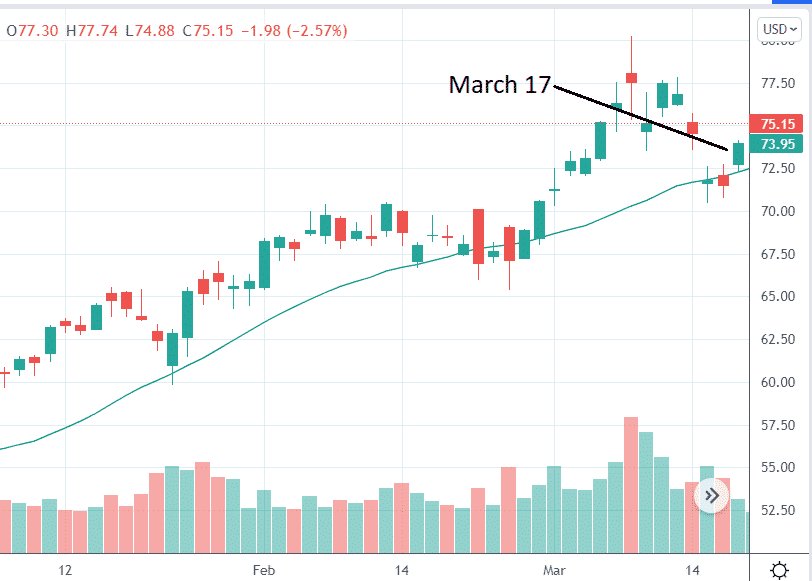

Let’s look at a diagonal option spread example on XLE, the S&P 500 energy sector ETF.

The ETF opened higher on March 17, 2022, after a pull-back to the 20-day simple moving average.

source: tradingview.com

After its two-day pause at the moving average, our thesis is that it might continue its bullish trend.

We want to construct an income trade with zero upside risk.

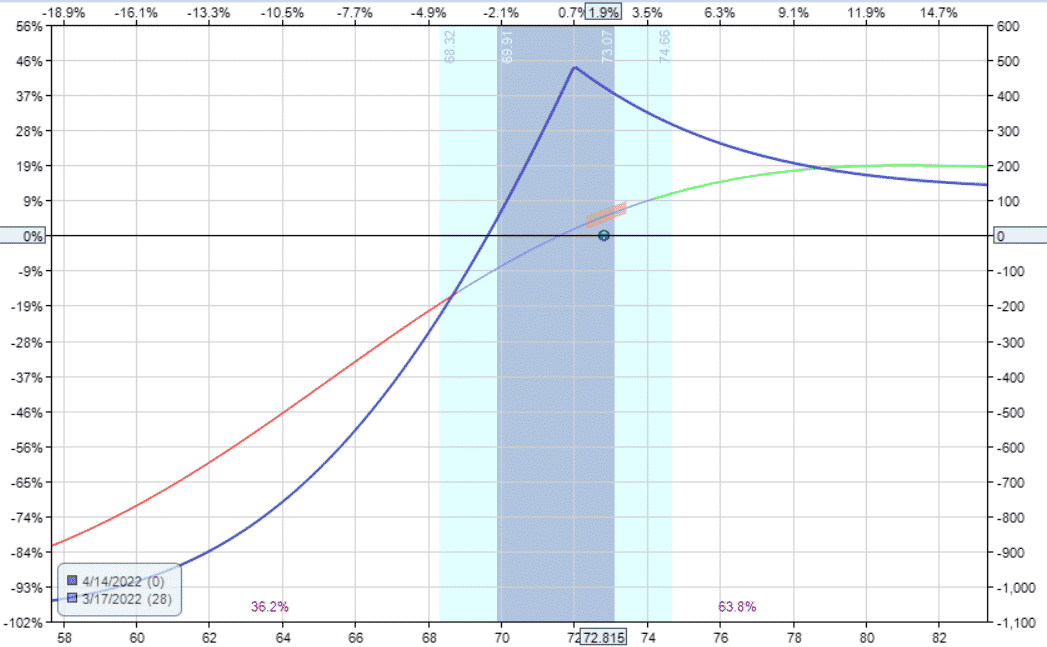

The payoff diagram looks like this.

source: OptionNet Explorer

This can be achieved by buying a deep in-the-money call around the 70-delta.

Its expiration is two months out. Then we sell a shorter-term call that is one month out at a higher strike.

We call this a diagonal option spread using calls.

Date: March 17, 2022

Price: XLE @ $72.82

Buy three May 20 XLE $68 call @ $6.58

Sell three Apr 14 XLE $72 call @ $2.99

We are using three contracts such that our max risk is about $1000.

We also check the implied volatility of the two options to see that they are reasonable.

The IV of the May 20 $68 call is 31.11.

The IV of the April 14 $72 call is 31.95.

A higher IV can be roughly thought of as “more expensive“.

It is normal for IV to be higher for options that are further out in time.

In our case, the two numbers are fairly close. So, we are not “over-paying” for the long option.

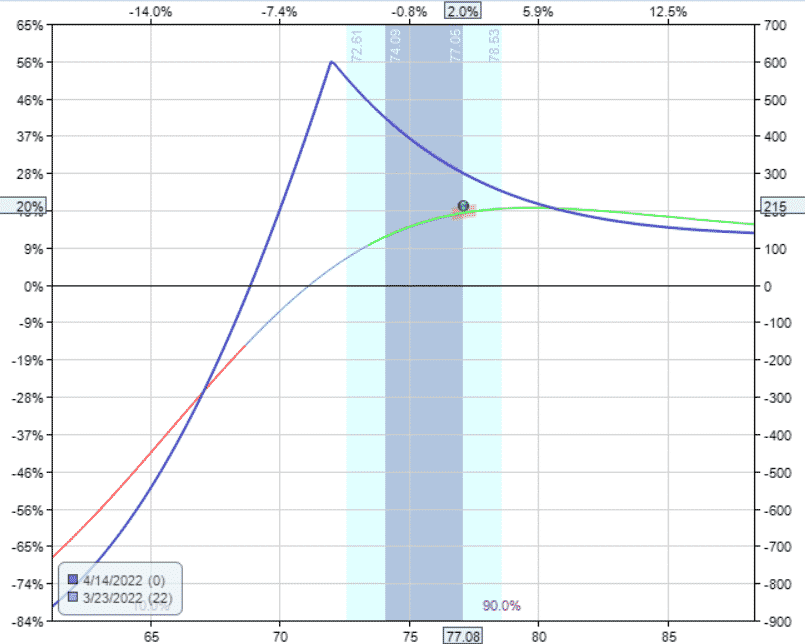

The profit target for a trade like this could be anywhere from 10% to 20% of the capital at risk.

On March 21, it reached $162 in profits, which is 15%.

On March 23. it reached $215 in profits, nearly 20%.

We hope this diagonal option spread example helps you with your trading.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.