Every trade involves some level of risk. The out-of-the-money call is no exception. In this article, we will look at the risks associated with purchasing a call out of the money.

We will discuss some strategies for mitigating these risks.

Contents

- The Basics

- Risk #1 – Price Risk (Delta)

- Risk #2 – Time Decay (Theta)

- Risk #3 – Decreases In Implied Volatility (Vega)

- Which Risk is the Greatest?

- Should I not Trade Out-of-the-money Calls Because Of These Risks?

- Closing Remarks

The Basics

Calls give investors the right to buy a security at a given price before a specific date in time.

Out-of-the-money calls are calls with strikes that are currently above the spot trading price of the security.

As a refresher, an option can have two sources of value.

As the strike price for out-of-the-money options is above the current trading price, these options have no intrinsic value.

Alternatively said if the expiration were moved up to today, these options would be worthless.

What these options do have is extrinsic value.

There are three main risks an out-of-the-money call has to lose value.

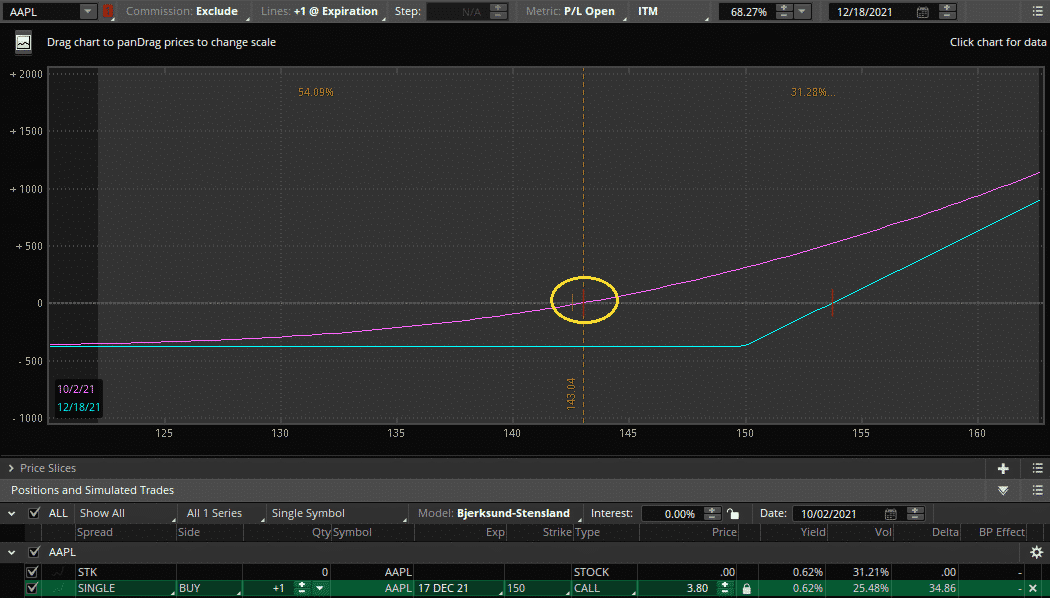

Using an example of an Apple 150 Call Option bought for $380 (shown below), we will explore the risks of losing value.

Risk #1 – Price Risk (Delta)

Most often, the largest risk to any option is the risk of a price move in the underlying stock.

In the example above, a move down makes it less likely that our 150 call will be in-the-money on expiration.

