Yes, they are. The married put and the long call are synthetics of each other.

The risk structure is the same, and their Greeks are very close.

However, there are some nuanced differences that you need to know about the two trades.

You can not allocate them the same way in your portfolio.

We will compare and contrast by using two hypothetical investors known as “stock investor” and “options investor“.

Contents

- The Stock Investor

- The Options Investor

- Following The Trade For a Gain

- Following The Trade For A Loss

- Don’t Over-Allocate Option Positions

- Conclusion

The Stock Investor

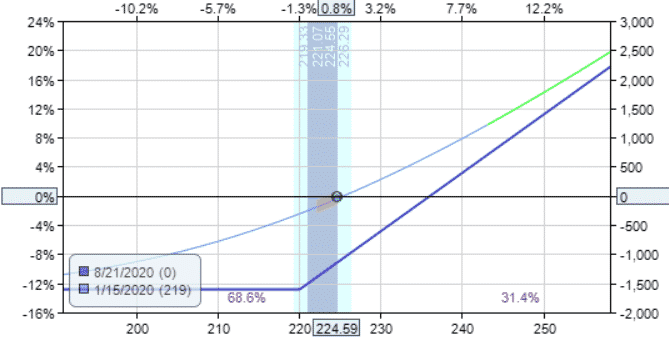

Suppose a “stock investor” initiates a married put position on Home Depot (HD) by buying 100 shares and a put option.

Date: January 15, 2020

Buy 100 shares of HD @ $224.59

Buy one August 21, 2020 HD $220 put at $11.45

Debit: $23,604

Max Risk: $1145 + $459 = $1604

Max Gain: unlimited

Delta Dollars: $22459 – .41 x $22459 = $13,250 (long put at 0.41 delta)

Delta: 58.98

Theta: -2.95

Vega: 67.69

Payoff diagram:

source: OptionNet Explorer

The Options Investor

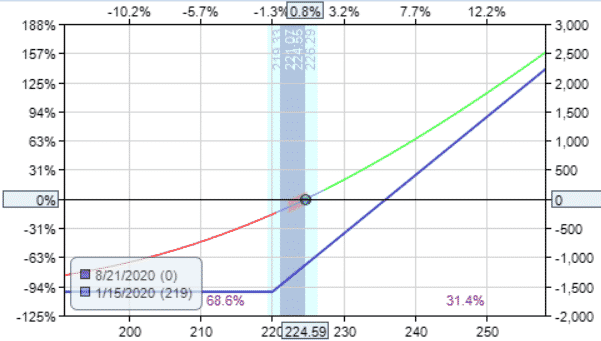

Suppose an “options investor” does not want to invest up to $23,604 for the purchase and prefers to purchase an in-the-money long call instead:

Date: January 15, 2020

Buy one Aug 21, 2020 HD $220 call at $15.95

Debit: $1595

Max Risk: $1595

Max Gain: Unlimited

Delta Dollars: 0.59 x $22459 = $13,250 (long call at 0.59 delta)

Delta: 58.76

Theta: -3.10

Vega: 67.69

source: OptionNet Explorer

Looks identical, right?

Following The Trade For a Gain

Let’s follow both stock investor and options investor on their respective married put and long call trades using historical options data from OptionNet Explorer.

About one month later, on February 21st, HD stock is up to $245.34.

The stock investor’s profit/loss (P&L) is $1510, about 6.4% of the initial capital invested.

Calculated by $1510/$23,604 = 6.4%

During that same time, the option investor’s P&L is $1423, or about 89% of the initial capital invested.

Calculated by $1423/$1595 = 89%

While the dollar amount gained by both investors is about the same, the difference is that the option investor had an 89% gain on capital invested, whereas the stock investor had a 6.4% gain.

This is the result of option leverage at work.

In theory, the dollar amount of the profit would be identical.

But in practice, it is not identical due to the difference in implied volatility between the long put of the stock investor and the long call of the options investor.

Following The Trade For A Loss

Let’s watch the two investors for another month continuing the same respective trades as it goes through the market selloff of March 2020 when HD stock price dropped to $162.39 on March 23rd.

On March 23rd, the P&L of the stock investor is –$1240, or -5% of the initial investment.

