Contents

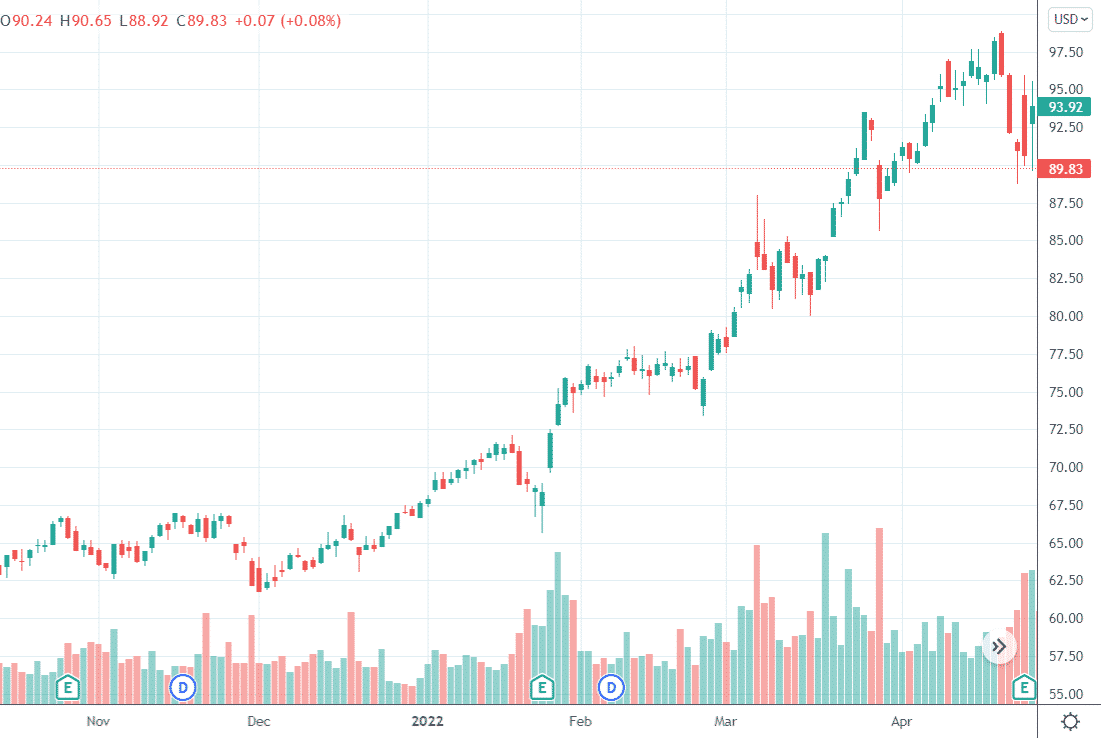

Suppose an investor is considering an iron condor on Archer-Daniels-Midland (ADM) after its earnings report, which had hardly moved the stock.

source: tradingview.com

Upon constructing a 5-point iron condor at the 15-delta on both sides, we see that the position delta of the condor is slightly negative, making the condor a bit bearish.

A glance at the price chart shows ADM to be in a general uptrend.

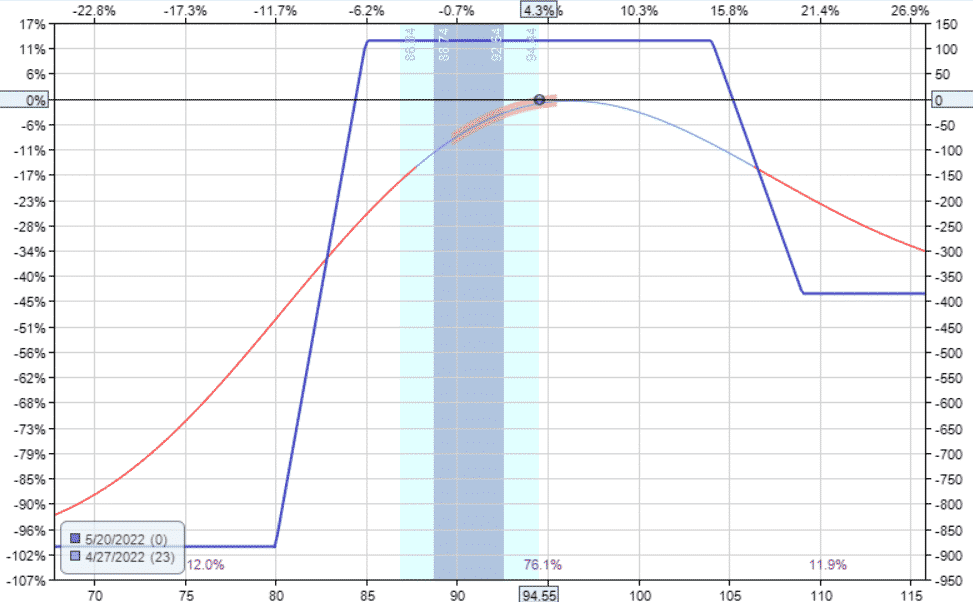

So to make the condor bullish to align with the trend, the investor sells more put spreads than call spreads, like this:

