Today, we are looking at the unbalanced butterfly.

We will discuss the trade set up and walk you through some examples.

Let’s get started.

Contents

- Introduction

- Unbalanced Butterfly Example – Post Earnings Reaction

- Net Sellers Of Extrinsic Value?

- When The Selloff Stops

- Conclusion

Introduction

The unbalanced butterfly is an options strategy that has three short legs located at the same strike.

An unbalanced butterfly strategy has positive theta which means that it benefits as time passes.

The at-the-money strike generally has the highest extrinsic value.

That means that it has the most time premium to lose as it goes to expiration.

Putting all three short legs of the unbalance butterfly near the stock price allows us to sell time premium.

Especially the stock is range-bound, and implied volatility is high.

Unbalanced Butterfly Example – Post Earnings Reaction

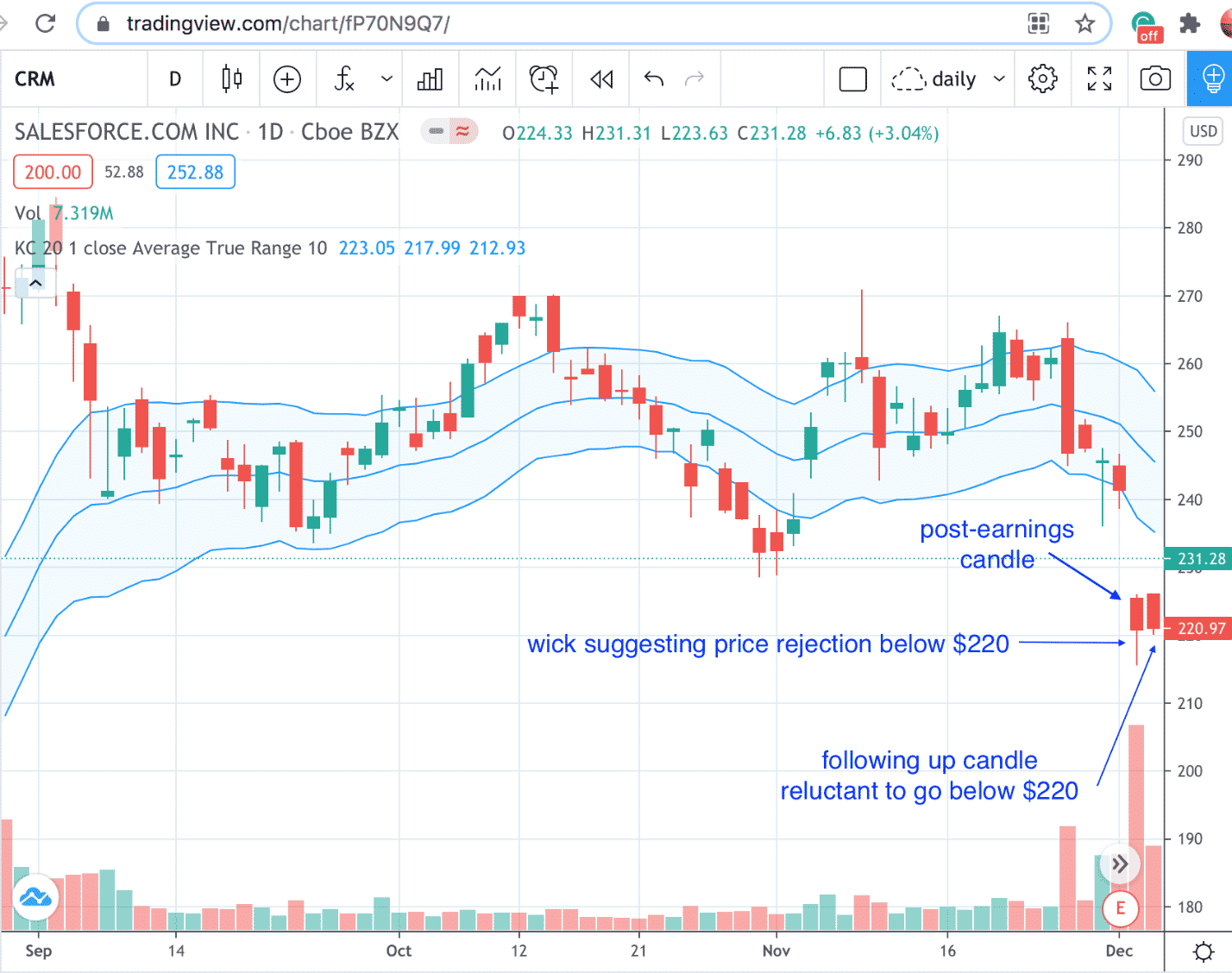

Salesforce (CRM) reported earnings after the market closed on December 1st, 2020.

