I’ve talked about iron condors a lot here at Options Trading IQ and that’s because they’re one of my favorite strategies.

But what is the best iron condor strategy? Are they all the same or are there specific things we can do to increase our success rate?

Let’s dive in and see if we can come up with some answers to these questions.

Contents

- A Quick Refresher On Iron Condors

- Parameters For The Best Iron Condor Trades

- Stock / ETF Selection

- Mechanical Decision Making Process

- Summary

A Quick Refresher On Iron Condors

Iron condors are simply a combination of a bull put spread and a bear call spread.

The trade aims to make a profit from stable stock prices and / or a drop in implied volatility.

By combining the two vertical spreads, traders can generate two lots of premium while only using the same amount of margin.

Parameters For The Best Iron Condor Trades

When it comes to iron condors the best policy is to rules and guidelines in place for how you will place the trade, when and how you’ll adjust and when you will exit (both profit taking and stop loss).

Below you will find the parameters I feel are the best for trading iron condors.

These are just my opinion of course, but keep in mind they have been gained over a 16 year trading career.

Parameters:

- Short strikes around delta 10-15

- Adjustment points:

- If short strike delta hits 25

- Stop loss at 2x premium received

- Close 7 days before expiration

- Don’t trade over earnings

- Don’t trade if VIX Futures Curve is in Backwardation

- Only stocks over $100

- Over 200 open interest in the chosen strikes

- Bid-ask spread no wider than $0.40

- Profit target 50% of premium received in less than 50% of the duration

With these rules and guidelines in place, you should have a very high success rate.

The key is to not let losing trades get out of control. I’ve seen it too many times where traders hold on too long hoping (hope is a dirty word in trading) the trade will come back their way.

Sometimes it does, but when it doesn’t the damage can be severe.

Stock / ETF Selection

As mention when I wrote about the best stocks for iron condors, there are four main criteria to look for when choosing a stock or ETF for an Iron Condor:

- High Liquidity

- Stock Price Above $100

- Large Capitalization / Good Liquidity

- High IV Rank

These are some of the best stocks for iron condors, just watch out for earnings.

