Rising market volatility got you down?

Whipsaw action keep taking out your stops?

Well, I have the answer. Learning strategies for trading a rising volatility environment is the key to becoming a successful options trader.

Today I’m going to talk about my 3 favorite strategies to trade when volatility is on the rise such as it is now. But first let’s take a quick look at implied volatility and discuss why it is so important.

Contents

- What Is Implied Volatility?

- Why You Should Care?

- Long Strangle / Long Straddle

- Iron Condor

- Calendar Spread

What Is Implied Volatility?

Implied volatility is a key concept for option traders and even if you are a beginner, you should try to have at least a basic understanding.

Volatility is the most subjective input into option pricing models and therefore gives us the greatest potential to find an edge. All other things being equal, higher implied volatility equals higher option prices.

Here is a theoretical example to demonstrate the idea. Let’s look at a stock priced at 50. Consider a 6-month call option with a strike price of 50:

If implied volatility is 90, the option price is $12.50

If implied volatility is 50, the option price is $7.25

If implied volatility is 30, the option price is $4.50

So you can see that the higher the volatility, the higher the option price.

Why You Should Care

Trading volatility is a fantastic skill to add to your trading armory. If you can correctly take a view on where implied volatility is heading, it gives you one more way to gain an edge in the markets.

Having an understanding of volatility will set you apart from most of the other traders out there.

Here are the three best strategies for trading rising volatility:

1. Long Strangle / Long Straddle

These are my personal favorites for getting long volatility as the positions have a significantly high Vega.

A long strangle is set up by buying an out-of-the-money call and an out-of-the-money put. If you were to use at-the-money options, it would be a long straddle as the call and the put are “straddling” the one option strike.

A long straddle costs a lot more but starts to make profits much quicker whereas and long strangle costs less but needs a larger move in the underlying in order to make a decent profit.

Let’s look at some examples using SPY, one of the most liquid vehicles for option traders. I’ll look at a July Long Straddle, a September Long Straddle, a July Long Strangle and a September Long Strangle. Then I will compare the four strategies.

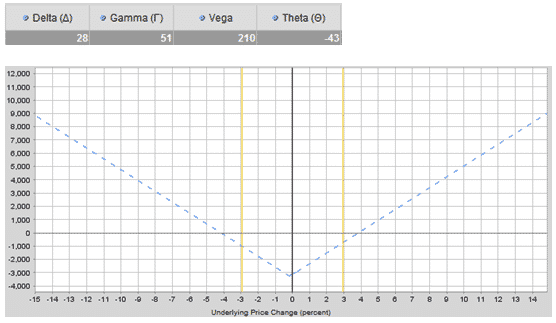

Date: June 11, 2013

Current Price: $163.10

Trade Set Up: SPY July Long Straddle

Buy 5 July 19th SPY 163 Calls @ $3.01

Buy 5 July 19th SPY 163 Puts @ $3.49

Premium: $3,250 Net Debit.

Date: June 11, 2013

Current Price: $163.10

Trade Set Up: SPY September Long Straddle

Buy 5 September 20th SPY 163 Calls @ $5.01

Buy 5 September 20th SPY 163 Puts @ $5.99

Premium: $5,500 Net Debit.

For the Strangles, I decided to go roughly 5% out-of-the-money and keep the position close to delta neutral. Let’s take a look at how they compare to the Straddles.

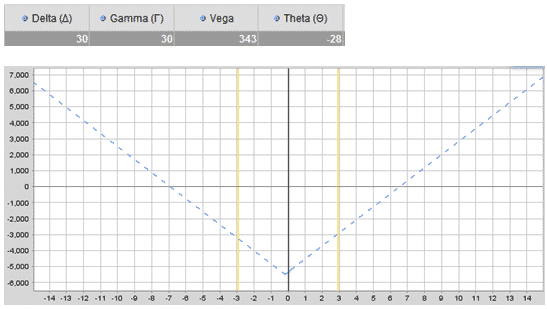

Date: June 11, 2013

Current Price: $163.10

Trade Set Up: SPY July Long Strangle

Buy 5 July 19th SPY 168 Calls @ $1.17

Buy 5 July 19th SPY 156 Puts @ $1.41

Premium: $1,290 Net Debit.

Date: June 11, 2013

Current Price: $163.10

Trade Set Up: SPY September Long Strangle

Buy 5 September 20th SPY 168 Calls @ $2.52

Buy 5 September 20th SPY 156 Puts @ $3.75

Premium: $3,135 Net Debit.