The following trading day, the price gapped down outside of the Keltner Channels.

It resulted in a candle with a bottom wick, suggesting price rejection below $220.

The investor watches one more day on December 3rd.

If it continues to trade lower, the investor will assume that Salesforce stock is still on the move spurred by the earnings announcement.

It so happens that it did not trade below the previous day’s low.

The investor initiates an unbalance butterfly at the end of the market day on December 3rd.

Date: December 3rd, 2021

Price: $220.97

Buy two Jan 15 CRM $230 put @ $17.00

Sell three Jan 15 CRM $220 put @ $11.10

Buy one Jan 15 CRM $210 put @ $7.08

Debit: $777.50

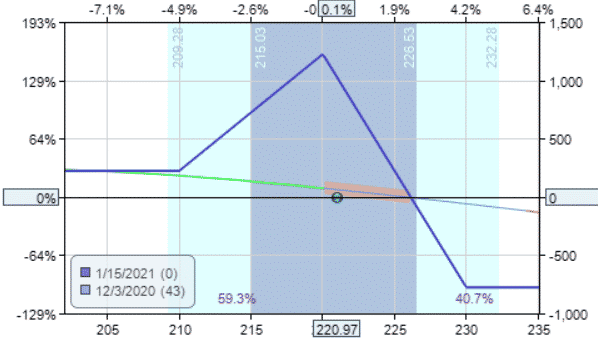

The payoff diagram looks as follows:

The trade is structured to eliminate risk on the downside.

Since the stock often continues in the direction of the earnings gap, we don’t want any risk should the price continues downward.

The max risk of $777.50 is on the upside.

Extrinsic Value

The extrinsic value of each leg is:

$210 put: $7.07

$220 put: $11.10

$230 put: $7.97

As you can see, the at-the-money strike of 220 had the highest extrinsic value.

We are sellers of that leg. And buyers of the other two legs.

Computing the net extrinsic value, we get:

$1110 x 3 + $707 x 1 + $797 x 2 = $1029

The investor plans to exit the trade if losses exceed $388.75, half of the initial debit invested.

The target profit is 10% to 15% of the initial debit.