AAPL

AMZN

BABA

CRM

DIS

FB

GOOGL

HD

JNJ

MA

MSFT

NFLX

NVDA

PCLN

WMT

Mechanical Decision Making Process

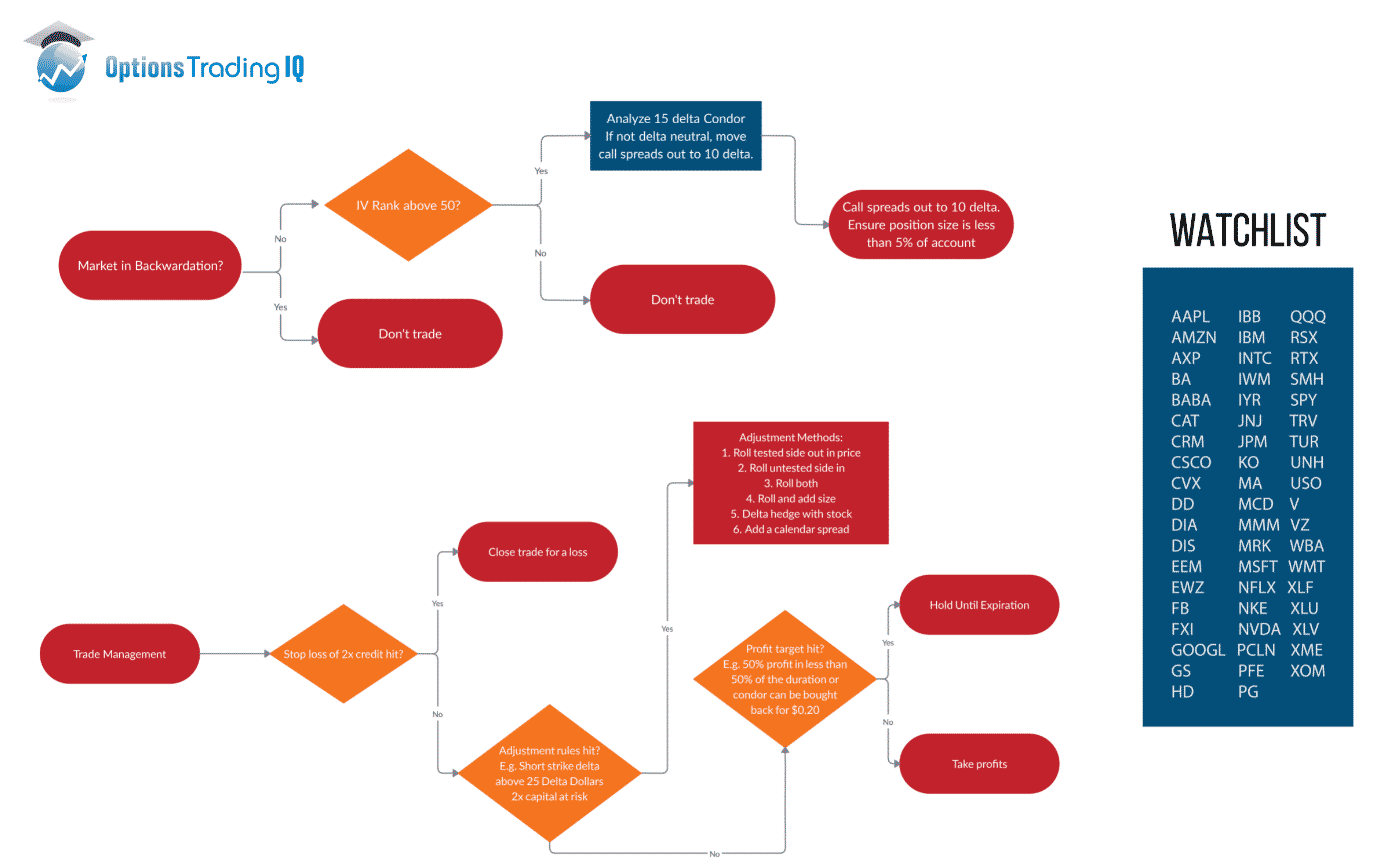

In my opinion, the only way to trade iron condors with a high success rate is to do it with a mechanical decision making process.

I put together the below flowchart which might help you. You don’t have to trade this plan exactly, but it gives you a good starting point and also gives you some insight into how you need to think about your iron condor trading.

If the below image is too hard to read you can go to this link to see it in more detail and save it down:

https://optionstradingiq.com/wp-content/uploads/Iron-Condor-Flowchart2.png

Summary

The best iron condor strategy is one that is mapped out in advanced with strict guidelines for entry, adjustment and exit.

Becoming more mechanical with your decision making will result in a much higher success rate.

Where traders go wrong is becoming too emotional and holding on to losing trades too long.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Kindly advise on the best DTE for Iron condor

It’s personal preference. Some people like weekly trades due to the high time decay, but they can be painful when they move against you. The sweet spot is around 30-45 days, but I’ll also do 60-90 trades. Just try a few different styles and see what works for you.

Do look at a price chart when selecting stocks for an iron condor to see if it’s range bound or trending? If so, will you avoid putting an iron condor on if the stock appears to be in and uptrend or downtrend?

Definitely. IV rank is a big factor, but number 1 is that your are picking a stock that you think will trend sideways. You can still make money on a low IV rank stock is it stays rangebound.

Thank you Gavin, that helps a lot. I have one other question. You mention don’t trade over earnings. If I’m looking at an iron condor using August 2021 options and earnings are expected on say July 20th. Would that be considered trading over earnings the trade shouldn’t be placed?

Thanks again for your help!

Yes, if you open the trade with August expiration and it is opened before July 20th, then the trade would be exposed to earnings. The safest would be to wait until after July 20th to open the trade.

Thanks again Gavin. Great stuff on your site, very educational!

Hi Gav, thank you for the terrific advice on condors. Just one question, stocks like AAPL AMZN and MFST are usually on the uptrend these days. Instead of waiting for it to be range bound, can you compensate by having a slightly more conservative delta or reducing lot sizes on the call side, and perhaps slightly more aggressive deltas on the put side ?

Yes, you can do that. It’s called a skewed iron condor or an unbalanced iron condor.

https://optionstradingiq.com/what-is-an-unbalanced-iron-condor/

Hi Gav,

Appreciate if you can please explain about the difference between Iron Condor and Iron butterfly strategy? And which of these strategy is more rewarding? Thanks.

Each can have their place at various times. I generally prefer condors because of the wider profit zone.