Calculated by –$1240/$23,604 = -5%

While HD stock is down 28%, the investor only lost 5% due to having the protective put in place.

On March 23rd, the P&L of the options investor was –$1298, or lost 81% of the initial investment.

Calculated by –$1298/$1595 = -81%

While the dollar amount lost by both investors is comparable, the percentage of the initial investment is not.

The P&L of the options investor went from positive 89% one month to negative -81% in the next month. Options have much bigger swings than stocks.

Don’t Over-Allocate Option Positions

While this is an extreme example to illustrate why an options investor should not over-allocate option positions.

It is certainly possible for the market to make such moves.

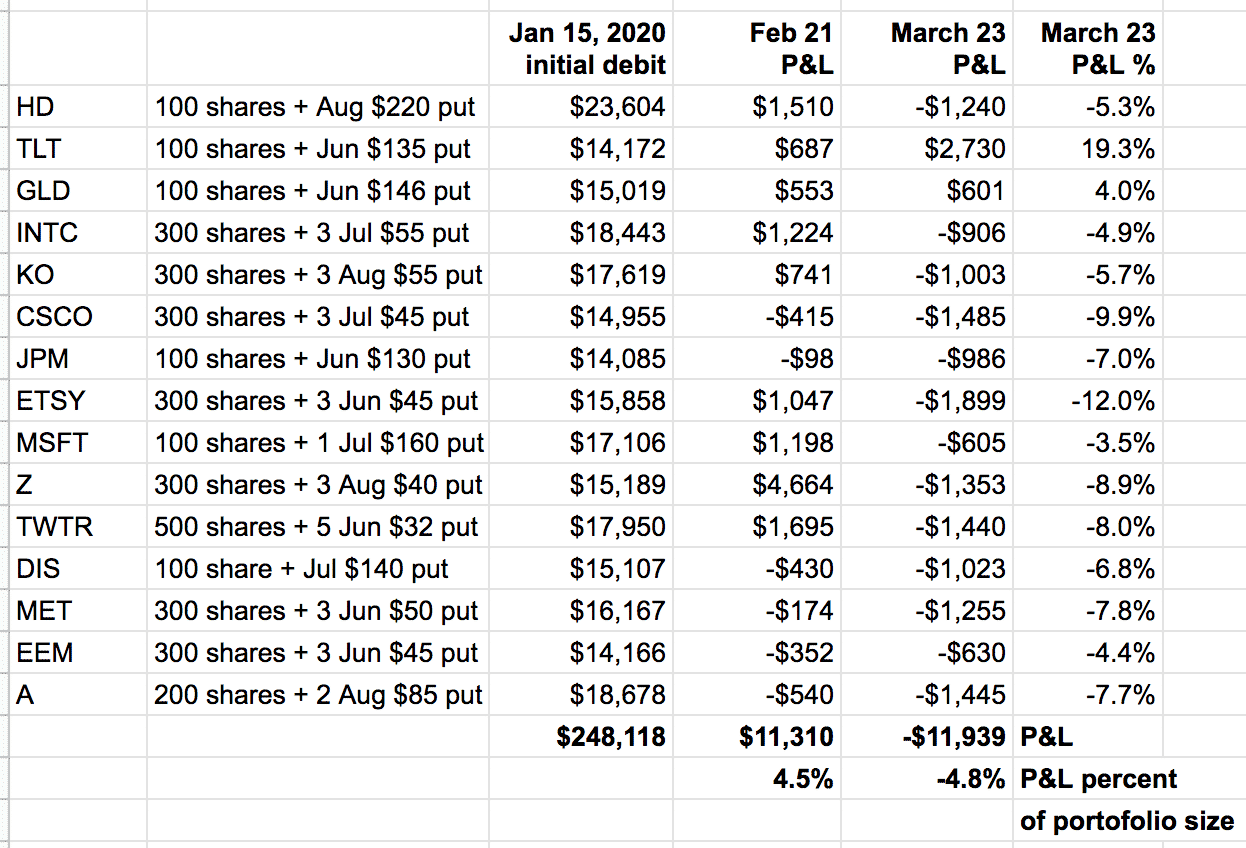

To further bring home the point, consider a portfolio size of $250,000.