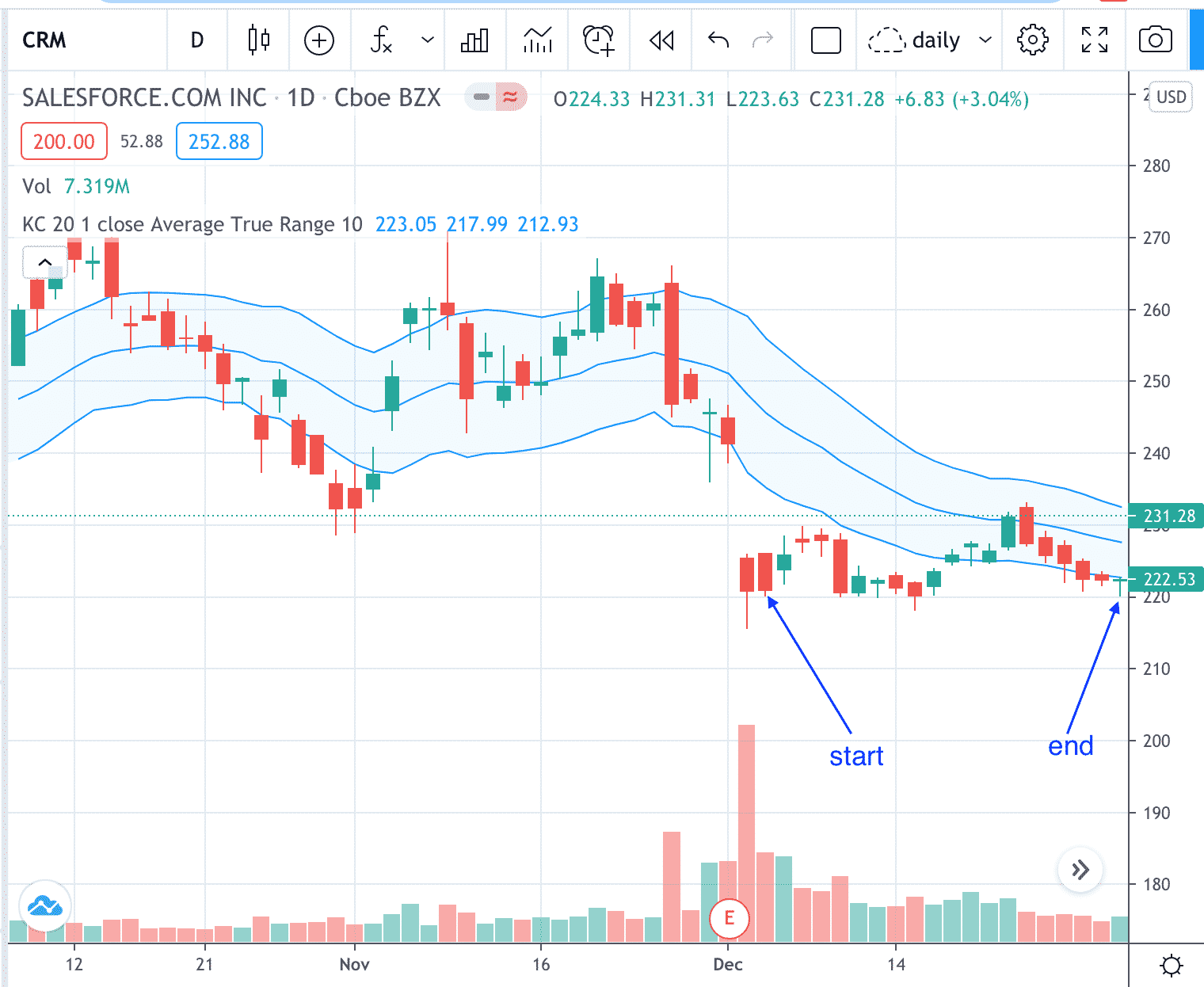

On December 31st, CRM closed at $222.53. The trade reached the profit target.

The investor exited the trade with a profit of $102.50, or 13% of the initial capital invested.

The stock cooperated nicely by trading sideways for 19 trading days and held the $220 level like a straight edge.

The extrinsic value of each leg at exit are:

$210 put: $1.58 (lost $5.49, or 78%)

$220 put: $4.32 (lost $6.78, or 61%)

$230 put: $2.63 (lost $5.34, or 67%)

On a dollar-per-share basis, the center short $220 strike lost the most extrinsic value.

We like the center $220 strike option leg to lose value because we sold that leg.

We do not want the other two legs to lose value because we are long those legs.

The investor’s net profit can be calculated as:

$678 x 3 – $549 x 1 – $534 x 2 = $417

Overall, the investor benefitted from the extrinsic value changes.

Of course, many other factors affected the pricing of the three legs, which then translates into the final P&L.

Net Sellers of Extrinsic Value

The unbalanced butterfly is similar to the broken wing butterfly and is a positive theta trade.

Positive theta means that it profits a time passes.

What is the mechanism that generates profits with time?

We are net sellers of extrinsic value.

Extrinsic value is the extra price tacked onto an option representing market participants’ perceived additional value due to time opportunity and implied volatility.

Extrinsic value decreases with time as it approaches expiration.

There is less time for opportunities to occur. As such, extrinsic value and time premium are the same thing.

As net sellers of time, we are watching time burn away with each passing day.

We sold $1029 worth of extrinsic value at the start of the trade.

To exit the trade, we had to buy back $612 of extrinsic value.

Selling high at $1029 and buying low at $612 means that we gained $417.

