Today we’re going to take a detailed look at the short call options strategy.

This is not a strategy that is recommended for beginners due to the unlimited loss potential, so don’t try this strategy until you have at least 12 months experience.

Let’s get started.

Contents

- What Are Short Call Options?

- Maximum Loss

- Maximum Gain

- Breakeven Price

- Payoff Diagram

- Risk of Early Assignment

- The Greeks

- Risks

- Examples

- Summary

What Are Short Call Options?

Short call options are also called naked calls due to the fact they are not covered by a position in the underlying stock.

Traders looking at this strategy would be mildly bearish, although it can be trading as an aggressive bearish position by bring the short strike closer to the stock price.

With a short call option, the trader is looking for the stock to stay flat or decline.

The trade can still profit in the case of the stock rising slightly, but that is not the preferred scenario as it could put the trade under pressure and see the trader sitting on unrealized losses and therefore faced with the difficult decision to cut losses or stay in a losing trade.

After placing a short call option trade, the trader has an obligation to sell the stock to the buyer of the option at the agreed price on or before the expiration date.

This would only occur if the call option was assigned by the buyer.

Assignment can occur at any time but is more likely when the stock price is above the strike price and there is little time value left in the call options.

If the stock price stays below the short strike for the duration of the trade, the call option will expire worthless and the option position will be removed from the seller’s account.

While this article is only focused on naked calls, selling a short call is common for investors who already own the stock and are looking to generate additional income. This strategy is known as a covered call.

Maximum Loss

The maximum loss on the trade is theoretically unlimited as the stock can continue moving higher with no limit.

For this reason, it is not a recommended strategy for beginners.

Some traders will set a stop loss at 1.5 to 2 times the premium received.

However, I’ve seen many cases where overbought stocks have rocketed higher following a positive news announcement.

Stop losses do little help in that situation as the stock blows right through the stop loss level.

Maximum Gain

The maximum gain for the strategy is limited to the premium received for selling the call option.

When calculating the percentage return, traders can take the premium received divided by the margin requirement.

This can be a little deceptive because the potential loss can be much higher than the margin requirement.

Also, if the stock moves higher, the margin requirements will increase as the position comes under pressure.

Breakeven Price

The breakeven price for a short call option strategy is the short call strike plus the premium received.

For example, if a stock is trading at $120 and the trader sells a $125 call option for a premium of $2.50, the breakeven price would be $127.50.

Keep in mind that is the breakeven price at expiry.

The trade could be in a loss position at much lower levels if the stock moves higher early in the trade.

Payoff Diagram

Short calls have a similar shaped payoff diagram to a long put.

Profits are flat below the strike price with a breakeven price equal to the strike price plus the premium.

Above the breakeven price, losses accrue on a one to one basis with a move higher in the stock price.

The T+0 line in the payoff diagram below show that losses can occur at prices lower than the breakeven price on interim dates.

Risk of Early Assignment

There is always a risk of early assignment when having a short option position in an individual stock or ETF.

You can mitigate this risk by trading Index options, but they are more expensive.

Usually early assignment only occurs on call options when there is an upcoming dividend payment and / or if there is very little time premium left.

Traders will exercise the call in order to take ownership of the stock before the ex-date and receive the dividend.

The Greeks

Short calls have negative delta, negative gamma, negative vega and positive theta.

DELTA

As a negative delta trade, the ideal scenario for the trader is a drop in the stock price. Delta is going to be the main driver of the trade as far as the greeks are concerned.

The closer the trade is placed to the stock price, the higher the negative delta will be.

Aggressively bearish traders would place the short strike closer to the money which would provide a larger negative delta exposure and generate a higher option premium.

Less bearish traders might place the trade further away from the stock price giving them less delta exposure but also reducing the amount of premium received.

