Today we are looking at option decay.

Option decay is an important concept in trading options.

For both options buyers and options sellers, we need to understand how options decay works.

Contents

What Is Option Decay?

Option decay is when the value of an option decreases with time (assuming all other factors remain the same).

This is true regardless of whether we are talking about a put option or a call option, a weekly option or a monthly option, an in-the-money option, or an out-of-the-money option.

It means that the value of all options decreases in value the closer it is to expiration — ceteris paribus.

What Is Ceteris Paribus?

Ceteris paribus is a fancy Latin phrase that means “all other things being equal.”

An option contract value is determined by many things.

It is affected primarily by the price of the underlying.

But it also changes as implied volatility changes.

And lastly, an option value is affected by the passage of time.

Option Decay – How Is Option Value Affected By Time?

Assuming that the price and volatility stay the same (which they will not, but just assume), then the option value decreases with the passage of time.

This is option decay. This decay is measured by the Greek theta.

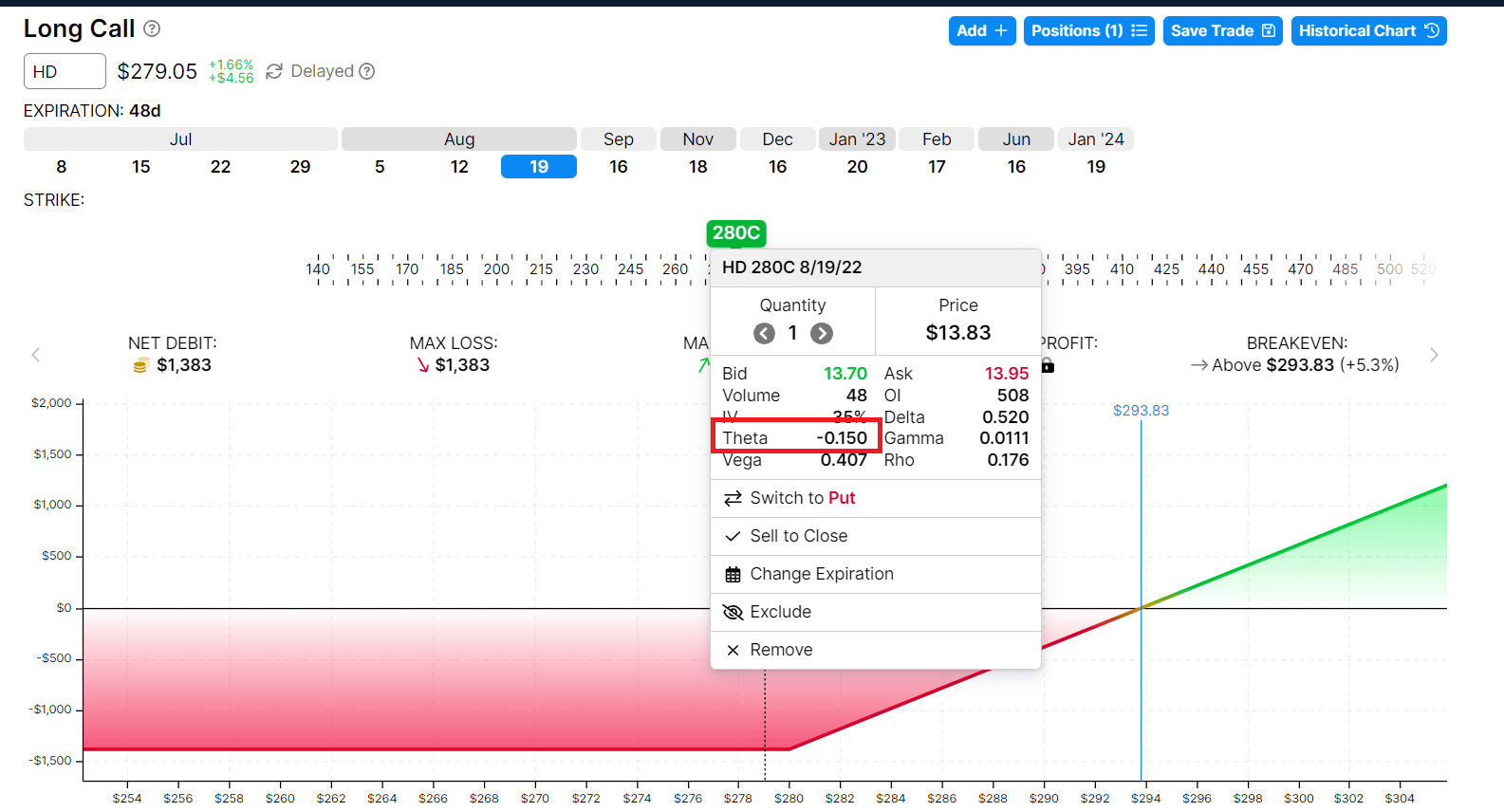

For example, the stock Home Depot (HD) is trading at $279 on July 1, 2022.

If an investor buys the $280-strike call option on Home Depot that is expiring on August 19, the investor will pay $1,383 for that option which will control 100 shares.

The price of the option is quoted as $13.83 per share.

source: OptionStrat.com

The theta shown for that option is “-0.150”.

Note that this is negative.

This means that if the price and volatility of Home Depot stay the same, then the call option price is expected to lose 15 cents per day.

This is on a per-share basis. Since one contract is 100 shares, the total loss per day due to time decay is $15 per day in this example.

So the next day, the value of the call buyer’s investment would decrease to around $1368.

When an investor buys an option, they need to understand that the value of the thing they bought will lose value every day.

If the investor is planning for the option to make money due to an upward price movement in Home Depot, the stock move needs to be large enough and happen soon enough to overcome the loss due to option decay.

How Can We Achieve Positive Theta?

Since all options decay with time, the theta of all options is negative.

How are options traders able to achieve positive theta?

They are able to do so by selling options instead of buying them.

The buyer has negative theta. So the seller has positive theta.

