A delta neutral option strategy is essentially a volatility trade.

In a short volatility example, traders want to maximize their time decay whilst simultaneously delta hedging to keep their directional exposure in check.

By doing this, theta and vega become the big drivers in the position rather than delta.

On of my favorite delta neutral strategies is the short straddle.

But first let’s recap what being delta neutral actual means.

Contents

- What Does Delta Neutral Mean?

- Delta Neutral Short Straddle

- Example – PM Short Straddle With Delta Heding

- Conclusion

What Does Delta Neutral Mean?

Delta is the most important greek for traders to understand.

It reflects an option’s sensitivity to changes in the underlying stock price.

Delta measures the expected price change of the option given a $1 change in the underlying.

Call options have a delta between 0 and 1.

Put options have a delta between 0 and -1.

So, if we buy a call option with a delta of 0.25, we have a delta of 25 (0.25 x 100 shares).

This is an equivalent exposure to owning 25 shares of the underlying stock.

Put option have negative delta, so if we buy a -0.25 delta put, our delta is -25.

This is equivalent to being short 25 shares of the stock.

Let’s say that instead of buying that -0.25 delta put, we sell it. Now we have positive delta of 25 (-0.25 x -1 x 100).

If we wanted the position to be delta neutral, we would need to sell 25 shares of the underlying stock.

Or, trade other options that gave us negative 25 delta.

So being delta neutral simply means having a net zero delta for our net position.

Let’s look at an example:

Delta Neutral Short Straddle

A short straddle is an advanced options strategy used when a trader is seeking to profit from an underlying stock trading in a narrow range.

It involves selling an at-the-money call and an at-the-money put.

These typically start delta neutral, or close too it.

As the underlying stock moves, the position starts to pick up either positive or negative delta.

If the stock rallies, the short straddle will show negative delta (i.e. the trader wants the stock to fall back into the straddle zone).

Conversely, if the stock falls, the short straddle will show positive delta (the trader wants the stock to rise back up).

Using stock buys and sells to hedge the delta allows us to focus on the two most important greeks in the trade – vega and theta.

There are two choices on how to delta hedge:

- When a certain delta level has been reached

- After a certain period of time has passed.

Typically, I tend to prefer to hedge my delta neutral option strategies via method 1.

However, in this example I chose to delta hedge once per week and I’ll walk you through the exact trades shortly.

I’ve mentioned here on the blog in the past that I like to search for really beaten down stocks in order to either a) find some value for a long-term play or b) take advantage of the high implied volatility.

One such trade that jumped out recently was on PM.

