A key aspect of covered call trading is deciding which strike price to select. Some investors may default to the at-the-money options, while others may choose strikes that are slightly out-of-the-money. In this lesson we will take a detailed look at a few different approaches for choosing which strike price to choose for your covered calls.

View previous covered call lessons on covered calls 101, compounding, volatility and open interest.

Selling OTM Calls

Most investors will default to choosing a slightly out-of-the-money call option for their covered calls. This strategy has the advantage that you are less likely to have your shares called away and you also have the potential to participate in some of the capital gain should the stock rally. The drawback of this method is that the premium received for selling the out-of-the-money call is lower which reduces the income portion of the trade and also provides less downside protection.

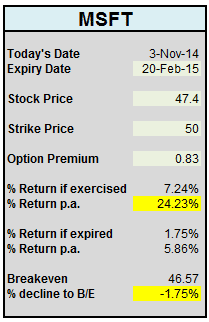

This is best explained using an example. On November 3rd, 2014, MSFT was trading at $47.40. The Feb 20th, 2015 $50 calls were trading at $0.83. If MSFT rises above $50 and the shares are called away, the investor received a healthy capital gain of $2.60 in addition to the option premium of $0.83. This equates to around +24.23% per annum, a very nice return indeed.

However, the low option premium of $0.83 provides very little downside protection. In fact, the trade will start to suffer losses once MSFT falls below $46.57 which is only a decline of -1.75%.

There is nothing wrong with selling out-of-the-money options as part of a covered call strategy, particularly if the investor is very bullish, however it may not be the right choice for everyone.

Selling ITM Calls

Many investors who are new to covered calls may not have ever considered selling a call option below the stock price.

“Why would I sell the stock for less than I bought it for”

While it may seem counterintuitive at first, selling in-the-money-calls is actually a valid and conservative strategy. Selling a strike price that is below your stock purchase price is generally not a problem, as the option premium received from selling the call increases your net sales price.

Using a simple example, if XYZ stock is trading at $40.00, you might sell a $39 call options for $2.50. If the stock gets called away, you net sales price is $41.50 which is greater than the $40 you paid for the stock. This results in a net gain of +3.75%.

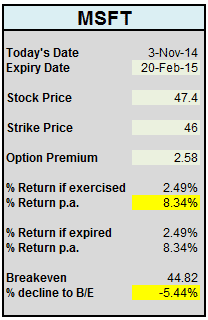

Using MSFT as our example again, let’s see how this strategy would work in the real world. Here you can see that we are receiving $2.58 for selling a Feb $46 call. If the stock gets called away, our net sales price would be $48.58 for a gain of +2.49% or 8.34% on an annualized basis.

The beauty of this trade lies in the increased downside protection that you have in exchange for giving up any capital appreciation.

You would consider selling an in-the-money option when you are less bullish on a stock and would prefer to focus on the income potential in the trade.

Selling ATM Calls

At-the-money options have the most time premium of any option strike. It’s for this reason that many covered call sellers are attracted to selling at-the-money calls.

Similar to in-the-money calls, you give up any potential capital gains, and your downside protection is also less than selling in-the-money calls. As you would expect, the risk / return data falls somewhere in the middle of the two strategies and may be the most appropriate for some investors.

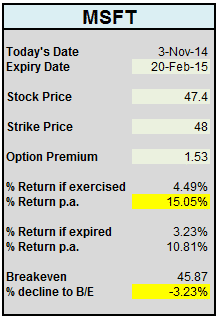

With MSFT trading at $47.40, there is no perfectly at-the-money option, but for this example we will take the $48 call.

You can see that the potential annualized return if the shares are called away is +15.05% which is right in the middle of the range we have looked at so far. The decrease to breakeven is also smack bang in the middle at -3.23%.

Probability Of Exercise

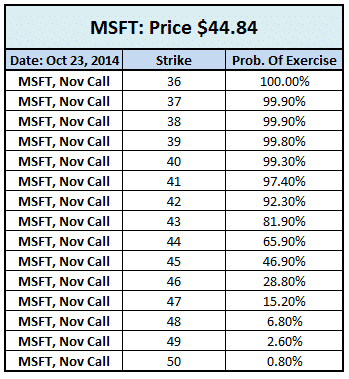

Another method you can use for deciding which covered call strike to sell is by looking at the probability of exercise. While financial markets are not an exact science, it is possible to gain an estimate of how likely an option is to be exercised based on statistical models. Most brokers will provide this data.

