Today, we’ll look at some free backtesting software. As always, let us know what you think in the comments section.

We will try and help beginner and novice investors by presenting them with four of the best backtesting websites that can be used for their trading strategies.

These backtesting sites have excellent reviews because they are effective, accurate, and easy to use.

Contents

- #1 – ETFScreen.com

- #2 – ETFReplay.com

- #3 – TradingView.com

- #4 – Meta Trader 4 and 5

- #5 – Thinkorswim

- #6 – QuantConnect

- FAQ

- Conclusion

Before we get started, you might not be entirely sure about what ‘backtesting‘ is in the first place.

Generally speaking, the concept of ‘backtesting’ can be used to test your personal trading strategy based on historical data from an investment market.

For example, you may look at historical price movements and trends and implement your strategy for that timeframe and see what the results would have been.

If the trading strategy was effective, it might be appealing to reuse that in the future when a similar trend shows up in the stock market.

Let’s start by listing four free backtesting sites perfect for investors of all skill levels.

#1 – ETFScreen.com

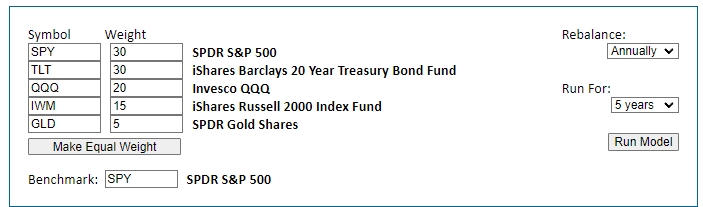

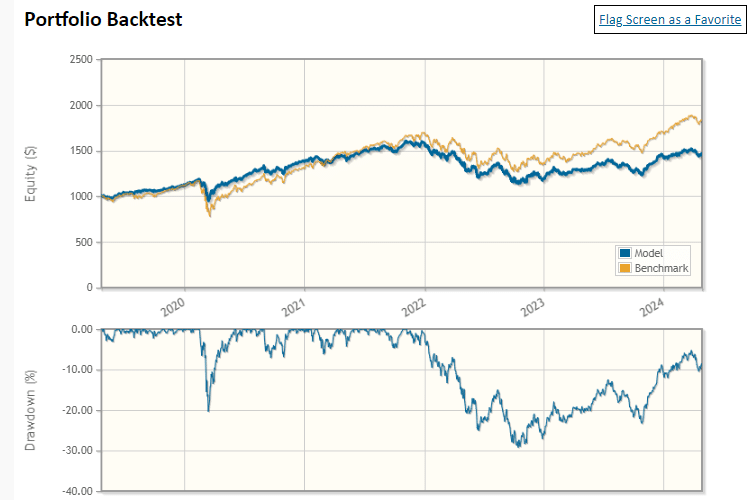

ETFScreen.com offers a comprehensive suite of tools and resources designed to empower investors in making informed decisions about exchange-traded funds (ETFs).

One standout feature is its robust backtesting capabilities, allowing users to analyze historical performance data and test various investment strategies with ease.

With customizable parameters and a user-friendly interface, ETFScreen.com enables investors to assess the effectiveness of different portfolio strategies over specific time periods, helping them identify potential opportunities and optimize their investment approach.

Whether you’re a novice investor or a seasoned trader, the backtesting capabilities of ETFScreen.com provide invaluable insights to enhance your ETF investing strategies and maximize your returns.

