Today, we will answer the question – “What is Vanna greek”?

We will discuss what Vanna is, how it works, and its importance in trading options.

Contents

- An Introduction

- What is Vanna?

- How Vanna Changes

- Does Vanna Matter?

- How Vanna Can Kill

- How To Manage Vanna In My Portfolio

- Concluding Remarks

Just when you start to understand the first derivative greeks, you are hit with a wrench.

There is more!

For math geeks, this is only intuitive, yet it may feel more like the movie Inception than real life for the average trader.

Yet be confused not as this article will provide an overview of one of these second-order Greeks, Vanna.

An Introduction

Before we get into the discussion about Vanna, we must know what the first-order Greeks are. These are most importantly Delta, Vega, and Theta.

If we do not clearly understand these Greeks, it is impossible to understand any second-order Greeks such as Vanna.

If you are still unfamiliar with these Greeks, take some time to review them before coming back to this article.

After all, we do not want to be one of those Twitter “know it alls” who spout off a bunch of third-level greeks without knowing how any of these things work.

The good news is if you already know the first-level Greeks and how the most crucial second-order greek (Gamma) works, you have a head start!

What is Vanna?

Vanna is a second-order greek derived from the delta.

Vanna measures the change in delta for any given increase or decrease in the level of implied volatility.

If this sounds familiar to you, it is because Gamma is similar.

It is the change in delta for any given increase or decrease in price.

So while delta will change as the underlying moves up and down, it will also change as volatility increases or decreases.

It will do so in some unique ways.

Let’s conceptualize it.

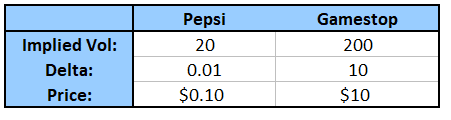

Imagine we have two stocks Pepsi and Gamestop.

Both are trading at $150.

We are bullish and buy $200 monthly calls on each.

The call on Pepsi costs 10 cents, while the call on Gamestop costs $10.

Why is the Gamestop call so much more expensive?

Because the level of volatility is a LOT higher on Gamestop than Pepsi.

Realistically, unless it is discovered drinking Pepsi cures cancer, there is little chance that Pepsi will reach $200 by next month.

In contrast, meme-driven Gamestop could reach $200 by tomorrow, let alone next month.

Because of this volatility, the delta of our $200 Pepsi call is a lot lower than the Gamestop Call.

Gamestop vs Pepsi

Let’s think of this realistically, if the price of Pepsi goes up by $1, what will happen to our Pepsi $200 call?

The answer is virtually nothing.

It is still worth ten cents.

After all, it doesn’t matter because either way, Pepsi is not going to $200.

In contrast, if Gamestop moves up a dollar, our Gamestop Call will be worth 10 cents more!

Now let’s imagine a universe where a Pepsi may cure cancer.

IV is now 200. What will the delta be?

Given the same price, strikes, and expiries, the delta will be the same as the delta of our Gamestop call.

This increase in the delta because of the change in implied volatility is Vanna.

Increasing the level of implied volatility increases the level of delta while decreasing the level of implied volatility decreases the level of delta.

How Vanna Changes

Now we have a basic idea of how Vanna works.

Despite this, it is essential to know that Vanna is not equal over the options surface.

Some options have a lot more Vanna than others.

