Interest rates are the lifeblood of the financial world.

They affect all financial instruments involved with the flow of money and time.

A few examples of these are Bonds, Mortgages, and, you guessed it, Options.

Regarding options, the influence of interest rates is fairly profound, especially as they move higher.

They directly affect how options are priced, making it essential for traders to stay aware of potential shifts in monetary policy.

Contents

Introduction

In recent history, traders didn’t need to worry about rates, with them being near zero for so long, but that has changed.

It all centers around the risk-free rate (often the rate for the one-year US bill), which is the return you can get on your money with zero theoretical risk.

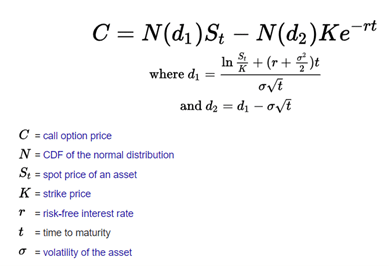

This rate is vital in the Black Scholes (shown here) and other pricing formulas.

Rate changes are often infrequent and small, usually only in 0.25% increments.

Even though these small changes can impact options pricing, their effect is often less dramatic than the more significant movements caused by other factors, such as volatility, delta, and theta decay.

This has not been the case recently, though, as rates rapidly moved from nearly 0% to over 4% within a 2-year period.

Join us below to learn more about the rates, how they impact options, and how to best prepare for it.

Understanding Options And Interest Rates

As mentioned above, the most important rate to have is the Risk-Free Rate; this will drive everything else in an options pricing model.

One thing to be aware of here is that you need an annualized rate there, so if you use something other than the Treasury, make sure you are calculating the annual rate correctly.

Higher interest rates help the pricing and effectiveness of call options through something called the ‘Interest Advantage.’

Conversely, put options become less appealing with higher rates in a condition named, as you may have guessed, the ‘Interest Disadvantage.’

This dynamic becomes even more pronounced when traders use margin or other leveraged funds to place options trades.

This changes the pricing equations slightly because the cost of borrowing now becomes a contender.

This borrowing cost is one reason the Risk-Free Rate is vital to this formula.

How Do Interest Rates Affect Options

Interest rates play a significant role in the pricing and usage of options, but the effect differs depending on the actual contract being used.

Higher interest rates are often better for call options because any unexpended capital can earn interest at higher rates.

This is especially important when considering whether to use a call option or just go long the underlying stock.

The time value of a dollar (or the discount rate) helps offset some premiums and, as a result, helps call buyers to pay lower premiums, boosting profitability.

In contrast to calls, rising interest rates can have a negative impact on puts; higher interest rates may make shorting stocks more attractive compared to purchasing puts outright.

A short seller can take the proceeds of the short sale and collect margin interest on it while they are waiting for the trade to work.

There are two main considerations for this, though; first, will the amount of interest be received to cover the margin paid to borrow the stock?

The second consideration is if your account is large enough to place this type of trade.

Options Pricing Models and Rate Sensitivity

Now that we know what rates are used and how they impact options pricing let’s look at how sensitive these models are to rate changes.

As with most things in options, we have a Greek for that: Rho.

Rho measures how sensitive an options price is to a change in the interest rates.

One thing about Rho, though, is that its impact is often muted by the fact that interest rate changes happen so infrequently.

As a result, minor interest rate fluctuations may not significantly impact pricing; as stated above, Theta, Delta, and Volatility have a much larger effect.

The only caveat to that is when you experience a shift similar to what we had when we started hiking rates.

This significant change in monetary policy can make Rho much more impactful on options pricing.

Another factor impacting Rho’s effect in options pricing is the “Moneyness” of the option.

An In the Money option will usually see a larger impact from rate fluctuations than an Out of the Money option.

One reason is that in-the-money options can be used as stock replacement and have an intrinsic value, whereas out-of-the-money options are more speculative and have no intrinsic value.

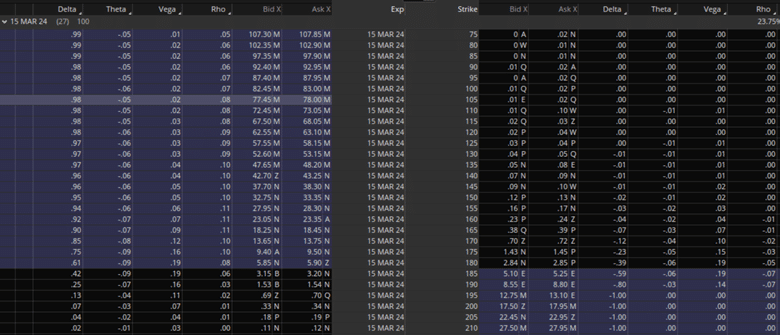

An example of the effects of Rho can be seen in the image below of Apple’s (AAPL) March calls and puts.

They are about a month out in terms of expiration, and Rho has a more profound effect on the In the Money and At the Money calls than the Out of the Money ones.

Its impact on Puts at this expiration is mostly limited to the strikes around at-the-money.

Practical Applications of Rho

Now that we have explored all of the impacts of rates let’s look at some examples and scenarios where rate changes could impact decisions.

Now that Rates are on the move again, we should show how Rho can impact options pricing in practical terms.

Rho, which is displayed as a decimal, is positive for call options and negative for put options, and the value of Rho is the percent change that occurs in the options price given a 1% move in the risk-free rate.

So, for instance, if rates move from 4% to 5% and a call option has a Rho of 0.25, the option price will increase by $0.25. For a put option with the same negative Rho, so -0.25, the put option price will decrease by $0.25.

Rho is also one of the few Greeks that can be applied to an entire portfolio to show how the aggregate positions would respond to changes in interest rates.

Some investors aim for a Rho of 0 so that they are completely unaffected by rate changes, in theory.

The last application for Rho is on LEAPS, as with the option’s moneyness, the further dated an option is, the more heavily it is impacted by Rho.

As a result of this, LEAPS, even Out of the Money ones, can see a more significant impact from rates than their shorter-dated counterparts.

Conclusion

In finance, particularly options trading, the link between interest rates and options pricing is important, especially as rates continue to increase.

The shift from near-zero rates to over 4% has highlighted this relationship, especially to new traders who have never been active in higher-rate environments.

The Risk-Free Rate, often the yield on the 1-year US Treasury bill, is central in options pricing models like Black-Scholes, affecting call and put options differently.

Higher rates benefit call options by providing an ‘Interest Advantage,’ whereas they diminish the appeal of put options, introducing an ‘Interest Disadvantage’ that makes short selling more enticing under certain conditions.

The impact of interest rates is also critical when leverage or margin is involved.

Here, the borrowing cost becomes the focus of a trading decision. A

dditionally, the sensitivity of options pricing to rate changes, measured by the Greek Rho, becomes more significant during large monetary policy shifts.

This sensitivity varies with the ‘moneyness’ and the duration of an option, impacting in-the-money and long-dated options more due to their intrinsic value and time component.

As rates and policy continue to evolve and change, understanding how this interplay occurs can help keep you on the right side of the trade as a trader.

We hope you enjoyed this article on the impact of interest rates on options.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.