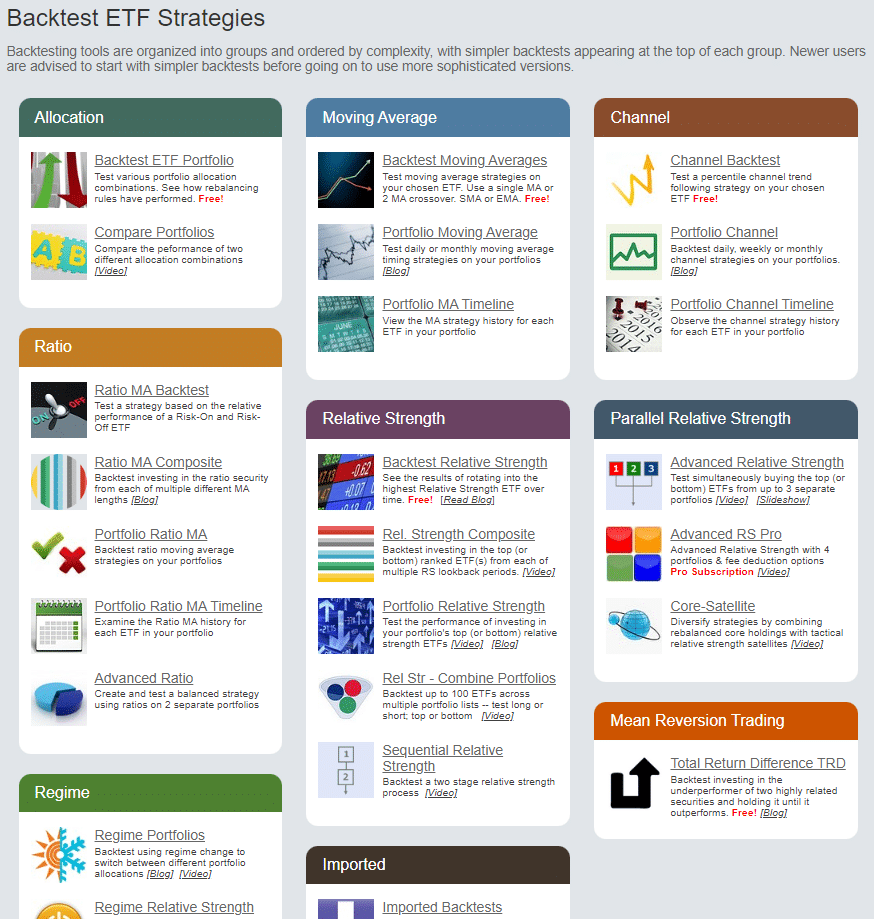

#2 – ETFReplay.com

If you are looking for a slightly more advanced backtesting platform, you’ll likely be satisfied with ETF Replay because it provides you with in-depth data for backtesting.

You can take advantage of RSI data and moving averages to test your strategies on this platform.

You can conveniently sign-up for a free account within a few minutes to get started.

The sign-up process is extremely simple, and all of the features are conveniently integrated into the website’s platform.

With its intuitive platform, users can easily backtest and analyze ETF trading strategies using historical data.

#3 – TradingView.com

You can technically use theTradingView’s platform for backtesting stock market data without paying anything at all.

Set the appropriate date range that you’d like to backtest, and then you can add your trading strategy into the chart.

Within moments, you’ll be able to analyze all of the data and instantly see the projected results of your backtest strategy.

In addition to its powerful backtesting capabilities, TradingView offers a comprehensive suite of tools and features to cater to the diverse needs of traders and investors.

Its intuitive charting platform allows users to visualize market data with precision and clarity, enabling thorough technical analysis to identify potential trading opportunities.

With an extensive library of indicators, chart types, and drawing tools, TradingView provides unparalleled flexibility for customizing charts to suit individual trading styles and preferences.

Traders can conduct in-depth analysis using a variety of charting techniques, from simple trendlines to complex Fibonacci retracements.

TradingView fosters a vibrant community of traders through its social networking features, where users can share trading ideas, strategies, and insights with fellow members.

This collaborative environment facilitates knowledge sharing and idea generation, empowering traders to learn from each other and stay ahead of market trends.