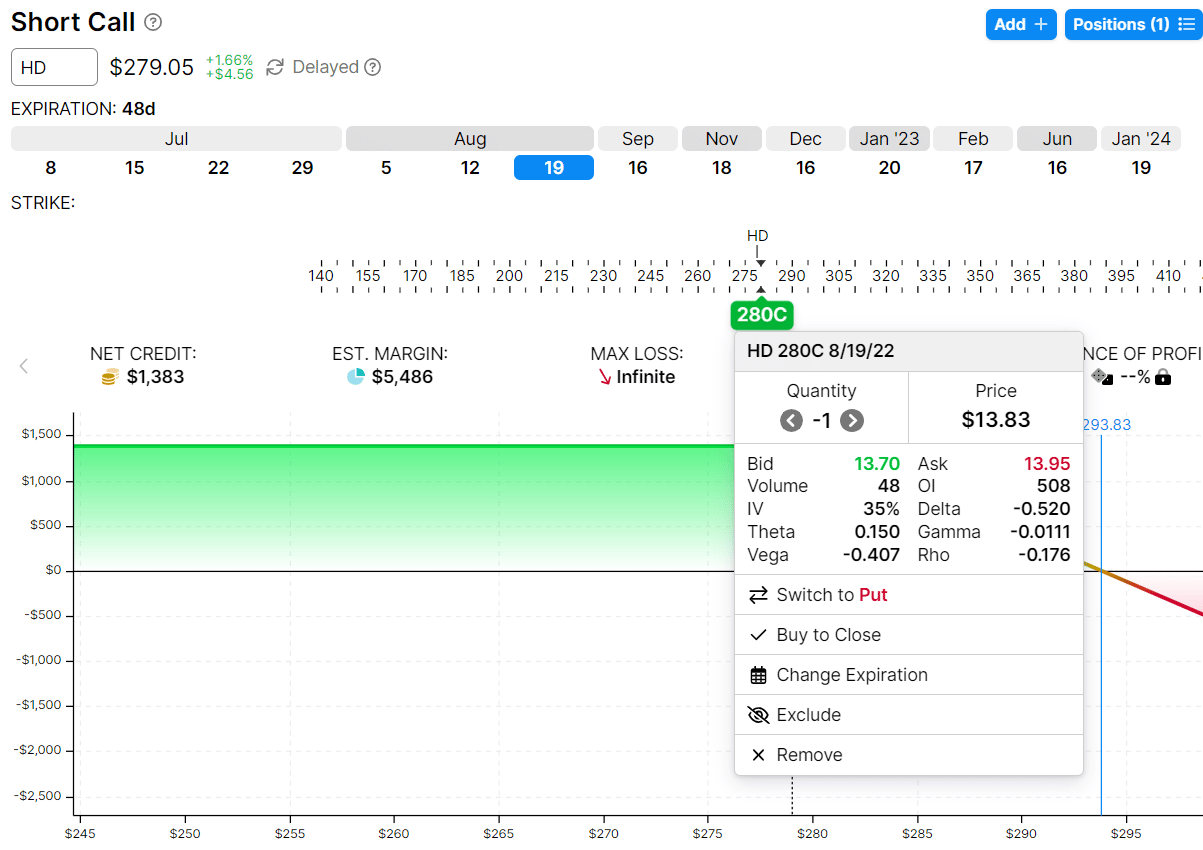

Here is what the option seller sees for that $280 HD call option:

The theta is 0.15 positive. This means that the seller of this option gains $15 of profit each day, assuming HD price and volatility don’t change.

For multi-leg options and spreads, the position theta is the sum of the thetas of each leg.

The option sellers make their profit by selling an asset that loses value with time.

It is like selling a large ice cube for $3 and buying it back for $1 when the ice cube has partially melted and is worth less.

Intuitive Understanding Of Option Decay

A put option contract is analogous to an insurance policy.

It enables the owner of the put contract to liquidate shares of stock at a specified price (the strike price) regardless of how far the stock price drops.

If this put option has 30 more days till it expires, it will be worth more than the put option that has only three days till expiration.

The former has more time in which it can protect the stock.