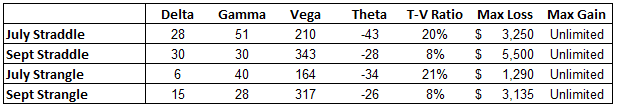

Rather than discuss the 4 variations individually, I feel it’s best to present some of the key information in table format so we can compare.

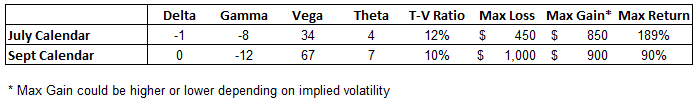

From the table, you can see that the longer term trades have a higher Vega and also less Theta decay. However, they also require more capital to be put into the trade.

With a higher Vega exposure, they will lose more if your view on rising implied volatility is incorrect. The September trades have a lower Theta to Vega ratio, so you are getting more Vega bang for your Theta buck.

Strangles require less capital than straddles, but the stock has to move further in order to make a profit at expiry. Strangles also have a lower Vega exposure and less Theta decay.

2. Iron Condor

One of my main trading strategies is an Iron Condor which is a short volatility trade. A long iron condor is a very common strategy for traders looking to generate monthly income from stocks that stay within a certain range.

The opposite of a long iron condor is a short iron condor which is a long volatility trade. If you are trading options for monthly income a short iron condor is a good addition to your portfolio as it will help offset any losses from your short volatility trades.

To set up a short iron condor, you buy an out-of-the-money bull call spread and an out-of-the-money bear put spread. A short iron condor is a net debit trade and your maximum loss is limited to the amount you pay for the trade.

Let’s look at some examples using SPY. I’ll look at a July and September Short Condor, again going 5% out-of-the-money and using 5 point wide wings.

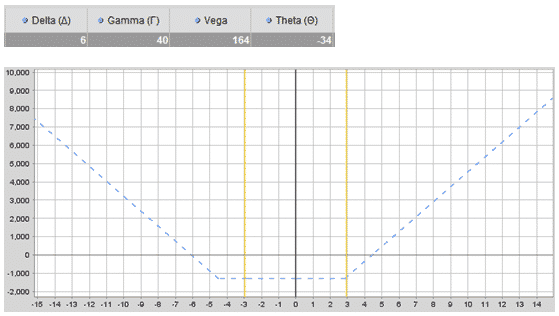

Date: June 11, 2013

Current Price: $163.10

Trade Set Up: SPY July Short Iron Condor

Buy 5 July 19th SPY 171 Calls @ $0.29

Sell 5 July 19th SPY 176 Calls @ $0.04

Buy 5 July 19th SPY 155 Puts @ $1.26

Sell 5 July 19th SPY 150 Puts @ $0.42

Premium: $545 Net Debit.

Date: June 11, 2013

Current Price: $163.10

Trade Set Up: SPY September Short Iron Condor

Buy 5 September 20th SPY 171 Calls @ $1.52

Sell 5 September 20th SPY 176 Calls @ $0.60

Buy 5 September 20th SPY 155 Puts @ $3.23

Sell 5 September 20th SPY 150 Puts @ $2.17

Premium: $990 Net Debit.

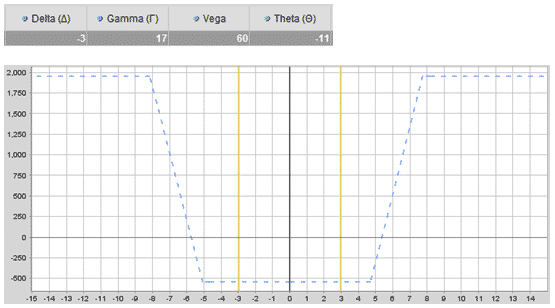

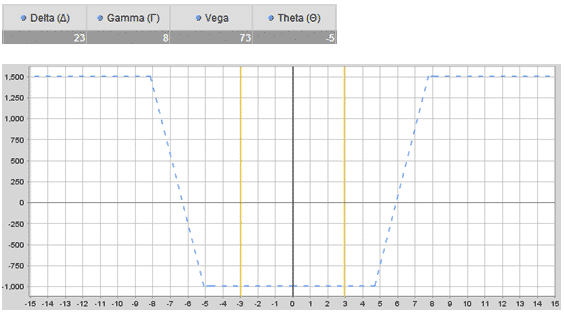

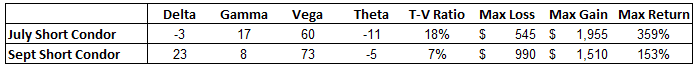

Let’s look at some of the key information in tabular format again.

The July Short Condor has a greater potential profit and lower capital at risk. The tradeoff is that you have less time for profits to come to fruition. You’re only getting slightly more Vega by trading further out in time but your Theta decay is basically cut in half.