$612 was computed by from: $432 x 3 – $158 x 1 – $263 x 2 = $612

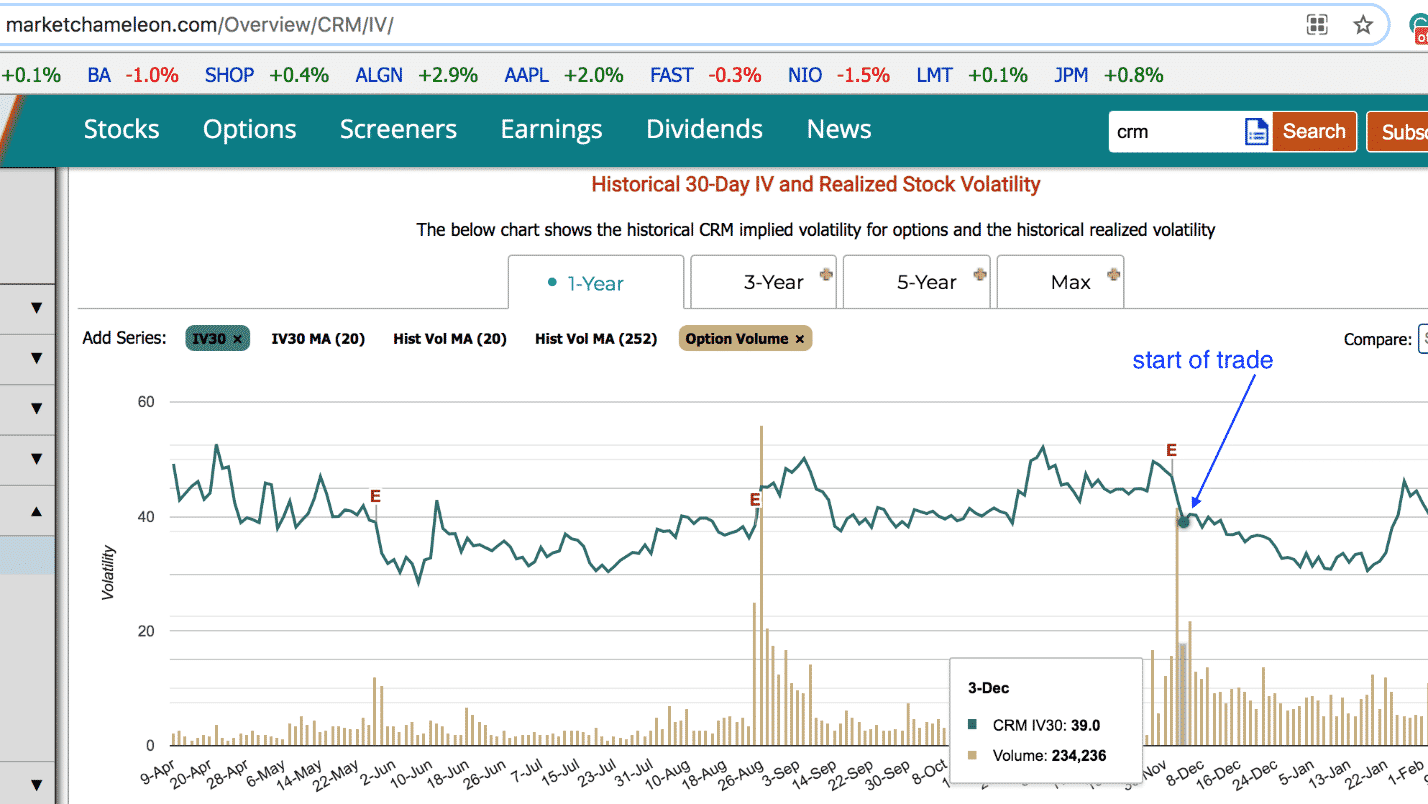

Extrinsic value also decreases if implied volatility decreases.

While it is true that implied volatility had already made a big drop post-earnings right before the trade was initiated, it does not mean that implied volatility cannot still go down further.

In fact, the implied volatility of Salesforce continued to drop many days after earnings.

