The gamma and theta relationship is essential for understanding options pricing, especially as expiration approaches.

Gamma measures how much an option’s delta changes with a $1 move in the underlying price.

In contrast, theta assesses the rate at which an option’s time value decreases.

These two Greeks are not often associated with each other but are linked quite closely.

Typically, high gamma leads to increased theta decay, which can impact your potential profit depending on your strategy.

If you want to profit from price changes while managing time decay, you must balance Gamma and Theta effectively.

Contents

Definitions Of Gamma And Theta

Before diving into the relationship between Gamma and Theta, let’s have a working definition of them and how they affect an option price.

As mentioned above, gamma measures how sensitive an option’s delta is to changes in the underlying asset’s price.

It tells a trader how much the delta will shift as the asset’s price fluctuates.

Higher gamma indicates that smaller price movements in the underlying asset can significantly change the option’s delta, altering both the option’s price and your potential profit or loss.

Theta quantifies the rate at which an option loses its extrinsic value as it nears its expiration date, also known as time decay.

This time decay means that if the underlying asset’s price remains stagnant, the option’s value will decrease over time.

This is one of the principles that options selling looks to profit from.

Understanding The Gamma-Theta Trade-Off

With a basic understanding of Gamma and Theta, let’s look at the relationship and trade-off between the two Greeks.

A high gamma often leads to increased theta decay, posing challenges for traders.

Positive gamma can help you profit from larger price movements if you’re an option buyer, but negative theta will erode your option’s value.

On the opposite side of that, if you are an options seller, a higher gamma can help you see a profit on the short option faster, but any sudden price moves in the underlying can quickly turn your profit into a loss.

To summarize:

- Higher gamma usually means greater potential profit from price changes.

- Positive gamma benefits option buyers but comes with increasing theta decay as expiration nears.

- Market volatility can amplify both gamma and theta effects, altering your risk profile.

Balancing Gamma and Theta can help keep your positions green and keep you on the right side of the trade.

It can also help anticipate how an option will react to a move in the underlying.

Theta/Gamma Ratio Explained

One way to simplify the relationship between Gamma and Theta is to create a ratio.

Theta/Gamma ratio is a quick way for options traders to quantify the interplay between the two Greeks.

It can clearly compare the time decay of an option (theta) and the rate of change in its delta (gamma).

Here are some key points about the Theta/Gamma ratio:

-

- A higher Theta/Gamma ratio indicates better risk-adjusted returns.

-

- In low implied volatility (IV) environments, risk/reward ratios are less favorable and can average a 1:1 ratio given the lower gamma on some positions.

-

- In high IV environments, the spike in gamma can yield an average risk/reward of as high as 1:6, depending on the strike, name, and gamma value.

-

- The Gamma/Theta ratio can also help traders identify the most advantageous market conditions based on their risk appetite.

-

Options Strategies High Gamma/Theta Ratios

To capitalize on a high gamma/theta ratio, consider deploying options strategies like the long straddle or long strangle, which are designed to benefit from significant price movements in the underlying asset.

A long straddle involves buying a call and a put option with the same strike price and expiration date, allowing traders to profit from any large price swings, regardless of direction.

This strategy benefits from a large gamma/theta ratio.

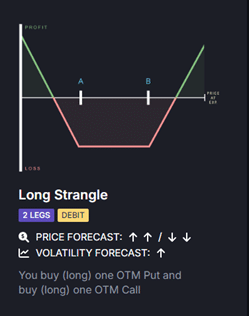

The long strangle is similar but involves buying out-of-the-money call and put options with different strike prices for the same week.

This can be a cost-effective alternative to a straddle while still providing exposure to large price moves.

Given that the options are further out of the money, a more significant move in the underlying is needed for the strategy to be profitable compared to the straddle.

The long straddle and strangle capitalize on a high gamma/theta ratio, which also comes with substantial theta decay, meaning the value of these options erodes over time if the underlying asset does not move significantly.

This makes them a solid choice for either news events or highly volatile names.

Image courtesy of UnusualWhales.

Ratio spreads and butterfly spreads are another way to position based on the gamma/theta ratio.

These spreads offer different gamma profiles and risk-reward dynamics, making them useful in specific market conditions.

A ratio spread involves buying and selling different quantities of options at different strike prices, which can give a more precise exposure to gamma and theta.

For example, a 1×2 ratio call spread has a positive gamma near the bought strike but a negative gamma near the sold strikes, allowing traders to benefit from moderate price movements while collecting premiums.

Butterfly spreads involve buying options at lower and higher strikes while selling options at a middle strike.

This setup offers limited risk and reward, with positive gamma near the wings but a more neutral exposure around the center strike.

Once you understand the gamma/theta ratio and how the two interact, creating options and positions that provide the exact exposure you are looking for becomes easier.

Straddle, Strangles, Butterflies, and Ratio Spreads are just a few examples of these types of trades.

Strategies For Managing Gamma And Theta

Knowing what positions to put on is only half the battle with gamma and theta, though effective management can considerably enhance your trading returns.

You can assess the risk-reward dynamics of your options positions by continually monitoring the gamma-theta ratio and market conditions.

Below are some strategies to help manage your positions:

Adjust for market volatility: As volatility increases or decreases, adjust the number of contracts or strikes to better align with the current market condition. For a strangle, for example, as volatility starts to leave a name, the strikes can get rolled closer to the current price to reduce the need for a large move.

Opt for longer-dated options: These help mitigate theta decay impacts while maintaining positive gamma, allowing you to profit from significant price movements without immediate time pressure. This works best for long-option strategies.

Re-evaluate positions regularly: For longer-term positions, evaluating and rolling strikes can help keep you profitable, even if the position is unprofitable.

Monitor the gamma-theta ratio: A higher ratio indicates better risk-adjusted returns, so aim to position yourself accordingly. As the ratio starts to fade, utilizing one of the strategies above or switching to a different stock may be necessary.

Conclusion

Understanding the relationship between Gamma and Theta is important for any options trader looking to optimize their strategy.

By balancing these two Greeks, you can better manage the dual pressures of price volatility and time decay.

Whether you employ strategies like long straddles and strangles to leverage high gamma/theta ratios or opt for butterfly spreads and ratio spreads to fine-tune your exposure, the key is monitoring and adjusting positions based on market conditions and risk tolerance.

Mastering the interplay between Gamma and Theta allows you to navigate the complexities of options trading more confidently and precisely, keeping your positions aligned with your trading objectives.

We hope you enjoyed this article on the relationship between Gamma and Theta in options.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi Gavin,

Which level of ratio do you recommend for long strangles. and Bfly for low and high implied Vol?

if I understand well, Theta/Gamma better for adjusting net selling positions and Gamma/Theta for long buying ones?

thanks

laurent M

Yes Theta/Gamma for net selling positions and Gamma Theta for net buying positions.