Example – PM Short Straddle With Delta Hedging

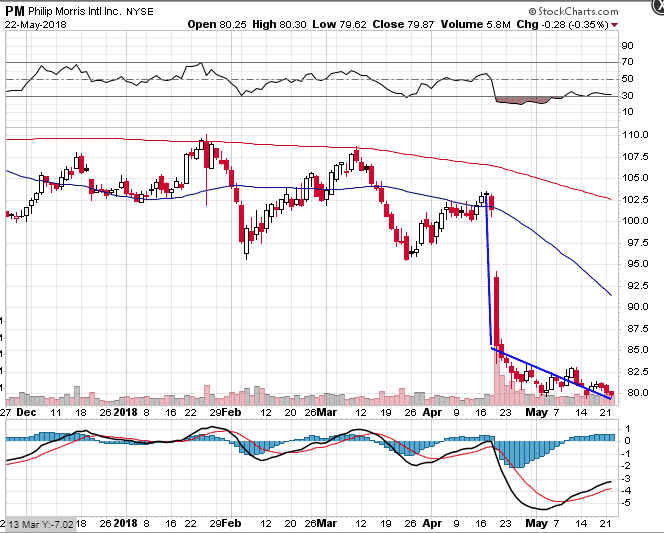

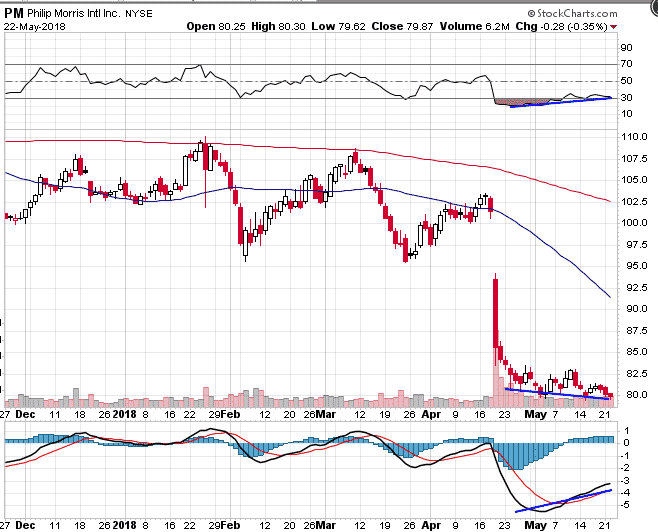

In late April, the company had a disastrous earnings announcement and dropped around 15% on the day.

These sorts of drops provide massive opportunities for option traders. You can see the drop in the chart below.

I’ve seen this pattern so many times in the last few years – a huge drop and then sideways to slightly lower over the next few weeks.

This pattern worked well for me last year with this ratio spread trade on TGT.

Tobacco is a dying industry and not one that I want to invest in, so I decided to try a pure volatility play by entering a delta neutral short straddle with weekly delta hedging.

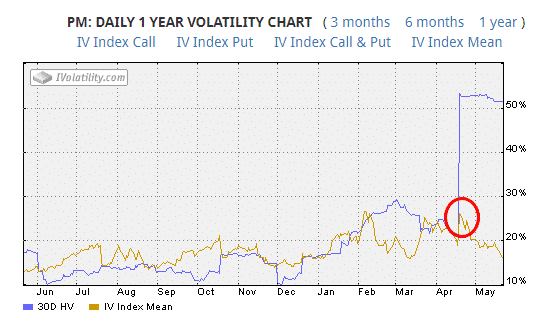

Below you can see the spike in implied volatility after the drop to the highest level in 12 months. That’s a great time to get short vol.

I decided to do a short straddle, but also to hedge out the delta as the stock moved.

I would neutralize the delta every week on Wednesday rather than at a pre-defined level of delta.

Trade Details:

Trade Date: April 25th, 2018

Sell 2 June 15th, 2018 82.50 Put @ $2.96. IV = 22.22%

Sell 2 June 15th, 2018 82.50 Call @ $2.55. IV = 22.22%

Net Credit: $ 1,102

With the straddle placed just above the stock price, this left me with slight positive delta, so I needed to sell a few shares to start perfectly delta neutral.