When comparing to the Straddles and Strangles, Short Condors do not provide nearly as much Vega exposure, however their capital at risk and Theta decay is MUCH lower.

3. Calendar Spread

A calendar spread is another long volatility trade that can be created using either puts or calls.

Typically most traders would use calls and construct the trade by selling 1 front month at-the-money call and buying 1 back month at-the-money call using the same strike price.

Calendar spreads are long volatility because the long dated option will have a higher Vega than the short dated option. Therefore you are buying more Vega than you are selling.

The other benefit of calendar spreads is that they benefit from time decay due to their positive theta.

Calendar spreads involve a net debit, so you are paying to place the spread. This debit is also the maximum that you can lose from the trade.

The ideal scenario for this trade is that the stock finishes at your strike price at expiry of the short dated option while also experiencing an increase in implied volatility on the long option.

For a variation of the trade, you can set up your calendar spread with a bullish or a bearish bias. Let’s compare two SPY Calendar spreads using July-Aug expiry and July-Sept expiry.

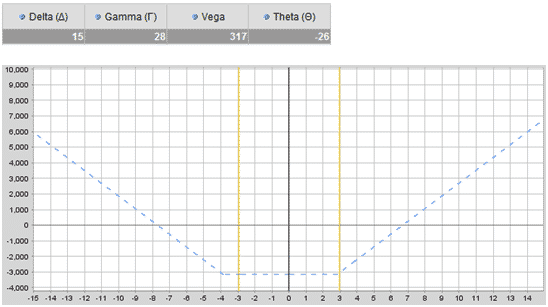

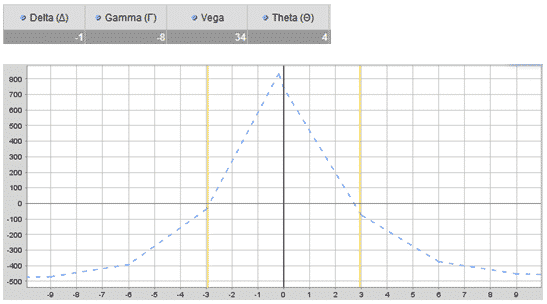

Date: June 11, 2013

Current Price: $163.10

Trade Set Up: SPY July-August Calendar Spread

Sell 5 July 19th SPY 163 Calls @ $3.01

Buy 5 August 16th SPY 163 Calls @ $3.91

Premium: $450 Net Debit.

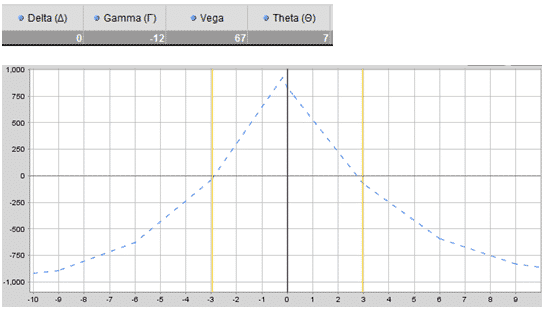

Date: June 11, 2013

Current Price: $163.10

Trade Set Up: SPY July-September Calendar Spread

Sell 5 July 19th SPY 163 Calls @ $3.01

Buy 5 September 20th SPY 163 Calls @ $5.01

Premium: $1,000 Net Debit.

Let’s take a look at how the two strategies compare.

Calendar Spreads provide one major difference to the strategies presented previously in that they are positive Theta. i.e. they make money as time passes.

You can see that by going out further in time, you can double you Vega exposure, and also increase Theta (although $7 a day is still a small amount of Theta).

The reason for the higher Theta in the September trade is that the long September calls decay at a slower rate than the long August calls.

With volatility looking like it has well and truly returned to the markets, now is a great time to start learning and testing out strategies that benefit from rising volatility.

Straddles and Strangles give you a large Vega exposure but cost a lot and decay quickly.

Short Iron Condors are cheaper but don’t give you the same level of Vega exposure and their maximum gain is capped.

Calendar Spreads give you a small amount of positive Vega exposure but have the added benefit of being positive Theta.

What’s your preferred method for trading rising volatility?

Please share this article on Facebook or Twitter using the buttons on the left! Thank you!!

Is there any conclusion to which works best?

What about additional strategies, like Short Iron Butterfly, Double Calendars?

What happens if you sell less vega than you bought on a diagonal (or calendar)? Are you reducing your profit potential 10-20% by doing so?

Typically, Diagonals and Calendars are going to be positive vega. They will do well if volatility rises.

I would suggest setting up some examples in Option Net Explorer and then changing the volatility parameters.

https://optionstradingiq.com/optionnet-explorer-review/