Contents

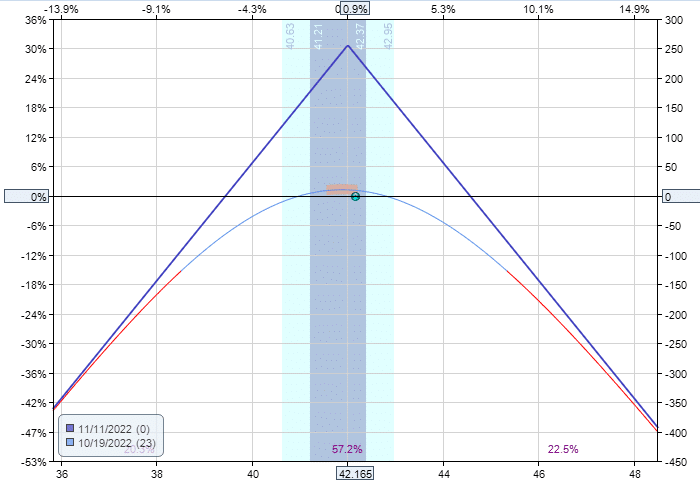

Today, we’re looking at a short straddle example on Cisco (CSCO).

The short straddle is an options strategy where you sell an at-the-money put option and a call option at the same strike price.

For example, here we are selling the put with the $42 strike price, and we are also selling the $42 call.

source: OptionNet Explorer

This diagram is the payoff graph or the risk graph.

The straight blue lines indicate the profit and loss (see the vertical axis) that would occur based on where Cisco’s price is (see the horizontal axis) at the expiration of the options.

These options were sold on October 19, 2022, when Cisco was trading at $41.77.

These options have an expiration of November 11, 2022.

So these options have about three weeks till expiration — 23 days, to be exact.

We say that these options have 23 DTE (days to expiration).

We are selling the options with the strike prices that are closest to the current price.

This is what we mean when we say selling “at-the-money” (ATM) options.

The ATM options typically have the highest extrinsic value of all the other options in the option chain for that same expiration.

The way this trade makes money is essentially selling the extrinsic value of options and receiving money in return.

In this case, we immediately received a credit of $256 when we sold the two options.

You can see it better if we write it like this.

TRADE DETAILS

Date: October 19, 2022

Price: CSCO @ $42.17

Sell one November 11 CSCO $42 put @ $1.14

Sell one November 11 CSCO $42 call @ $1.42

Credit received: $255.50

The options price is listed at a price per share, keeping in mind that one contract is 100 shares.

We are selling one contract for the $42 put and one for the $42 call.

We say we are selling one straddle.

Max Profit

The $256 credit is the maximum profit we could make on this trade.

This will occur if we were to hold the trade to expiration, and Cisco happens to be at $256 at the moment of expiration.

This is highly unlikely, so we do not plan on making the max profit.

We plan on exiting the trade prior to expiration by buying back the straddle at a lower price than what we sold it for. We pocket the difference as profit.

What if we are not able to buy back the straddle at a lower price than what we have sold it for?

Well, then we have to buy it back at a higher price, which means that we lose money.

The curved line in the above payoff graph does the theoretical calculations for us as to how much profit we would have if we were to close the trade today.

It depends on where the price of the Cisco stock is at. If Cisco is at $42.17, we will make zero profit.

Because we just sold the straddle, and if we were to buy it right back, we would make no profit.

If Cisco stock goes down to $40 per share, the curved line (known as the T+0 line) indicates that we would lose about $40.

If Cisco stock goes up to $44, we will lose about $50.

The more that Cisco’s stock price deviates from its current price, the more we lose.

That is why this strategy is to be used on stocks that you do not think will make a big move.

Max Loss

The short straddle has what is known as an “unlimited loss” strategy or an undefined-risk strategy.

Looking at the risk graph, you see that the loss trails off to infinity on both sides — in theory.

In reality, the price of the stock can only go as low as zero, as unlikely as that is.

That caps the loss on the downside at $4200 – $256, or $3944.

Due to the $256 credit received, this loss is less than what a buy-and-hold investor would experience under the same conditions.

On the upside, the risk is unlimited.

Probabilistically speaking, the stock price can only go up by so much in any given amount of time.

