The Disney Pre-Earnings Straddle trade has been a good one in recent times.

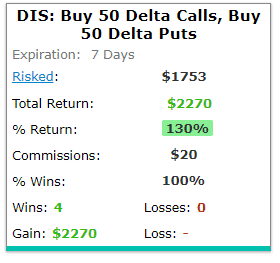

Over the last year, this trade has had a 4 out of 4 success rate.

I found this idea via CMLViz with the thesis for the trade being that you buy an at-the-money straddle 7 days out from earnings and then sell it 1 day before earnings. We don’t want to take the trade through earnings and suffer the huge volatility crush. But we’re hoping for some movement in the stock and a rise in volatility in the lead up to earnings.

Here’s how the trade played out in this case:

Trade Date: May 1st 2018

Buy 5 May 11th, 2018 100 Put @ $2.01. IV = 30.90%

Buy 5 May 11th, 2018 100 Call @ $2.04. IV = 30.50%

Net Debit: $2,050

Capital at Risk: $2,050

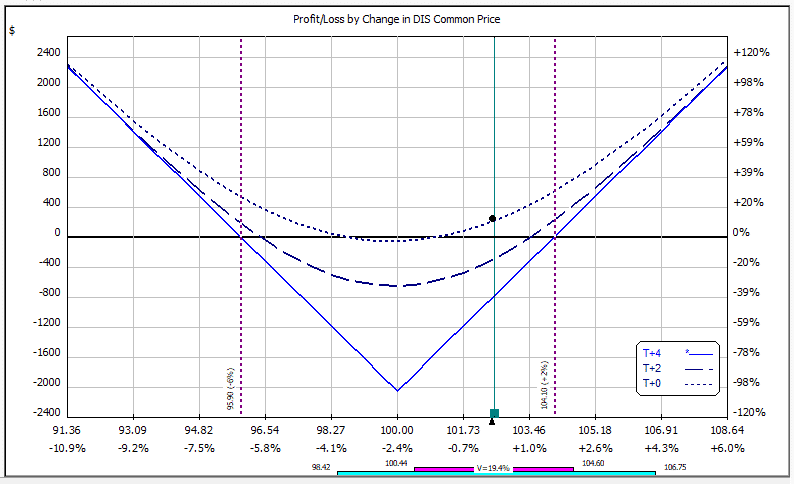

Here’s how the trade looked to start:

The first preference is for the stock to make a big move in either direction. But, it can also make money if the stock stays flat, but volatility increases.

Volatility tends to increase into and earnings announcement because of the huge level of uncertainty and this type of trade is a staple for professional option traders.

In this case, when we close the trade out on May 7th, DIS has risen to $102.48 and we sell the straddle before the earnings date:

Trade Date: May 7th 2018

Sell 5 May 11th, 2018 100 Put @ $1.07. IV = 49.30%

Sell 5 May 11th, 2018 100 Call @ $3.53. IV = 48.30%

Net Debit: $2,300

It’s important to point out a couple of things, firstly implied volatility has risen from 30% to 48% which is great because this is a long vega trade.

Secondly, the puts have gone up in value and the puts have held their value pretty well because traders are still willing to pay for protection through the earnings announcement.

The net profit on the trade was $250 less commissions or around 12% on capital at risk. Not bad for a 6 day trade!

You can see below that over the past 12 months this trade has worked very well.

You can read more about the basic idea behind the trade here.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.