I thought I heard it all – from Jade Lizards to Broken Heart Butterflies, to ZEBRAs, to Christmas trees.

Until one fine day, I heard the mention of the Razzle Dazzle option trade on YouTube.

You have to hand it to Scot Ruble of Stratagem Trade for coming up with creative names for his options strategies, some of which include “ViPars,” “Newton’s Cradle,” and “Dragonfly.”

We are not here to talk about those.

We are here today to talk about his Razzle Dazzle trade.

The dictionary defines razzle-dazzle as “noisy, showy, and exciting activity and display designed to attract and impress.”

Sounds very much like a circus.

Does the trade live up to its name? Let’s see.

Because the aforementioned YouTube was in podcast style, there are no visuals of the trade.

At 36 minutes into the talk, Scot described an example of the trade in words for which experienced options traders can mentally visualize.

However, some visuals will definitely help.

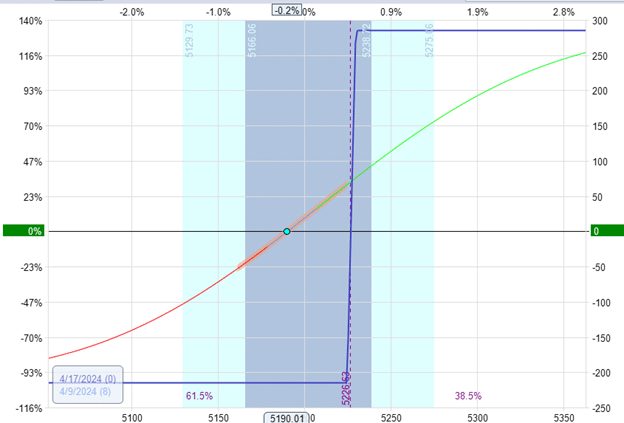

So, we will try to approximately model his example trade in OptionNet Explorer.

Suppose a trader is bullish on the SPX and buys a bull call spread a week out in time.

Trade Details

Date: April 9, 2024

Price: SPX @ 5190

Buy one April 17 SPX 5225 call

Sell one April 17 SPX 5230 call

Debit: -$215

Delta: 1.86

Theta: -6.29

Vega: 4.34

The problem with this spread is that it has negative time decay (see the negative theta).

So, if SPX doesn’t move, the trade will lose money.

To perform the “razzle dazzle,” the trader will sell daily far out-of-the-money bear call credit spreads to collect some credits.

Do that for several days, and one would have collected enough to finance the cost of the bull call spread substantially.

One might even be able to sell enough to get the bull call spread for free.

There is a risk, of course.

It is possible that SPX can shoot up through the bear call spread and take a maximum loss on the credit spread.

The trader can use mitigation tactics such as rolling up or out in time.

However, that assumes the trader watches the market on the zero-DTE credit spread.

If the trader doesn’t want to watch intraday, just use longer-term expirations, such as a month-long bull call spread and selling weekly bear call credit spreads.

The concept is the same if the trader is bearish.

They would buy bear put spreads and sell smaller, out-of-the-money, shorter-term bull put spreads to help finance the main trade.

Because selling credit spreads has a positive theta, it also negates the effect of the negative theta of the main trade.

Summary

It is good to have a directional trade strategy whenever the market shows strong directionality.

The Razzle Dazzle option strategy is a directional strategy where the long spread is the primary driver.

The shorter-duration, far-out-of-the-money credit spreads help finance the long spread and give enough positive theta to offset the negative theta of the long spread.

The key to its success is, of course, its management and the reading of the market. How much credit spreads to sell?

How close?

When to roll or exit them?

The management of the credit spreads adjusts the amount of directionality of the long spread.

The trader shifts the risk from the debit spread to the credit spreads and vice versa.

In other words, the risk can be shifted from the long term to the shorter term or vice versa.

The Razzle Dazzle uses the profits of 0-DTE credit spreads to finance a directional debit spread.

If traders are good at 0-DTE trading, they can get free debit spreads to speculate on direction without risk.

If a trader is bad at 0-DTE trading, the losses from the credit spreads are offset by the gains from the debit spread.

We hope you enjoyed this article on the Razzie Dazzle option strategy.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hat’s off for the patience required to decipher what you did from Scot/”JL Lord” and his latest trade scheme, described ramblingly. If I understand, this fellow blew up a hedge fund and I’ve accordingly never been inclined to take one of his instruction courses. Curious to hear what others have to say about this trade in real-time.