Date: April 26, 2022

Price: ADM @ $94.55

Buy two May 20 ADM $80 put @ $0.35

Sell two May 20 ADM $85 put @ $0.75

Sell one May 20 ADM $104 call @ $0.55

Buy one May 20 ADM $109 call @ $0.20

Credit: $115

Max Risk: $885

This is an unbalanced condor with two put spreads and one call spread.

The initial position delta is bullish at 5.81.

Delta: 5.81

Theta: 5.43

Vega: -7.21

Gamma: -3.83

Let’s see how this trade plays out.

Decision Point

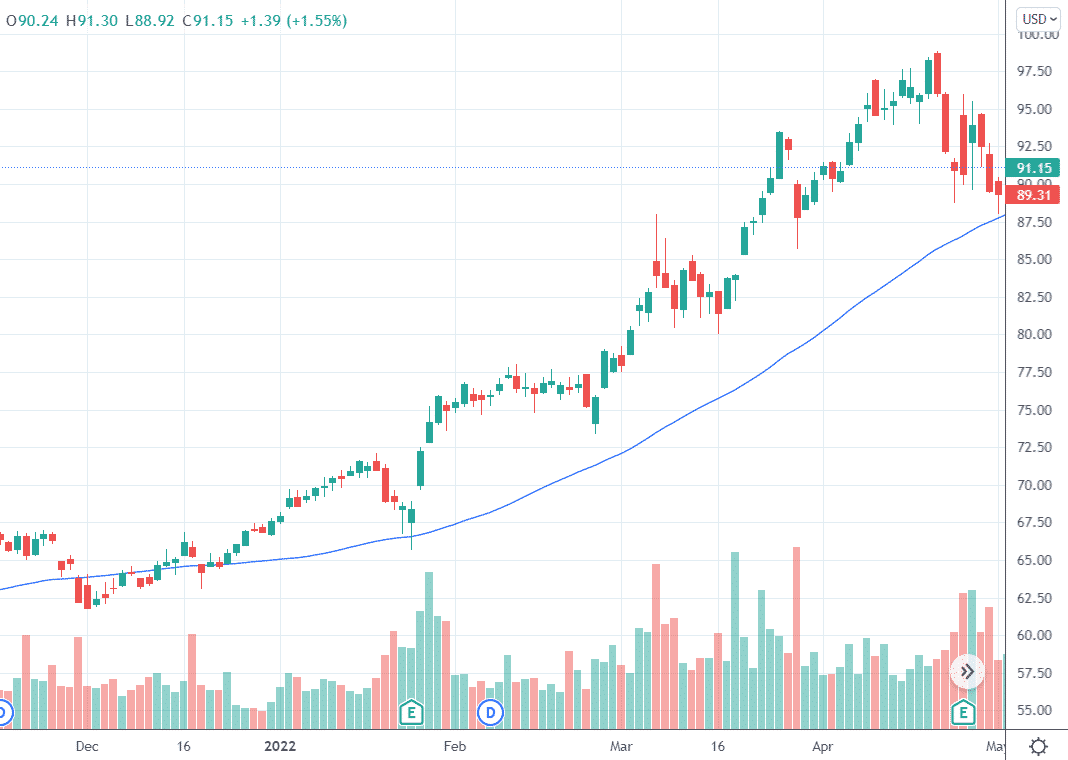

On May 2nd, ADM trades down to the 50-day moving average (but does not break through).

source: tradingview.com

The put spread is being tested, with its short strike at the 30 delta.

We typically start adjusting the tested side when the delta of its short option gets larger than 25-delta.

So it needs an adjustment.

