Call debit spreads offer traders the opportunity to express a bullish view on an underlying security.

They can do this all while having a defined risk if they are wrong and defined benefit if they are right.

Despite this, the call debit spread can be traded in so many different ways.

This article will review the call debit spread and discuss some strategies on how to trade them.

Let’s get started.

Contents

- What Is A Call Debit Spread

- How to Trade Call Debit Spreads?

- When to Trade Call Debit Spreads?

- Concluding Remarks

What Is A Call Debit Spread

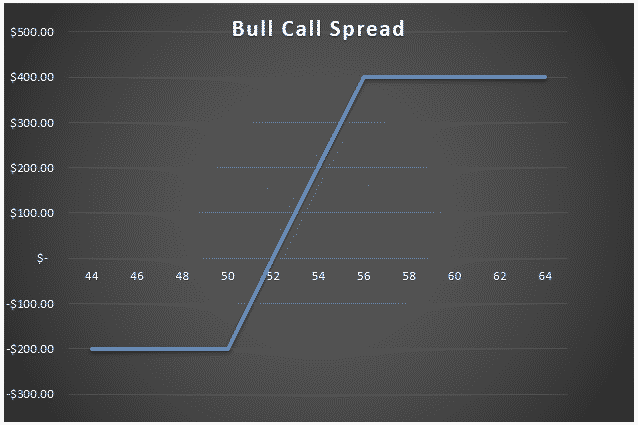

A call debit spread is a bullish options strategy that involves buying a call option and selling a further strike call option.

A debit is paid for the long call, and a smaller credit is received for the short call resulting in a net debit on the trade.

This net debit is the maximum loss on the trade.

The maximum payoff is the width of the strikes minus the debit paid.

If the structure sounds familiar, it probably is.

If you have heard of a “Bull Call Spread,” a “Call Vertical,” or a “Digital,” they are the same thing as a call debit spread.

How to Trade Call Debit Spreads?

The most important view expressed in any call debit spread is a bullish view.

This is because the delta of our long strike is always greater than the delta of our short strike.

When evaluating whether to use a call debit spread, being bullish on the underlying is essential.

Without being so is like making a sandwich without the bread.

Now that you are bullish, you have to think to yourself: Why trade a call debit spread?

After all, numerous other options structures express a bullish view, such as buying calls, selling puts, covered calls, or simply buying shares of a stock.

Some people will say that the payoff structure of call debit spreads is a major selling point.

After all, we have a specific amount we can lose on the trade and a specific amount we can gain.

For tight call debit spreads, it can make it similar to a binary option. Heads we win, tails we lose.

This simplicity can be extremely valuable from a risk management perspective.

Nevertheless, it still does not make call debit spreads more or less profitable than other structures.

When To Trade A Bull Call Spread

Deciding when to pick a call debit spread over another structure can be challenging.

Especially when two call debit spreads can express quite different views, let’s look at an example.

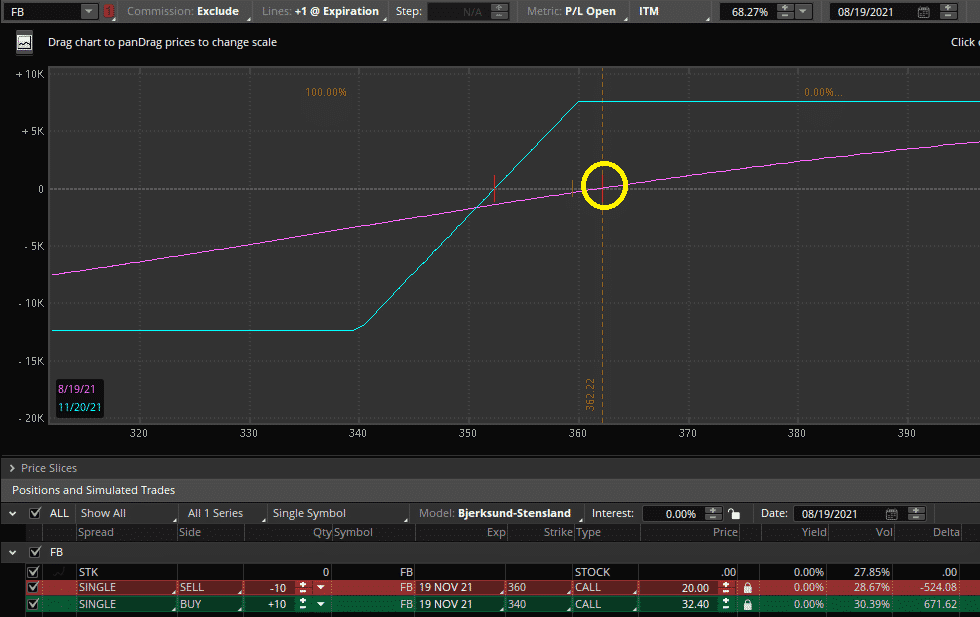

In the below example, we have two call debit spreads on Facebook.

For our first example, we have placed a 340/360 call debit spread on Facebook for a debit of $12.40.