The trader would simply have to stop the loss by exiting the trade at the point where the loss is too much.

Time Decay Of Options

Looking at the T+0 line, you may be concerned that it shows that we cannot make any profit regardless of where the price of Cisco is at.

The T+0 line is completely below the zero-profit horizontal line.

This is true. We cannot make any profit now because we just sold the straddle.

For the straddle to make money, you must let some time pass.

We say that the straddle makes its money via time decay.

As time passes, the value of the options decreases because there is less time left to expiration.

We like it when options price decrease because we can buy back the straddle options at a lower price to close the trade.

The more precise term would be to say that the value of options decay with time or that time decays the value of options.

Since that is a lot of words, you will see people simply say “time decay” in informal chats and forums.

Some will say “theta decay.” Theta is the option Greek that measures how much the value of the option changes with the passage of time. In our example, the straddle has a combined theta of +5.32.

A positive theta number means that the strategy makes money with the passage of time. A negative theta number means that the strategy loses money as time passes.

The short straddle, like the short strangle, iron condor, the butterfly, and the calendar has a positive theta.

They all benefit from the passage of time. Thus, patience is required.

As time pass, the T+0 line will creep upwards and morph closer to the blue line.

Adjustment

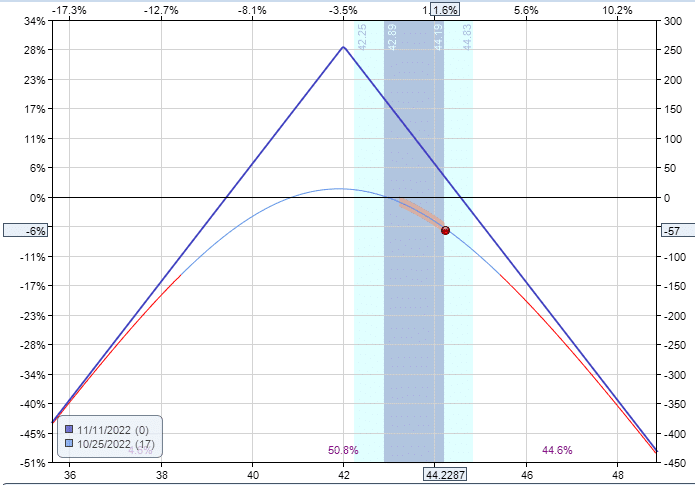

On October 25, the payoff graph looks like this:

See how the curved line has risen to indicate that the short straddle will be profitable at certain price ranges of Cisco.

Unfortunately, Cisco is not within that price range.

The price of Cisco has moved too far from its original position up to $44.23.

So, our short straddle is not profitable yet.

In fact, its price has moved so far from the short strikes of the straddle that it is time for an adjustment.

One possible adjustment is to sell another straddle at a price slightly higher than Cisco’s current price.

We will sell another straddle at $46.

Date: October 25, 2022

Price: CSCO @ $44.23

Sell one November 11 CSCO $46 put @ $2.17

Sell one November 11 CSCO $46 call @ $0.46

Credit: $262.50

The sale of this straddle gives us an additional credit of $263.

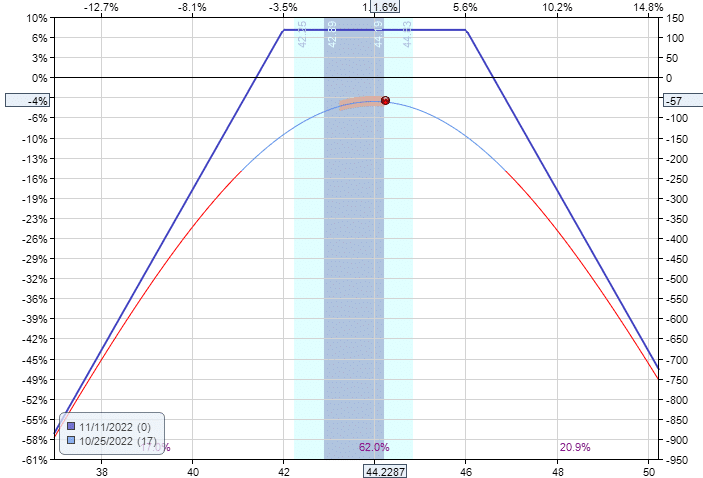

The payoff graph after the adjustment looks like this:

source: OptionNet Explorer

The positional delta was reduced from -55 to -11.

