In the world of option trading, pitfalls abound. In this article, we’ll dive into the realm of common option trading mistakes, helping you navigate these treacherous waters with confidence.

Options trading is often glamorized for its incredible returns and low start-up capital requirement.

Behind these definite perks, there are some common mistakes that many options traders make at various times in their journey.

Contents

Mistake #1: Neglecting Proper Education

One of the fastest ways to destroy your options account is through lack of education.

Once you get past the basics of Calls and Puts, there is a deep pool of knowledge to drink from, and all of these details can make or break your trading career.

The solution to this mistake is simple, though: always reading or watching things related to options or trading.

Any place where you can get reliable and accurate information will accomplish this.

After the basics, dig into the Greeks and some more advanced trading techniques.

Following that, you should learn about rolling and adjusting positions.

Finally, dive into some of the most advanced options and techniques.

This is just a suggested path; as long as you keep learning, you will be fine.

Mistake #2: Ignoring Risk Management

If education is one of the fastest ways to destroy your account, ignoring risk management is THE fastest way to blow it up.

Often, traders think that because many strategies are defined risks, you can just size up indefinitely.

This is a fallacy because, unlike equities, derivatives expire worthless if you are wrong.

Additionally, selling options is advertised as a great way to “beat the options market,” and it is very effective.

However, selling options without a hedge can quickly put your account in a lot of pain.

The first part of the solution to this mistake is twofold.

First, set your account limits well in advance of the trade.

Depending on account size, total position limits often range from 2% to 10% of an account balance.

This limits the number of contracts you can trade in, and if followed, will keep your account around long enough to trade out of it.

The second part of the solution is to have stop losses on your trades.

If you can keep them mentally and will faithfully execute them, then that works.

If you can’t, set a hard stop with your broker so you aren’t tempted to “let it ride and see if it comes back.”

Both of these are simple solutions but aren’t always easy to implement, but if you can implement them, risk management will never be an issue for you.

Mistake #3: Chasing the Hype

It’s easy to get caught up in the excitement of a hot stock tip or a trending options play.

But blindly following the crowd can lead to some serious issues for your account.

You don’t know when the tip you heard was actually relevant or if it’s even a tip at all.

It could be exit liquidity for someone stuck in a large position.

Remember, the market is a cunning beast that thrives on separating the herd from their hard-earned cash.

The solution to this mistake is to keep your exposure to these places to a minimum.

Follow your trading place to keep yourself stable in the markets.

If you find yourself on X (formerly Twitter) during the trading day, keep your stream of traders to reliable sources.

The best accounts don’t share stock tips; they trade potential setups.

If you don’t see the reasoning behind a trade, it’s probably not a great trade.

Follow your plan, and you’ll stay safe.

Mistake #4: Overlooking Liquidity

Liquidity is a tough beast to tame, especially in options because they are a straight market.

No broker is stepping in the middle to keep the spreads tight, like on equities or futures.

It’s completely possible, and often the case, that some very liquid stocks have almost no options liquidity.

This can leave you stranded in a contract even after the trade is done.

This is perhaps the easiest mistake to avoid because you can see right on your trading platform, unlike the others, where it’s mostly internal.

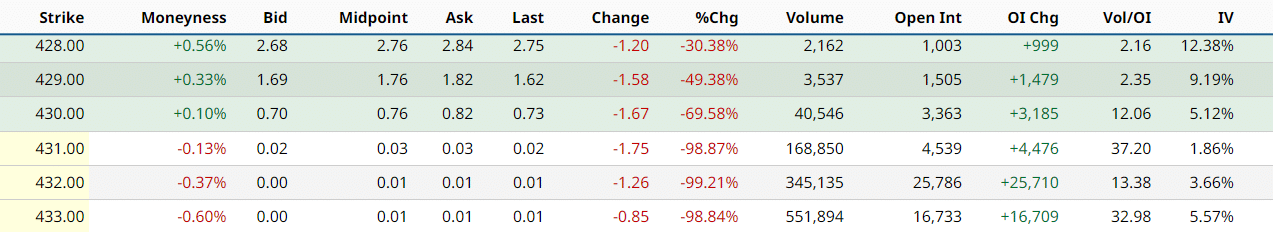

Whenever you want to enter a position, look at the Open Interest and Volume columns for the strike you watch.

If it has a high open interest, there are often plenty of contracts to help you close a trade.

If it has a high volume, the spreads will often be tighter and easier to trade out.

Ideally, you want open interest and trading volume to be at least triple digits. Below is an example of some call contracts on the SPY.

Mistake #5: Trading the Entire Market

Our final mistake plagues traders in almost every trading realm: not keeping your watchlist size in check.

Just because you have a specific setup nailed down does not mean it applies equally well across every instrument.

Each instrument has its unique trading rhythm; over time, you become accustomed to how it acts.

Options add another layer of complexity to the equation because every instrument’s options also have their own quirks.

For instance, Telsa Options almost always have an elevated Implied Volatility; those options are going to behave significantly differently than the options of Coca-Cola.

The solution to this mistake is to keep your watchlist small to start.

Focus on a small number of tickers that you enjoy trading and fit your style and timeframe.

Over time, as you get better at options trading, you will learn how to read the market with more proficiency, and you’ll be able to add more stocks to your universe if you want to.

Many traders, though, choose to stick with a small watchlist that they are very proficient at.

Conclusion

Options are an amazing trading tool and can offer a lot of potential for traders of all skill levels.

They have a lower cost of entry and can produce some seriously outsized returns for the money.

They do come with their own learning curve and with their own mistakes that many traders make.

These five mistakes are the most common among new and experienced options traders.

They aren’t always easy to spot but are often simple to solve.

We hope you enjoyed this article on common option trading mistakes to avoid.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thank,

This information is great to see and I will dig in starting 11-26-23.

I subscribe to BarCharts and follow you

Hope we can stay in touch.