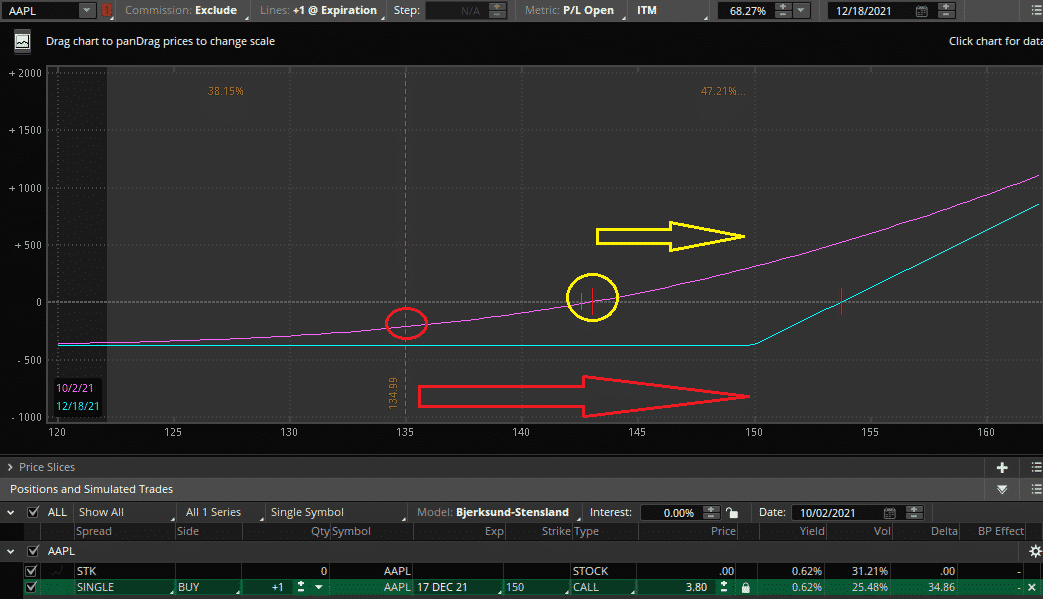

To show this, we have moved the spot price down to $135, with all things equal.

We can see from our arrows at our new price.

The stock has further to go for the call option to have any value.

Our purple line, showing our instantaneous P&L, shows a loss of $22, more than half our $380 call option value.

Risk #2 – Time Decay (Theta)

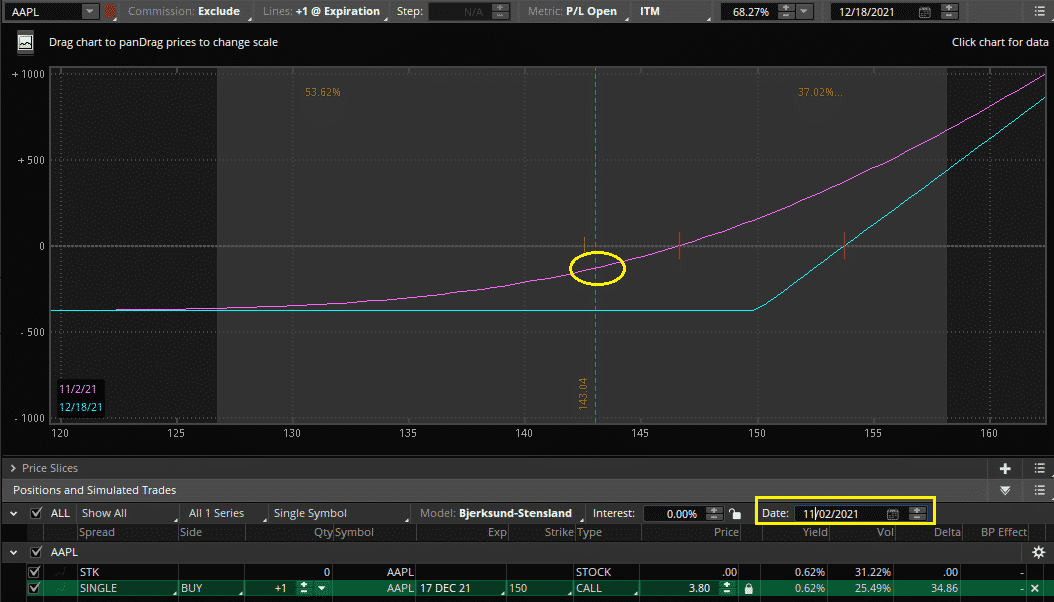

Time decay is the process of which an option will lose value by the passage of time, with all other things equal.

The price needs to move to $150 for our option to be worth anything on expiration time is valuable.

The more of it, the better.

Therefore, with no or little movement in the security, the passage of time is to our detriment.

In the below example, we have moved time forward one month from our current date with no change in share price.

We can see that despite having over a month left to expiration, our options contract has already lost a fair amount of value (-$130) of its original premium.

Out-of-the-money shorter-dated options will be specifically sensitive to theta decay as every day that passes, the move they need to obtain becomes more and more improbable.