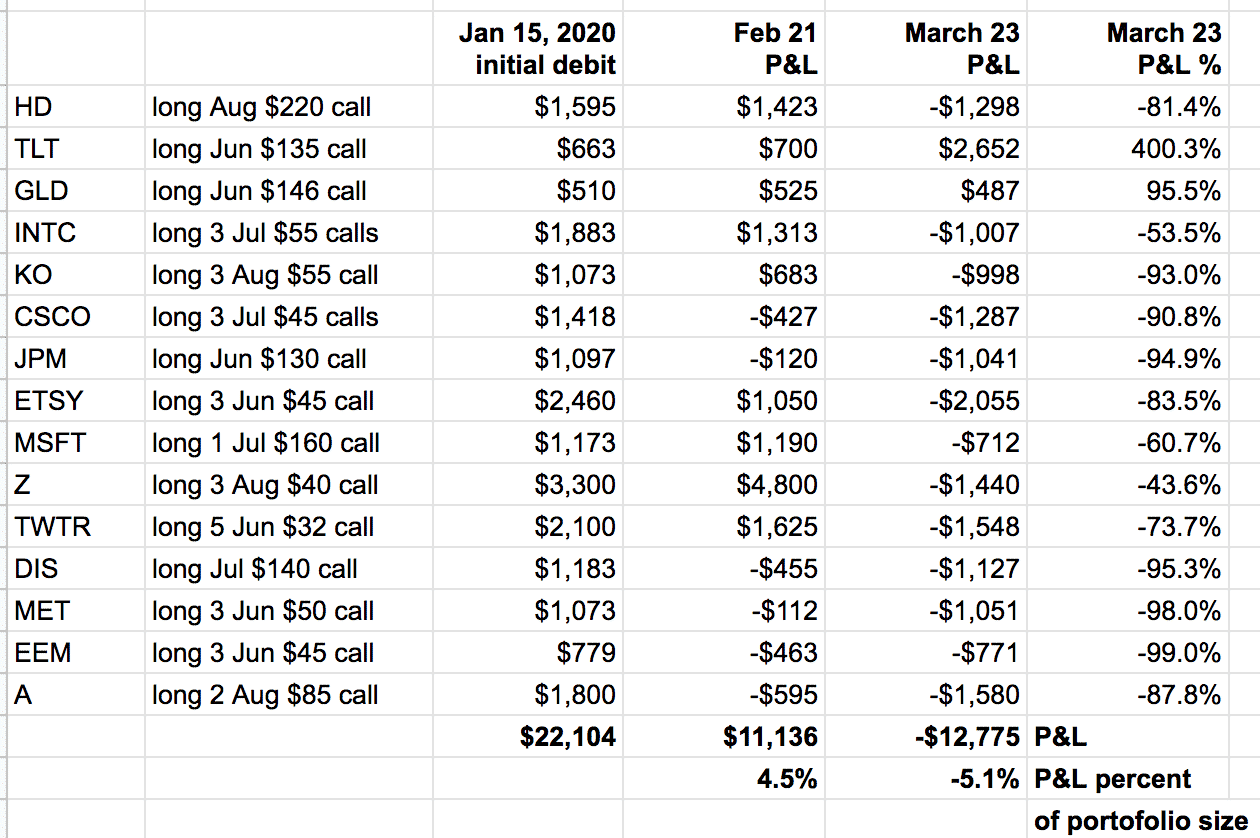

A stock investor can allocate 15 of the following married put positions on January 15, 2020:

The portfolio is up 4.5% in Feb and is down -4.8% in March, which is not so bad since these are protected defined-risk positions instead of straight stock positions.