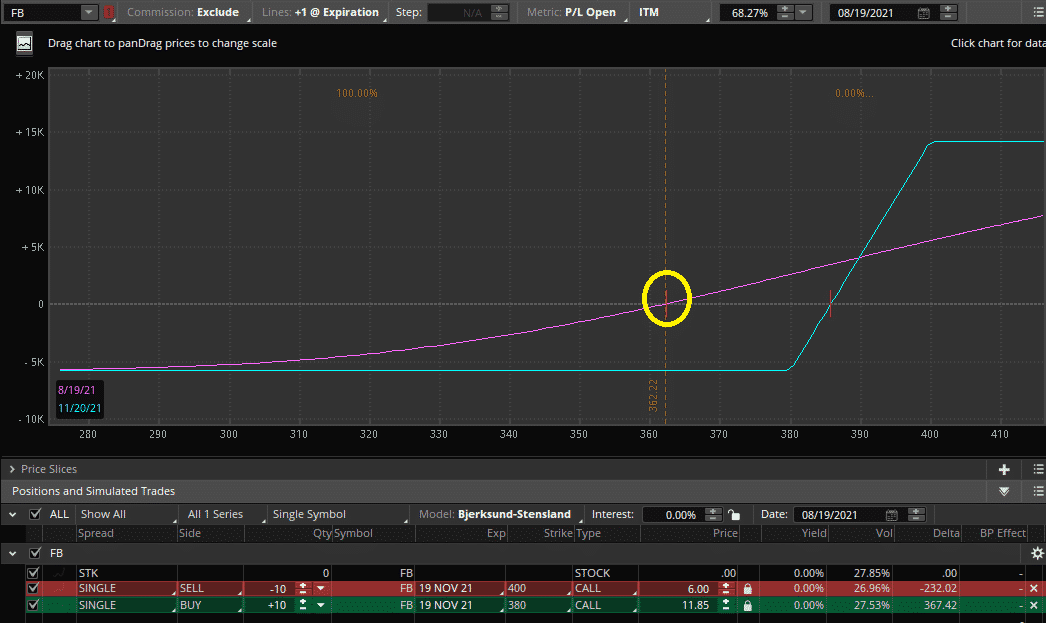

In our second example below, we have the same call debit spread on Facebook but using these 380/400 strikes for a debit of $5.85

We can see that both positions are bullish and will benefit from the increase in Facebook stock price.

Despite this, the similarities end there. In our first position, we are short volatility.

If the Facebook stock does not move upon expiration, we will realize our full profit on the position.

In contrast, if Facebook does not move by expiration, we lose our entire debit for the second position.

We are long volatility.

Volatility Exposure Changes Over Time

Another interesting thing about this volatility exposure is it is not constant over time.

Let’s say that tomorrow Facebook beats earnings, and the price shoots up to $400.

Our first position is still short volatility, but now our second position has switched from long to short volatility.

Let’s think about what we expect to happen:

Position 1: We think the Facebook stock will moderately appreciate in price or stay flat.

Position 2: We think Facebook has the potential to increase substantially in price, more than the market is pricing in.

A call debit spread allows us to reflect a specific view on what we think will happen, which we cannot do by simply buying shares.

Depending on our strikes and the underlying trading price, the volatility component can be either large or non-existent.

Tip*** If you have no opinion on volatility trading, tight at-the-money call debit spreads will have very little volatility exposure in either direction.

When to Trade Call Debit Spreads?

We have seen the versatility of call debit spreads. With a defined risk and reward and the ability to express any specific bullish view, the call debit spread is a very useful tool in an investor’s arsenal.

Despite this, there are times when call debit spreads are not the best choice.

Let’s explore a few of them.

Overpriced Put Skew:

Put skew causes the out-of-the-money puts to be priced at higher volatility than the out-of-the-money calls.

Trading call debit spreads on underlyings with high put skew will result in lower risk to reward ratios for the structures.

This does not mean that the structure is poor, as we know return distributions are not normal, but it will dampen returns.

Certain single stocks occasionally exhibit call skew, making trading call debit spreads more appealing, at least initially.

Commissions and Liquidity:

Trading shares of the underlying will always be the most liquid and offer the lowest commissions resulting in the lowest trading costs.

It has to be factored in that trading the options has added costs.

This is enhanced as a call debit spread has two legs instead of simply selling a put or buying a call.

This can result in four transactions, in and out.

Thus call debit spreads are best avoided on very illiquid options or if an individual is day trading.

Incorrectly expresses an investors view: While we showed how call debit spreads could be very dynamic to express a bullish view, they still cannot express all opinions.

For example, an investor believes that a stock will get acquired in the near future for a larger gain.

Limiting themselves to a defined benefit does not make sense.

A simple call option would work better.

Conversely, if an investor does not believe the stock will fall below a certain price and that volatility is expensive would be better off simply selling a put option.

Concluding Remarks

Call debit spreads are a versatile tool allowing investors to express a bullish view on an underlying position.

This is all while having a fixed maximum payoff and loss.

Trading them correctly involves clearly understanding what you think will happen and then comparing that to the market’s pricing for the spread.

If you have a well-defined bullish view, a call debit spread will almost always be effective.

Despite this, it is important to note that there is a small added cost to trading call debit spreads which can reach the point of being more substantial with illiquid underlyings.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.