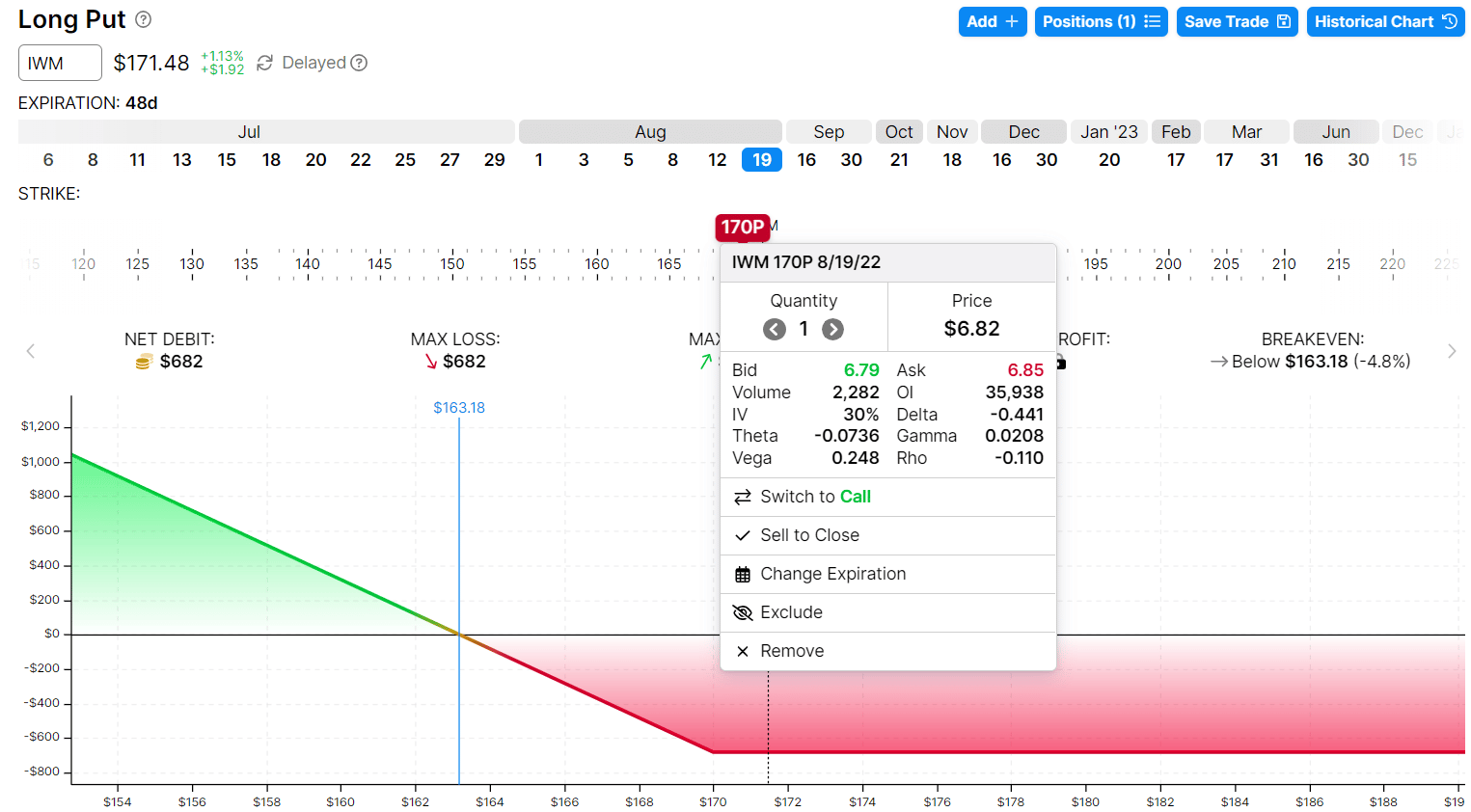

For example, a put option contract on the Russell ETF (IWM) has a theta of -0.0736 when purchased with 48 days till expiration.

This put option has a strike price of $170. IWM is trading at $171.48.

This put option is considered “out-of-the-money.”

It has no intrinsic value. All of its value is extrinsic value.

This put option would become completely worthless at expiration in 48 days if IWM closes anywhere above $170 on the expiration day.

This is the reason why the put option will be worth less and less each day until it is worth zero at expiration (provided that it stays out-of-the-money).

The rate of decay is not linear.

The rate of decay accelerates the closer it nears expiration.

If you take a look at theta a week later, it is not going to be -0.0736.

If everything else stays the same, the theta will be more negative with each passing day.

It may be -0.08 or -0.10 or -0.15.

But everything else does not stay the same.

The price changes and the implied volatility changes, both of which will affect the Greek theta.

So, in reality, if you look at the theta a week later for this put option, it may be greater than -0.0736 or less than -0.0736.

Whatever that theta may end up to be a week later, for a single long put option, the theta will always remain negative.

This is also true of a single long call option.

For complex multi-leg option positions, the position theta can swing from negative to positive.

FAQs

Can you really make money from option decay?

Yes, it is possible when done correctly with a good strategy.

Non-directional options traders use option decay as their primary income generator.

Which option Greek is the most important?

Delta is the most important options Greek.

Directional options traders make money by predicting the direction of the stock correctly.

To them, delta is the most important Greek.

However, some directional options traders also utilize positive theta as a secondary factor in their trades.

Conclusion

Option decay affects all options.

Both options buyers and options sellers are aware of this.

Option buyers believe that they can utilize the option to profit on the stock price move before the option decay dwindles away some of the profits.

Sellers are betting that the option buyers are not able to do this.

Option sellers are expecting to profit from option decay.

Option sellers are putting on option structures with positive theta.

They are selling call options and selling put options.

They are selling credit spreads.

By selling options they receive money from the sale.

Non-directional option traders are also seeking positions with positive theta.

Sometimes they receive a credit to get into the position, such as an iron condor position.

Sometimes they have to pay a debit to get into the position, such as a butterfly or a calendar.

Complex construction such as the broken-wing-butterfly and the double-diagonal can be entered for either a credit or a debit.

Whether it is entered for a credit or debit is not of concern to them.

What matters is that theta is positive, which means that option decay is working in their favor. This is how their money is made.

A large price move (in either direction) is how their money is lost.

We hope you enjoyed this article on option decay.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thank you Trevor, good article.

Trevor?? 🙂

That was helpful – thanks!

Good article.