What a few weeks it has been in the stock market! Hooley Dooley.

Just when it looked like market we’re going to fall off a cliff, stocks rebounded and now we are back at all-time highs in the space of 12 trading days! Truly amazing.

Most of the easy money from this rally has probably been made at this point and stocks will only have another 3-4% potential upside over the next few weeks.

Rather than going long stocks here it may be worth looking at a pairs trade given the wide divergence is some of the major sectors.

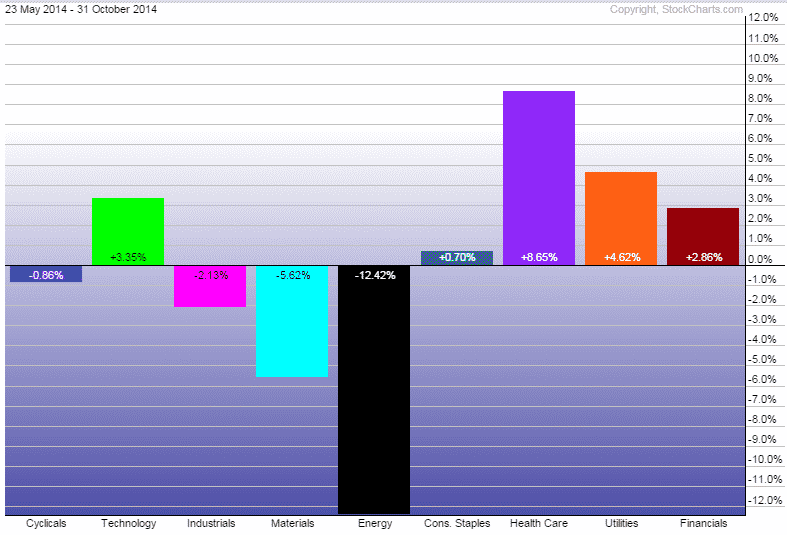

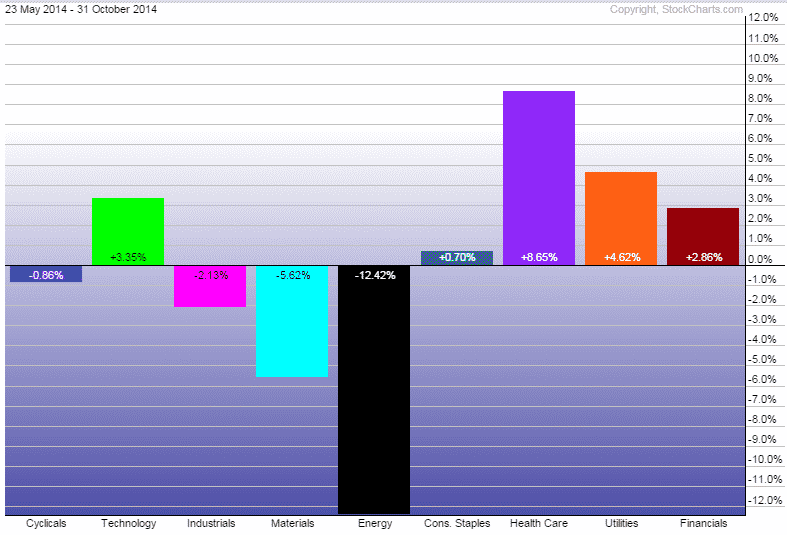

Over the past 5 months healthcare is up 8.65% and utilities are up 4.62%.

The defensive sectors have been crushing it, but energy has been smoked. The energy sector is down 12.42% over the same time period.

If true stock market is indeed going to continue pumping out new highs as some people expect, it could be worth a punt on a mean reversion trade by getting long energy and short healthcare or one of the other defensive sectors.

You could do this via going long XLE and short XLV. Or you could play it via options.

Given the huge run up in the market, and the defensive names in particular, perhaps the upside in XLV is limited. On the other hand, energy has been the downtrodden sector this year and could be due to catch up to the rest of the market.

Using options can help you take advantage of that opinion while also giving you a small margin for error on each trade.

The risk is that if this years sector performance continues, you could end up with losses on both sides of the trade.