When The Selloff Stops

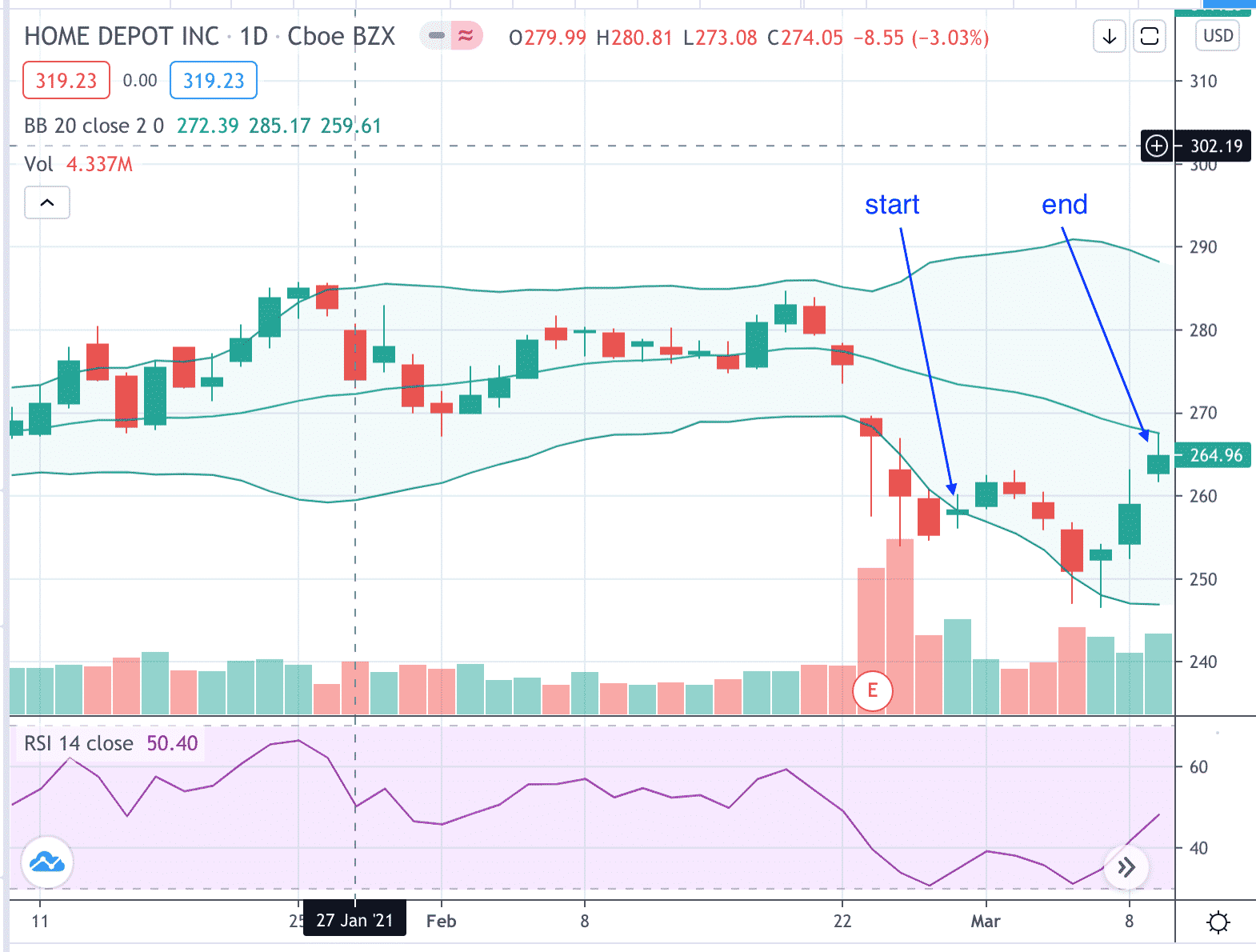

In the latter half of February 2021, Home Depot (HD) started on a steep selloff.

When the investor sees that RSI bounces up from 30 putting in a Doji candle, the investor assumes that the selloff has stopped and initiates an unbalanced butterfly taking advantage of the heightened implied volatility due to the selloff.

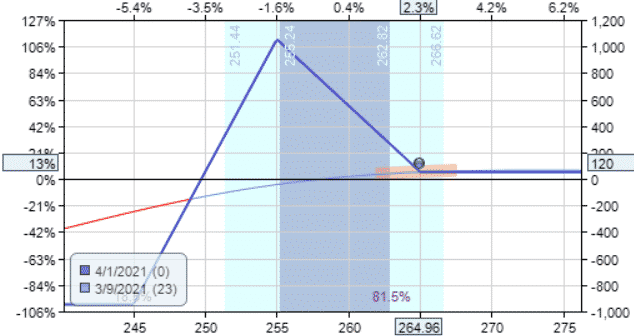

Date: Feb 26, 2021, Price: $258.34

Buy one Apr 1st HD $265 call @ $5.225

Sell three Apr 1st HD $255 call @ $10.05

Buy two Apr 1st HD $245 call @ $17.20

Debit: $947.50

The Greeks:

Delta: 12.07

Theta: 2.41

Vega: -10.23

On March 9th, the trade exited with a profit of $120, or 13% of the initial debit.

Conclusion

If you can find situations where a stock trades sideways while implied volatility drops, then the unbalanced butterfly can take advantage of theta decay.

The exciting thing about the unbalanced butterfly is that we are buying the butterfly with a debit.

Yet, we are net sellers of time value.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.