the increase in volatility.

This is because while on inception, both calls have a Delta of 50, the call we sold has a lot more Gamma.

If we do not hedge our Deltas, we move from a directionless to a directional bet.

Calendar Calls As A Low-Risk Strategy

The reality is that most of the time, Calendar Calls will have muted returns.

This is because we are trading the same underlying and at the same price.

The only thing we are betting on is the forward volatility between the two strikes and the realized volatility in the meantime.

One structure wins with more short Gamma, and the other will conversely win with more short Vega.

For example, it is rare for the front of the term structure to move as much as the back.

In our example of moving vols up 10%, it is more likely that the front would have moved up by even more than that in most situations.

Also, if we had implied volatility shoot up 10%, most likely, we would have some realized movement in the stock.

As a note, it is common to have large, realized moves with drops in Vega.

This occurs typically in events such as earnings when Vega drops as the unknown information is now priced in.

These events seem tradable until you realize the term structure is already pricing this in.

For example, the Bed Bath and Beyond long calendar appears to make a lot of sense until you realize earnings is tomorrow morning.

Sure, the curve will go down afterward, but we should have a large stock move in the meantime.

High Volatility

This causes extremely high volatility in the shorter expiries.

Many investors like the use of calendars in low implied volatility environments.

This usually involves selling a shorter-term call and buying a longer-term call.

The thesis is that volatility has been low and should continue to stay low in the short term.

In the longer term, it is expected at some point that volatility will mean revert to a more normal IV environment.

This thesis is a strong one.

The issue is that the idea is so strong that the market is usually already pricing it in.

This can be seen from a term structure in steep contango. It results in you selling low IV and buying higher IV.

Despite this, it may be wise in some situations.

Another reason for the Long Call Calendar trades is taking advantage of Theta decay in the front option while being hedged with long volatility in the back.

The problem with this is if a large price move occurs, it is unlikely the back Vega will make up for the short Gamma unless you can hedge through the move.

Sometimes this is impossible to do.

So, while a strategy of long calendar spread will collect a small amount of extra variance risk premia over the long run, it is not without its risks.

Concluding Remarks

Call Calendar Spreads allow investors to take trades across different options expiries.

This allows the unique ability to bet on the shape of the term structure and trade forward volatility.

It also allows investors to balance the Gamma Vega trade-off.

Being a conservative strategy, the gains and losses are usually not very pronounced as both legs work against each other.

That being said, they are a handy tool to take advantage of certain situations using options.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.