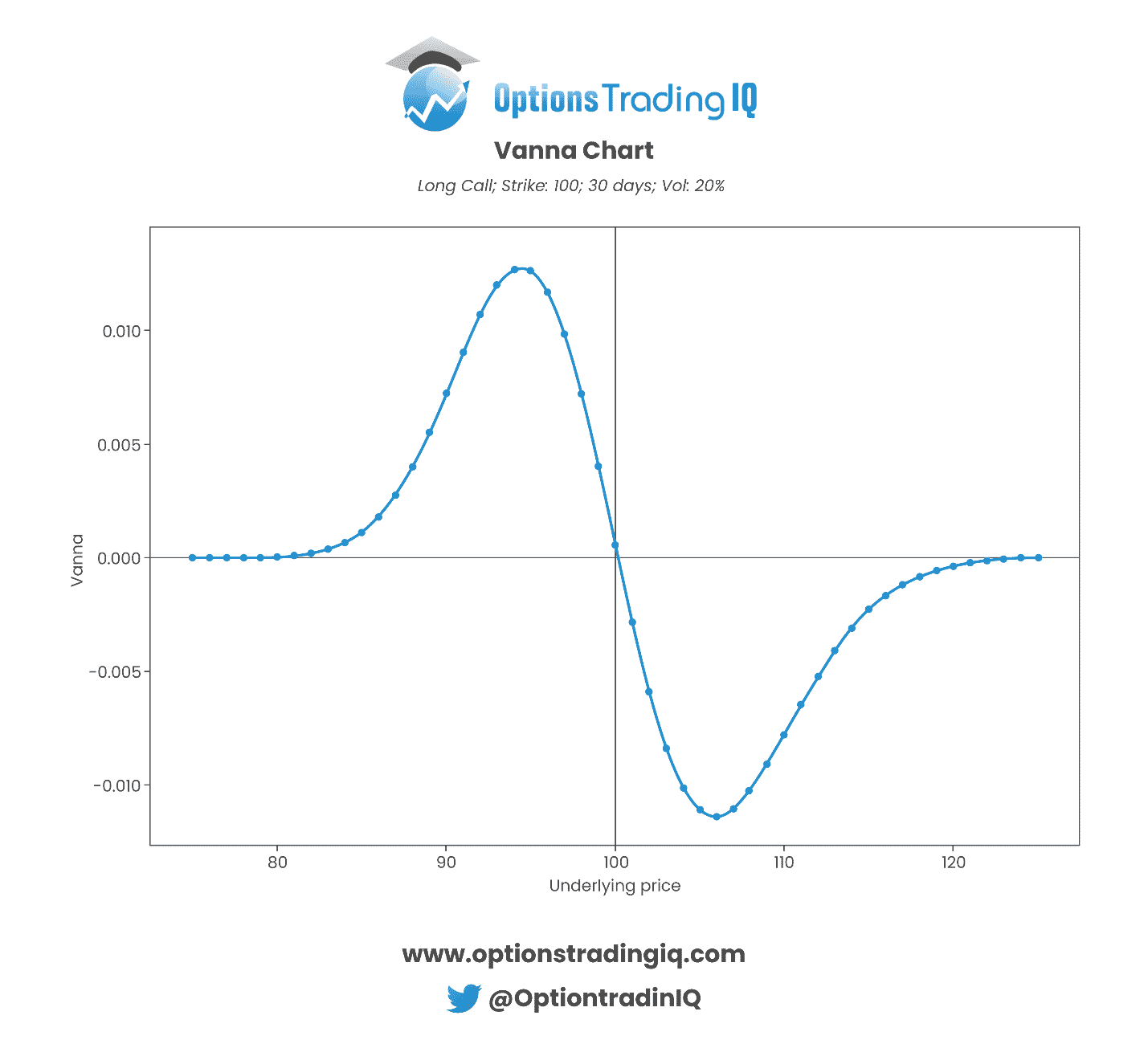

The chart below shows this.

Interestingly enough, we can see that the options with the most Vanna are the wings that are moderately out-of-the-money.

We can see that as the underlying reaches our strike and is at-the-money, our Vanna exposure = 0.

That means that an increase or decrease in volatility does not affect the options at all.

Remember, we cannot have a delta over 1, so any increase in the delta of one option corresponds to a decrease in delta in the other option.

Our Vanna of 0 at-the-money is in contrast to Gamma, which is highest at-the-money.