Sell 6 shares of PM @ $81.81

Cost: –$490.86

Margin: $4,700

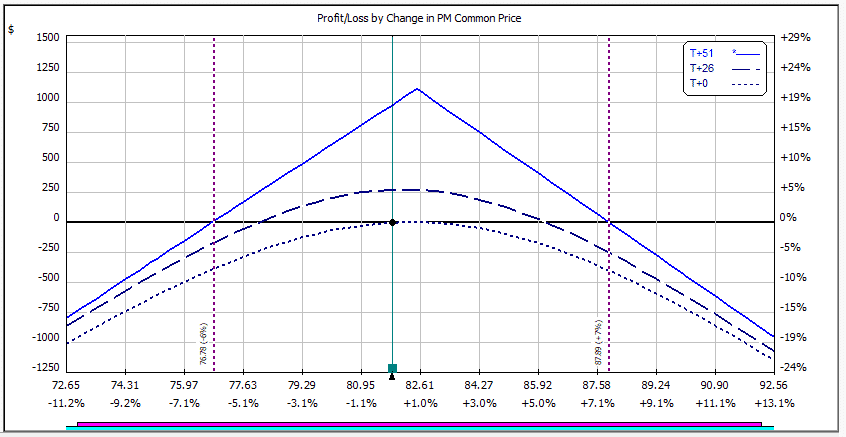

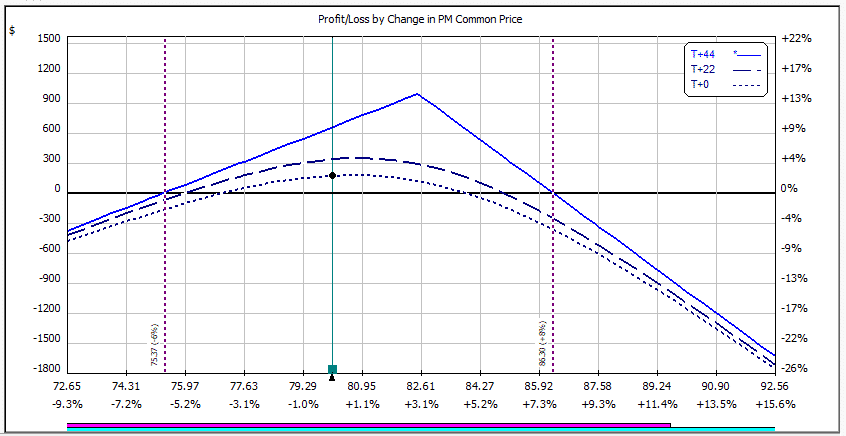

Here’s what the payoff diagram looked like. At trade initiation, you can’t tell much difference between this delta hedged trade and a regular short straddle.

If we move forward a week to May 3rd, we can see the trade has performed well so far and is up around $175.

Implied volatility has dropped from 22% to 19% so that has really benefited this trade (it’s a short vol trade after all).

Also, we were short 6 shares and PM shares have dropped from $81.81 to $80.10.

At this point we have positive delta because we want the stock to rally back up to the middle of the straddle.

So, we need to sell some shares to hedge our delta.

With a current position delta of +55, we sell another 55 shares at $80.10 which gives us a net share position of -61.

BEFORE DELTA HEDGING

AFTER DELTA HEDGING

One important thing to notice here is that we have extended our profit zone on the downside and also reduced the rate at which the trade will lose money if PM continued to drop.

Our previous breakeven was $76.79 and our new breakeven is $75.37, not a huge difference, but it still helps.

More importantly, let’s say PM dropped hard to $72.65 the unhedged trade would lose over $800 whereas the hedged trade would only lose about $400.