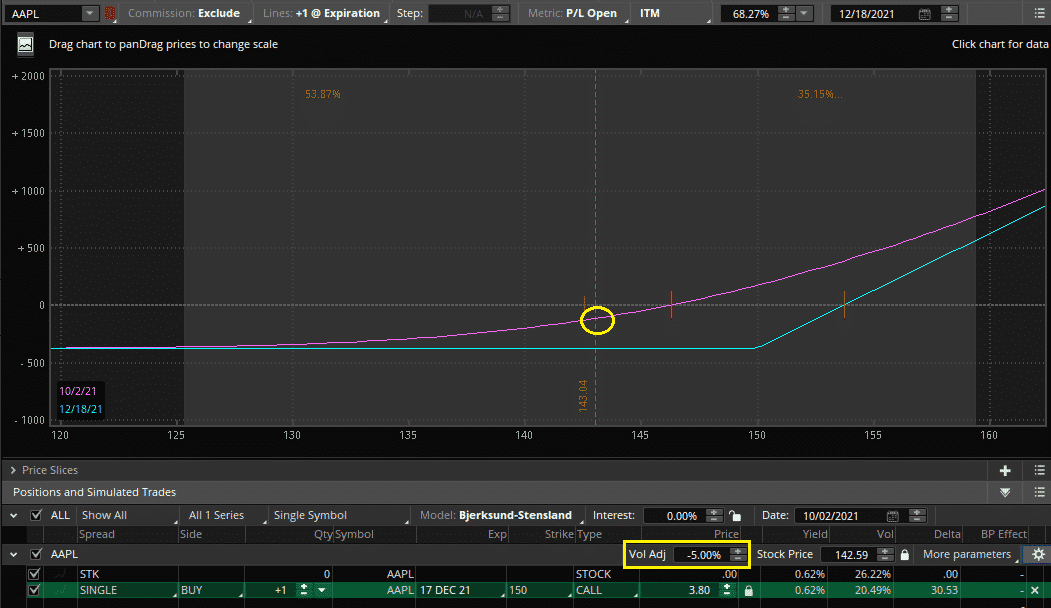

Risk #3 – Decreases In Implied Volatility (Vega)

One of the most common risks overlooked with buying call options is vega risk.

This is the risk that the level of implied volatility falls, thus making it less likely that the stock will have a significant move higher than our call option strike.

This could happen as the market decides its expectations for future volatility are now lower.

In turn, this lowers the value of the contract.

In this example, our contract has a volatility of 25.4%.

To explore what a decrease in vega will do to the contract.

The graph below shows the change for a 5% decrease in implied volatility.

We can see here that simply adjusting the volatility 5% lower results in a $120 loss, all other things equal.

It is essential to know that just like price, vega can also be beneficial.

If the level of volatility goes up, the call option can benefit.

Hence if you want exposure to long vega, a call option is a great way to do it.

Which Risk is the Greatest?

All out-of-the-money call options will have these three risks to varying degrees.

Despite this, there can be vast differences.

Shorter dated options have significantly more theta risk than longer-dated options.

In contrast, longer-dated options have very little theta but a lot more vega risk.

For those who enjoy sports betting, purchasing an out-of-the-money short-dated call is equivalent to betting on your hometown (underdog) team to win a game.

They are not expecting to win, so the payoff will be great if they do.

In this case, the match’s events (delta and theta) determine the outcome.

In contrast, a longer-dated call option is similar to betting on your team making the playoffs.

While winning or losing a match may have some effect, things like injuries to your team’s star player or poor chemistry (vega) can play a far bigger role.

Based on these risks, there is no out-of-the-money call that is universally “better”.

If you want exposure to short-dated moves in a security trade, the near-dated calls, or longer-term moves or think volatility is undervalued, choose the longer-dated calls.

Should I not Trade Out-of-the-money Calls Because Of These Risks?

Some novice investors will suggest only trading in-the-money calls as they are less “risky” than out-of-the-money options.

In fact, on a contract per contract basis, this is wrong.

A single in-the-money delta 70 call will have almost identical theta and vega exposures to a delta 30 call.

The big difference is that the in-the-money option has a lot more delta risk.

A call option’s maximum loss is its premium.

Therefore on a contract per contract basis, the in-the-money options have more risk.

Of course, if an investor wants this increased delta exposure, the 70 delta call will perform better.

It will also have a higher probability of profit. In contrast, the delta 30 calls will have a higher risk to reward ratio.

Closing Remarks

The risk of buying out-of-the-money calls is that they expire worthless, and the premium paid is lost.

This is common as out-of-the-money calls are only made up of extrinsic value and need to be in-the-money and have intrinsic value to have any worth on expiration.

There are three risks for out-of-the-money calls.

Price risk occurs if the price of the security falls.

Theta decay occurs if time passes when the stock realizes less volatility than is implied, causing the option to lose time value.

Lastly, vega risk occurs if the level of implied volatility falls.

Out-of-the-money calls have a low probability of profit but a high payoff.

This can make evaluating a strategy’s performance in the short term difficult.

By focusing on the risks of these options, we can better understand when we are comfortable taking these exposures and understand why our options’ value changes over time.

If we are uncomfortable with the losses and risks, we can always trade smaller positions or reduce risk.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.