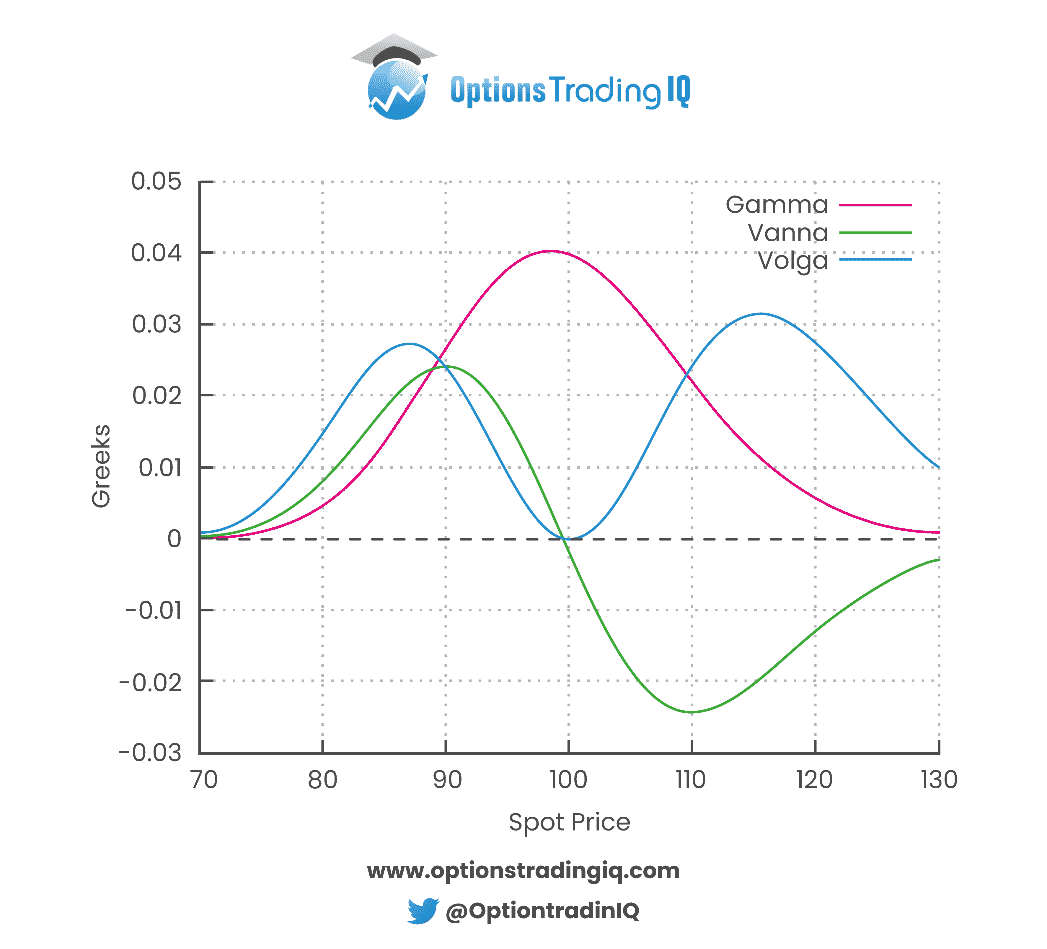

Here we can see this difference in a chart comparing Gamma, Vanna, and Volga.

Also, notice that as we increase far enough away from the spot price, Vanna decreases.

This may seem a bit conflicting at first.

However, remember our Pepsi / Gamestop example. Since our $200 Pepsi call has so little value, a 1-point increase in implied volatility from 20% – 21% will do almost nothing to the option’s value.

Exactly how a $1 price move did nothing to the price of the option. Those wings have extremely low Delta, Vanna, and Gamma.

They are virtually worthless.

Does Vanna Matter?

At this point, it is vital to ask the question of whether Vanna matters.

The answer is that it depends on who you are and what you are trading.

Vanna is extremely important for a market maker who manages an inventory across multiple strikes, expirations, and tickers.

In contrast, for the average investor trading Iron Condors or Verticals, Vanna is almost irrelevant.

The foremost importance for the average retail trader is on the first level greeks like Delta, Vega, Theta, and then Gamma.

Though depending on what you are trading, Vanna can become a silent assassin.

This is especially true if you are selling out-of-the-money options.

The below example will demonstrate.

How Vanna Can Kill

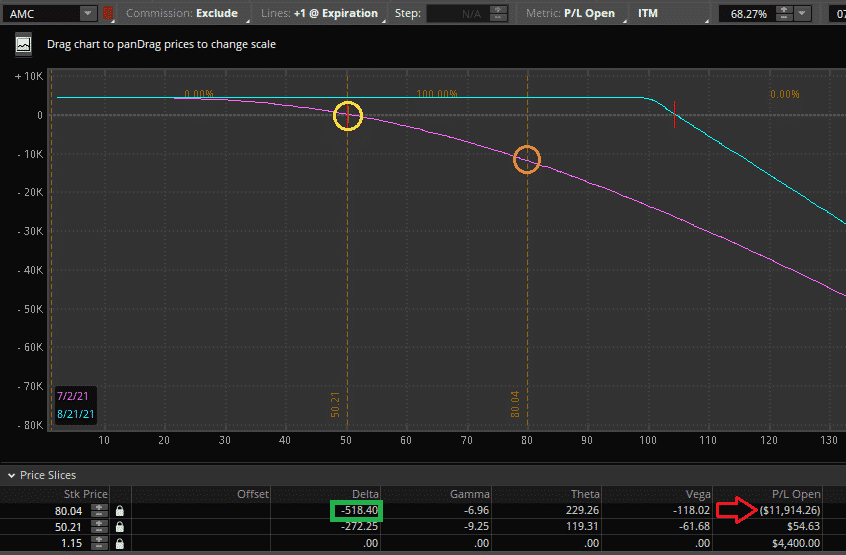

For this example, I will take the most volatile stock at the moment, AMC, and we are going to sell some naked calls.

Juicy premiums, yes, lots of Vanna, yes sir.

Below we have AMC trading at its current price of $50 at the yellow circle.

