The “reverse iron butterfly” is the reverse of the more commonly used iron butterfly strategy that we wrote about last time.

So be sure to become familiar with the typical iron butterfly first.

Once you understand that, you will know how to “reverse” it.

Instead of selling a call and a put as the center strikes, the reverse iron butterfly buys a call, and a put as the center strikes.

The basis of this strategy is buying a straddle.

However, to help finance the cost of the straddle, we sell a further out-of-the-money call and sell an additional out-of-the-money put.

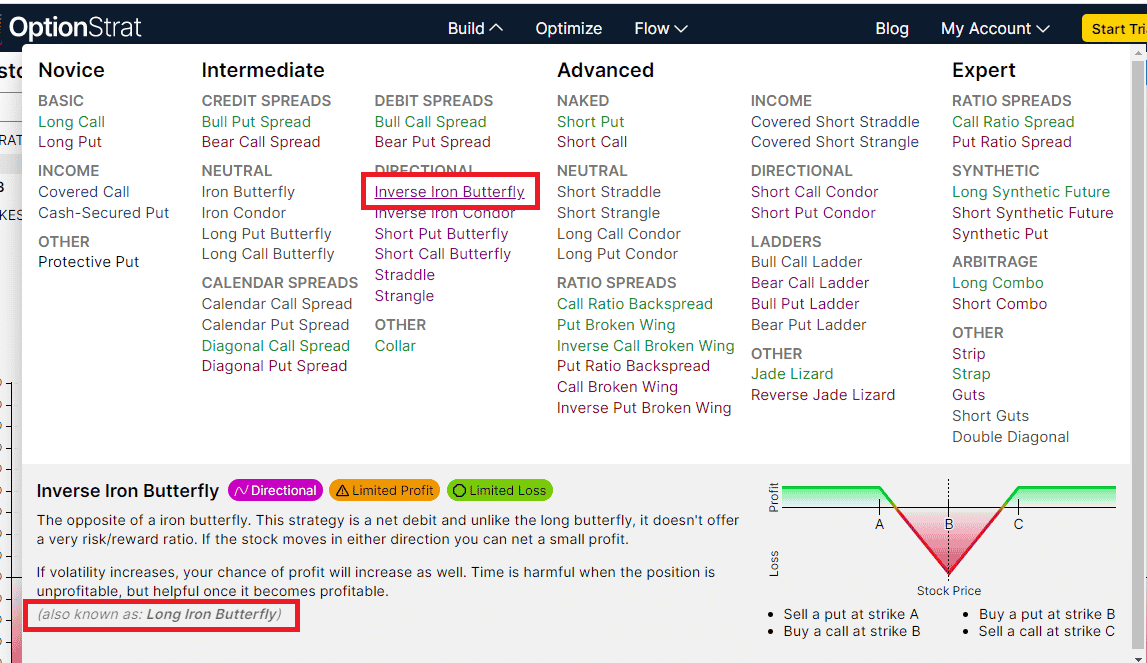

If you ever come across a strategy name that you have never heard of, go to OptionStrat’s build menu, and you can see a list of possible options strategies.

Here they call it “Inverse Iron Butterfly.”

source: OptionStrat.com

The description also mentions that this is also known as the “Long Iron Butterfly.”

We’ll get into that later.

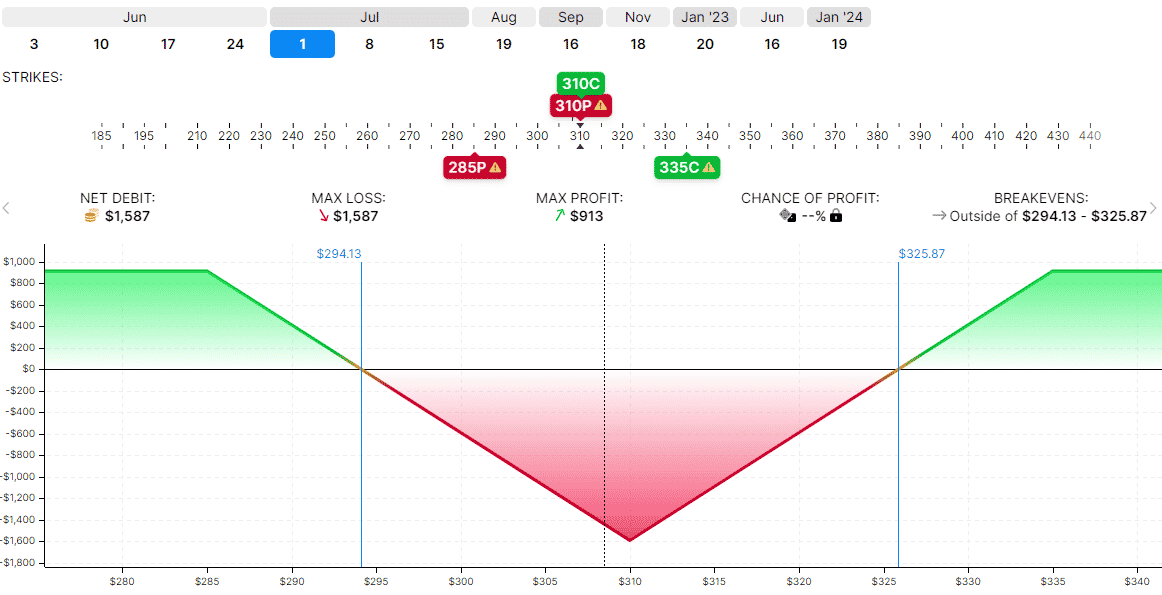

By clicking on the strategy, you can see the payoff diagram.

Like the straddle, you want the stock to make a big move into the green area of the graph at expiration.

In this example, the max profit is capped at $913.

If the stock doesn’t move and ends up at $310 at expiration, the loss is at the bottom of the valley at –$1587.

This is the most you can lose in the trade. It is possible to lose 1.7 times your max potential gain in this case.

This example is on Home Depot (HD) stock placed with the following option orders:

Date: May 27, 2022

Price: HD @ $308.50

Sell one July 1st HD $335 call @ $1.48

Buy one July 1st HD $310 call @ $8.78

Buy one July 1st HD $310 put @ $12.55

Sell one July 1st HD $285 put @ $3.98

Net Debit: –$1587

The sale of the two out-of-the-money options helped but did not entirely offset the cost of the two expensive at-the-money options.

We still have a pay a net debit of $1587 to enter into this trade.

We say that we “buy” an inverse iron butterfly.

After the purchase, we say we are long the inverse iron butterfly.

Just like when we buy a call option, we are long that call option.

Hence, this strategy is also known as the “long iron butterfly.”

You can think of the “long iron butterfly” as a “long straddle” with extra two short options as wings.

If investors simply mention “iron butterfly” without the adjective “long” in front of it, they refer to the more commonly used “short iron butterfly” where the middle strikes are being sold.

The Greeks of the Reverse Iron Butterfly

The Greeks of our example are:

Delta: -1.7

Theta: -8.0

Vega: 20.0

They are the opposite of the Greeks for the regular iron butterfly.

Here, theta is negative, which means that time decay is working against us.

Every day that price does not move, the strategy loses $8.

Vega is positive, which means that as implied volatility increases, it should become favorable for the trade (with other factors being equal).

So that is the reverse iron butterfly. If you have any questions, please send us an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.