If you want to hold on to your shares to avoid capital gains tax and continue to collect dividends, then selling calls with a lower probability of being exercised makes sense.

Looking at the table of MSFT call options below, you can see that the in-the-money calls have a high probability of being exercised, while the out-of-the-money calls have a much lower probability.

If you’re a long-term income investor and you don’t want to sell your stocks, looking at the probability of exercise can help you decide which strike price to sell.

2% OTM The Sweet Spot?

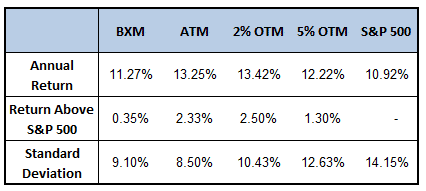

In 2006, Goldman Sachs completed a study of the covered call strategy. Their study found that the strategy of writing covered calls on the S&P 500, when compared to simply buying and holding the S&P 500, increased returns and lowered portfolio volatility. The results of the study are shown below:

Goldman compared the return of the S&P500 with that of BXM (CBOE S&P 500 Buy Write Index) as well as three of their own Buy Write strategies.

You can see that a strategy of selling 2% out-of-the-money calls yielded the highest return and the volatility (as measured by standard deviation) was lower for all covered call strategies.

Technical Analysis

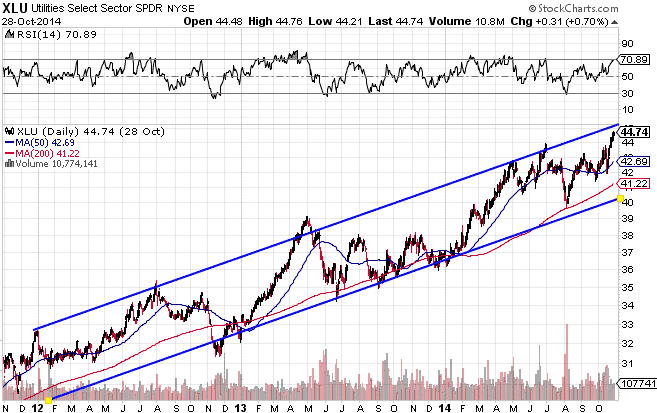

Using technical analysis is another valid method for selecting your covered calls strikes. While I won’t go into a detailed discussion about technical analysis here, if you’re indicators are telling you that the stock is bullish, it would be wise to choose further out-of-the-money strikes. Conversely if your indicators are telling you to be cautious, a more conservative covered call strategy would be appropriate.

Some technical patterns you might look at when determining your strikes could include:

- Moving averages

- Fibonacci levels

- Support and resistance

- Trend lines and channels

To give one example, XLU has traded in a clearly defined trend channel for the past few years and at the beginning of November, 2014 it was trading near the top of the channel. This would be a time to be a little more conservative with your strike selection as any gains in the short-term are likely to be relatively muted.

Gavin,

In your second example with MSFT at 47.4, a strike of 48 and premium of 2.58; if expired the return should be 2.58/47.4=5.44%.

Bob

Hi Bob, the strike price in the second example if actually $46 not $48. As it’s in-the-money you are giving up some of the capital gain, so I believe the return is correct.

Hi Gav

For me this was a timely topic. I’m in the process of acquiring a company who’s stock I want to own through selling puts. Not only will I acquire it but at a discount(eventually). OnceI acquired I plan on selling covered calls.

The 2% OTM seems a little small to me especially when dealing with higher Beta stocks, but Goldman was only looking at S&P 500 stocks.

I prefer a mix of tech analysis, especially support and resistance as well as the use of delta’s and IV to arrive at Standard deviation figures. The company I’ve targeted also pays a handsome dividend, which further reduces my cost to own.,

Hi Don,

Excellent comment. I actually have a post coming out this weekend that discusses how to create a covered call portfolio and discusses the inclusion of some higher beta stocks to increase the return.

Using technical analysis is also a solid method of choosing where to place your short calls.

G.

If we are selling call for 1 month expiry then what ATR we should use daily or monthly? Pl suggest

Daily