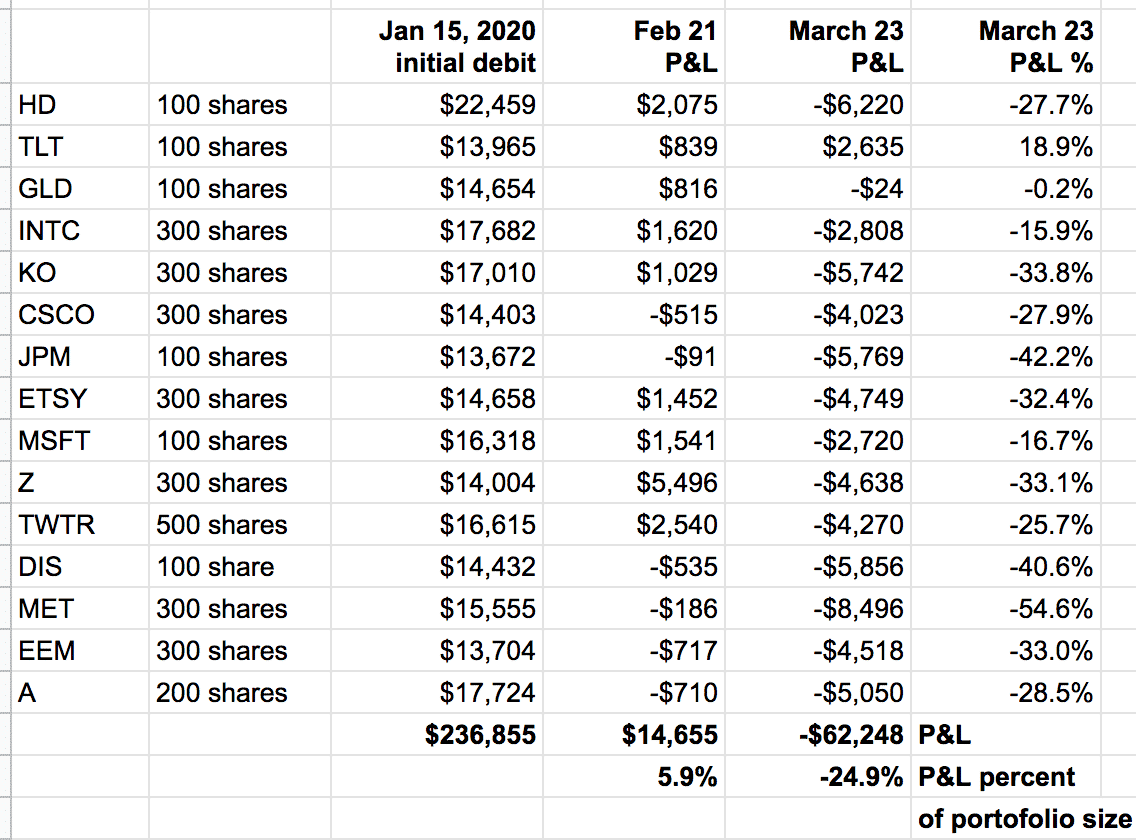

The investor would have gained a little bit more during the good times, but the portfolio would be down 25% in the bad times.

An options investor with long call positions would do about the same as the married put investor: 4.5% and -5.1%.

But since only $22,000 of a $250,000 portfolio is being used.