Fast forward tomorrow, and AMC has jumped.

It is now trading at $80.

Here we can see the P&L loss on the purple line. For a move to $80, we have lost over $11,900 on a ten lot.

Yikes! We are losing money on delta.

We can also see the purple line steepening; this is our Gamma working against us.

Yet this is not all.

What will happen to AMC stock tomorrow if it jumps to $80?

If you said volatility would increase, you are correct.

Let’s say it increases 50%, which is most likely far less than it actually would.

Here are the results:

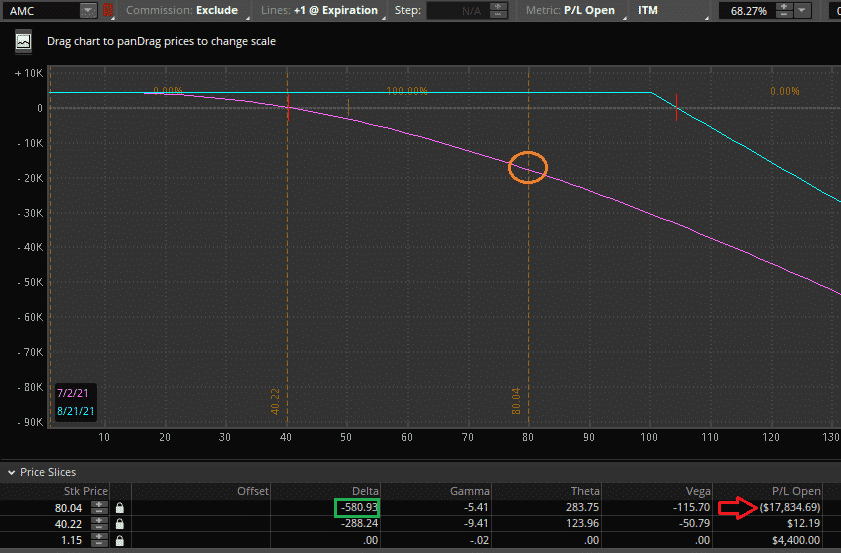

Now we have lost over $17,800.

A lot of these losses will come from our short vega.

Have a look at the green box. In the initial example, we have -518 negative deltas.

We have increased volatility (with no change in price from above), and now we have -580 deltas. Vanna is taking its toll, and not in a good way.

Imagine walking down a dark alley and encountering a band of football hooligans.

Looks like you are wearing the wrong jersey.

The biggest of the bunch punches you in the gut, causing you to cripple to the ground.

This is delta.

As you crumble to your knees, the next one comes in and starts hitting you with repeated kicks.

This is Gamma.

Now one comes in for a couple of customary curb stomps. This is vega.

At this point, you are on the ground, bleeding, gasping for air.

You are starting to rely solely on hope. “I hope they go away” Or in the case of a portfolio, “I hope the position comes back, I have no margin left, and my losses are huge. This can’t keep happening”.

Right at this point, Vanna steps in for the coup de grace.

It is not that Vanna is a vital Greek or that it usually affects your portfolio very much.

It is that when it does, it often makes its mark at the worst possible moment.

How To Manage Vanna In My Portfolio

The easiest way to avoid Vanna is to avoid selling option wings naked.

Contrastingly one does not have to be short Vanna at all and can buy the OTM wings and potentially have Vanna work for them.

This can result in colossal lottery type winners.

There is an issue with this, though.

Nobody wants to sell the wings.

Market makers want to buy them, punters like to gamble on them, and there is not enough premium for many volatility sellers to be excited about them.

Hence, they are often extremely overpriced.

Once in a blue moon, you may get a huge payoff, but over the long term, the portfolio will most likely dribble out by buying these Vanna rich options.

So what is the solution?

It’s not to change your trading drastically, be mindful of what will happen in hypothetical scenarios.

By stressing your position, you can see what effect Vanna will have and allow you to see if you are comfortable with that risk.

Just as above in the AMC position.

It doesn’t mean never sell wings but be aware of the risk. If it is too large, size down if needed or moved to a risk-defined structure like an Iron Condor.

Alternatively, if the position moves against you, take the loss and move on before your risk becomes too high. It is that simple.

Concluding Remarks

Vanna and other second-order Greeks may seem daunting at first.

Yet Vanna is simply the change in an options delta for any change in implied volatility.

Vanna is not much of a concern for the average retail investor who places small or risk-defined trades.

Trading off of it may avoid the real value of the trade and discount the greater importance of the first-level Greeks.

Despite this, for investors selling OTM options with size, being mindful of the effects of Vanna are important.

This can mean sizing down or choosing risk-defined structures that mitigate Vanna risk.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.