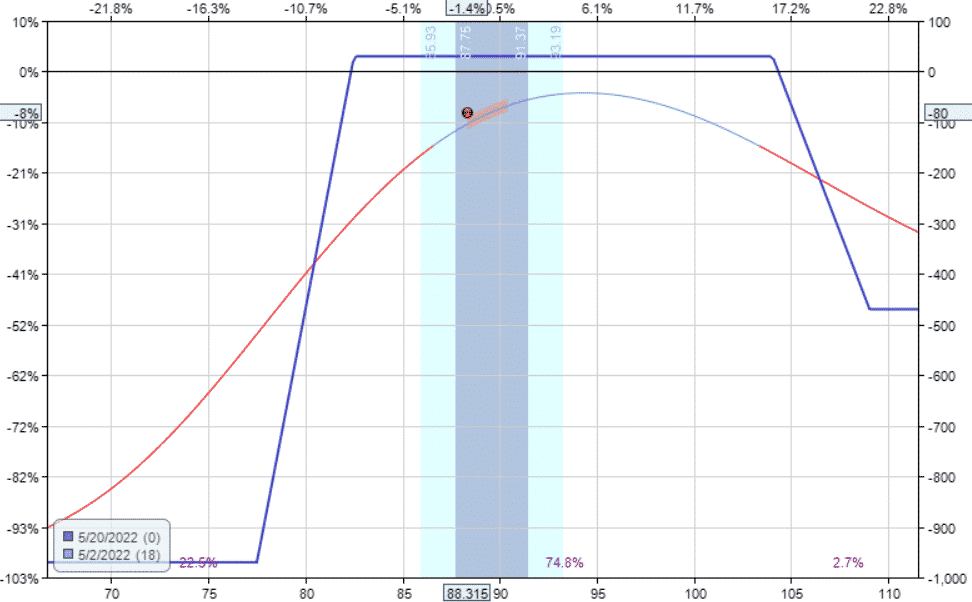

The payoff graph shows P&L to be down $80:

source: OptionNet Explorer

Let’s examine the thought process of two hypothetical traders: trader A who we will call “Adam” and trader B who we will call “Betty”.

Scenario 1

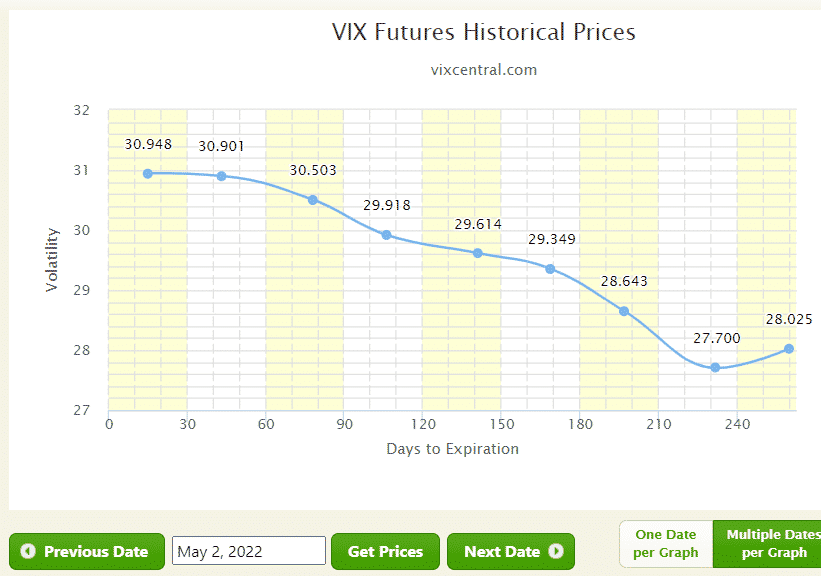

Adam is aware of a potential market-moving event of an FOMC meeting press conference in two days on May 4th.

He also checks the VIX futures term structure and sees that it is in slight backwardation, which signals potential rough market conditions:

source: vixcentral.com

The VIX index is high at 33, which indicates a bit of fear and uncertainty in the market.

Considering that large market moves are not good for condor-like positions, Adam decides to close the trade for a small loss of –$80 and reduce market exposure.

Scenario 2

Betty is more optimistic and sees the price chart of ADM as being in a pull-back of an uptrend that still has not broken below the 50-day moving average.

She, too, is aware of the FOMC meeting.

However, her thought is that after the announcement, the implied volatility would drop because uncertainty would lessen.

A lowering of implied volatility helps an iron condor position.

Nevertheless, it is at an adjustment point, which means that the trade can not just be left the way it is.

