This guide outlines the steps to trade Covered Calls for beginners on Interactive Brokers.

Understanding the mechanics of covered calls can enhance your trading strategy and generate additional income.

Contents

What Are Covered Calls?

A covered call is an options strategy that involves holding a long position in an asset and selling call options on that same asset.

This method can provide income from option premiums while potentially allowing for some capital appreciation.

It is essential for traders to understand the risks and rewards associated with this strategy before proceeding.

Getting Started With Interactive Brokers

Interactive Brokers offers a robust platform for trading options.

This guide uses the classic Trader Workstation (TWS) interface.

Setting Up Your Trades

Start by entering the stock ticker into the platform.

For example, consider using Apple.

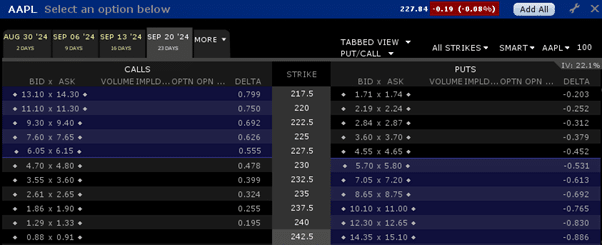

Once the stock is selected, navigate to the option chain.

Identify a call option slightly out of the money, such as the 235 strike price, for monthly covered calls.

Place an order to buy 100 shares of the selected stock.

Set the order at the midpoint price for quicker execution.

After the stock purchase is filled, sell one contract of the out-of-the-money call option at the midpoint price.

For tightly traded stocks like Apple, this step can often be executed with minimal delay.

Using Option Combinations

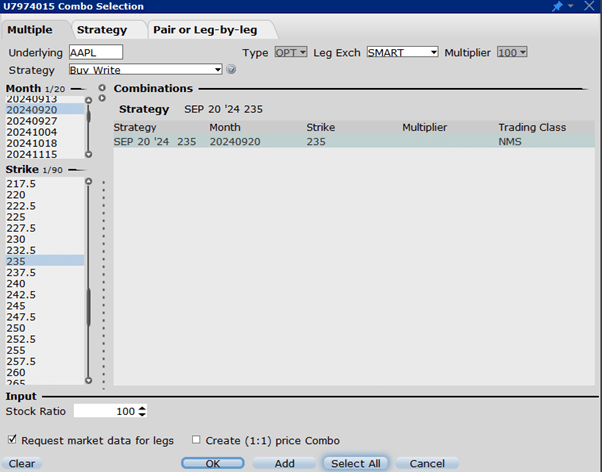

For traders who prefer combining the buy and sell orders into a single transaction, Interactive Brokers allows this through the Options Combination feature:

In the option combos section, choose the Buy Write strategy.

This option allows you to buy 100 shares while simultaneously selling a call option.

Specify your desired expiration date and the strike price for the call option.

Ensure to select the Buy Write option, not the sell option.

If setting up trades after hours, determine the midpoint of the stock price and the call option price.

Use an external tool, such as Excel, to calculate the appropriate prices for your orders.

Analyzing Trade Risk

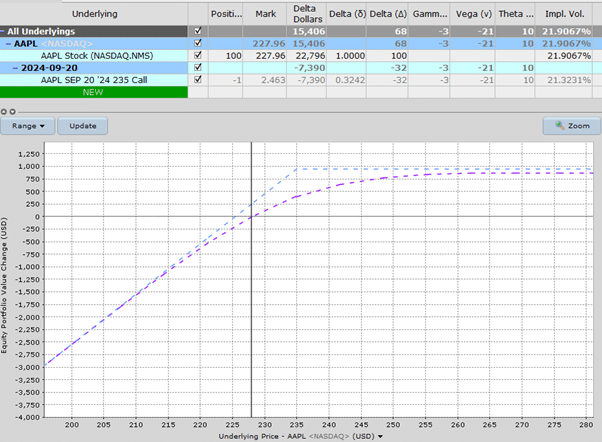

Before executing any trade, assess the risk using Interactive Brokers’ Risk Navigator.

Enter the parameters of your covered call, including the stock and options details.

Examine the risk graph for potential outcomes and ensure that the Greeks align with your trading strategy.

Exploring In-the-Money Covered Calls

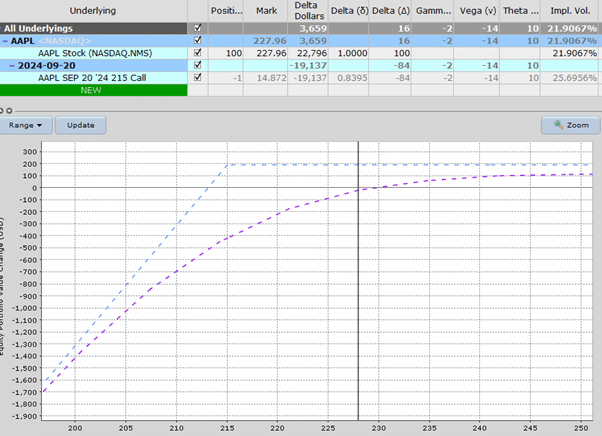

Some traders might consider deep in-the-money covered calls for lower risk and reduced volatility.

For instance, choose an option with a strike price around 215.

Compare the profit potential with that of a standard out-of-the-money call.

While the deep in-the-money call provides a smaller profit potential, it can also reduce risk exposure.

Conclusion

Executing covered calls on Interactive Brokers is not overly difficult once you get the hang of it.

By understanding the mechanics, traders can implement this strategy with minimal fuss.

We hope you enjoyed this article on Covered Calls for beginners on Interactive Brokers.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi Gav,

Is this ‘ Buy write’ feature available on IBKR mobile app?

Thanks

Sajith

Most likely, but I have not come across it yet I usually do it as two order on the mobile app. Something to look in to though.