And you can see that the price is more centered now.

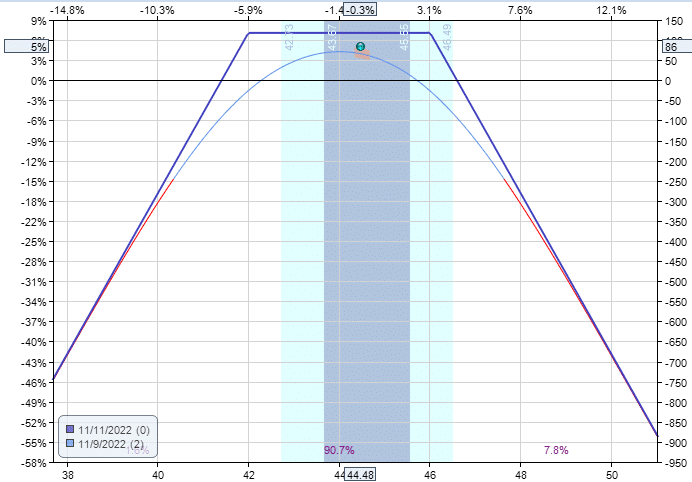

Closing Trade

On the morning of November 9, the trade is looking good. Time has passed, which pushed up the T+0 line.

Another factor that causes the T+0 line to rise is a drop in the implied volatility of the underlying.

This is because the short straddle is a short vega trade and profits as volatility drops.

We close the trade on the morning of November 9.

Date: November 9, 2022

Price: CSCO @ $44.48

Buy to close November 11 CSCO $42 call @ $2.54

Buy to close November 11 CSCO $42 put @ $0.05

Buy to close November 11 CSCO $46 call @ $0.10

Buy to close November 11 CSCO $46 put @ $1.64

Debit: –$432

Since we got a total credit of $519 and we paid $432 to close it. The net profit on the trade is $87.

FAQs

What factors affect the price of the straddle?

The price of the straddle depends on its time to expiration, the strike price in relation to the current price of the underlying, and the implied volatility of the underlying.

If the credit of the first straddle was $256 and the credit of the second straddle was $263, why isn’t the max profit on the trade $519?

When you are selling two straddles at different strike prices, the max profit is not the sum of the credits received.

This is because the price of Cisco can not end up at the strike prices of both straddles at the same time at expiration.

It may potentially end up at the strike price of one of the straddles.

But that means that it is not located at the strike price of the other straddle. So the other straddle can not be at a max profit and may even be at a loss.

If you look back at the resulting risk graph of the two straddles, you see that the max profit on the trade with the two straddles is about $120.

How can we calculate the max profit of a dual straddle exactly?

The sale of the first straddle at $42 gave us a credit of $256.

The sale of the second straddle at $46 gave us a credit of $263.

That is a net credit of $519.

The trade will be at a max profit if Cisco ends up between $42 and $46 at expiration.

When that is the case, then:

The short $42 call will be in the money.

The short $42 put will expire worthless.

The short $46 call will expire worthless.

The short $46 put will be in the money.

The short $46 put being in-the-money means that we have to buy 100 shares of Cisco at $46 per share.

The short $42 call being in the money means that we have to sell 100 shares of Cisco at $42 per share.

We would lose $4 per share, or $400.

Since we got a total credit of $519, our max profit would be $119 (from $519 minus $400).

You can scroll back to the post-adjusted payoff graph and confirm that the highest point of the expiration graph is, in fact, $119.

Conclusion

The short straddle can be intimidating for the beginning options trader because of its unlimited risk potential.

However, some experienced traders like the short straddle because it provides the most efficient capture of time decay and volatility crush.

Selling at-the-money premium without the cost of any protective long options is like a well-oiled machine rolling without friction.

Having long options as protection adds “friction.”

Friction reduces efficiency.

The closer the long options are to the short options, the more friction there is.

When the short straddle works, it’s great.

But it can just as easily roll in the wrong direction.

I personally still like the defined risk of the iron condor.

Then other traders may prefer the butterfly, which is just a short straddle with two additional long protective legs.

We hope you enjoyed this short straddle example.

If you have any questions, please leave a comment below or send an email.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.