Deciding when to sell covered calls will depend on your view of future stock performance. Covered calls will perform well in flat, slightly rising and slightly falling markets. They can significantly underperform during strong bull markets. During large bear markets, covered calls will experience negative returns, but those returns will be less negative than outright stock ownership.

View previous covered call lessons on covered calls 101, compounding, volatility, open interest, selecting covered call strikes and setting up a covered call portfolio.

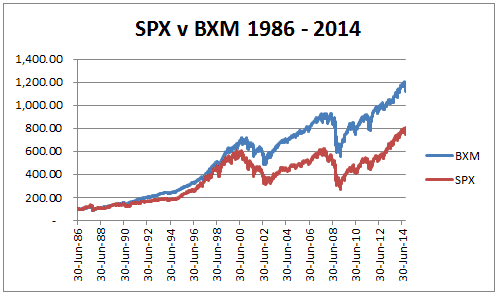

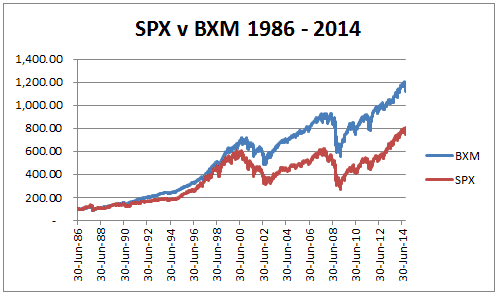

Based on the data provided by the CBOE, we can see that BXM (CBOE S&P 500 BuyWrite Index) has significantly outperformed the S&P 500 over the tracking period of 1986 to 2014. If we convert both indexes to a starting point of 100 on Jun 30th, 1986 BXM has risen to 1,160.02 for a return of 1,060.02%. the S&P 500 on the other hand has risen to 804.52 for a gain of 704.52%.

The methodology for calculating the BXM index is shown below and if you want to learn more about it, you can download this pdf.

Clearly over a long term horizon, a strategy of selling covered calls has outperformed pure stock ownership.

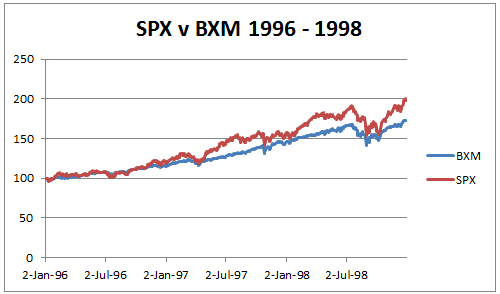

Given our knowledge that covered calls outperform stocks in all markets except sharply rising markets, let’s take a look at a period when stocks went on an epic rally. From January 1, 1996 to December 31, 1998, the S&P 500 returned almost 100%. In comparison, BXM returned only 73%.

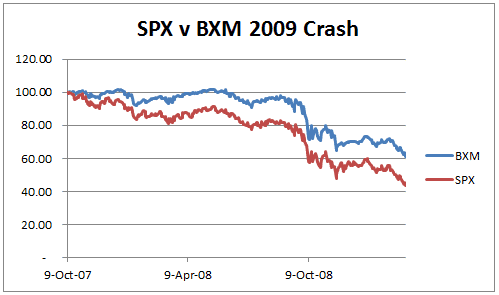

As you can see, in rapidly rising markets, a covered call strategy will underperform. What about when stock crash? Let’s look at the recent bear market in 2008-2009 and compare the performance.

From the high on October 9th, 2007 to the low on March 5th, 2009 the S&P 500 dropped 56%. In comparison BXM only dropped 39%. So while the performance of a covered call strategy lost money, the losses were significantly less than outright stock ownership.

Taking this information in to account, we can ask the question when is the best time to sell covered calls? That partly depends on your investment timeframe, but taking the overall data from 1986, we can recognize that the best time to sell covered calls is any time, provided you do it consistently and over a long term horizon.

If your time frame for investing is much shorter, the best time to sell covered calls is when you expect stocks to be flat to slightly higher.