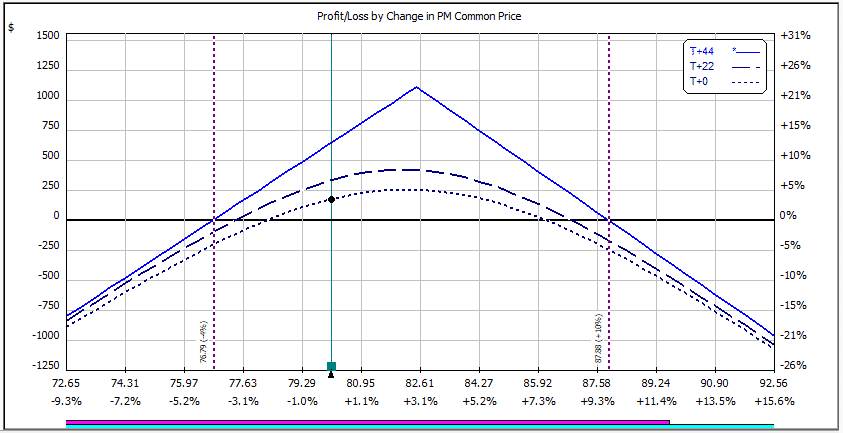

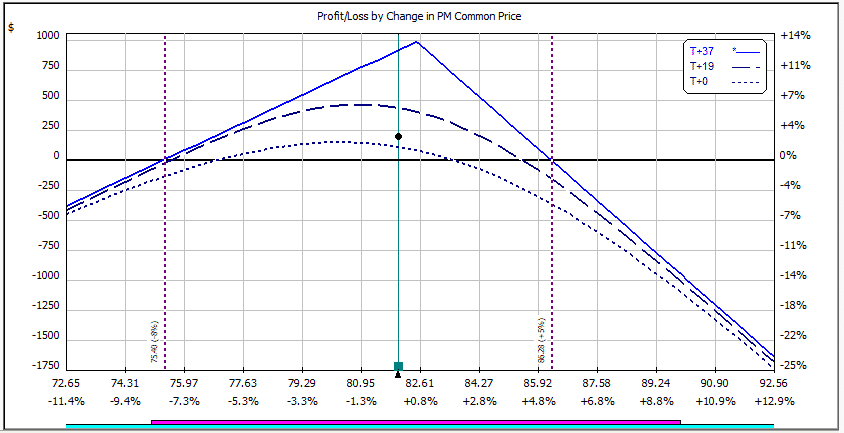

By May 10th, PM had rallied back to $81.99 and the trade was +$195 (in this case we actually would have been $100 better off if we had not delta hedged, but that wasn’t the goal of the trade).

By rallying back towards the centre of the straddle, the trade now had negative delta because of the short 61 shares.

With a position delta of -53, we buy 53 shares at $81.99. Our new share position is -8.

BEFORE DELTA HEDING

AFTER DELTA HEDGING

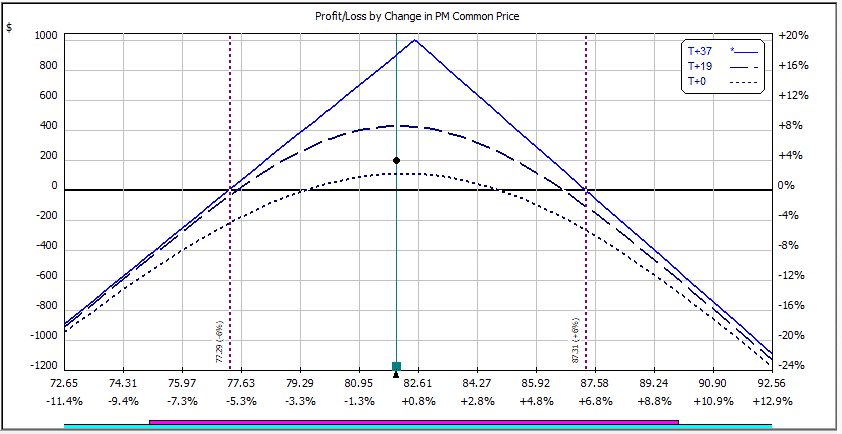

Now we go forward another week to May 17th and PM has dropped again to $80.89 and the trade is +290.

Implied volatility has dropped further to 18% and time decay is really kicking in as the options get closer to expiry.

We’ve made about $400 from the short straddle, but because the stock has bounced down, up, then back down again, we have lost about $100 from delta hedging.

We certainly would have been better off without the delta hedge, but as I said earlier, that wasn’t the goal for the trade.

My concern was that the stock was so weak it could suffer a continued decline.

If that had happened, we would have done much better by delta hedging.

At this point, the position had a delta of +45, so to delta hedge we would sell 45 shares at $80.89.

However, I decided to take a bit of a gamble and leave the position with positive delta.

As you can see on the chart, the stock had been completely beaten down and was starting to show some divergence on the charts.

So far that has been the wrong decision with the stock dropping further to $79.87. C’est la vie!

As of the close of business on May 22nd, the trade was +$311 and had delta of +94.

From here, I could leave the trade as is, or get back to delta neutral, or I could just hedge some of the delta.

Conclusion

There are many delta neutral option strategies and the idea presented here is just one example.

In this case we placed a short straddle trade, and in order to reduce our price risk, we decided to delta hedge each week.

While the trade did work out, it would have been more profitable without the delta hedge.

Trade Safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.