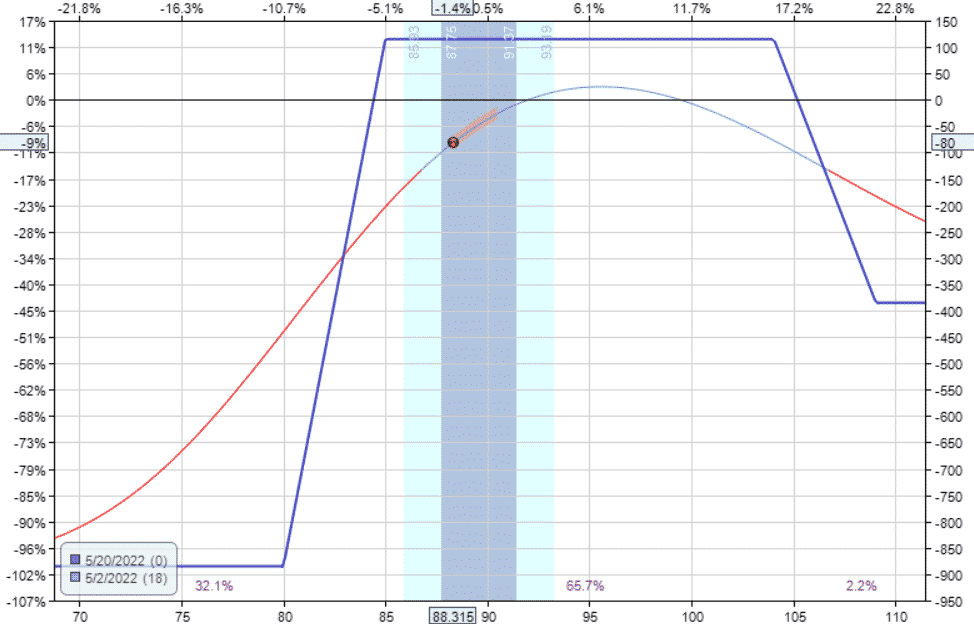

She decides to make the following adjustment by rolling the put spreads down by 2.5 points.

Date: May 2, 2022

Sell to close two May 20 ADM $80 put @ $0.73

Buy to close two May 20 ADM $85 put @ $1.83

Sell to open two May 20 ADM $82.5 put @ $1.15

Buy to open two May 20 ADM $77.5 put @ $0.48

Debit: $85

The adjustment moves the short put down to the 23-delta, which is now at an acceptable value.

The adjustment costs a total of $85.

This increases the max risk by that same amount from $885 to $970.

It also lowers the potential possible profit of the trade, as seen in the adjusted payoff graph:

The max potential profit is now only $30.

Betty used up $85 of the $115 initial credit.

Betty could not have rolled the spread lower because then the adjustment would cost more than the initial credit, bringing the entire payoff graph below zero.

She is willing to get out of the trade as soon as it gets back to breakeven and sets a good-to-cancel order to close all legs of the trade if it can be done for a debit of $30 or less.

Why $30? That is the remaining initial credit that was left after the adjustment.

How did Betty do?

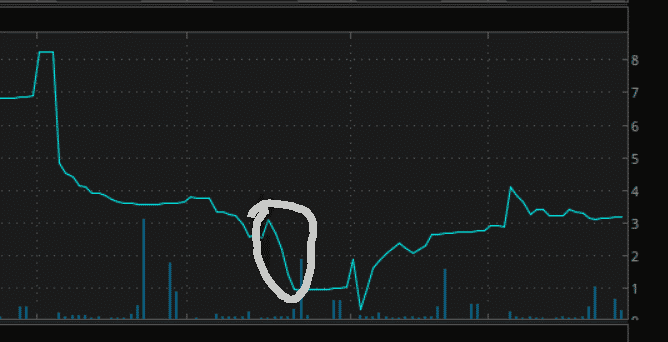

The VIX did drop right after the FOMC announcement as can be seen on this 30-minute chart.

source: tradingview.com

VIX is the volatility index for the S&P500.

But one would see similarities for most equities.

The implied volatility chart of ADM shows the same:

source: ThinkOrSwim application

Shortly after the FOMC announcement, the order to close the condor was triggered.

This is due to both the drop in implied volatility and a positive response by the market, as evidenced by an upward price movement immediately following the announcement.

Betty got out of the position at breakeven (excluding commissions, slippage, and fees).

Conclusion

Both Adam and Betty have valid points on both sides.

Trading is a multi-faceted decision-making process in the face of uncertainty.

How would you have handled this scenario?

Let us know in the comments.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Why not roll the calls down and either leave the puts alone or use some of the credit to offset rolling the puts?

Yes, that’s a valid adjustment strategy as well.