While shorting volatility can be a good idea on many occasions, there are times that a trader may want to long volatility.

That is, initiate a trade when volatility is low and close the trade for a profit when volatility increases.

This is especially apropos when the VIX volatility index is at its lowest and seems unlikely to go much lower.

There are many ways to go long the VIX.

Today, we will look at using the out-of-the-money (OTM) butterfly option structure.

Contents

The Inverse Relationship Between SPX and VIX

A lot of the time, the market likes to go up.

This is the chart of the SPX (the S&P 500 index).

When SPX goes up, the VIX tends to go down…

The VIX is the volatility index of the S&P 500.

Therefore, shorting the VIX is what a lot of traders will do.

The only problem is that occasionally, the VIX spikes up, and the short VIX trade is in trouble.

So, some traders will attempt to capture those temporary rises in VIX with perhaps some market timing.

How Do We Go Long On The VIX?

VIX is an index, so we cannot simply buy shares of the VIX.

Yes, you can buy shares of VXX (an ETF that tracks the VIX) or use a bull call debit spread or many other ways.

Today, we will use the out-of-the-money (OTM) butterfly on the VIX.

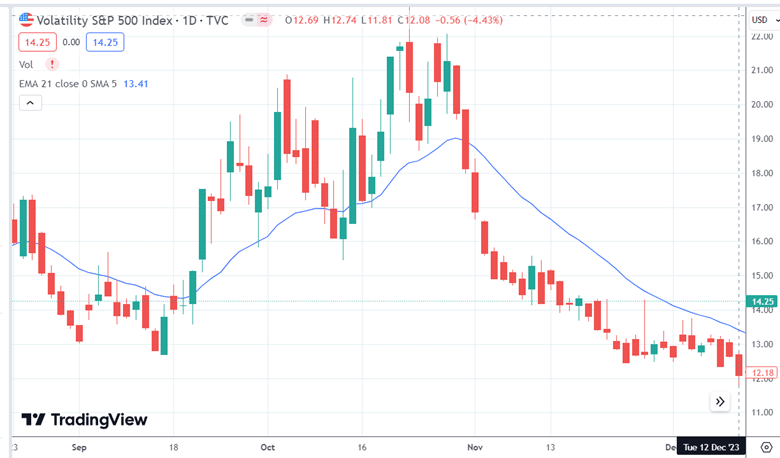

Suppose on December 12, 2023; we feel that the SPX (shown below) is due for a pullback, having not touched the 21 EMA for a while and is now up four green candles in a row.

Because we anticipate a pullback on the SPX, we also anticipate a corresponding rise in the VIX.

Right now, we see that the VIX is at a low of 12.

How high might VIX go in a pullback?

No one knows.

Let’s guess around 15.

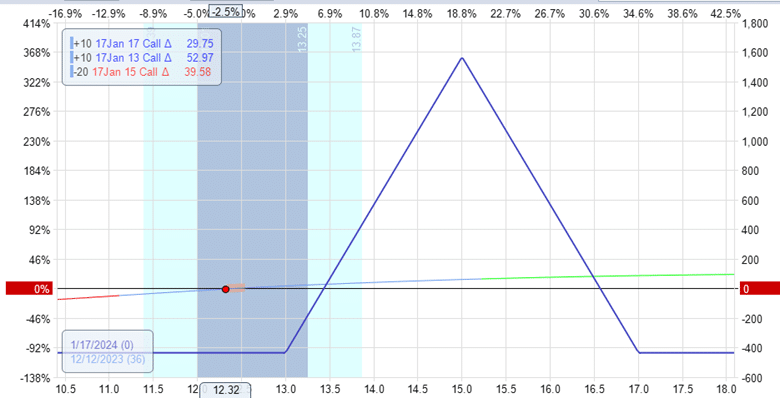

So a trader might buy ten butterflies with the short strikes centered at 15 for an expiration 36 days away:

Date: December 12, 2023

Price: VIX @ 12.32

Buy ten January 17, 2024 VIX 13 call @ $2.01

Sell twenty January 17, 2024, VIX 15 call @ $1.21

Buy ten January 17, 2024 VIX 17 call @ $0.85

Debit: $435

We use call options because the fly is out-of-the-money (OTM) above the current price.

The payoff graph will look like this:

Because this is a symmetrical fly, meaning that the upper wing width and the lower wing width are the same (at 2 points each), the maximum amount we can lose on this fly is the debit paid. In this example of a 10-lot fly, it would be $435.

This is where the lowest part of the graph is at about $400 P&L.

The highest tip of the graph represents the maximum theoretical potential profit of about $1600.

Hence, this trade has a theoretical reward-to-risk of 4.

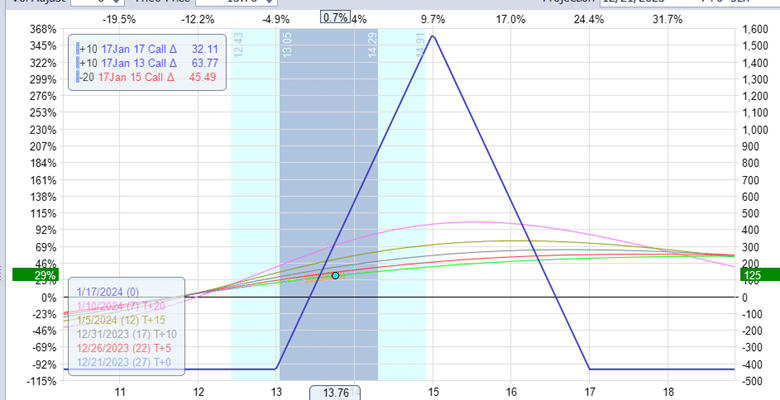

We are not waiting for expiration or waiting for the VIX to get to exactly 15.

If you look at the T+0 line (curved line above), we will make some profit as long as VIX goes up.

It is at the discretion of the individual trader to decide when and how much profit is good enough to close the trade.

The Greeks

Even if the VIX does not go up but stays where it is, profit from theta is still possible as time passes.

This is because the fly is placed close enough to the current price that it still has a positive theta even though the price dot is outside the expiration graph tent.

Albeit, theta is quite small and is certainly not this trade’s primary driver of profits.

The Greeks for this starting position are:

Delta: 32

Theta: 2

Vega: -0.93

The primary money maker in this trade is the positive delta.

On December 21, just nine days after the trade was entered, the VIX went up to 14.

This move in the VIX corresponded to a pullback in the SPX.

Is this good enough to take profit?

To some, yes.

The payoff graph shows a P&L of $125, or 29% return on margin.

To others, they might want to wait to see if VIX goes up more.

The next day, the P&L increased to $160, a 37% return.

But for those who waited too long, the VIX came back down almost as quickly as it went up.

On December 28, the profits on the fly were gone since the VIX returned back down to 12.5.

On January 4, the VIX gave us another chance to profit when it spiked again.

Summary

The VIX OTM fly is a good strategy when VIX is very low and likely not to go lower.

Because VIX tends to revert to its mean, it is just a matter of time before it goes back up.

Give the fly a good number of days to expiration and wait for the VIX to come back up a little so we can close the trade for a profit.

It also can act as a hedge to other strategies that are long the market. If the market drops, VIX tends to spike up.

So this is how the VIX OTM fly does its job.

We hope you enjoyed this article on how to get long volatility with the VIX OTM Fly.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.