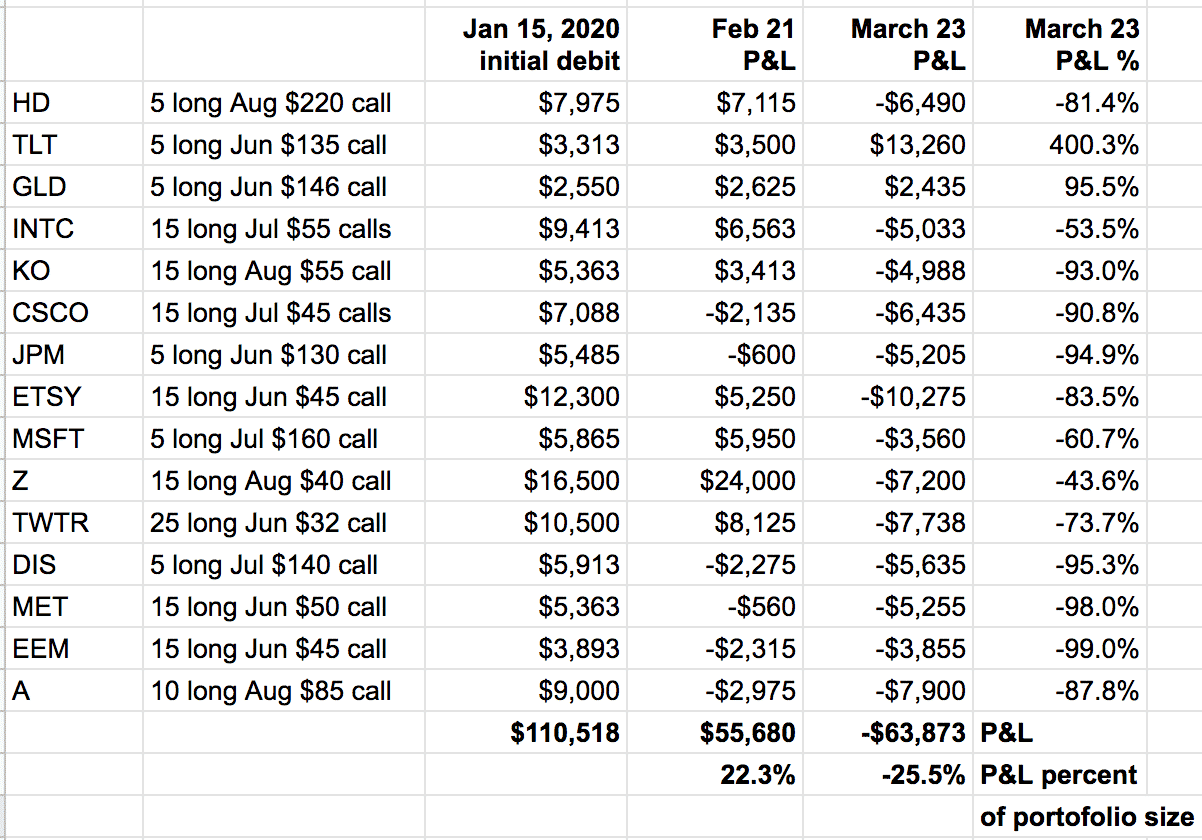

The options investor may decide to increase the position size for each position.

Instead of one long call on Home Depot, the investor purchases five long calls on HD.

Everything is multiplied by 5, including the gains and losses.

We see that even if only use half of the portfolio’s capital, the portfolio can sometimes lose 25% of its value, as it did on March 23rd.

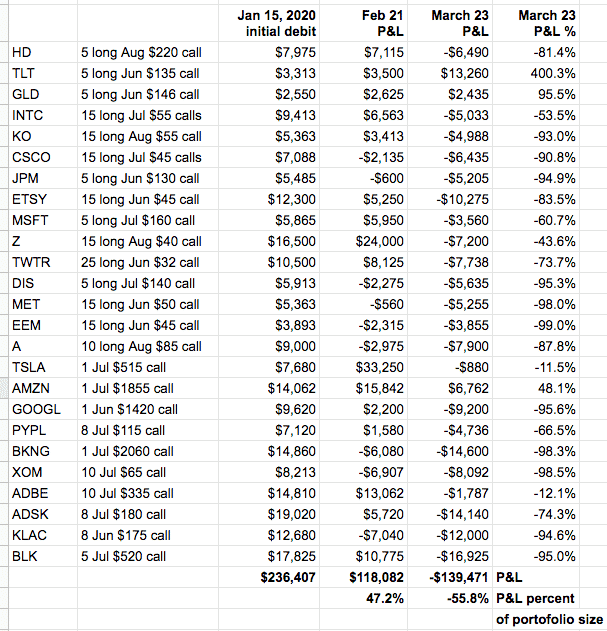

If the investor decided to fully allocate the entire portfolio to long calls (even if supposedly “diversified” across the 25 underlyings shown below), the portfolio would lose half its value in just one bad market downturn.

When a portfolio loses 50% of its value, it requires a doubling of the remaining amount in gains to break even.

Conclusion

Each investor needs to decide how much risk to take by proper position sizing and portfolio allocation.

Because of the low capital requirement of the long call, it can be difficult to properly conceptualize the amount of risk that is being taken, especially for investors who are transitioning to options from the stock investing world.

The long call is indeed equivalent to the married put position.

So every time you buy a long call, think of it as equivalent to buying 100 shares of the underlying plus a protective put with the same strike and expiration.

The Delta Dollars of the two positions will be nearly identical.

The reader is encouraged to learn about and use Delta Dollars to gauge the amount of market exposure a particular option position has in terms of stock equivalents.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.