By income butterflies, we refer to non-directional flies that rely on theta decay for their profit.

These strategies benefit when implied volatility (IV) drops because they are negative vega trades.

But with IV so low already, how much more can it go?

The VIX is the CBOE Volatility Index and is a popular measure of the implied volatility of the S&P 500.

As of June 2023, the VIX is at a low of 14.

With the VIX at the lowest point in 3 years (almost at pre-Covid levels), many traders ask if they can trade butterflies at such low volatility.

Contents

Hedge With Some Negative Delta

Volatility is mean-reverting. With volatility at its low point, it will likely go back up at some point.

When?

No one knows.

How can we protect our butterfly if volatility goes up?

Give it some negative delta.

In order for volatility to go up, the market most likely would have dropped.

Having some negative delta to profit from this down move will compensate for our loss due to negative vega.

Butterfly in Low IV

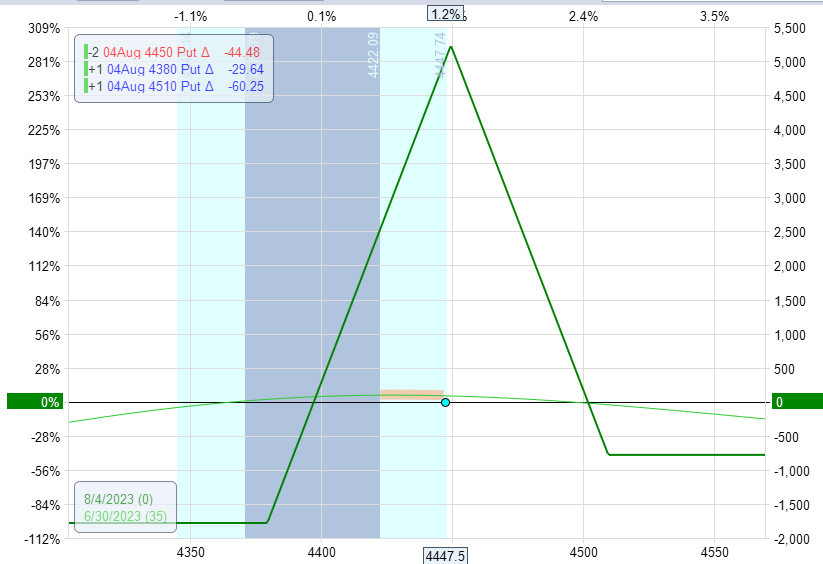

Consider the following butterfly on June 30, 2023, where the VIX was at a three-year low of 13.

It has 35 days till expiration (DTE) and has a negative -0.8 delta.

It costs $780 for one contract on the SPX.

The expiration graph determines the reward-to-risk, which is about 3, calculated by $5200/$1750.

Is this good pricing? Is this a good reward-to-risk for this 60/70 butterfly (60 points upper wing and 70 points lower wing)?

Not really.

Butterfly in High IV

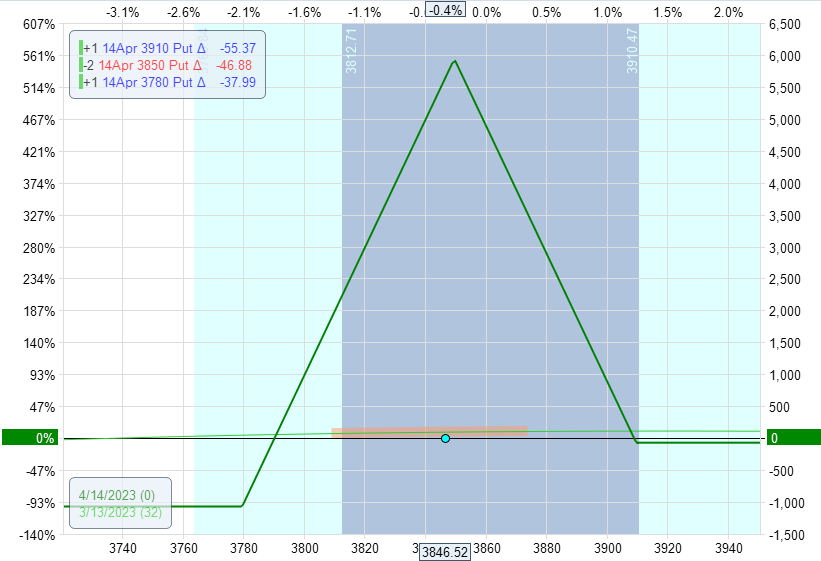

Let’s see how we can get better pricing and reward-to-risk when we have a higher IV, such as on March 13, 2023, when the VIX is 25.

This butterfly is also a 60/70 butterfly.

It has a similar 32 DTE.

But it only costs $70 for one contract.

Its reward-to-risk is about 6 (twice as much as the June butterfly).

This is the advantage of putting on these butterflies at high IV.

Extending the DTE

But we cannot always have high IV. How can we trade these butterflies at lower IVs?

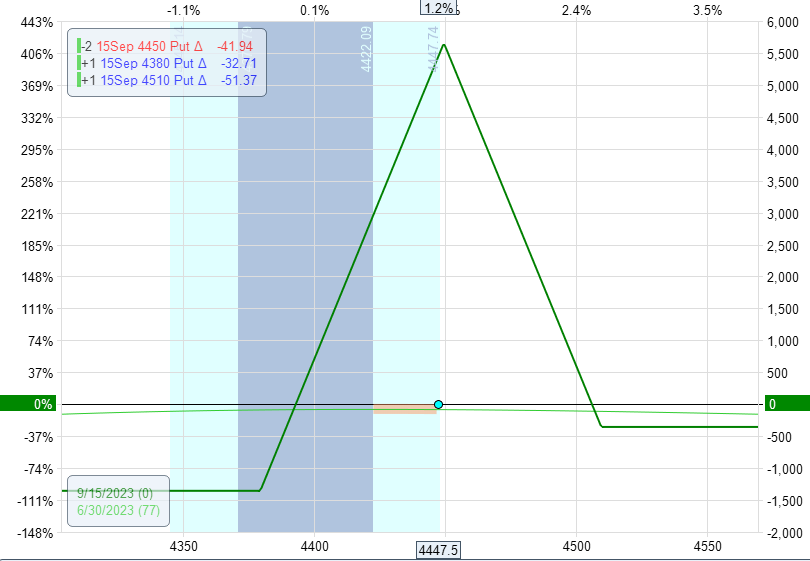

Let’s try extending the DTE to 77 for the June butterfly.

Now the 60/70 butterfly with the same strikes costs $355 instead of $780 (half as much).

The reward-to-risk has improved slightly to $5500/$1500 = 3.6.

While this is still not as good as the butterfly in high IV, the metrics are at least improving in the correct direction.

Conclusion

Butterflies are simply less efficient at making money in a low IV environment.

It may not be obvious why this is the case, but modeling the butterflies in OptionNet Explorer during high and low IV environments just turns out this is the way it is.

Some experienced butterfly traders will scale down their butterflies during these lower IV periods.

And others may start pairing the strategy with other strategies which perform better in lower IV environments (such as calendars).

But that’s up to you.

If you must trade butterflies during low IV, give it some negative delta to protect it if IV spikes.

And extend the DTE to longer terms to lower its cost and improve its reward-to-risk ratio.

We hope you enjoyed this article on income butterflies.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.