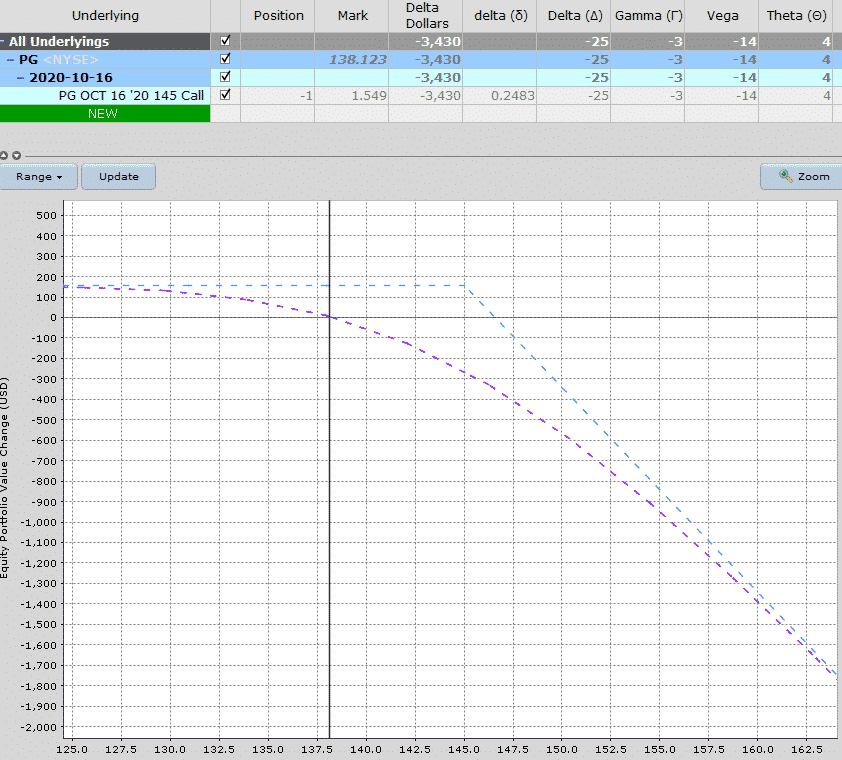

In the PG example above, the trade has a delta of -25 which is an equivalent exposure to being short 25 shares.

The delta will change as the trade progress due changes in the stock price and the other greeks.

GAMMA

Short calls are negative gamma which means the delta exposure will become more negative as the stock rises.

This has the effect of losses starting to “snowball” as the stock rises.

For this reason, it’s important to cut losses or hedge earlier rather than later.

The PG short call example has gamma of -3 meaning that for every $1 change in the underlying stock price, the delta will change by 3.

VEGA

Vega is the greek that measures a position’s exposure to changes in implied volatility. If a position has negative vega overall, it will benefit from falling volatility.

Negative vega on a short call strategy means the position will benefit from a decrease in implied volatility after placing the trade.

If the stock stays flat and implied volatility drops, the trade will start to be in a profitable position.

The PG short call strategy has vega of -14 meaning that for every 1% change in implied volatility, the P&L on the position will change by +/- $14.

THETA

Short call options are a positive theta trade meaning that they will benefit from time passing.

This is also known as time decay.

The PG trade has theta of 4 meaning that the trade will make $4 per day from time decay with all else being equal.

Risks

It goes without saying that as a bearish trade, there is a risk that the price of the underlying will rise causing an unrealized loss, or a realized loss if we close the trade.

Some other risks associated with short call options:

ASSIGNMENT RISK

We talked about this already so won’t go into to much detail here and while this doesn’t happen often it can theoretically happen at any point during the trade. The risk is most acute when a stock trades ex-dividend.

If the stock is trading well below the sold call, the risk of assignment is very low. E.g. a trader would generally not exercise his right to buy PG at $145 when PG is trading at $138 purely to receive a $0.50 dividend.

The risk is highest if the stock is trading ex-dividend and the short call is in the money.

One way to avoid assignment risk is to trade stocks that don’t pay dividends, or trade indexes that are European style and cannot be exercised early.

However, this should not be the primary factor when determining which underlying instrument to trade.

Otherwise, think about closing your short call option before the ex-dividend date if it is in-the-money.

EXPIRATION RISK

Leading into expiration, if the stock is trading just above or just below the short call, the trader has expiration risk.

The risk here is that the trader might get assigned and then the stock makes an adverse movement before he has had a chance to cover the assignment.

In this case, the best way to avoid this risk is to simply close out the spread before expiry.

While it might be tempting to hold the spread and hope that the stock drops and stays below the short call, the risks are high that things end badly.

Sure, the trader might get lucky, but do you really want to expose your account to those risks?

VOLATILITY RISK

As mentioned on the section on the greeks, this is a negative vega strategy meaning the position benefits from a fall in implied volatility.

If volatility rises after trade initiation, the position will likely suffer losses.

Examples

Let’s look at an example trade:

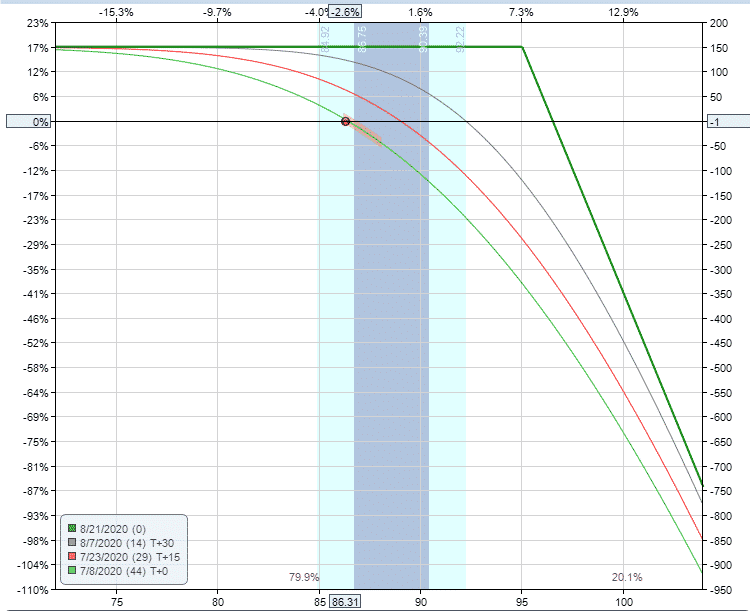

CVX SHORT CALL

Date: July 7, 2020

Current Price: $86.31

Trade Set Up:

Sell 1 CVX Aug 21st, 95 call @ $1.51

Premium: $151 Net credit

Capital (Margin) Requirement: $864

Return Potential: 17.48%

Annualized Return Potential: 141.78%

The trade was never under pressure and expired for a full profit.

Let’s also look at an example of a losing trade to illustrate what can go wrong.

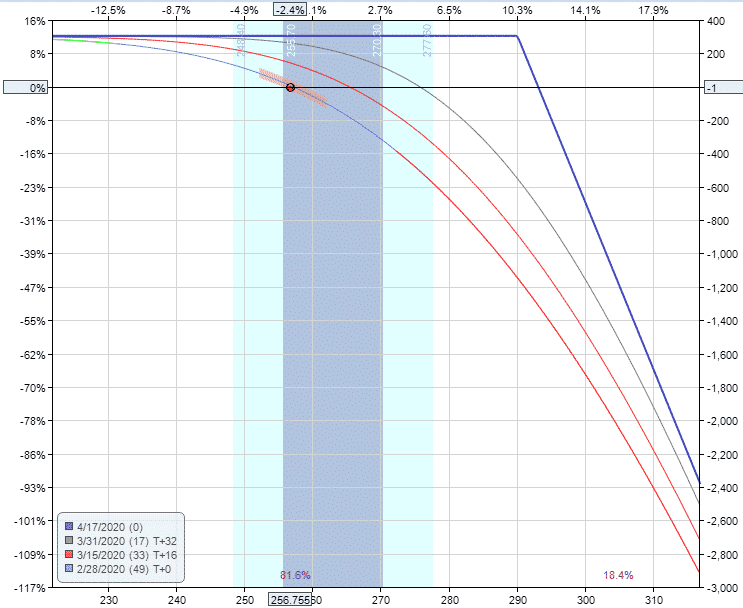

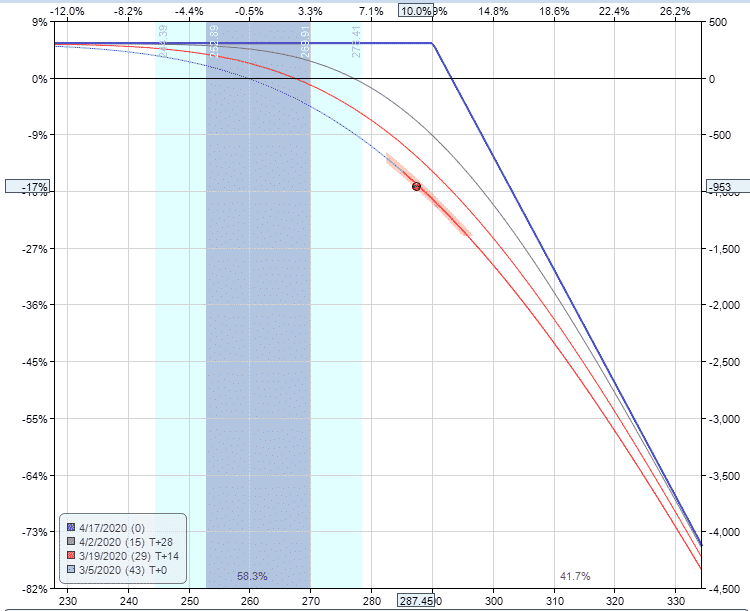

UNH SHORT CALL

Date: February 27, 2020

Current Price: $256.76

Trade Set Up:

Sell 1 UNH Apr 17th, 290 call @ $3.06

Premium: $306 Net credit

Capital Requirement: $2,568

Return Potential: 11.92%

Annualized Return Potential: 86.99%

This trade did not work at all and within a few days the trade was down $950. A good example of what can go wrong.

The margin requirement had also blown out to $5,495 which is an important consideration to keep in mind when trading short calls.

Summary

Short call options are a risky strategy due to the unlimited loss potential, so they are not recommended for beginners.

Traders employing this strategy are looking for the stock to decline, stay flat, or not rise by too much.

The profit is limited to the premium received.

Aggressively bearish traders might place the short call closer to the money in order to obtain a larger negative delta exposure and higher premium received.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.