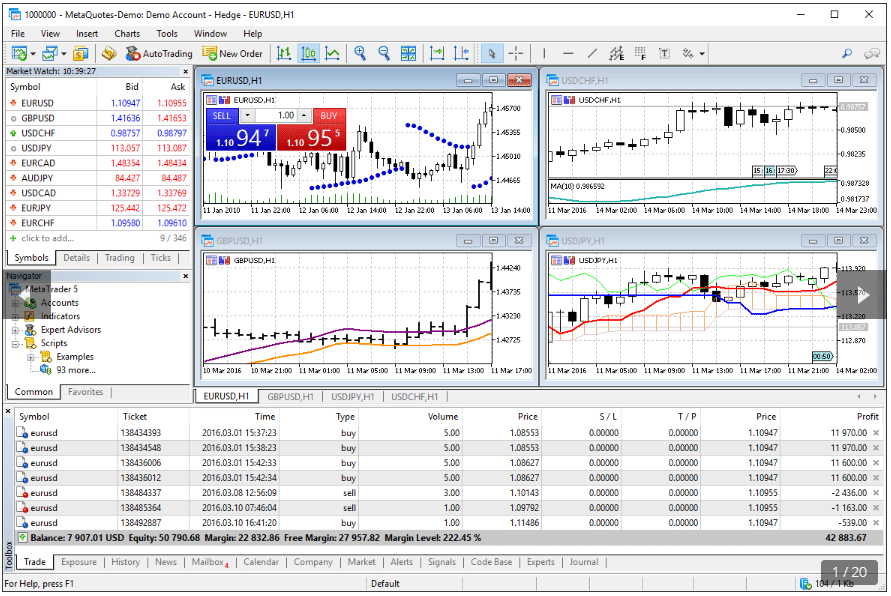

#4 – MetaTrader 4 and 5

MetaTrader 4 is a widely used forex trading platform known for its user-friendly interface and robust charting capabilities.

It offers basic backtesting functionality, allowing traders to test automated trading strategies using historical data and optimize their performance.

Building upon the success of MT4, MetaTrader 5 offers an expanded range of features, including more advanced backtesting capabilities.

Traders can access a wider selection of technical indicators and timeframes, as well as additional asset classes such as stocks and commodities, making it a versatile platform for algorithmic trading.

#5 – ThinkorSwim

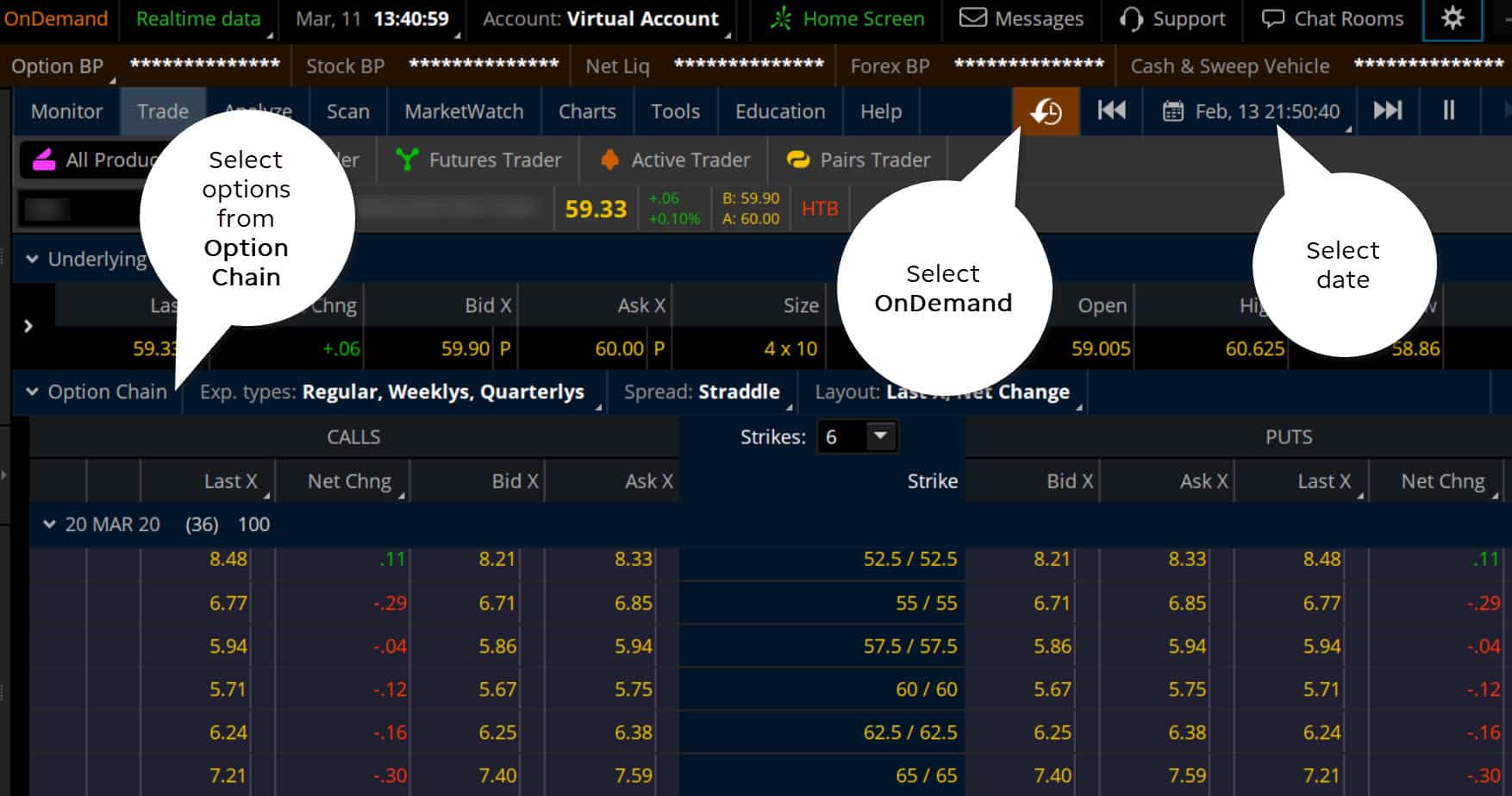

Thinkorswim, by TD Ameritrade, stands out as a feature-rich trading platform offering comprehensive backtesting capabilities for stocks, options, and futures.

Traders benefit from its sophisticated tools, including thinkScript scripting language and customizable scanners, enabling them to develop and test complex trading strategies with precision and efficiency.

The platform’s advanced charting functionality, with over 400 technical studies and drawing tools, empowers traders to conduct thorough technical analysis and refine their strategies based on historical market data.

Thinkorswim’s seamless integration with TD Ameritrade’s brokerage services provides traders with access to real-time market data, news, and order execution.

#6 QuantConnect

QuantConnect is an innovative open-source algorithmic trading platform that revolutionizes the way traders develop, backtest, and deploy trading strategies across various asset classes.

With its extensive support for multiple programming languages, including Python and C#, QuantConnect provides traders with unparalleled flexibility to implement custom algorithms tailored to their specific trading objectives.

The platform’s robust backtesting infrastructure allows users to analyze historical market data and simulate the performance of their strategies under different market conditions, helping them identify profitable opportunities and optimize their trading approach.

QuantConnect’s cloud-based architecture ensures seamless scalability and reliability, enabling traders to deploy and monitor their strategies in real-time across global markets.

With a vibrant community of developers and access to a vast library of data sources, QuantConnect empowers traders to collaborate, innovate, and stay ahead of the curve in the dynamic world of algorithmic trading.

FAQ

What Is Backtesting Software?

Backtesting software is a tool used by traders and investors to test their trading strategies using historical data.

It allows traders to simulate how their trading strategies would have performed in the past and to identify potential strengths and weaknesses in their approach.

Why Should I Use Backtesting Software?

Backtesting software can help you evaluate the effectiveness of your trading strategy before you risk real money in the markets.

It allows you to see how your strategy would have performed in various market conditions, and can help you identify areas for improvement or optimization.

What Are Some Popular Free Backtesting Software Options?

Some popular free backtesting software options include TradingView, MetaTrader 4, and ProRealTime.

Each platform has its own strengths and weaknesses, so it’s important to research and compare different options to find the one that best fits your needs.

What Should I Look For When Choosing A Backtesting Software?

When choosing a backtesting software, you should consider factors such as the platform’s ease of use, available features, and compatibility with your trading strategy.

You should also consider the quality and availability of historical data, as well as the platform’s support and community resources.

Do I Need To Be A Programmer To Use Backtesting Software?

“No, not all backtesting software requires programming knowledge.

Some platforms offer drag-and-drop interfaces or pre-built trading strategy templates, while others require more advanced programming skills.

It’s important to choose a platform that matches your technical skill level and comfort level.

Can I Use Backtesting Software For Options Trading?

Yes, backtesting software can be used for options trading strategies.

However, it’s important to choose a platform that supports options trading and allows you to test your specific options trading strategies.

Some platforms may have limited options trading features or require additional programming to test complex options strategies.

Conclusion

You have now had the opportunity to take a closer look at four of the best free backtesting sites that are helpful to investors of all skill levels.

You should closely evaluate each one before finalizing your decision.

In some cases, it may be helpful to use multiple platforms for backtesting to ensure your results are accurate.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Purchase iron condor course many years back but no time to watch it. Now free can i hv the link to it. Thanks

I will email you the link to reset your password.